Regulatory News:

Vivendi (Paris:VIV):

2020 KEY FIGURES % change year-on

(in millions of euros) % change year- -year at constant

on-year currency and

perimeter(2)

Revenues EUR16,090 M +1.2% -0.6%

EBITA(3,4) EUR1,627 M +6.6% +3.7%

EBIT(4) EUR1,468 M +6.3%

Earnings before provision

for income taxes(1) EUR2,182 M +47.7%

This press release contains audited consolidated financial

figures established under IFRS, which were approved by Vivendi's

Management Board on March 1, 2021, reviewed by the Vivendi Audit

Committee on March 1, 2021, and by Vivendi's Supervisory Board on

March 3, 2021 under the chairmanship of Yannick Bolloré.

In 2020, revenues were EUR16,090 million, up 1.2%. This increase

mainly resulted from the growth of Universal Music Group (UMG),

Canal+ Group(2) and Editis(2) , partially offset by the slowdown in

other activities, mainly Havas Group and Vivendi Village, all of

which were affected by the consequences of the COVID-19

pandemic.

At constant currency and perimeter(2) , revenues were almost

stable (-0.6%) compared to 2019.

Following good growth in the first quarter of 2020 (+4.4% at

constant currency and perimeter(2) ) and a decline in the second

quarter (-7.9%), Vivendi's revenues recovered in the third (+0.7%)

and fourth (+0.7%) quarters.

For the second half of 2020, at constant currency and

perimeter(2) , revenues slightly increased (+0.7%) compared to the

second half of 2019 and compared to a decrease of 2.0% for the

first half of 2020.

EBITA was EUR1,627 million, an increase of 6.6% compared to

2019. At constant currency and perimeter(2) , EBITA increased by

3.7%, primarily driven by the growth of UMG and Canal+ Group.

EBIT was EUR1,468 million, an increase of 6.3% compared to

2019.

Other financial charges and income were a net income of EUR589

million, compared to a net income of EUR65 million in 2019. In

2020, the revaluation of the investments in Spotify and Tencent

Music Entertainment was a net gain of EUR591 million, compared to

EUR139 million in 2019. In addition, in 2020, Vivendi received an

additional payment of EUR56 million for the sale of GVT in 2015,

following the favorable settlement of a tax litigation in

Brazil.

On March 31, 2020, the sale of 10% of UMG's share capital to a

Tencent-led consortium was recorded, in accordance with IFRS

standards, as a sale of non-controlling interests and therefore has

not impacted the Consolidated Financial Statement of Earnings. As a

result, in accordance with IFRS 10, the capital gain on the sale of

10% of UMG's share capital was directly recorded as an increase in

equity attributable to Vivendi SE shareowners for EUR2,385

million.

Provision for income taxes reported to net income was a net

charge of EUR575 million, compared to a net income of EUR140

million in 2019. Excluding the current tax income of EUR473 million

resulting from the aforementioned favorable decision of the French

Council of State (Conseil d'État) in 2019 regarding the use of

foreign tax receivables upon the group's exit from the Global

Profit Tax System), provision for income taxes reported to net

income increased by EUR242 million in 2020.

Earnings attributable to non-controlling interests were EUR167

million, compared to EUR34 million in 2019. This increase of EUR133

million primarily reflected the Tencent-led consortium's share of

Universal Music Group's net earnings as from March 31, 2020.

Earnings before provision for income taxes which allows the best

comparison versus the 2019 earnings(1) , amounted to a profit of

EUR2,182 million, an increase of 47.7%.

Earnings attributable to Vivendi SE shareowners amounted to a

profit of EUR1,440 million (or EUR1.26 per share - basic), compared

to EUR1,583 million in 2019 (or EUR1.28 per share - basic). In

2019, excluding the current tax income of EUR473 million regarding

the use of foreign tax receivables upon the exit from the Global

Profit Tax System, earnings attributable to Vivendi SE shareowners

increased by 29.7%.

Adjusted net income was a profit of EUR1,228 million (or EUR1,08

per share - basic), compared to EUR1,741 million in 2019 (or

EUR1.41 per share - basic), a decrease of 29.5%. In 2019, it

included the current tax income of EUR473 million regarding the use

of foreign tax receivables upon the exit from the Global Profit Tax

System.

As of December 30, 2020, Vivendi's Financial Net Debt increased

by EUR889 million to EUR4,953 million.

If the contemplated distribution of 60% of UMG's share capital,

which is expected to involve the repayment by UMG of the loan

granted by Vivendi, were to occur, and taking into account the

EUR2.8 billion in cash received from the sale of an additional 10%

of UMG's share capital to the Tencent- led consortium, the Vivendi

Group's pro-forma net debt would amount to EUR0.3 billion, based on

the balance sheet as of December 31, 2020.

Vivendi has significant financing capacity. As of December 31,

2020, EUR3.3 billion of the group's committed credit facilities

were available.

As of December 31, 2020, the average "economic" term of the

group's financial debt, calculated based on the assumption that the

available medium-term credit lines may be used to redeem the

group's shortest term borrowings, was 4.8 years (compared to 5.3

years as of December 31, 2019).

As Vivendi's consolidated equity amounted to EUR16.431 billion,

the Group's net debt-to-equity (gearing) ratio was 30% as of

December 31, 2020.

Although the COVID-19 pandemic is having a more significant

impact on certain countries or businesses than others, in 2020,

Vivendi has demonstrated resilience in adapting its activities to

continue to best serve and entertain its customers, while reducing

costs to preserve its margins. The business activities showed good

resilience, in particular music and pay television. However, as

previously mentioned, the other businesses such as Havas Group and

Vivendi Village (in particular live entertainment) were affected by

the pandemic's effects. Editis has enjoyed a strong rebound in its

businesses in France since June 2020.

Vivendi continually monitors the current and potential

consequences of the crisis. It is difficult at this time to

determine how it will impact Vivendi's results in 2021. Businesses

related to advertising and live performance have a risk of being

more impacted than others. Nevertheless, the Group remains

confident in the resilience of its main businesses. It continues to

make every effort to ensure the continuity of its activities, as

well as to best serve and entertain its customers and audiences

while complying with the guidelines of authorities in each country

where it operates.

Planned distribution of 60% of UMG's share capital to Vivendi's

shareowners

For a number of years, Vivendi's leading institutional

shareholders have been pressing for a split or the distribution of

Universal Music Group (UMG) to reduce Vivendi's conglomerate

discount.

Prior to considering a favorable response to this request, the

Management Board wished to obtain a fair value for UMG to better

serve the interests of its shareholders and therefore support the

fulfillment of its development plan to become a global leader in

content, media and communications.

The Chairman of the Management Board set a minimum target of

EUR30 billion for UMG's enterprise value. The acquisition by the

Tencent-led consortium of a 20% stake in UMG's share capital,

completed between March 2020 and January 2021 on the basis of this

valuation, as well as interests expressed by other investors at

potentially higher prices, have now enabled the Management Board to

consider a distribution in kind of 60% of UMG's share capital to

Vivendi shareholders.

This distribution, exclusively in kind, would take the form of

an exceptional distribution ("special dividend"). The listing of

UMG's shares, issued by its holding company, would be applied for

on the regulated market of Euronext NV in Amsterdam, in a country

that has been one of UMG's historical homes.

A Vivendi Extraordinary Shareholders' Meeting will be called for

March 29, 2021, to modify the company's by-laws and make the

principle of this distribution in kind possible and pursue this

project. Subject to a favorable shareholder vote, a Shareholders'

Meeting could be called before the end of 2021 to vote on this

distribution of UMG shares.

Prisma Media

On December 23, 2020, Vivendi entered into a put option

agreement for 100% of Prisma Media. Prisma Media is the leading

French press group in the sector, in print and digital, with twenty

essential flagship brands of the magazine press, from Femme

Actuelle to GEO, via Capital, Gala, Télé Loisirs, and more.

In accordance with applicable regulations, the contemplated

acquisition remains subject to the information and consultation

process with Prisma Media's employee representative bodies, the

authorization from the relevant competition authorities as well as

the finalization of legal documentation.

Prisa

On January 25, 2021, Vivendi announced that it owned 9.9% of

Prisa's share capital. Prisa, which owns El Pais, Santillana,

Cadena SER, Radio Caracol, AS and Los 40 Principales, is the leader

in media and education in the Spanish-speaking world.

The acquisition of a stake in Prisa is part of Vivendi's

strategy to strengthen its position as a global content, media and

communications group and to expand its access to Spanish-speaking

markets in Europe, Latin America and the United States.

Returns to shareholders

Since January 1, 2020, Vivendi has repurchased 96,52 million of

its own shares (i.e., 8.14% of its share capital), representing

EUR2.35 billion, including 23.02 million shares under the previous

buyback program and

73.50 million shares under the current program.

As of March 3, 2021, Vivendi holds 100.44 million treasury

shares, representing 8.47% of the share capital.

In addition, the Annual General Shareholders' Meeting to be held

on June 22, 2021 will vote on the proposal of an ordinary dividend

of 0.60 euro per share with respect to fiscal year 2020. This

dividend would represent a yield of approximately 2%. The

ex-dividend date would be June 23, 2021, with payment on June 25,

2021.

Creation Unlimited, Vivendi's raison d'être

Vivendi offers a perfect environment for all types of talent in

the creative industries. This is why the Group has defined its

raison d'être through its tagline Creation Unlimited, meaning to

unleash creation by revealing all talent, valuing all ideas and

cultures and sharing them with as many people as possible.

This raison d'être enables Vivendi to create value not only for

the company but for the entire creative community and represents a

genuine commitment on the part of Vivendi, its management and all

its employees.

There are three dimensions to it:

-- Implementing all means necessary to promote diverse, inclusive and

original creation;

-- Guiding new talent and supporting established talent in their artistic

and professional approach; and

-- Making the most beautiful content and talent shine as widely as possible.

Evolution of the CSR program

Vivendi redefined its CSR program in 2020, putting its social,

societal and environmental impacts into perspective and setting a

first milestone for 2025. The new program, entitled Creation for

the Future, directly ties in with Vivendi's raison d'être: Creation

Unlimited.

The new program consists of three pillars:

-- Creation for the Planet, "Innovating to protect the planet", frames the

Group's commitment to respond to the climate emergency and protect the

environment. Vivendi has defined its 2020-2035 climate strategy, notably

in line with the 2015 Paris Agreement and the Science-Based Targets

initiative which the Group joined this year. Additionally, Vivendi is

going further by planning to achieve carbon neutrality (reach "Net Zero")

by 2025, bearing in mind that some entities have already achieved this

goal.

-- Creation for Society, "Imagining tomorrow's society," reflects the

societal responsibility incumbent on the Group through the content it

produces or distributes. Vivendi is especially committed to fostering

open societies by making culture and education more accessible.

-- Creation with All, "Building a responsible world together," expresses

Vivendi's ambition to involve its internal and external stakeholders in

building a more inclusive and responsible world.

The CSR program is a powerful performance lever that enables

Vivendi to share the value that it creates with all its

stakeholders.

Strengthening of ESG disclosure in financial communications

The year 2020 was also marked by the accelerated integration of

Environmental, Social and Governance (ESG) criteria into Vivendi's

financial communications. This process, initiated by the Chairman

of the Supervisory Board, Yannick Bolloré, at the Shareholders'

Meeting of April 20, 2020, is characterized by the intensification

of collaboration between various transversal internal working

groups and the deepening of dialogue with investors and ESG

analysts.

Vivendi consulted the leading French and international ESG

institutional investors owning an interest in Vivendi's capital. As

a result, the Group has gained a better understanding of their

methodologies, expectations, and perception of the Group's ESG

performance.

Comments on the Businesses Key Financials

Universal Music Group

In 2020, Universal Music Group's (UMG) revenues amounted to

EUR7,432 million, up 4.7% at constant currency and perimeter

compared to 2019 (+3.8% on an actual basis).

Recorded music revenues grew by 6.7% at constant currency and

perimeter thanks mainly to the growth in subscription and streaming

revenues (+16.2%), which more than offset the 6.0% decline in

physical sales compared to 2019, and the 19.0% decline in download

sales.

Recorded music best sellers for 2020 included new releases from

The Weeknd, Lil Baby, Pop Smoke, BTS, Justin Bieber, King &

Prince, Taylor Swift and Juice WRLD, as well as continued sales

from Billie Eilish and Post Malone.

In 2020, UMG had four of the Top 5 artists of the year on

Spotify globally (Drake, J Balvin, Juice WRLD and The Weeknd), the

No. 1 song of the year (The Weeknd's Blinding Lights) and two of

the Top 3 albums (The Weeknd's After Hours and Post Malone's

Hollywood's Bleeding). In addition, based on US data from Nielsen

Music/MRC, UMG had all of the Top 6 albums of the year with Lil

Baby, Taylor Swift, Pop Smoke, The Weeknd, Juice WRLD and Post

Malone.

Music publishing revenues increased 14.4% at constant currency

and perimeter compared to 2019, driven by increased subscription

and streaming revenues, as well as the receipt of a digital royalty

claim in the second quarter of 2020.

On December 7, 2020, Universal Music Publishing Group (UMPG)

announced a landmark agreement in which UMPG acquired Bob Dylan's

entire catalog of songs, encompassing more than 600 copyrights,

spanning 60 years, and recorded more than 6,000 times by an array

of artists from many countries, cultures and music genres.

Merchandising and other revenues were down 39.6% at constant

currency and perimeter compared to 2019, due to the impact of the

health pandemic on both touring and retail activity.

Driven by the growth in revenues, revenues mix and cost control,

UMG's EBITA amounted to EUR1,329 million, up 20.1% at constant

currency and perimeter compared to 2019 (+18.3% on an actual

basis).

On February 8, 2021, UMG and TikTok announced a global agreement

that delivers equitable compensation for recording artists and

songwriters, and significantly expands and enhances the companies'

existing relationship, promoting the development of new innovative

experiences and the ability to forge deeper bonds between fans and

artists.

Canal+ Group

At the end of December 2020, Canal+ Group's total subscriber

portfolio (individual and collective) reached 21.8 million,

including 8.7 million in mainland France, compared to 20.3 million

at the end of December 2019.

In 2020, Canal+ Group's revenues were EUR5,498 million, up 4.4%

compared to 2019 (down 0.9% at constant currency and

perimeter).

Pay-TV in mainland France recorded a net increase of its total

subscriber base of 262,000 over the past 12 months.

Revenues from international operations increased sharply by

19.8% (up 4.0% at constant currency and perimeter), thanks to the

significant growth in the number of subscribers (+1.2 million

year-on-year) across all geographical areas except Asia-Pacific,

and the success of the M7 integration.

Studiocanal's revenues declined by 17.0% year-on-year, as the

filming and distribution of movies and series were particularly

affected by the pandemic. However, this decrease was partially

offset by the good performance of the catalog.

In 2020, Canal+ Group's profitability improved compared to 2019.

EBITA recorded a strong increase of 26.7%, reaching EUR435 million,

compared to EUR343 million in 2019.

In October 2020, Canal+ Group announced that it held 12% of the

share capital of the South African company MultiChoice Group Ltd,

the leader in pay-TV in anglophone and lusophone sub-Saharan

Africa, becoming the second-largest shareholder.

Canal+ Group, the exclusive distributor of Disney+ in France

since it became available in Canal+ offers on April 7, 2020,

entered into distribution agreements with other operators in the

fourth quarter of 2020 to expand this streaming service.

In December 2020, French Broadcasting Authority (Conseil

Supérieur de l'Audiovisuel) ("CSA") authorized Canal+ Group to

renew its DTT license in France for three years, i.e., until

December 6, 2023. This reception mode concerned nearly 2% of Canal+

Group subscribers at the end of December 2020.

On February 4, 2021, the Professional Football League and Canal+

Group announced a global agreement regarding the audiovisual rights

for Ligue 1 Uber Eats and Ligue 2 BKT for the 2020-2021 season.

Since the 25th day of Ligue 1 Uber Eats and Ligue 2 BKT, and until

the end of the 2020-2021 season, Canal+ Group has had the exclusive

audiovisual rights, live and in full, to all Ligue 1 Uber Eats

matches and eight of the ten Ligue 2 BKT matches. In addition to

the audiovisual rights to these matches, Canal+ Group will hold all

the magazine rights during the week and on weekends.

In addition, on March 2, 2021, Canal+, which has been a partner

of the TOP 14 for more than 35 years, won the latest call for

tenders launched by the National Rugby League for broadcasting

rights in France until the end of the 2026-2027 season. These

exclusive broadcasting rights cover all TOP 14 matches, live as

well as near-live clips, and all programs devoted to them, in all

media formats.

Havas Group

During the fourth quarter of 2020, global economic activity

continued its gradual recovery, in line with the third quarter

performance. The advertising market is more stable and continues to

improve, albeit to varying degrees depending on the geographical

region and sector.

Against this challenging backdrop, Havas Group reported a clear

improvement in the fourth quarter with organic net revenue(5)

growth of -7.5%, compared to -10.4% in the third quarter of

2020.

With the exception of Asia-Pacific, all geographical regions

continued to improve or consolidate their performances(6) . The

North American agencies continued to hold up well, thanks to a

dynamic advertising market and the resilience of health and

wellness communications. Under the impetus of both the Creative and

Media businesses, Europe reported an overall stronger performance,

although with contrasting results between countries. Latin America

consolidated its recovery, and a new organization was implemented

in the Asia-Pacific agencies.

Havas Group's revenues for 2020 were EUR2,137 million, down

10.1% (-10.8% at constant currency and perimeter) compared to 2019.

Net revenues were EUR2,049 million, down 9.2% compared to 2019 and

organic growth was -9.9% compared to 2019. Exchange rates had a

negative impact of -1.4% (+2.5% in 2019) and acquisitions

contributed +2.1%.

In 2020, EBITA was EUR121 million, compared to EUR225 million in

2019. Thanks to its agility, the benefits of the cost adjustment

plan introduced at the beginning of the crisis enabled Havas Group

to absorb more than 50% of the decline in its revenues over the

full-year 2020 (before restructuring charges).

Havas Group has begun 2021 with confidence: business activity,

especially in the second half of 2020, proved highly dynamic, with

the winning of prestigious new clients including Jacobs Douwe

Egberts, Epic Games, Tetra Pack and PMU. The reinforcement of

existing offerings and the launch of two new and groundbreaking

initiatives, Havas CX and Havas Market, make Havas Group's

expertise more attractive than ever. Thanks to its cost adjustment

plan and the introduction of new organizational structures, Havas

Group is in good shape and well equipped to make the most of any

new growth opportunities its markets may present. At the same time,

it is keeping a close eye on economic and social developments.

Editis

In an extremely turbulent environment in 2020 with the closure,

during some periods, of a large number of the points of sale in

France (the publishing market fell by -67% in April, -25% in May

and -35% in November), the market ended the year just 2.7% lower

than 2019 (source GfK 2020), demonstrating its resilience. However,

certain segments, such as tourism, were heavily affected.

In 2020, Editis' revenues reached EUR725 million, a slight

decrease of 1.3% at constant currency and perimeter compared to

2019. In 2020, the school reform had a lower impact than in

2019.

With its Nathan and Bordas brands, Editis is strengthening its

leadership position in education and remains the leader in the very

competitive market of senior-year high school curriculum

reform.

Editis' general literature and that of its third-party

publishing partners performed well, with several of Editis titles

included among the year's best-sellers across all categories.

Editis was the best-represented publishing group in the Top 20

best-selling new releases in 2020 in France, with nine titles sold

by the group(7) .

Likewise, several of Editis' new releases were selected for

prestigious literary awards, such as La Grâce by Thibault de

Montaigu (Plon publishing house), which was awarded the Prix de

Flore(7) .

Nimba Éditions, a 100% Ivorian publishing house launched with

the support of Vivendi's local presence, published its first titles

in December 2020. Nimba Éditions aims to reveal local talent and

offer relevant and intelligent content to readers in Côte d'Ivoire

and neighboring French-speaking countries.

In 2020, Editis' EBITA was EUR38 million, compared to EUR43

million for the same period in 2019 (12-month pro forma). Thanks to

cost control, Income from operations was up by 2.4% at constant

currency and perimeter compared to 2019.

Other businesses

In 2020, Gameloft's revenues were EUR253 million, down 2.1%

compared to 2019 (-1.5% at constant currency and perimeter). Sales

on OTT platforms, representing 74% of Gameloft's total revenues,

were up by 0.9%, driven by the success of Asphalt 9: Legends on

mobile phones, PCs and Nintendo Switch (+30% annual growth) and the

resilience of the catalog. In 2020, Disney Magic Kingdoms, March of

Empires, Asphalt 9: Legends, Dragon Mania Legends and Asphalt 8:

Airborne recorded the highest sales, representing 53% of Gameloft's

total revenues. In 2020, Gameloft continued to implement its

internal transformation plan, which resulted in a sharp drop in

operating expenses and a significant increase in its margins.

Consequently, in 2020, Gameloft's EBITA improved by EUR12 million

to -EUR24 million.

After a very good start at the beginning of the first quarter of

2020, the lockdown measures gradually taken in Europe and Africa

weighed very heavily on Vivendi Village's activities in 2020.

Significant cost-cutting measures have been implemented. New

concert and show formats accessible remotely by the public and

based on different forms of monetization are being successfully

tested. Two techno music events (Junction 2), in July 2020 and

January 2021, each attracted 3 million fans worldwide. Paid

livestream concerts featuring M Pokora and Jenifer were held in

December 2020. These initiatives could prove to be a natural and

sustainable complement to live performance activities and an

additional revenue source.

New Initiatives brings together the businesses of Dailymotion

and GVA.

In 2020, the audience for Dailymotion's premium content grew by

19% compared to 2019. This increase was driven by existing

partnerships with the Vendée Globe and Numerama in France, EPCR

(European Professional Club Rugby) and the EuroLigue basketball

league in Europe, Daily Mail in the United Kingdom, CNN in the

United States, Cocina al Natural in Mexico, as well as by the

signing of new partnerships, notably with MoviePilot in Germany,

Conde Nast and Genius in the United States, Sakshi and Vikatan in

India, and Interworks and CTS in Asia. Dailymotion's program-based

monetization platform also continued to grow and recorded a strong

31% increase in revenues in 2020 compared to 2019.

GVA is a FTTH (Fiber to the home) operator that has been active

in Sub-Saharan Africa for three years and is already present in

five countries. Specialized in providing ultra-high-speed Internet

access in African cities, GVA's network covered more than half a

million homes and businesses by the end of 2020. Two new operations

were launched in 2020 in Abidjan (Côte d'Ivoire) and Kigali

(Rwanda). In 2021, GVA expects to continue its strong growth based

on the always high demand for ultra-high-speed home broadband

service in Africa.

Agenda

March 29, 2021: Extraordinary Shareholders' Meeting

April 22, 2021: Publication of the first quarter 2021

revenues

June 22, 2021: Annual Shareholders' Meeting

July 28, 2021: Publication of the first half-year 2021

earnings

For additional information, please refer to the "Financial

Report and Audited Consolidated Financial Statements for the year

ended December 31, 2020" to be released later on Vivendi's website

(www.vivendi.com).

About Vivendi

Since 2014, Vivendi has been focused on building a world-class

content, media and communications group. In content creation,

Vivendi owns powerful, complementary assets in music (Universal

Music Group), movies and series (Canal+ Group), publishing (Editis)

and video games (Gameloft) which are the most popular forms of

entertainment content in the world today. In the distribution

market, Vivendi has acquired the Dailymotion platform and

repositioned it to create a new digital showcase for its content.

The Group has also joined forces with several telecom operators and

platforms to maximize the reach of its distribution networks. In

communications, through Havas, the Group possesses unique creative

expertise in promoting free content and producing short formats,

which are increasingly viewed on mobile devices. In addition,

through Vivendi Village, the Group explores new commercial

activities in live entertainment, franchises and ticketing that are

complementary to its core activities. Vivendi's various businesses

cohesively work together as an integrated industrial group to

create greater value. www.vivendi.com

Important Disclaimers

Cautionary Note Regarding Forward-Looking Statements. This press

release contains forward-looking statements with respect to

Vivendi's financial condition, results of operations, business,

strategy, plans and outlook, including the impact of certain

transactions and the payment of dividends and distributions, as

well as share repurchases. Although Vivendi believes that such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance. Actual

results may differ materially from the forward-looking statements

as a result of a number of risks and uncertainties, many of which

are outside our control, including, but not limited to, the risks

related to antitrust and other regulatory approvals as well as any

other approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des Marchés Financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des Marchés Financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward-looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Unsponsored ADRs. Vivendi does not sponsor an American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is "unsponsored" and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

Although the COVID-19 pandemic is having a more significant

impact on certain countries or businesses than others, in 2020,

Vivendi has demonstrated resilience in adapting its activities to

continue to best serve and entertain its customers, while reducing

costs to preserve its margins. The business activities showed good

resilience, in particular, music and pay television. However, as

previously mentioned, the other businesses such as Havas Group and

Vivendi Village (in particular live entertainment) were affected by

the pandemic's effect. Editis has enjoyed a strong rebound in its

businesses in France since June 2020.

Vivendi continually monitors the current and potential

consequences of the crisis. It is difficult at this time to

determine how it will impact Vivendi's results in 2021. Businesses

related to advertising and live performance have a risk of being

impacted more than others. Nevertheless, the Group remains

confident in the resilience of its main businesses. It continues to

make every effort to ensure the continuity of its activities, as

well as to best serve and entertain its customers and audiences

while complying with the guidelines of authorities in each country

where it operates.

In 2020, Vivendi tested the value of goodwill allocated to its

Cash-Generating Units (CGU) or groups of CGU by applying valuation

methods consistent with previous years. Vivendi ensured that the

recoverable amount of CGU or groups of CGU tested exceeded their

carrying value (including goodwill). In 2020, government measures

implemented to address the COVID-19 pandemic in the main regions

where Vivendi operates, namely population lockdowns and the closing

of certain businesses, have slowed down the conduct of certain

business activities, which adversely affected the operating

performance of Vivendi's businesses in 2020, in particular Havas

Group, Studiocanal and Vivendi Village. Notwithstanding the

uncertainties created by the COVID-19 pandemic, Vivendi considered

that the decline in the operating performance of these businesses

observed in 2020 is unlikely to be permanent and should not affect

their long-term outlook.

ANALYST CONFERENCE CALL

Speakers:

Arnaud de Puyfontaine

Chief Executive Officer

Hervé Philippe

Member of the Management Board and Chief Financial Officer

Date: March 3, 2021

6:15pm Paris time -- 5:15pm London time -- 12:15pm New York

time

Media invited on a listen-only basis.

The conference will be held in English.

Internet: The conference can be followed on the Internet at:

www.vivendi.com (audiocast)

Numbers to dial:

-- USA: +1 212 999 6659

-- France: +33 (0) 1 7037 7166

-- UK (Standard International Access) : +44 (0) 33 0551 0200

-- Password: Vivendi

An audio webcast and the slides of the presentation will be

available on the company's website www.vivendi.com.

(1) Performance metric most comparable with the performance

recorded in 2019. In 2019, earnings attributable to Vivendi SE

shareowners benefited from a EUR473 million current tax income

relating to the utilization of foreign tax receivables in respect

of the group's exit from the Consolidated Global Profit Tax System.

In addition, Vivendi owned 100% of UMG's capital in 2019.

(2) Constant perimeter notably reflects the impacts of the

acquisition of M7 by Canal+ Group (September 12, 2019), the

acquisition of the remaining interest in Ingrooves Music Group,

which was consolidated by Universal Music Group (March 15, 2019)

and the acquisition of Editis (January 31, 2019).

(3) Non-GAAP measures.

(4) A reconciliation of EBIT to EBITA are presented in Appendix

I.

(5) Net revenues correspond to revenues less pass-through costs

rebilled to customers.

(6) Appendix VI: New contracts and award wins by Havas Group in

2020.

(7) Appendix VII: Successes and prizes awarded to the publishing

houses of Editis and its partners in 2020.

APPIX I

VIVI

CONSOLIDATED STATEMENT OF EARNINGS

(IFRS, audited)

Year ended December 31

Year ended December 31, % Change

2020 2019

REVENUES 16,090 15,898 + 1.2%

Cost of revenues (8,812) (8,845)

Selling, general and administrative

expenses excluding amortization of

intangible assets acquired through

business combinations (5,463) (5,334)

Income from operations* 1,815 1,719 + 5.6%

Restructuring charges (106) (161)

Other operating charges and income (82) (32)

Adjusted earnings before interest and

income taxes (EBITA)* 1,627 1,526 + 6.6%

Amortization and depreciation of

intangible assets acquired through

business combinations (159) (145)

EARNINGS BEFORE INTEREST AND INCOME

TAXES (EBIT) 1,468 1,381 + 6.3%

Income from equity affiliates -

non-operational 126 67

Interest (37) (46)

Income from investments 36 10

Other financial charges and income 589 65

588 29

Earnings before provision for income

taxes 2,182 1,477 + 47.7%

Provision for income taxes (575) 140

Earnings from continuing operations 1,607 1,617 - 0.6%

Earnings from discontinued operations - -

Earnings 1,607 1,617 - 0.6%

Non-controlling interests (167) (34)

EARNINGS ATTRIBUTABLE TO VIVI SE

SHAREOWNERS 1,440 1,583 - 9.1%

Earnings attributable to Vivendi SE

shareowners per share - basic (in

euros) 1.26 1.28

Earnings attributable to Vivendi SE

shareowners per share - diluted (in

euros) 1.26 1.28

Adjusted net income* 1,228 1,741 - 29.5%

Adjusted net income per share - basic

(in euros)* 1.08 1.41

Adjusted net income per share -

diluted (in euros)* 1.07 1.41

In millions of euros, except per share amounts.

* non-GAAP measures.

The non-GAAP measures of "Income from operations", "adjusted

earnings before interest and income taxes (EBITA)" and "adjusted

net income" should be considered in addition to, and not as a

substitute for, other GAAP measures of operating and financial

performance. Vivendi considers these to be relevant indicators of

the group's operating and financial performance. Vivendi Management

uses income from operations, EBITA and adjusted net income for

reporting, management and planning purposes because they exclude

most non-recurring and non-operating items from the measurement of

the business segments' performances. Furthermore, as of December

31, 2020, in the context of the COVID-19 pandemic, Vivendi had not

changed the definition of these indicators, which are therefore

comparable to fiscal year 2019.

For any additional information, please refer to the "Financial

Report and Audited Consolidated Financial Statements for the year

ended December 31, 2020", which will be released online later on

Vivendi's website (www.vivendi.com).

APPIX I (Cont'd) VIVI CONSOLIDATED STATEMENT OF EARNINGS (IFRS,

audited) Reconciliation of earnings attributable to Vivendi SE shareowners

to adjusted net income

Year ended December 31,

(in millions of euros) 2020 2019

Earnings attributable to Vivendi SE shareowners

(a) 1,440 1,583

Adjustments

Amortization and depreciation of intangible

assets acquired through business combinations 159 145

Amortization of intangible assets related to

equity affiliates 60 60

Other financial charges and income (589) (65)

Provision for income taxes on adjustments 121 37

Impact of adjustments on non-controlling

interests 37 (19)

Adjusted net income 1,228 1,741

1. As reported in the Consolidated Statement of Earnings.

Adjusted Statement of Earnings

Year ended December 31, % Change

(in millions of euros) 2020 2019

Revenues 16,090 15,898 + 1.2%

Income from operations 1,815 1,719 + 5.6%

EBITA 1,627 1,526 + 6.6%

Income from equity affiliates -

non-operational 186 127

Interest (37) (46)

Income from investments 36 10

Adjusted earnings from continuing

operations before provision for

income taxes 1,812 1,617 + 12.1%

Provision for income taxes (454) 177

Adjusted net income before

non-controlling interests 1,358 1,794

Non-controlling interests (130) (53)

Adjusted net income 1,228 1,741 - 29.5%

APPIX II

VIVI

REVENUES, INCOME FROM OPERATIONS AND EBITA BY BUSINESS SEGMENT

(IFRS, audited)

Year ended December

31,

% Change

at

constant

% Change currency

at and

(in millions of constant perimeter

euros) 2020 2019 % Change currency (a)

Revenues

Universal Music

Group 7,432 7,159 +3.8% +5.1% +4.7%

Canal+ Group 5,498 5,268 +4.4% +4.9% -0.9%

Havas Group 2,137 2,378 -10.1% -8.8% -10.8%

Editis 725 687 +5.6% +5.6% -1.3%

Gameloft 253 259 -2.1% -0.9% -1.5%

Vivendi Village 40 141 -71.4% -71.4% -71.9%

New Initiatives 65 71 -7.5% -7.5% -7.5%

Elimination of

intersegment

transactions (60) (65)

Total Vivendi 16,090 15,898 +1.2% +2.2% -0.6%

Income from

operations

Universal Music

Group 1,377 1,168 +18.0% +19.7% +19.8%

Canal+ Group 485 431 +12.6% +13.5% -3.1%

Havas Group 163 268 -39.2% -39.2% -40.6%

Editis 51 59 -12.3% -12.3% +2.4%

Gameloft (17) (28) +37.3% +44.1% +44.3%

Vivendi Village (51) (16) x 3,2 x 3,2 x 2,6

New Initiatives (65) (68) +4.3% +4.3% +4.3%

Corporate (128) (95) -36.0% -35.7% -35.7%

Total Vivendi 1,815 1,719 +5.6% +7.1% +3.0%

EBITA

Universal Music

Group 1,329 1,124 +18.3% +20.1% +20.1%

Canal+ Group 435 343 +26.7% +27.9% +5.2%

Havas Group 121 225 -46.1% -46.2% -47.7%

Editis 38 52 -26.5% -26.5% -11.2%

Gameloft (24) (36) +34.0% +39.5% +39.6%

Vivendi Village (59) (17) x 3,6 x 3,6 x 2,8

New Initiatives (75) (65) -16.0% -16.0% -16.0%

Corporate (138) (100) -37.5% -37.3% -37.3%

Total Vivendi 1,627 1,526 +6.6% +8.3% +3.7%

1. Constant perimeter notably reflects the impacts of the acquisition of M7

by Canal+ Group (September 12, 2019), the acquisition of the remaining

interest in Ingrooves Music Group, which was consolidated by Universal

Music Group (March 15, 2019) and the acquisition of Editis (January 31,

2019).

APPIX II (Cont'd)

VIVI

QUARTERLY REVENUES BY BUSINESS SEGMENT

(IFRS, audited)

2020

Three months Three months

Three months Three months ended ended

(in millions of ended March ended June September December

euros) 31, 30, 30, 31,

Revenues

Universal Music

Group 1,769 1,690 1,855 2,118

Canal+ Group 1,372 1,302 1,380 1,444

Havas Group 524 495 484 634

Editis 116 146 232 231

Gameloft 61 69 63 60

Vivendi Village 23 3 8 6

New Initiatives 15 13 16 21

Elimination of

intersegment

transactions (10) (12) (16) (22)

Total Vivendi 3,870 3,706 4,022 4,492

2019

Three months Three months

Three months Three months ended ended

(in millions of ended March ended June September December

euros) 31, 30, 30, 31,

Revenues

Universal Music

Group 1,502 1,756 1,800 2,101

Canal+ Group 1,252 1,266 1,285 1,465

Havas Group 525 589 567 697

Editis (a) 89 171 210 217

Gameloft 68 65 61 65

Vivendi Village 23 43 42 33

New Initiatives 15 19 16 21

Elimination of

intersegment

transactions (15) (15) (11) (24)

Total Vivendi 3,459 3,894 3,970 4,575

1. As a reminder, Vivendi has fully consolidated Editis since February 1,

2019.

APPIX III

VIVI

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(IFRS, audited)

(in millions of euros) December 31, 2020 December 31, 2019

ASSETS

Goodwill 14,183 14,690

Non-current content assets 3,902 2,746

Other intangible assets 848 883

Property, plant and equipment 1,125 1,097

Rights-of-use relating to leases 1,068 1,245

Investments in equity affiliates 3,542 3,520

Non-current financial assets 4,285 2,263

Deferred tax assets 736 782

Non-current assets 29,689 27,226

Inventories 366 277

Current tax receivables 128 374

Current content assets 1,346 1,423

Trade accounts receivable and other 5,482 5,661

Current financial assets 135 255

Cash and cash equivalents 976 2,130

Current assets 8,433 10,120

TOTAL ASSETS 38,122 37,346

EQUITY AND LIABILITIES

Share capital 6,523 6,515

Additional paid-in capital 2,368 2,353

Treasury shares (2,441) (694)

Retained earnings and other 9,309 7,179

Vivendi SE shareowners' equity 15,759 15,353

Non-controlling interests 672 222

Total equity 16,431 15,575

Non-current provisions 1,060 1,127

Long-term borrowings and other

financial liabilities 4,171 5,160

Deferred tax liabilities 1,166 1,037

Long-term lease liabilities 1,070 1,223

Other non-current liabilities 916 183

Non-current liabilities 8,383 8,730

Current provisions 670 494

Short-term borrowings and other

financial liabilities 2,230 1,777

Trade accounts payable and other 10,095 10,494

Short-term lease liabilities 221 236

Current tax payables 92 40

Current liabilities 13,308 13,041

Total liabilities 21,692 21,771

TOTAL EQUITY AND LIABILITIES 38,122 37,346

APPIX IV

VIVI

CONSOLIDATED STATEMENT OF CSH FLOWS

(IFRS, audited)

Year ended December 31,

(in millions of euros) 2020 2019

Operating activities

EBIT 1,468 1,381

Adjustments 1,035 779

Content investments, net (1,481) (676)

Gross cash provided by operating activities

before income tax paid 1,022 1,484

Other changes in net working capital 293 67

Net cash provided by operating activities

before income tax paid 1,315 1,551

Income tax (paid)/received, net (89) (283)

Net cash provided by operating activities 1,226 1,268

Investing activities

Capital expenditures (438) (413)

Purchases of consolidated companies, after

acquired cash (96) (2,106)

Investments in equity affiliates (120) (1)

Increase in financial assets (1,425) (177)

Investments (2,079) (2,697)

Proceeds from sales of property, plant,

equipment and intangible assets 3 8

Proceeds from sales of consolidated companies,

after divested cash 65 22

Disposal of equity affiliates 10 -

Decrease in financial assets 285 1,046

Divestitures 363 1,076

Dividends received from equity affiliates 41 8

Dividends received from unconsolidated

companies 30 3

Net cash provided by/(used for) investing

activities (1,645) (1,610)

Financing activities

Net proceeds from issuance of common shares in

connection with Vivendi SE's share-based

compensation plans 153 175

Sales/(purchases) of Vivendi SE's treasury

shares (2,157) (2,673)

Distributions to Vivendi SE's shareowners (690) (636)

Other transactions with shareowners 2,759 (13)

Dividends paid by consolidated companies to

their non-controlling interests (98) (41)

Transactions with shareowners (33) (3,188)

Setting up of long-term borrowings and increase

in other long-term financial liabilities 5 2,101

Principal payment on long-term borrowings and

decrease in other long-term financial

liabilities (1) (6)

Principal payment on short-term borrowings (1,071) (787)

Other changes in short-term borrowings and

other financial liabilities 739 870

Interest paid, net (37) (46)

Other cash items related to financial

activities (22) (7)

Transactions on borrowings and other financial

liabilities (387) 2,125

Repayment of lease liabilities and related

interest expenses (255) (254)

Net cash provided by/(used for) financing

activities (675) (1,317)

Foreign currency translation adjustments of

continuing operations (60) (4)

Change in cash and cash equivalents (1,154) (1,663)

Cash and cash equivalents

At beginning of the period 2,130 3,793

At end of the period 976 2,130

APPIX V

VIVI

KEY CONSOLIDATED FINANCIAL DATA FOR THE LAST FIVE YEARS

(IFRS, audited)

As a reminder, in 2019, Vivendi applied a new accounting

standard:

-- IFRS 16 -- Leases: in accordance with IFRS 16, the impact of the change

of accounting standard was recorded in the opening balance sheet as of

January 1, 2019. In addition, Vivendi applied this change of accounting

standard to the Statement of Financial Position, Statement of Earnings

and Statement of Cash Flows in 2019; therefore, the data relative to

prior years is not comparable.

As a reminder, in 2018, Vivendi applied two new accounting

standards:

-- IFRS 15 -- Revenues from Contracts with Customers: in accordance with

IFRS 15, as from 2017, Vivendi applied this change of accounting standard

to revenues. The data presented below with respect to fiscal year 2016

are historical and therefore not restated; and

-- IFRS 9 -- Financial Instruments: in accordance with IFRS 9, as from 2018,

Vivendi applied this change of accounting standard to the Statement of

Earnings and Statement of Comprehensive Income restating its opening

balance sheet as of January 1, 2018; therefore, the data relative to

prior years in this report is not comparable.

Year ended December 31,

2020 2019 2018 2017 2016

Consolidated data

Revenues 16,090 15,898 13,932 12,518 10,819

Income from

operations (a) 1,815 1,719 1,439 1,098 853

Adjusted earnings

before interest and

income taxes (EBITA)

(a) 1,627 1,526 1,288 969 724

Earnings before

interest and income

taxes (EBIT) 1,468 1,381 1,182 1,018 887

Earnings attributable

to Vivendi SE

shareowners 1,440 1,583 127 1,216 1,256

of which earnings

from continuing

operations

attributable to

Vivendi SE

shareowners 1,440 1,583 127 1,216 1,236

Adjusted net income

(a) 1,228 1,741 1,157 1,300 755

Net Cash

Position/(Financial

Net Debt) (a) (4,953) (4,064) 176 (2,340) 1,231

Total equity 16,431 15,575 17,534 17,866 19,612

of which Vivendi SE

shareowners' equity 15,759 15,353 17,313 17,644 19,383

Cash flow from

operations (CFFO)

(a) 696 903 1,126 989 729

Cash flow from

operations after

interest and income

tax paid (CFAIT)

(a) 548 567 822 1,346 341

Financial investments (1,640) (2,284) (694) (3,685) (4,084)

Financial divestments 360 1,068 2,303 976 1,971

Dividends paid by

Vivendi SE to its

shareholders 690 636 568 499 2,588 (b)

Purchases/(sales) of

Vivendi SE's

treasury shares 2,157 2,673 - 203 1,623

Per share data

Weighted average

number of shares

outstanding 1,140.7 1,233.5 1,263.5 1,252.7 1,272.6

Earnings attributable

to Vivendi SE

shareowners per

share 1.26 1.28 0.10 0.97 0.99

Adjusted net income

per share 1.08 1.41 0.92 1.04 0.59

Number of shares

outstanding at the

end of the period

(excluding treasury

shares) 1,092.8 1,170.6 1,268.0 1,256.7 1,259.5

Equity per share,

attributable to

Vivendi SE

shareowners 14.42 13.12 13.65 14.04 15.39

Dividends per share

paid 0.60 0.50 0.45 0.40 2.00 (b)

In millions of euros, number of shares in millions, data per

share in euros.

1. The non-GAAP measures of Income from operations, EBITA, Adjusted net

income, Net Cash Position (or Financial Net Debt), Cash flow from

operations (CFFO) and Cash flow from operations after interest and income

tax paid (CFAIT) should be considered in addition to, and not as a

substitute for, other GAAP measures of operating and financial

performance as presented in the Consolidated Financial Statements and the

related Notes, or as described in this Financial Report. Vivendi

considers these to be relevant indicators of the group's operating and

financial performance. Each of these indicators is defined in the

appropriate section of this Financial Report. In addition, it should be

noted that other companies may have definitions and calculations for

these indicators that differ from those used by Vivendi, thereby

affecting comparability. Furthermore, as of December 31, 2020, in the

context of the COVID-19 pandemic, Vivendi had not changed the definition

of these indicators, which are therefore comparable to fiscal year 2019.

2. With respect to fiscal year 2015, Vivendi paid an ordinary dividend of

EUR3 per share, i.e., an aggregate dividend payment of EUR3,951 million.

This amount included EUR2,588 million paid in 2016 (EUR1,318 million for

the second interim dividend of EUR1 per share and EUR1,270 million

representing the balance of EUR1 per share) and EUR1,363 million paid in

2015 (first interim dividend of EUR1 per share).

APPIX VI

Havas Group

New contract and award wins in 2020

Main budgets won

In 2020, Havas continued its global development by winning

numerous new clients in creative, media expertise and healthcare

communications, both locally and globally.

Havas Creation

3M, AARP, Accor, Allianz, Amazon Workforce, BMW e-sports, EDF,

Fanta, Harman JBL, Homeserve, John West, KFC, Suzuki, T3 Go, and

Yili Group.

Havas health & you

AbbVie, Astellas, AstraZeneca, Biomarin, Karyopharm, Kyowa

Kirin, Novartis, Orexo, Pfizer, Roche, Sanofi, Servier, Takeda,

UCB, and ViiV.

Havas Media

Telefonica, Sanofi, JDE Peets, Agrolimen, Lactalis, 3M,

Europcar, Karo Pharma, Promote Iceland, Epic Games, Signify, and

Tetra Pak, BBC, PMU and Audible.ca.

Main awards won

BETC ranked first in the Contagious Pioneer 2020 Top 10 agencies

and also received the special award of "Agency of the Year" at the

Eurobest thanks to two Grand Prizes for its "Crocodile Inside"

campaigns for Lacoste and "Underground Première" for 13ème Rue as

well as 6 Gold. Camp + King took second place in the "Small Agency

of the Year" ranking established by Advertising Age, one of the

industry's leading magazines. In the latest Campaign Brief 2020

Bestads Rankings, Buzzman ranked 12th among the world's best

agencies of the year.

The agencies' creativity was recognized at a large number of

festivals and ceremonies, including the D&AD, where the group's

agencies won 17 awards, including two Gold, five Silver and ten

Bronze, as well as the first-ever "Black Pencil of the Decade",

awarded to Host/Havas' "Palau Pledge" campaign.

At the One Show, they won 20 awards, including six Gold and five

Silver, for BETC Paris' Crocodile Inside and Crocodile Free

campaigns for Lacoste and Arnold Boston's two campaigns, "In

Someone Else's Shoes" for Santander Bank and "Run For Life" for the

Red Cross in Brazil.

At the Webby Awards, the group's agencies won 17 awards, led by

two first prizes from HOY for its campaign "100 years making

history" for Citroën, and Havas New York for its campaign "Adidas

original archive video series".

Effies were awarded Chile, Austria, Argentina, Belgium, Russia,

Germany, India, the United States, Poland, Peru, Colombia, Turkey

(11 awards including 6 Gold) and France (14 awards including one

Grand Prix and 5 Gold).

The Havas Media network shined at the Festival of Global Media.

The "Waiting Wins" campaign for CANAL+ won two Golds, and the

"Project Save" campaign for the Government of Valenzuela won one

Gold.

Havas Creative's New Business team was elected New-Business

Development Team of the Year by Campaign magazine for the second

consecutive year. Havas Europe held the top spot in the 2020 R3 (R3

Worldwide's New Business League for Europe) ranking of the best New

Business performances by creative networks in 2019.

APPIX VII

Successes and literary prizes won

By Editis and its partners in 2020

Among the successes achieved by Editis' publishing houses are

the following, hardback literature with Ken Follett's last novel,

Le Crépuscule et l'Aube (Robert Laffont publishing house, worldwide

release), and Marc Lévy's C'est arrivé la nuit (Robert

Laffont/Versilio publishing house); cookbooks with the success of

the first, second and third volumes of Fait Maison by Cyril Lignac;

non-fiction with Toujours Plus by two-million subscriber influencer

Léna Situations (Robert Laffont publishing house); comic books with

the fifth volume of L'Arabe du futur by Riad Sattouf (Allary

publishing house), and the youth segment with the good results of

L'agenda Scolaire by Roxane (Solar publishing house). In the

end,

Likewise several publications of Editis' new releases were

selected for prestigious literary awards: La Grâce by Thibault de

Montaigu (Plon publishing house) was awarded the Prix de Flore;

Apeirogon by Colum McCann (Belfond publishing house) received the

best foreign book award and the Prix Renaudot Poche was awarded to

Charles de Gaulle by Eric Roussel (Perrin publishing house).

Third-party publishers were not outdone, with the Prix

Interallié for Un crime sans importance by Irène Frain (Seuil

publishing house), as well as, among others, the Prix Médicis for

French literature, the Prix Médicis for foreign literature and the

Prix Femina Romans Etrangers.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20210303005864/en/

CONTACT: Media

Paris

Jean-Louis Erneux

+33 (0)1 71 71 15 84

Solange Maulini

+33 (0) 1 71 71 11 73

Investor Relations

Paris

Xavier Le Roy

+33 (0)1 71 71 18 77

Nathalie Pellet

+33 (0) 1 71 71 11 24

Delphine Maillet

+33 (0)1 71 71 17 20

SOURCE: Vivendi

Copyright Business Wire 2021

(END) Dow Jones Newswires

March 03, 2021 14:19 ET (19:19 GMT)

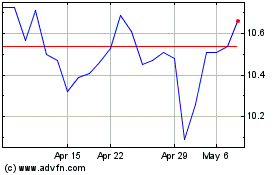

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Mar 2024 to Mar 2025