UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

[X]

|

QUARTERLY REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED S

EPTEMBER

30, 2010

|

|

OR

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 000-53941

VIRTUAL MEDICAL INTERNATIONAL, INC.

(Formerly, QE Brushes, Inc.)

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

469 St. Pierre Road

Los Angeles, California 90077

(Address of principal executive offices, including zip code.)

(310) 470-2616

(Registrant’s telephone number, including area code)

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (SS 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [ ] NO [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

Large Accelerated Filer

|

[ ]

|

|

Accelerated Filer

|

[ ]

|

|

|

Non-accelerated Filer

|

[ ]

|

|

Smaller Reporting Company

|

[X]

|

|

|

(Do not check if smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [X] NO [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicated the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date

17,607,500 as of November 15, 2010

.

TABLE OF CONTENTS

|

|

Page

|

|

|

|

|

PART I.

|

|

|

|

|

|

Item 1

.

|

Financial Statements.

|

3

|

|

|

|

|

|

|

|

Consolidated Balance Sheets as of September 30, 2010 and December 31, 2009 (Unaudited)

|

F-1

|

|

|

|

Consolidated Statements of Expenses for the three and nine months ended September 30, 2010 (Unaudited)

|

F-2

|

|

|

|

Consolidated Statements of Cash Flows for nine months ended September 30, 2010 (Unaudited)

|

F-3

|

|

|

|

Notes to Consolidated Financial Statements (Unaudited)

|

F-4

|

|

|

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

9

|

|

|

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

9

|

|

|

|

|

|

Item 4.

|

Controls and Procedures.

|

9

|

|

|

|

|

|

|

PART II.

|

|

|

|

|

|

|

Item 1A.

|

Risk Factors.

|

10

|

|

|

|

|

|

Item 2.

|

Changes in Securities and Use of Proceeds.

|

10

|

|

|

|

|

|

Item 6.

|

Exhibits.

|

10

|

|

|

|

|

|

Signatures

|

11

|

|

|

|

|

Exhibit Index

|

12

|

PART I. – FINANCIAL INFORMATION

ITEM 1.

FINANCIAL STATEMENTS.

|

VIRTUAL MEDICAL INTERNATIONAL, INC.

|

|

Formerly QE Brushes, Inc.

|

|

(A Development Stage Company)

|

|

Consolidated Balance Sheets

|

|

(Unaudited)

|

|

|

|

September 30,

|

|

|

December 31,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

ASSETS

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash

|

|

$

|

-

|

|

|

$

|

48,253

|

|

|

Total Current Assets

|

|

|

-

|

|

|

|

48,253

|

|

|

Investment in securities available for sale,

|

|

|

|

|

|

|

|

|

|

|

|

|

2,856,000

|

|

|

|

-

|

|

|

Total Assets

|

|

$

|

2,856,000

|

|

|

$

|

48,253

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

-

|

|

|

$

|

142

|

|

|

Note payable - related party

|

|

|

19,467

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

19,467

|

|

|

|

142

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Convertible Preferred stock, $.00001 par, 10,000,000 shares

|

|

|

|

|

|

|

|

|

|

authorized, 50,000,000 shares issued and outstanding

|

|

|

20

|

|

|

|

-

|

|

|

Common stock, $.00001 par, 250,000,000 shares authorized

|

|

|

|

|

|

|

|

|

|

17,607,500 and 6,695,000 shares issued and outstanding,

|

|

|

|

|

|

|

|

|

|

respectively

|

|

|

176

|

|

|

|

6,696

|

|

|

Additional paid-in capital

|

|

|

7,932,761

|

|

|

|

128,761

|

|

|

Accumulated other comprehensive (loss)

|

|

|

(2,940,000

|

)

|

|

|

-

|

|

|

Deficit accumulated during the development stage

|

|

|

(2,156,424

|

)

|

|

|

(87,346

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders’ Equity

|

|

|

2,836,533

|

|

|

|

48,111

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity

|

|

$

|

2,856,000

|

|

|

$

|

48,253

|

|

The accompanying notes are an integral part of these unaudited financial statements.

F-1

|

VIRTUAL MEDICAL INTERNATIONAL, INC.

|

|

|

Formerly QE Brushes, Inc.

|

|

|

(A Development Stage Company)

|

|

|

Consolidated Statements of Expenses

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From Inception

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(July 19, 2007)

|

|

|

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

|

Through

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

OPERATING EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal fees

|

$

|

13,588

|

|

|

$

|

1,675

|

|

|

$

|

26,484

|

|

|

$

|

1,675

|

|

|

$

|

60,601

|

|

|

Accounting fees

|

|

3,830

|

|

|

|

5,450

|

|

|

|

15,919

|

|

|

|

13,183

|

|

|

|

40,041

|

|

|

Office expense

|

|

1,019

|

|

|

|

725

|

|

|

|

1,965

|

|

|

|

1,474

|

|

|

|

6,038

|

|

|

License and fees

|

|

-

|

|

|

|

220

|

|

|

|

2,581

|

|

|

|

540

|

|

|

|

5,022

|

|

|

Professional fees

|

|

2,002,734

|

|

|

|

13,330

|

|

|

|

2,005,700

|

|

|

|

15,535

|

|

|

|

2,028,295

|

|

|

Travel

|

|

708

|

|

|

|

-

|

|

|

|

2,315

|

|

|

|

-

|

|

|

|

2,313

|

|

|

Loss on disposal of inventory

|

|

14,114

|

|

|

|

-

|

|

|

|

14,114

|

|

|

|

-

|

|

|

|

14,114

|

|

|

Total operating expenses

|

|

2,035,994

|

|

|

|

21,400

|

|

|

|

2,069,078

|

|

|

|

32,407

|

|

|

|

2,156,424

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING LOSS

|

|

(2,035,994

|

)

|

|

|

(21,400

|

)

|

|

|

(2,069,078

|

)

|

|

|

(32,407

|

)

|

|

|

(2,156,424

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

(2,035,994

|

)

|

|

|

(21,400

|

)

|

|

|

(2,069,078

|

)

|

|

|

(32,407

|

)

|

|

$

|

(2,156,424

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE LOSS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss in investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

available for sale

|

|

(2,940,000

|

)

|

|

|

-

|

|

|

|

(2,940,000

|

)

|

|

|

-

|

|

|

|

(2,940,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE LOSS

|

$

|

(4,975,994

|

)

|

|

$

|

(21,400

|

)

|

|

$

|

(5,009,078

|

)

|

|

$

|

(32,407

|

)

|

|

$

|

(5,096,424

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares

|

|

10,189,565

|

|

|

|

6,695,000

|

|

|

|

9,101,868

|

|

|

|

6,695,000

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

$

|

(0.22

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.20

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

The accompanying notes are an integral part of these unaudited financial statements.

F-2

|

VIRTUAL MEDICAL INTERNATIONAL, INC.

|

|

|

Formerly QE Brushes, Inc.

|

|

|

(A Development Stage Company)

|

|

|

Consolidated Statements of Cash Flows

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From Inception

|

|

|

|

|

|

|

|

(July 19, 2007)

|

|

|

|

|

Nine Months Ended

|

|

|

Through

|

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

2010

|

|

|

Cash Flows From Operating Activities

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(2,069,079

|

)

|

|

$

|

(32,407

|

)

|

|

$

|

(2,156,424

|

)

|

|

Adjustments to reconcile net loss to net cash

|

|

|

|

|

|

|

|

|

|

|

|

|

|

used in operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for services

|

|

|

2,001,500

|

|

|

|

-

|

|

|

|

2,004,182

|

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

Prepaid expenses

|

|

|

-

|

|

|

|

-

|

|

|

|

142

|

|

|

Accounts payable

|

|

|

(142

|

)

|

|

|

(207

|

)

|

|

|

(143

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cash Used For Operating Activities

|

|

|

(67,721

|

)

|

|

|

(32,614

|

)

|

|

|

(152,243

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale of common stock to founder

|

|

|

-

|

|

|

|

-

|

|

|

|

3,775

|

|

|

Notes payable - related party

|

|

|

19,468

|

|

|

|

-

|

|

|

|

19,468

|

|

|

Proceeds from sale of common stock

|

|

|

-

|

|

|

|

-

|

|

|

|

129,000

|

|

|

Total Cash Provided by Financing Activities

|

|

|

19,468

|

|

|

|

-

|

|

|

|

152,243

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Increase (Decrease) in Cash

|

|

|

(48,253

|

)

|

|

|

(32,614

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash at Beginning of Period

|

|

|

48,253

|

|

|

|

86,079

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash at End of Period

|

|

$

|

-

|

|

|

$

|

53,465

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosure of Cash Flow Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$

|

31

|

|

|

$

|

-

|

|

|

$

|

31

|

|

|

Income taxes paid

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non Cash

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued for Acquisition of Marketable Securities

|

|

$

|

5,796,000

|

|

|

$

|

-

|

|

|

$

|

5,796,000

|

|

|

Other Comprehensive Loss

|

|

$

|

2,940,000

|

|

|

$

|

-

|

|

|

$

|

2,940,000

|

|

The accompanying notes are an integral part of these unaudited financial statements.

F-3

|

VIRTUAL MEDICAL INTERNATIONAL, INC.

|

(Formerly QE Brushes, Inc.)

(A Development Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

NOTE 1. Basis of Presentation

The unaudited financial statements of Virtual Medical International, Inc. (hereafter referred to as “VMI” or “The Company”) have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Although certain information normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted, the Company believes that the disclosures are adequate to make the information presented not misleading. These financial statements should be read in conjunction with the financial statements and notes thereto for the fiscal year ended December 31, 2010, included in The Company’s Form 10-K.

The financial statements included herein reflect all normal recurring adjustments that, in the opinion of management, are necessary for a fair presentation. The results for interim periods are not necessarily indicative of trends or of results to be expected for the full year ended December 31, 2010.

ACCOUNTING POLICIES

Investments

The Company’s investments are considered available for sale instruments. The cost of securities sold is determined by the specific identification method. Net unrealized holding gains and losses are reported as accumulated other comprehensive income, a separate component of stockholders’ equity. Declines in the fair value of individual available-for-sale securities below their cost that are other than temporary, result in a write-down of the individual security to its fair market value. These write-downs are reflected in earnings as a realized loss on available-for-sale securities. Factors affecting the determination of whether an other-than-temporary impairment has occurred include a downgrading of the security by a rating agency, a significant deterioration in the financial condition of the issuer, or that management would not have the intent or ability to hold a security for a period of time sufficient to allow for any anticipated recovery in fair value.

ASC 820, “Fair Value Measurements”, requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

F-4

|

VIRTUAL MEDICAL INTERNATIONAL, INC.

|

(Formerly QE Brushes, Inc.)

(A Development Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

Level 2

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The Company’s financial instruments consist principally of Investments. Pursuant to ASC 820, the fair value of our investments is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assets. The Company believes that the recorded values of all of the other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

Reclassifications

Certain reclassifications have been made to prior period’s balances to conform to classifications used in 2010.

NOTE 2. Description of Business

QE Brushes, Inc. (the predecessor name of the corporation) was incorporated in Nevada on July 19, 2007, for the purpose of developing, manufacturing and selling toothbrushes designed specifically for dogs and cats. Subsequently, the board of directors and shareholders decided to change the business direction and the name of the company. On August 26, 2010, the name was officially changed to Virtual Medical International, Inc.

The company plans to be in the business of medical education through the internet, and will seek to develop and or acquire websites that are designed to convey to patients the risks and benefits of medical treatments in an easy to understand, yet comprehensive fashion. By using these services, patients will be able to make more informed decisions regarding their care and treatment thereby decreasing risk of a misinformed malpractice suit against a physician or a hospital. This decrease in risk will result in a decrease in the overall cost to malpractice liability insurance companies, which represent our primary compensation targets. The company also plans to create virtual waiting rooms where patients will be able to see physicians online twenty four hours a day.

NOTE 3. Going Concern

The company has incurred net losses from the date of inception (July 19, 2007) through September 30, 2010, and has not generated any revenue. Currently the company has no cash and will have to raise additional capital through the sale of common stock.

These conditions and uncertainties raise substantial doubt as to The Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might be necessary if VMI is unable to continue as a going concern.

F-5

|

VIRTUAL MEDICAL INTERNATIONAL, INC.

|

(Formerly QE Brushes, Inc.)

(A Development Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

NOTE 4. Stockholders’ Equity

On March 18, 2010, the Company adopted a two-for-one forward stock dividend, which increased the outstanding common stock from 6,695,000 shares as of December 31, 2009 to 13,390,000 shares. Immediately after, or in conjunction with the forward stock dividend, four directors and a consultant returned a total of 2,250,000 shares to the company for cancellation. The return of these shares resulted in a new balance of 11,140,000 common shares outstanding as of March 31, 2010.

On July 7, 2010, management approved a one-for-two reverse stock split which decreased the outstanding common stock from 11,140,000 shares as of March 31, 2010 to 5,532,500 shares.

During the quarter ended September 30, 2010, the Company issued 7,000,000 common shares and 2,000,000 shares of voting preferred, convertible (on a one to one basis), and restricted stock in exchange for 1,680,000 common shares of Entertainment Arts Research, Inc.(“EAR”), a Nevada corporation that trades on the over-the counter pink sheet market. This transaction was valued at $5,796,000 which was the fair value of the EAR shares received in the transaction.

On July 7, 2010, management approved the issuance of 5,000,000 common shares valued at $.40 per share to two individuals for consulting services.

NOTE 5. Subsidiary Corporation

On June 7, 2010, The Company filed articles of incorporation in Nevada in order to form a new corporation named Sotoo, Inc. Sotoo, Inc. is wholly-owned and has not conducted any business.

NOTE 6. Related Party

The current CEO of VMI, Frank D’ Ambrosio owns a corporation (Explain My Surgery, Inc.) which has advanced WMI $19,467 during the third quarter of 2010. This amount bears no interest, is unsecured and due on demand. There was not a cash advance to VMI, rather Explain My Surgery, Inc. paid various invoices on behalf of VMI.

NOTE 7. Subsequent Event

On October 15, 2010, the Company held a special; meeting of the shareholders in order to amend the articles of incorporation to increase the authorized shares of preferred stock from ten million (10,000,000) to fifty million (50,000,000) shares; and authorized shares of common stock from ninety million (90,000,000) to two hundred and fifty million (250,000,000) shares. In addition, the shareholders also voted to change the name of the Company from QE Brushes, Inc. to Virtual Medical International, Inc.

|

ITEM 2.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

This section of the quarterly report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results of our predictions.

We are a start-up corporation and have not yet generated or realized any revenues from our business operations. Our auditors have issued a going concern opinion on the financial statements for the year ended December 31, 2009. The Company cannot anticipate the commencement of revenue generation. Also, there is a negative working capital position of $19,467.

Results of Operations

During the three months ended September 30, 2010, the company had no revenues and incurred operating expenses of $2,035,993, which were primarily stock based compensation for consulting fees. During the comparable three month period ended September 30, 2009, the Company also had no revenues and incurred operating expenses of $21,400, which primarily consisted of professional fees.

Liquidity and Capital Resources

As of September 30, 2010, the company had no cash and no other current assets. The Company had $19,467 in accounts payable, which resulted in a negative working capital balance of $19,467. This compares with a working capital balance of $48,111 as of December 31, 2009. Working capital decreased by $67,578 from December 31, 2009 to September 30, 2010.

|

ITEM 3.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK.

|

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 4. CONTROLS AND PROCEDURES

Under the supervision and with the participation of our management, including the Principal Executive Officer and Principal Financial Officer, we have evaluated the effectiveness of our disclosure controls and procedures as required by Exchange Act Rule 13a-15(b) as of the end of the period covered by this report. Based on that evaluation, the Principal Executive Officer and Principal Financial Officer have concluded that these disclosure controls and procedures are effective.

There were no changes in our internal control over financial reporting during the quarter ended September 30, 2010 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

None

ITEM 6. EXHIBITS

|

Exhibit No.

|

Document Description

|

|

|

|

|

10.1

|

Amended Consultants Work Agreement with Gregory Ruff dated July 7, 2010.

|

|

|

|

|

10.2

|

Amended Consultants Work Agreement with Robert Tessanari dated July 7, 2010.

|

|

|

|

|

31.1

|

Certification of Principal Executive Officer pursuant Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

31.2

|

Certification of Principal Financial Officer pursuant Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

32.1

|

Certification of Chief Executive Officer pursuant Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

32.2

|

Certification of Chief Financial Officer pursuant Section 906 of the Sarbanes-Oxley Act of 2002.

|

SIGNATURES

In accordance with Section 13 or 15(d) of the Securities and Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on this 15

th

day of November, 2010.

|

|

VIRTUAL MEDICAL INTERNATIONAL, INC.

|

|

|

(Formerly, QE Brushes, Inc.)

|

|

|

(the “Registrant”)

|

|

|

|

|

|

|

BY:

|

MARC SALLS

|

|

|

|

Marc Salls

|

|

|

|

President and Director

|

|

|

|

|

|

|

BY:

|

FRANCIS D’AMBROSIO

|

|

|

|

Francis D’Ambrosio

|

|

|

|

Principal Executive Officer

|

|

|

|

|

|

|

BY:

|

DAVID HOSTELLEY

|

|

|

|

David Hostelley

|

|

|

|

Principal Financial Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

Document Description

|

|

|

|

|

10.1

|

Amended Consultants Work Agreement with Gregory Ruff dated July 7, 2010.

|

|

|

|

|

10.2

|

Amended Consultants Work Agreement with Robert Tessanari dated July 7, 2010.

|

|

|

|

|

31.1

|

Certification of Principal Executive Officer pursuant Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

31.2

|

Certification of Principal Financial Officer pursuant Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

32.1

|

Certification of Chief Executive Officer pursuant Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

32.2

|

Certification of Chief Financial Officer pursuant Section 906 of the Sarbanes-Oxley Act of 2002.

|

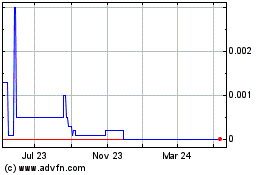

Virtual Medical (CE) (USOTC:QEBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

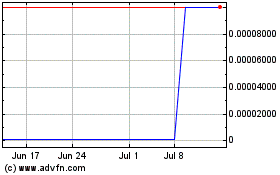

Virtual Medical (CE) (USOTC:QEBR)

Historical Stock Chart

From Jan 2024 to Jan 2025