Vestas Cuts Guidance and Books Hefty Writedowns on Russia, Ukraine Business

May 02 2022 - 3:14AM

Dow Jones News

By Dominic Chopping

Vestas Wind Systems AS late Sunday cut its full-year guidance

after announcing hefty write-downs on its Russia and Ukraine

business, higher warranty provisions and impairment losses on

legacy offshore activities.

"The business environment worsened significantly during the

first quarter of 2022 due to Russia's invasion of Ukraine, and the

associated ripple effects on global trade and cost inflation,"

Vestas said.

"At the same time, we have seen lockdowns in China that will

continue to impact the wind-power industry throughout 2022,

together with increased cost inflation for raw materials,

wind-turbine components and energy prices."

In total, Vestas booked 565 million euros ($595.5 million) of

one-off costs in the quarter, in addition to EUR195 million of

warranty provisions caused by increasing repair and upgrade costs

of offshore wind turbines.

The Danish wind-turbine maker said it recognized EUR401 million

of costs following its decision to withdraw from the Russian market

while stopping all service and construction activities in

Ukraine.

The costs relate to inventory located in Russia and Ukraine that

isn't expected to be sold, as well as assets such as buildings and

equipment in Russia that have been written down to zero as they

aren't expected to be used or sold, the company said.

Further costs of EUR183 million were booked in relation to an

adjustment of its manufacturing footprint by ceasing production at

certain factories in China and India, the company said.

Vestas posted a first-quarter net loss of EUR765 million,

compared with a loss of EUR68 million a year earlier, as revenue

rose 27% to EUR2.49 billion.

Analysts in a FactSet poll had expected a net loss of EUR89

million on revenue of EUR2.37 billion.

Order intake rose to EUR3.0 billion from EUR1.6 billion, while

the total turbine and service order backlog reached EUR48.9

billion, compared with EUR44.7 billion, the company said.

For 2022, the company said it now expects revenue of between

EUR14.5 billion and EUR16.0 billion, compared with previous

guidance of between EUR15.0 billion and EUR16.5 billion, and a

pre-items earnings before interest and taxes margin of -5% to 0%,

compared with 0% to 4% previously.

Service revenue is expected to grow by at least 10%, compared

with previous guidance of around 5%, with a pre-items service Ebit

margin of around 23%, compared with 25% previously, the company

said.

It said it still anticipates total investments of around EUR1

billion for the year.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

May 02, 2022 02:59 ET (06:59 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

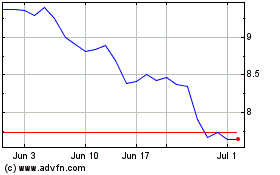

Vestas Wind Systems AS (PK) (USOTC:VWDRY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vestas Wind Systems AS (PK) (USOTC:VWDRY)

Historical Stock Chart

From Nov 2023 to Nov 2024