IRVINE, CA

-- July 22, 2020 -- InvestorsHub

NewsWire -- Vemanti

Group, Inc.

(OTC

PINK:VMNT) a multi-asset

technology-driven company, today announced

that

its portfolio

company, Fvndit, Inc.

("Fvndit"), has disbursed

a record of

over $15M USD in loans to SMEs in

Vietnam through its P2P lending

marketplace, eLoan JSC ("eLoan").

eLoan's

total

revenues for FY2019 increased by 338% compared to FY2018.

Despite the global

uncertainties

around

COVID-19,

it

is still

projected to exceed last year's performance. Most of the loans are

short-term loans, averaging a two-month term. The average ticket size of

the loans facilitated stands at $50,000 USD. Small to Medium-Size

Enterprises (SMEs) play a major role in Vietnam's economy,

accounting for 98% of all enterprises, more than 41% of GDP

($261.64 billion - nominal, 2019

est.), and over 50% of employment. Access to credit is the

biggest challenge for these businesses.

It is

estimated that 70% of the SMEs in

Vietnam don't have access to proper financing. Banks regard loans to

SMEs as risky relative to high transaction costs and approval

process could take 1-2 months.

Most

banks

don't

find enough

value in

underwriting loans for SMEs, often because their typical

loan size is not very large, and banks cannot justify the money or

the manpower they spend on underwriting smaller business

loans.

Banks

providing commercial loans prefer to allocate their resources to

larger firms rather than SMEs.

"We measure our success

not just on numbers but also the impact we're creating.

Helping SMEs

grow is important

for Vietnam's

continued rise as a regional

economic

driver. Our retention rate

is over 70%. There is a

huge

unmet credit

demand that we

want

to fill. We're currently

working on closing a sizable

financing transaction

with

institutional

investors to increase our loan

portfolio and diversification of

products to strengthen

eLoan's position as the

market-leading P2P

SME

financing

platform in

Vietnam. We're also

confident in expanded

future growth

with strategic

partnerships currently in the

works as well as

the

ones

we already

have in place

like

Nam A Bank

and Investree."

stated

Tan Tran, CEO

of Vemanti

Group, who is

also Fvndit's

CEO.

Fintech today

is a much sought-after space in Vietnam's

emerging economy and with a $23B-financing gap for SMEs

in the country, a joint report released

by the International Finance Corporation (IFC) and SME Finance

Forum estimated. eLoan's

P2P

lending

platform

addresses

the long-standing

issue of lack of SME

financing by using

technology to streamline the loan

underwriting procedures, making it relatively

cost-effective and efficient with

end to end

processing completed

in

as little as

24 hours. With a population

of close to

100M and a consistent growth

in the annual gross domestic product (GDP), Vietnam

has emerged

as one of the next big lands of opportunity in Southeast

Asia.

The current macro

environment has brought economic

challenges globally.

However, it has also created a myriad of opportunities for P2P

platforms like eLoan. P2P lending has started

to come to fruition during the crisis, not just by surviving but by

playing a role in the economic recovery. P2P has outpaced

traditional

bank savings, making alternative

lending one of the more attractive products on the market for

yield-seeking investors. As part of an effort

to further

enhance user

experience, eLoan is looking to deploy

a mobile

app in

the near

future, available for both iOS

and Android, to match their website capabilities in terms of

account management for individual investors. With it,

users

will be able to set their own investment rules and

have a

customized portfolio by

manually participating in

individual

loans or setting up an automated

fixed-income

strategy.

For more news and

updates, current shareholders and

prospective investors of VMNT can follow @Vemanti

on Twitter

(https://twitter.com/Vemanti).

About

Vemanti Group, Inc.

Vemanti

Group,

Inc. (OTC

PINK:VMNT)

is a technology-driven multi-asset company that seeks to be active

in high-growth and emerging markets. Our core strengths are in

technology development and investment. We drive growth through

acquisition and investment in disruptive and foundational

technologies by targeting early-stage companies that have market

viable products or by starting a new subsidiary of our own.

Strategically, we focus mainly on fintech applications combined

with other emerging technologies, including blockchain and machine

learning/AI.

About

Fvndit, Inc.

Fvndit,

Inc. ("Fvndit"), pronounced like "Fund

it", is a California- and Vietnam-based fintech company, focused on

solving the working capital problem for SMEs using technology. The

team is comprised of engineers, designers, data scientists, trade

finance and banking veterans across 2 locations: Irvine, CA and

HCMC, Vietnam. It's using technology to re-build core parts of the

business funding infrastructure and make the underwriting and

financing seamless for small businesses. Its wholly-owned

subsidiary, eLoan, JSC

("eLoan"), operates an online

P2P funding and investing marketplace in Vietnam, its current local

market.

About

eLoan, JSC.

eLoan,

JSC ("eLoan") (https://eloan.vn) is a peer-to-peer (P2P) lending marketplace that allows

investors to lend money directly to small and medium-sized

enterprises (SMEs) based in Ho Chi Minh City, Vietnam.

eLoan

is the first

peer-to-peer lending company and one of the few fintech firms in

Vietnam focusing purely on serving SME clients with short-term

loans. Its platform is run on a proprietary AI-driven

decision-making and credit-rating system. The company is a legal

entity registered under the laws of Vietnam and is not affiliated

with E-LOAN, Inc. and http://eloan.com,

a Division of Banco Popular de Puerto Rico.

Legal Disclaimer

This press release

contains forward-looking statements within the meaning of Section

27a of the Securities Act of 1933, as amended and section 21e of

the Securities and Exchange Act of 1934, as amended. Those

statements include the intent, belief or current expectations of

the company and its management team. Forward-looking statements are

projections of events, revenues, income, future economics,

research, development, reformulation, product performance or

management's plans and objectives for future operations. Some or

all of the events or results anticipated by these forward-looking

statements may not occur. Prospective investors are cautioned that

any such forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, and that actual

results may differ materially from those projected in the

forward-looking

statements as a result of various factors. Accomplishing the

strategy described herein is significantly dependent upon numerous

factors, many that are not in management's control.

Contact

Information

Vemanti

Group,

Inc.

Investor

Relations

(800)

768-1288

ir@vemanti.com

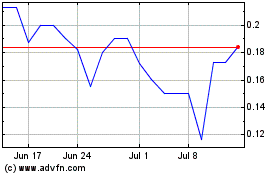

Vemanti (PK) (USOTC:VMNT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Vemanti (PK) (USOTC:VMNT)

Historical Stock Chart

From Mar 2024 to Mar 2025