Singapore Fines Credit Suisse and Local Bank in 1MDB Inquiry

May 29 2017 - 11:09PM

Dow Jones News

By P.R. Venkat and Jake Maxwell Watts

SINGAPORE -- Singapore's financial regulator imposed fines on

Swiss bank Credit Suisse AG and a local bank for

antimoney-laundering control failures connected with an

investigation into alleged misappropriation from Malaysian state

fund 1MDB.

The Monetary Authority of Singapore said Tuesday it had fined

Credit Suisse S$700,000 (US$504,613) and United Overseas Bank Ltd.

S$900,000, after it found several breaches of regulations and

inadequate scrutiny of customers' transactions and activities.

In addition, the central bank and regulator said it had issued

financial sector bans on three individuals and served advance

notice on three others of its intention to ban them, too.

The fines were imposed on the two banks at the conclusion of a

two-year review into the role of Singapore's financial institutions

related to 1MDB, or 1Malaysia Development Bhd. Singapore is one of

several countries around the world, including the U.S., probing the

fund's activities.

During its extensive review, MAS has shut two foreign private

banks and fined six others in addition to UOB and Credit Suisse for

various breaches of antimoney-laundering regulations. It has fined

banks operating in Singapore a combined S$29.1 million for their

roles in handling 1MDB-related fund flows.

The private banks that have been shut down are BSI Bank and

Falcon Bank, while banks like UBS AG, Standard Chartered Bank PLC,

and DBS Group Holdings had financial penalties imposed against

them.

1MDB has denied wrongdoing. In a statement, Credit Suisse said

that it acknowledges the outcome of the review and regrets that it

has fallen short of MAS and the bank's own high standards.

UOB said it accepts the findings by the MAS and that it has

instituted measures to address the areas of concern, including

enhancing its training program to raise risk-and- control awareness

among staff.

MAS said in a statement its review of financial institutions in

Singapore, where hundreds of millions of dollars connected to

alleged misappropriations from 1MDB flowed, is the most extensive

it has ever undertaken. While it did not find pervasive control

weaknesses at Credit Suisse and UOB, MAS said the two banks had

breached regulations several times.

Write to P.R. Venkat at venkat.pr@wsj.com and Jake Maxwell Watts

at jake.watts@wsj.com

(END) Dow Jones Newswires

May 29, 2017 22:54 ET (02:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

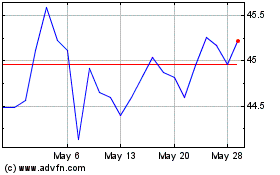

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Jan 2025 to Feb 2025

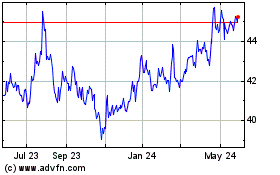

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Feb 2024 to Feb 2025