U.K. Pound Hits Six-Month High as Referendum Looms

June 23 2016 - 2:10AM

Dow Jones News

The British pound was up again Thursday as Asian markets began

trading, in a flurry of last-minute betting activity before a

landmark U.K. referendum on whether to stay in the European Union.

Against the U.S. dollar, the pound touched a six-month high of

$1.4847, a 3.4% gain for the week so far.

The pound has been surging this week, catalyzed by polls showing

a slight lead for the "remain" side that opened up after the

killing of pro-EU British lawmaker Jo Cox that some believe has

tilted fence-sitters toward a pro-EU vote.

This sets up the pound for a number of scenarios, and possibly

much volatility.

While the odds favor a pro-EU vote, there is a risk of "buy on

the rumor, sell on the fact," which could temporarily sink the

pound against the dollar after the referendum, even if voters

choose to remain.

Analysts project the pound would crater if Britons vote to exit,

likely surrendering all of its recent gains and more. The pound

could collapse below the psychological support level of $1.4000,

triggering preset trading orders that would accelerate the

fall.

There are also longer-term implications.

Victor Yong, interest rates strategist for United Overseas Bank

in Singapore, said that if the U.K. were to exit, the Bank of

England might cut its base interest rate from the current record

low of 0.50%—potentially to zero, possibly within days, or weeks at

most.

Given the urgency of the situation, the BOE would likely act

quickly, though its first priority would be to ensure interbank

funding liquidity doesn't dry up. In the event of an exit vote,

banks might refuse to lend to each other out of fear that other

banks' creditworthiness will be undermined by diminished access to

European markets and rising U.K. defaults.

The BOE has already laid out arrangements with other global

central banks to pump cash into markets to prevent a freezing of

the financial system, Mr. Yong said.

The central bank's bias would certainly shift toward an easing

policy, he added, but a zero interest-rate policy might prove too

radical given the recent debate about its effectiveness. A 25

basis-point cut combined with an asset purchase program might be

announced to buffer a Brexit shock on the U.K. economy, Mr. Yong

said.

On the other hand, if the U.K. remains in the EU, gradually

improving economic data might persuade the BOE to lift interest

rates in 2017, following the path of the U.S. Federal Reserve, he

added.

Write to Ewen Chew at ewen.chew@wsj.com

(END) Dow Jones Newswires

June 23, 2016 01:55 ET (05:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

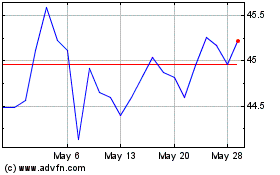

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Oct 2024 to Nov 2024

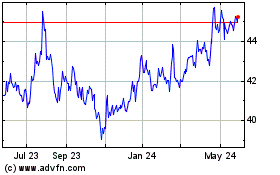

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Nov 2023 to Nov 2024