- Current report filing (8-K)

May 28 2010 - 1:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

MAY 28, 2010 (MAY ___, 2010)

Date of Report (Date of earliest event reported)

REGAL GROUP INC.

(Exact name of registrant as specified in its charter)

NEVADA 333-134536 PENDING

(State or other jurisdiction (Commission File No.) (IRS Employer

of incorporation) Identification No.)

|

3723 E. MAFFEO ROAD

PHOENIX, ARIZONA 89050

(Address of principal executive offices) (Zip Code)

516-659-6677

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions.

[_] Written communications pursuant to Rule 425 under the Securities Act (17

CFR240.14d-2(b))

[_] Soliciting material pursuant to Rule 14a-12 under Exchange Act (17

CFR240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR240.13e-4(c))

ITEM 8.01 OTHER EVENTS.

On May 27, 2010, the board of directors (the "Board") of Regal Group, Inc., a

Nevada Corporation (the "Company") executed a resolution extending the term of

certain unexercised warrants previously issued by the Company pursuant to a

private placement offering conducted by it commencing November, 2007 (the

"Offering"). Such Offering was for the sale by the Company of up to 1,000,000

units, each consisting of one pre-split share of the Company's common stock,

$0.001 par value per share ("Common Stock"), and one two-year warrant (the

"Warrant") to purchase a pre-split share of the Company's Common Stock at an

exercise price of $1.00 per share. However, beginning May 28, 2010, Warrants to

purchase an aggregate of 4,333,335 post-split shares of the Company's Common

Stock are to expire (the "Expiring Warrants").

In executing the resolution, the Board had determined that the exercise of the

Expiring Warrants by the holders thereof constitutes an important component of

the Company's future financing plan for its ongoing operations. As such, the

Board has resolved to extend the term of the Expiring Warrants for a period of

two years in order to facilitate the holders thereof to exercise such Expiring

Warrants should the market price of the Company's Common Stock exceed the

exercise price of the Expiring Warrants.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

None.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as

amended, the registrant has duly caused this Current Report on Form 8-K to be

signed on its behalf by the undersigned thereunto duly authorized.

Dated: May 28, 2010 REGAL GROUP INC.

By: /s/ Eric Wildstein

Name: Eric Wildstein

Title: President, Chief Executive Officer and Director

|

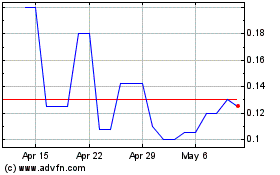

UHF Logistics (PK) (USOTC:RGLG)

Historical Stock Chart

From Feb 2025 to Mar 2025

UHF Logistics (PK) (USOTC:RGLG)

Historical Stock Chart

From Mar 2024 to Mar 2025