0001514056

false

0001514056

2022-12-31

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) December 31, 2022

TRAQIQ,

INC.

(Exact

name of registrant as specified in charter)

| California |

|

000-56148 |

|

30-0580318 |

(State

or other Jurisdiction of

Incorporation

or Organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

14205

SE 37th Street, Suite

100

Bellevue,

WA |

|

98006 |

| (Address

of Principal Executive Offices) |

|

(zip

code) |

(425)

818-0560

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any

of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $.0001 per share |

|

TRIQ |

|

OTC

QB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 |

Material

Contracts. |

Acquisition

of Assets

On

January 5, 2023, TraQiQ, Inc., a California corporation (the “Company”), consummated the transactions contemplated by the

Asset Purchase Agreement dated as of December 30, 2022 (the “Purchase Agreement”) among Renovare Environmental, Inc. (“REI”)

and BioHiTech America, LLC (“BHT” and, together with REI, the “ Renovare Sellers”) and the Company, pursuant

to which the Sellers sold and assigned to the Company, and the Company purchased and assumed from the Renovare Sellers, (a)

certain assets related to the business of (i) offering aerobic digestion technology solutions for the disposal of food waste at the point

of generation and (ii) data analytics with respect to food waste (collectively, the “Digester Business”) and (b) certain

specified liabilities of the Sellers, including, but not limited to, indebtedness in an amount equal to $3,017,089.85 (the “Michaelson

Debt”) owed to Michaelson Capital Special Finance Fund II, L.P. (“Michaelson”).

In

exchange for the assets of the Digester Business, the Company (a) paid the Renovare Sellers an amount equal to $150,000 (the “Cash

Consideration”) and (b) issued to REI (i) 1,250,000 shares of the Company’s Series B Preferred Stock, par value $0.0001 (the

“Series B Preferred Stock”), and (ii) 15,686,926 shares of the Company’s common stock, par value $0.0001 (the “Common

Stock”), a portion of which is being held in escrow. The Purchase Agreement contained standard representations and warranties by

the Company and the Renovare Sellers which, except for fundamental representations, remain in effect for twelve months following the

closing date. 1,568,693 shares of the Common Stock portion of the closing consideration were placed into escrow, the release of which

is contingent upon a mutual agreement of the parties or January 4, 2024 or if a claim is pending, a final non -appealable order

of any court of competent jurisdiction.

Additional

agreements ancillary to the asset acquisition were also executed, including but not limited to a bill of sale, assignment and assumption

agreement, an escrow agreement and a domain name assignment agreement.

The

Renovare Sellers also agreed that, for a period of five years from closing date, the Sellers would not engage in a business that competes

with the Digester Business.

Debt

Exchange Agreements

In

connection with the transactions contemplated by the Purchase Agreement, the Company entered into Debt Exchange Agreements dated as of

December 30, 2022 with certain of its creditors, including Ajay Sikka, the Company’s Chairman and Chief Executive Officer, pursuant

to which such creditors exchanged $5,277,570 of debt, in the aggregate, which represented all amounts of debt owed by the Company to

such creditors, $3,242,570 of which was held by Ajay Sikka, for an aggregate of 137,613 shares of Series B Preferred Stock, 45,000 of

which shares were issued to Ajay Sikka, and 21,254,929 shares of Common Stock, 9,475,657 of which shares were issued to Ajay Sikka.

OID

Promissory Note

To

facilitate the Company’s payment of the Cash Consideration, on January 4, 2023, the Company borrowed the full amount of the Cash

Consideration from an accredited investor in exchange for a 20% OID Senior Secured Promissory Note dated January 4, 2023 in the original

principal amount of $180,000 (the “OID Note”). The OID Note matures on January 4, 2024, bears interest at the rate of ten

percent (10%) per annum and has no prepayment penalty. In the event of a default by the Company under the OID Note, the

outstanding principal and interest will be convertible by the holder into Common Stock at a conversion price equal to the lower of (i)

$.015 per share and (ii) an amount equal to 90% of the average of the two lowest volume weighted average prices of the Common Stock for

the five consecutive trading days prior to the conversion date.

Assumption

Agreement

In

connection with the Company’s assumption of the Michaelson Debt, pursuant to the Purchase Agreement, Michaelson, the Company, the

Renovare Sellers, BHT Financial, LLC (“BHTF”), BioHiTech Europe, PLC (“BHTE”), E.N.A. Renewables (“ENA”)

and New Windsor Resource Recovery (together with the Sellers, BHTF, BHTE and ENA, the “Renovare Companies”) entered into

an Assumption Agreement dated as of December 30, 2022 (the “Assumption Agreement”), pursuant to which the Company assumed

all of the obligations and liabilities with respect to the Michaelson Debt.

Secured

Term Note

In

connection with the transactions contemplated by the Purchase Agreement and the Assumption Agreement, on January 5, 2023, the Company

issued to Michaelson an Amended and Restated Senior Secured Term Note dated December 30, 2022 (the “Michaelson Note”) in

the principal amount equal to the Michaelson Debt. The Michaelson Note is payable in five principal installments, with the first four

installments each in the principal amount of $250,000 payable on each of January 31, 2023, March 31, 2023, June 30, 203 and September

30, 2023 and with the last installment in the total remaining principal balance payable on December 31, 2023. The Michaelson Note bears

interest at the rate of twelve percent (12%) per annum that is payable monthly.

Security

Agreement

In

connection with the transactions contemplated by the Purchase Agreement, the Assumption Agreement and the Michaelson Note, the Company

entered into a Security Agreement dated as of December 30, 2022 with Michaelson, pursuant to which the Company granted to Michaelson

a security interest and lien upon all of the Company’s personal property, tangible or intangible, and whether then owned or thereafter

acquired, or in which the Company has or at any time obtains any right, title or interest, in each case to collateralize the Company’s

obligations under the Michaelson Note and the Assumption Agreement.

Disposition

of Subsidiaries

On

December 31, 2022, the Company entered into an Assignment of Stock (the “MTP Agreement”) with Mimo Technologies Private Ltd.

(“MTP”) and Lathika Regunathan (“LR”), pursuant to which the Company sold, assigned and transferred to LR, and

LR purchased from the Company, all of the Company’s equity interests in MTP in exchange for nominal consideration.

On

December 31, 2022, the Company entered into an Assignment of Stock (the “TSP Agreement”) with TraQiQ Solutions Private Ltd.

(“TSP”) and LR, pursuant to which the Company sold, assigned and transferred to LR and LR purchased from the Company, all

of the equity interests in TSP in exchange for nominal consideration.

On

December 31, 2022, the Company entered into an Assignment of Units (the “Rohuma Agreement”, and, together with the MTP Agreement

and the TSP Agreement, the “Disposition Agreements”) with Rohuma LLC (“Rohuma”) and Happy Kompany LLC (“Happy”)

pursuant to which the Company sold, assigned and transferred to Happy, and Happy purchased from the Company, all of the equity interests

in Rohuma in exchange for nominal consideration. Pursuant to the Rohuma Agreement, the Company assumed the liabilities of Rohuma with

respect to two loans with Paypal/Loanbuilder in an aggregate principal amount of $155,053 plus any accumulated interest and fees.

| Item

2.01 |

Completion

of Acquisition or Disposition of Assets. |

As

described under Item 1.01 of this Current Report on Form 8-K, on January 5, 2023, the Company completed its acquisition of certain assets

related to the Digester Business from the Renovare Sellers in exchange for (a) a cash payment by the Company to the Renovare Sellers

in an amount equal to $150,000 and (b) the issuance by the Company to REI of (i) 1,250,000 shares of Series B Preferred Stock and (ii)

15,686,926 shares of Common Stock with the cash purchase price funded by borrowings under the OID Note. The foregoing does not constitute

a complete summary of the terms of the Purchase Agreement or the transactions contemplated thereby, and reference is made to the disclosures

contained in Item 1.01 hereof and the complete text of the Purchase Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K,

which are incorporated by reference herein.

As

described under Item 1.01 of this Current Report on Form 8-K, on December 31, 2022, the Company completed its disposition of its equity

interests in each of MTP, TSP and Rohuma, in each case in exchange for nominal consideration and pursuant to the applicable Disposition

Agreement. The foregoing does not constitute a complete summary of the terms of the Disposition Agreements or the transactions contemplated

thereby, and reference is made to the disclosures contained in Item 1.01 hereof and the complete text of the Disposition Agreements filed

as Exhibits 10.2 through 10.4 to this Current Report on Form 8-K, which are incorporated by reference herein.

| Item

2.03 |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

In

connection with the acquisition of the assets of REI and BHT, as described above, on January 5, 2022, the Company issued to Michaelson

the Michaelson Note in the principal amount of $3,017,089.84. and delivered the Michaelson Security Agreement. The foregoing does not

constitute a complete summary of the terms of the Michaelson Note or the Michaelson Security Agreement and reference is made to

the disclosures contained in Item 1.01 hereof and the complete text of the Michaelson Note and the Michaelson Security Agreement filed

as Exhibits 4.1 and 10.5, respectively, to this Current Report on Form 8-K, which are incorporated by reference herein.

In

connection with the acquisition of the assets of REI and BHT, as described above, on January 5, 2023, the Company issued to an accredited

investor the OID Promissory Note in the principal amount of $180,000. The foregoing does not constitute a complete summary of the terms

of the OID Note and reference is made to the disclosures contained in Item 1.01 hereof and the complete text of the OID Note filed as

Exhibit 4.2 to this Current Report on Form 8-K, which are incorporated by reference herein.

The

information set forth under Item 2.01 is incorporated herein by reference.

| Item

3.02 |

Unregistered

Sale of Equity Securities. |

The

information set forth in Item 1.01 of this Current Report on Form 8-K regarding the issuance of the shares of Common Stock and Series

B Preferred Stock by the Company pursuant to the Purchase Agreement and the Debt Exchange Agreements is incorporated herein by reference.

The securities issued pursuant to the Purchase Agreement and Debt Exchange Agreements are restricted securities and were offered

and sold in a private transaction to accredited investors (as such term is defined in Rule 501(a), as promulgated under the Securities

Act of 1933), without registration under the Securities Act and the securities laws of certain states, in reliance on the exemption provided

by Section 4(a)(2) or Section 3(a)(9) of the Securities Act of 1933, as amended, and similar exemptions under applicable state laws.

The securities sold in the foregoing transactions may not be offered or sold in the United States absent registration or an applicable

exemption from registration requirements.

| Item

3.03 |

Material

Modification to Rights of Security Holders. |

In

connection with the transactions contemplated by the Purchase Agreement and the Debt Exchange Agreements, on December 30, 2022, the Company

filed a Certificate of Determination with the Secretary of State of the State of California (the “COD”), pursuant

to which the Company created a new class of preferred stock, designated as Series B Preferred Stock. The rights related to the Series

B Preferred Stock are virtually identical to the rights related to the Common Stock, except that each share of Series B Preferred Stock

is convertible into 100 shares of Common Stock. However, the holders of shares of Series B Preferred Stock will not have the right to

convert such shares if the holder, together with its affiliates, would beneficially own in excess of 4.99% of the number of shares of

Common Stock outstanding immediately after giving effect to its conversion and under no circumstances may convert any shares of Series

B Preferred Stock if the holder, together with its affiliates, would beneficially own in excess of 9.99% of the number of shares of Common

Stock outstanding immediately after giving effect to its conversion. The foregoing does not constitute a complete summary of the terms

of the COD and reference is made to the complete text of the COD filed as Exhibit 3.1 to this Current Report on Form 8-K, which is incorporated

by reference herein

| Item

9.01 |

Financial

Statements and Exhibits. |

(a)

Financial statements of businesses acquired. The financial statements required by Item 9.01 with respect to the acquisition described

in Item 2.01 are not being filed herewith but will be filed by amendment to this Current Report on Form 8-K no later than 71 calendar

days after the date on which this Current Report on Form 8-K was required to be filed pursuant to Item 2.01.

(b)

Pro forma financial information. The pro forma financial information required by Item 9.01 with respect to the acquisition described

in Item 2.01 above is not being furnished herewith but will be furnished by amendment to this Current Report on Form 8-K no later than

71 calendar days after the date on which this Current Report on Form 8-K was required to be filed pursuant to Item 2.01.

(d)

Exhibits

See

the Exhibit Index below, which is incorporated by reference herein.

| Exhibit

No. |

|

Description |

| 3.1 |

|

Certificate of Designation, as filed by TraQiQ, Inc. with the Secretary of State of the State of California on December 30, 2022 |

| 4.1 |

|

Amended and Restated Senior Secured Term Note, dated as of December 30, 2022, issued by TraQiQ, Inc. to Michaelson Capital Special Finance Fund II, L.P. |

| 4.2 |

|

20% OID Senior Secured Promissory Note, dated as of January 4, 2023, issued by TraQiQ, Inc. to Evergreen Capital Management LLC |

| 10.1* |

|

Asset Purchase Agreement, dated as of December 30, 2022, by and among TraQiQ, Inc., Renovare Environmental, Inc. and BioHiTech America, LLC |

| 10.2 |

|

Assignment of Stock, dated as of December 31, 2022, by and among TraQiQ, Inc., Mimo Technologies Private Ltd. and Lathika Regunathan |

| 10.3 |

|

Assignment of Stock , dated as of December 31, 2022, by and among TraQiQ, Inc., TraQiQ Solutions Private Ltd. and Lathika Regunathan |

| 10.4 |

|

Assignment of Units, dated as of December 31, 2022, by and among TraQiQ, Inc., Rohuma LLC and Happy Kompany LLC represented by Sandeep Soni |

| 10.5* |

|

Security Agreement, dated as of December 30, 2022, between TraQiQ, Inc. and Michaelson Capital Special Finance Fund II, L.P. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

| * |

Schedules,

exhibits and similar supporting attachments to this exhibit are omitted pursuant to Item 601(b)(2) of Regulation S-K. We agree to

furnish a supplemental copy of any omitted schedule or similar attachment to the Securities and Exchange Commission upon request. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

January 6, 2023 |

TRAQIQ,

INC. |

| |

|

|

| |

By:

|

/s/

Ajay Sikka |

| |

|

Ajay

Sikka |

| |

|

Chief

Executive Officer |

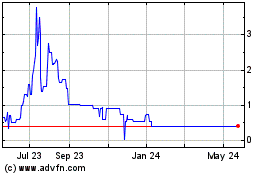

TraqIQ (QB) (USOTC:TRIQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

TraqIQ (QB) (USOTC:TRIQ)

Historical Stock Chart

From Jul 2023 to Jul 2024