UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. )

| Filed

by the Registrant ☒ |

Filed

by a Party other than the Registrant ☐ |

Check

the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material Pursuant to ss. 240.14a-12

TOFUTTI

BRANDS INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

Fee not required.

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

☐

Fee paid previously with preliminary materials:

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

(1)

Amount previously paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

TOFUTTI

BRANDS INC.

50

Jackson Drive

Cranford,

New Jersey 07016

Telephone:

(908) 272-2400

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

May

19, 2022

To

Our Shareholders:

On

behalf of the Board of Directors, I cordially invite you to attend the 2022 Annual Meeting of the Shareholders of Tofutti Brands Inc.

The Annual Meeting will be held at 10:00 a.m. on Thursday, June 23, 2022, at the Homewood Suites, 2 Jackson Drive, Cranford, New Jersey

07016. The Homewood Suites is located off Exit 136 of the Garden State Parkway (telephone no. 908-709-1980).

We

intend to hold the meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation and are sensitive to the

public health and travel concerns that our stockholders may have and the protocols that federal, state, and local governments may impose.

In the event that it is not possible or advisable to hold the meeting in person, we will announce alternative arrangements for the meeting

as promptly as practicable, which may include holding the meeting solely by means of remote communication. If we take this step, we will

announce the decision to do so in advance by filing the notice as Definitive Additional Materials with the Securities and Exchange Commission.

If you plan to attend our Annual Meeting in person, please check our website (www.tofutti.com) prior to the meeting. As always,

we encourage you to vote your shares prior to the Annual Meeting.

The

matters expected to be acted upon at the Annual Meeting are:

| |

1. |

To

elect four directors to the Board of Directors for the ensuing year; |

| |

|

|

| |

2. |

To

approve, by non-binding advisory vote, the resolution approving named executive officer compensation (“Say on Pay Vote”); |

| |

|

|

| |

3. |

To

approve, by non-binding advisory vote, the frequency of future non-binding advisory votes on resolutions approving future named executive

officer compensation (“Say When on Pay Vote”) |

| |

|

|

| |

4. |

To

ratify the selection of Mazars USA LLP as our independent registered public accounting firm for the fiscal year ending December 31,

2022; and |

| |

|

|

| |

5. |

To

act upon any other matters that may properly be brought before the Annual Meeting and any adjournment thereof. |

Shareholders

of record at the close of business on May 16, 2022, the record date for the Annual Meeting, will be entitled to notice of, and to vote

at, the meeting or any adjournment thereof.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON June 23, 2022: This Proxy Statement,

the proxy card and our 2021 annual report are available at www.astproxyportal.com/ast/06247

Your

vote is important. Whether or not you plan to attend the meeting, we urge you to vote your shares at your earliest convenience. This

will help ensure the presence of a quorum at the meeting. Promptly voting your shares by signing, dating, and returning the enclosed

proxy card will save us the expense and extra work of additional solicitation. A pre-addressed envelope for which no postage is required

if mailed in the United States is enclosed. Voting your shares now will not prevent you from attending or voting your shares at the meeting

if you desire to do so.

| |

By

order of the Board of Directors, |

| |

|

| |

Steven

Kass |

| |

Steven

Kass |

| |

Chief

Executive Officer |

TOFUTTI

BRANDS INC.

50

Jackson Drive, Cranford, New Jersey 07016

__________________________

PROXY

STATEMENT

This

Proxy Statement is furnished to shareholders of Tofutti Brands Inc. (the “Company,” “Tofutti” or “we,”

“our,” or “us”), in connection with the Annual Meeting of Shareholders to be held at 10:00 a.m. on Thursday,

June 23, 2022 at the Homewood Suites, 2 Jackson Drive, Cranford, New Jersey 07016, and at any adjournment thereof. The Homewood Suites

is located off Exit 136 of the Garden State Parkway (telephone no. 908-709-1980).

We

intend to hold the meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation and are sensitive to the

public health and travel concerns that our stockholders may have and the protocols that federal, state, and local governments may impose.

In the event that it is not possible or advisable to hold the meeting in person, we will announce alternative arrangements for the meeting

as promptly as practicable, which may include holding the meeting solely by means of remote communication. If we take this step, we will

announce the decision to do so in advance by filing the notice as Definitive Additional Materials with the Securities and Exchange Commission.

If you plan to attend our Annual Meeting in person, please check our website (www.tofutti.com) prior to the meeting. As always,

we encourage you to vote your shares prior to the Annual Meeting.

The

Board of Directors is soliciting proxies to be voted at the Annual Meeting. This Proxy Statement and Notice of Annual Meeting, the proxy

card and our Annual Report to Shareholders are expected to be mailed to shareholders beginning on or about May 19, 2022.

VOTING

INFORMATION

Who

can vote?

You

may vote if you were a shareholder of record as of the close of business on May 16, 2022. This date is known as the record date. You

are entitled to one vote for each share of common stock you held on that date on each matter presented at the Annual Meeting. As of May

16, 2022, 5,153,706 shares of our common stock, par value $0.01 per share, were issued and outstanding.

How

many votes are needed to hold the Annual Meeting?

To

take any action at the Annual Meeting, a majority of our outstanding shares of common stock entitled to vote as of May 16, 2022, must

be represented, in person or by proxy, at the Annual Meeting. This is called a quorum.

What

is a proxy?

A

“proxy” allows someone else to vote your shares on your behalf. Our Board of Directors is asking you to allow the individuals

named on the proxy card (Steven Kass and Efraim Mintz) to vote your shares at the Annual Meeting.

How

do I vote by proxy?

Shareholder

of Record: Shares Registered in Your Name

If

on May 16, 2022 your shares were registered directly in your name with our transfer agent, American Stock Transfer and Trust Company,

then you are a shareholder of record. As a shareholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether

or not you plan to attend the Annual Meeting, we urge you to vote your shares by completing and returning the enclosed printed proxy

card.

When

a proxy card is returned properly signed and dated, the shares represented thereby will be voted in accordance with the instructions

on the proxy card. If a shareholder returns a signed proxy card but does not mark the boxes, the shares represented by that proxy card

will be voted as recommended by the Board of Directors. If a shareholder does not return a signed proxy card or does not attend the Annual

Meeting and vote in person, his or her shares will not be voted. Abstentions and “broker non-votes” are not counted in determining

outcomes of matters being acted upon. They are counted only for determining a meeting quorum. If a shareholder attends the Annual Meeting,

he or she may vote by ballot.

Beneficial

Owner: Shares Registered in the Name of a Broker or Bank

If

on May 16, 2022 your shares were held not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar

organization, then you are the beneficial owner of shares held in “street name” and the Notice of Annual Meeting and Proxy

Statement are being forwarded to you by that organization. The organization holding your account is considered to be the shareholder

of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent

regarding how to vote the shares in your account. Simply follow the voting instructions provided to ensure that your vote is counted.

You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote your shares

in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

Can

I change my vote after I submit my proxy?

Yes.

You can change or revoke your proxy at any time before it is voted by submitting another proxy with a later date or attending the meeting

and voting in accordance with the instructions below. You also may send a written notice of revocation to Tofutti Brands Inc. 50 Jackson

Drive, Cranford, New Jersey 07016, Attention: Steven Kass, Secretary.

Can

I vote in person at the Annual Meeting instead of voting by proxy?

Yes.

However, we encourage you to vote your shares at your earliest convenience to ensure that your shares are represented and voted. If you

vote your shares by proxy and later decide you would like to attend the meeting and vote your shares in person, you will need to provide

a written notice of revocation to the secretary of the meeting before your proxy is voted. If the holder of record of your shares is

a broker, bank or other nominee and you wish to vote in person at the meeting, you must request a legal proxy from your broker, bank

or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting. If you intend to attend

the meeting, please contact the Company at skass@tofutti.com.

What

are the Board of Directors’ recommendations on how I should vote my stock?

The

Board of Directors recommends that you vote your shares as follows:

Proposal

1 – “FOR” the election of each of the directors.

Proposal

2 – “FOR” the approval, by non-binding advisory vote, of the resolution approving named executive officer compensation

(“Say on Pay Vote”).

Proposal

3 – “THREE YEARS” on the advisory vote to determine the frequency of future

advisory votes on executive compensation.

Proposal

4 – “FOR” the ratification of the selection of Mazars USA LLP as our independent registered public accounting

firm for the fiscal year ending December 31, 2022.

What

if I do not specify how I want my shares voted?

If

you are a record holder who returns a completed proxy card that does not specify how you want to vote your shares on one or more proposals,

the proxies will vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted in

the following manner:

Proposal

1 – “FOR” the election of each of the directors.

Proposal

2 – “FOR” the approval, by non-binding advisory vote, of the resolution approving named executive officer compensation

(“Say on Pay Vote”).

Proposal

3 – “THREE YEARS” on the advisory vote to determine the frequency of future

advisory votes on executive compensation.

Proposal

4 – “FOR” the ratification the selection of Mazars USA LLP as our independent registered public accounting firm

for the fiscal year ending December 31, 2022.

If

you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other

nominee will be unable to vote those shares, except with respect to the ratification of the selection of Mazars USA LLP as our independent

registered public accounting firm. See “How are votes counted?”

How

are votes counted?

Except

as noted, all proxies received will be counted in determining whether a quorum exists and whether we have obtained the necessary number

of votes to approve each proposal. An abstention from voting will be used for the purpose of establishing a quorum, but for purposes

of determining the outcome of the proposal as to which the proxy is marked “abstain,” the shares represented by such proxy

will not be treated as affirmative votes.

A

broker non-vote will also be used for the purpose of establishing a quorum, but will not otherwise be counted in the voting process.

Thus, broker non-votes will not affect the outcome of any of the matters being voted on at the Annual Meeting. Generally, broker non-votes

occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (i) the broker

has not received voting instructions from the beneficial owner and (ii) the broker lacks discretionary voting power to vote such shares.

How

many votes are required to approve each proposal?

To

be elected a director, each nominee must receive a plurality of the votes cast at the Annual Meeting for the election of directors. An

affirmative majority of the votes cast at the Annual Meeting is required to ratify the appointment of auditors. Abstentions and broker

non-votes are not counted in determining the number of shares voted for or against any nominee for director or any proposal.

The

Estate of David Mintz, our former Chairman of the Board and Chief Executive Officer, holds 2,630,440 shares of common stock

representing approximately 51.0% of the outstanding shares, permitting it to elect all the members of the Board of Directors and

thereby effectively control the business, policies and management of our Company. The executor of the estate has indicated that he

presently intends to vote in favor of the election of each of the directors, the approval of the resolution approving the named

executive officer compensation and the ratification the selection of Mazars USA LLP as our independent registered public accounting

firm for the fiscal year ending December 31, 2022. He has also indicated that he presently intends to vote for three years on

the advisory vote to determine the frequency of future advisory votes on executive compensation.

Who

pays for this proxy solicitation?

The

Company will pay the cost of soliciting proxies for the Annual Meeting, including the costs of preparing, assembling and mailing the

proxy materials. We will provide copies of proxy materials to fiduciaries, custodians and brokerage houses to forward to the beneficial

owners of shares held in their name. We may reimburse such fiduciaries, custodians and brokers for their costs in forwarding the proxy

materials.

In

addition to the solicitation of proxies by mail, certain of our officers and other employees may also solicit proxies personally or by

telephone, facsimile, email or other means. No additional compensation will be paid to these individuals for any such services.

OUR

BOARD OF DIRECTORS

Board

Members

Our

Board of Directors is responsible for the overall management of the Company. The Board of Directors is currently comprised of five directors.

All of our directors standing for re-election will hold office until the next Annual Meeting of Shareholders and until their successors

have been elected and qualified. The name, age and business experience of each of our directors running for re-election are shown below.

| Name |

|

Age |

|

Position |

| Joseph

N. Himy |

|

51 |

|

Director |

| Scott

Korman |

|

61 |

|

Director |

| Efraim

Mintz |

|

52 |

|

Director |

| Franklyn

Snitow |

|

74 |

|

Director |

Joseph

N. Himy was elected to serve as a member of our Board of Directors on October 30, 2013 by our Board of Directors. He served on our Audit

Committee from October 30, 2013 until his resignation on August 16, 2021. He has been Managing Director of The CFO Squad, a financial

and business advisory firm providing outsourced CFO advisory and regulatory consulting services primarily for public companies since

August 2011. From May 2008 until August 2011, Mr. Himy was Chief Financial Officer of Vyteris, Inc., manufacturer of the first active

transdermal patch approved by the U.S. Food and Drug Administration for the pain associated with blood draws, intravenous cannulations

and laser ablation of superficial skin lesions. Prior to May 2008 and from October 2004, Mr. Himy held various other positions at Vyteris,

including Corporate Controller and VP of Finance. Mr. Himy received a B.S. degree in Accounting from Brooklyn College of the City University

of New York and is a certified public accountant. Mr. Himy’s accounting and financial and corporate governance experience background

enhances the breadth of experience of the board of directors.

Scott

Korman has served as a member of our Board of Directors since December 2011 and is a member of our Audit Committee. Mr. Korman founded

Nashone, Inc., a private equity firm, in 1984 and is its President. Nashone is also involved in financial advisory, turnaround and general

management assignments. Mr. Korman previously served as Chairman of Da-Tech Corporation, a Pennsylvania based contract electronics manufacturer.

He previously served as Chairman and CEO of Best Manufacturing Group LLC., a leading manufacturer and distributor of uniforms, napery,

service apparel, and hospitality and healthcare textiles. Mr. Korman also served as President and CEO of Welsh Farms Inc., a full-service

dairy, processing and distributing milk, ice cream mix and ice cream products. Mr. Korman received a B.S. degree in Economics from the

University of Pennsylvania Wharton School in 1977. He also serves on the boards of various not-for-profit groups and was the founder

of the Englewood Business Forum. Mr. Korman’s experience as a CEO of a frozen dessert company enhances the breadth of experience

of the board of directors.

Efraim

Mintz was elected to serve as a member of our Board of Directors on December 29, 2020 by our Board of Directors. He was also appointed

to serve on the Audit Committee. He is the founding Executive Director of the Rohr Jewish Learning Institute (JLI), the largest network

of adult education, providing accredited courses, seminars, and multiple educational offerings in 2,000 chapters across the globe since

1999. He is also the founder of the Wellness Institute, offering mental health educational offerings and trainings for social workers,

educators, and parents. He oversees a network of trained and certified course developers and instructors delivering courses accredited

by the American Medical Association (AMA), the American Bar Association (in over 35 states), and the American Psychological Association

(APA). He oversees a staff of 70 program coordinators, faculty members, department heads, creative marketing and web developers and directs

a network of education departments for teens, university students, women’s studies, online learning and accredited continuing professional

education. Mr. Mintz’s executive and managerial experience enhances the breadth of experience of the board of directors.

Franklyn

Snitow has been a director since 1987 and was appointed to serve on the Audit Committee on August 16, 2021. He is currently a partner

in the New York City/Baltimore law firm of Offit Kurman. Mr. Snitow’s legal and corporate governance background enhances the breadth

of experience of the board of directors.

Board

of Directors and Committees

Leadership

Structure and Risk Oversight

Our

business and affairs are managed under the direction of our Board of Directors, composed of four non-employee directors as of the date

of this Proxy Statement. Our Board of Directors as a whole establishes our overall policies and standards, reviews the performance of

management and considers our overall risk regarding our operations and goals and how those risks are being managed. Members of the Board

of Directors are kept informed of our operations at meetings of the Board of Directors and its Audit Committee and through reports and

discussions with management. In addition, members of the Board of Directors periodically visit our facilities. Members of management

are available at Board of Directors meetings and at other times to answer questions and to discuss issues. Since the death of David Mintz,

who was the Chief Executive Officer of our company and Chairman of our Board of Directors, there has not been a Chairman of the Board

of Directors. Prior to Mr. Mintz’s death, our company combined the positions of CEO and Chairman of the Board because of the small

size of the company and the efficiency involved. A lead independent director has not been designated because the Board does not believe

it is warranted for a company of our size and complexity.

Director

Meetings and Committees

Our

Board of Directors held three meetings during 2021. Messrs. Himy, Korman and Mintz attended three meetings and Mr. Snitow attended two

meetings. We do not have a policy with regard to directors’ attendance at annual meetings of shareholders, but we encourage our

directors to attend the annual meetings. At our 2021 annual meeting of shareholders, three of the four directors in office were in attendance

either in person or remotely.

Our

Board of Directors has an Audit Committee, but there are no committees performing the functions of either a compensation committee or

nominating committee. Our Audit Committee held four meetings during 2021.

Nominations

Process, Executive Compensation; Director Independence; Board Diversity

It

is the position of our Board of Directors that it is not necessary for our company to have a separate nominating and compensation committee

in light of the “Controlled Company” status of our company, the composition of our Board of Directors and the collective

independence of our independent directors, which enable the company to fulfill the functions of standing committees.

Candidates

for independent Board members have typically been found through recommendations from directors or other individuals associated with us.

Our shareholders may also recommend candidates by sending the candidate’s name and resume to the Board of Directors under the provisions

set forth below for communication with our Board. No such suggestions from our shareholders were received in time for our Annual Meeting.

We have no predefined minimum criteria for selecting Board nominees and do not have a formal diversity policy, although we believe that

the independent directors should have a range of relevant experience, independence, diversity and strong communication and analytical

skills. In any given search, our independent directors may also define particular characteristics for candidates to balance the overall

skills and characteristics of our Board and our perceived needs. However, during any search, our independent directors reserve the right

to modify its stated search criteria for exceptional candidates.

We

currently have only one executive officer, and our Board as a whole sets his compensation. In setting compensation, the Board reviews

and considers prior compensation levels of the executive officer, the contribution of the executive officer during the course of the

year and our financial condition and prospects for the upcoming year. The Board determines the amount of cash (or any other compensation)

to be paid to our directors. Our non-employee directors earned director compensation in fiscal year 2021 based on the number of meetings

attended.

Audit

Committee

The

Audit Committee currently consists of Messrs. Korman, Mintz and Snitow. Mr. Himy resigned as a member of our Audit Committee on August

16, 2021 and Mr. Snitow was appointed to replace him. Our Board of Directors has determined that Messrs. Korman and Snitow are independent,

as that term is defined under the independence standards for audit committee members in the Securities Exchange Act of 1934, as amended.

The Board of Directors has also determined that Mr. Korman is an audit committee financial expert, as that term is defined in Item 407

of Regulation S-K.

The

Audit Committee is responsible for reviewing and helping to ensure the integrity of our financial statements. Among other matters, the

Audit Committee, with management and our independent auditors, reviews the adequacy of our internal accounting controls that could significantly

affect our financial statements, reviews with the independent accountants the scope of their audit, their report and their recommendations,

and recommends the selection of our independent accountants. The Audit Committee held four meetings in addition to the meetings of the

Board of Directors during 2021. Messrs Korman, Mintz and Snitow attended all of those meetings. The Board of Directors adopted and maintains

a written charter for the Audit Committee which is published on the investor relations page of our website (www.tofutti.com).

Code

of Ethics

We

have adopted a Code of Business Conduct and Ethics, which applies to directors, officers, employees and agents of our company. We have

also adopted a Code of Ethics for Senior Officers, which applies to our chief executive officer, and all senior financial officers of

our company, including the chief financial officer, chief accounting officer or controller, or persons performing similar functions.

The Code of Business Conduct and Ethics and the Code of Ethics for Senior Officers are publicly available on our website at www.tofutti.com

and printed copies are available upon request. If we make any substantive amendments to the Code of Business Conduct and Ethics or the

Code of Ethics or grant any waivers, including any implicit waiver, from a provision of these codes to our chief executive officer, chief

financial officer or corporate controller or our directors, we will disclose the nature of such amendment or waiver on our website.

Shareholder

Communications with the Board of Directors

Our

shareholders may communicate with the members of our Board of Directors by writing directly to the Board of Directors or specified individual

directors to:

Secretary

Tofutti

Brands Inc.

50

Jackson Drive

Cranford,

New Jersey 07016

Our

Secretary will deliver shareholder communications to the specified individual director, if so addressed, or to one of our directors who

can address the matter.

PROPOSAL

I

ELECTION

OF DIRECTORS

At

the Annual Meeting four directors are to be elected, each to serve until the next annual meeting of shareholders and until their respective

successor is elected and qualified or until their respective death, resignation or removal. The Board of Directors proposes the election

of the nominees named below, who currently are members of our Board of Directors.

Unless

authorization to do so is withheld, proxies received will be voted FOR the nominees named below. If any nominee should

become unavailable for election before the Annual Meeting, the proxies will be voted for the election of such substitute nominee as the

present Board of Directors may propose. The persons nominated for election have agreed to serve if elected, and the Board of Directors

has no reason to believe that the nominees will be unable to serve.

Nominees

Our

Board of Directors proposes the election of the following nominees as members of the Board of Directors:

| |

Joseph

N. Himy |

Scott

Korman |

Efraim

Mintz |

Franklyn

Snitow |

Our

Board unanimously recommends that shareholders vote FOR the election of each nominee for Director named above.

OUR

EXECUTIVE OFFICERS

The

Board of Directors appoints the executive officers of the Company who are responsible for administering our day-to-day operations. Officers

serve at the discretion of the Board of Directors. There are no family relationships between any of our directors and the executive officers.

Executive officers devote their full time to the operations of our company. The names of our current executive officers, their ages,

and their positions are shown below. A biographical summary of our sole executive officer is included below.

Name

of Executive Officer

|

|

Position

|

|

Age

|

| Steven

Kass |

|

Chief

Executive Officer and Chief Financial Officer |

|

70 |

Steven

Kass has been our Chief Financial Officer since November 1986. After the death of David Mintz, he was appointed Interim Chief Executive

Officer and then was appointed Chief Executive Officer by the Board of Directors on June 9, 2021.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table shows the amount of our common stock beneficially owned as of May 16, 2022 by (i) each person or group as those terms

are used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), believed by us to beneficially

own more than 5% of our common stock, (ii) each of our directors, (iii) each of our executive officers, and (iv) all of our directors

and executive officers as a group. Except as otherwise noted, each person named in the table has sole voting and investment power with

respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

Name and

Address of Beneficial Owner(1) | |

Amount and Nature of Beneficial Owner(2) | | |

Percent of Class(3) | |

| Estate of David Mintz | |

| 2,630,440 | (4) | |

| 51.0 | % |

| Steven Kass | |

| 220,000 | | |

| 4.1 | % |

| Franklyn Snitow | |

| 33,100 | | |

| * | |

| Joseph N. Himy | |

| — | | |

| * | |

| Scott Korman | |

| — | | |

| * | |

| Efraim Mintz | |

| | | |

| * | |

| All Executive Officers and Directors as a group (5 persons in fiscal 2021) | |

| 253,100 | | |

| 4.7 | % |

| * |

Less

than 1%. |

| |

|

| (1) |

The

address of the Estate of Mr. David Mintz and Messrs. Joseph Himy, Steven Kass, Efraim Mintz and Frank Snitow is c/o Tofutti Brands

Inc., 50 Jackson Drive, Cranford, New Jersey 07016. The address of Mr. Snitow is 805 3rd Avenue, 12 Floor, New York, New

York 10022. The address of Mr. Korman is c/o Nashone, Inc., 175 Elm Road, Englewood, NJ 07361. Each of these persons has sole voting

and/or investment power of the shares attributed to him. |

| (2) |

Beneficial

ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment

power with respect to securities. Shares of common stock relating to options currently exercisable or exercisable within 60 days

of May 16, 2022 are deemed outstanding for computing the percentage of the person holding such securities but are not deemed outstanding

for computing the percentage of any other person. Except as indicated by footnote, and subject to community property laws where applicable,

the persons named in the table above have sole voting and investment power with respect to all shares shown as beneficially owned

by them. |

| (3) |

Based

on 5,153,706 shares issued and outstanding as of May 16, 2022. |

| (4) |

Mr.

Efraim Mintz is acting as the executor of the Estate of David Mintz, but disclaims any beneficial interest in the shares of common

stock held by the Estate. |

SECTION

16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section

16(a) of the Exchange Act requires our officers and directors and persons who own more than ten percent of our common stock to file initial

statements of beneficial ownership (Form 3) and statements of changes in beneficial ownership (Forms 4 or 5) of common stock and other

equity securities of the company with the Securities and Exchange Commission, or the SEC. Officers, directors and greater than ten percent

shareholders are required by SEC regulation to furnish us with copies of all such forms they file.

To

our knowledge, based solely on our review of the copies of such forms received by us, or written representations from certain reporting

persons that no additional forms were required for those persons, we believe that during fiscal year 2021 all persons subject to these

reporting requirements filed the required reports on a timely basis.

EXECUTIVE

COMPENSATION

Compensation

Overview

Tofutti

Brands, Inc. is a “smaller reporting company” under the rules promulgated by the Securities and Exchange Commission and the

Company complies with the disclosure requirements applicable to smaller reporting companies. This executive compensation summary is not

intended to meet the “Compensation Discussion and Analysis” disclosure required of larger reporting companies.

The

following table sets forth information concerning the total compensation during the last three fiscal years for our named executive officers

whose total salary in fiscal 2021 totaled $100,000 or more:

Summary

Compensation Table

| Name and Principal Position | |

Fiscal Year | | |

Salary ($) | | |

Bonus ($) | | |

Stock Awards ($) | | |

Option Awards ($) | | |

Non-Equity Incentive Plan Compensation ($) | | |

All Other Compensation ($) | | |

Total($) | |

| David Mintz* | |

| 2021 | | |

| 104,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 104,00 | |

| Chief Executive Officer | |

| 2020 | | |

| 459,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 459,000 | |

| and Director | |

| 2019 | | |

| 450,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 450,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Steven Kass** | |

| 2021 | | |

| 151,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 151,000 | |

| Chief Executive and Financial Officer | |

| 2020 | | |

| 127,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 127,000 | |

| | |

| 2019 | | |

| 125,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 125,000 | |

*

Mr. Mintz ceased to be an executive officer upon his death in February 2021.

**

After the death of Mr. Mintz, Mr. Kass was appointed Interim Chief Executive Officer and then was appointed Chief Executive Officer by

the Board of Directors on June 9, 2021.

Narrative

Disclosure to Summary Compensation Table

Because

of our size and the limited number of executive officers, our compensation structure is not complex. We do not currently have any employment

agreements with our executive officers, nor do we anticipate entering into employment contracts with our executive officers and key personnel

in the future. Our executive officers receive salaries based on the prior salaries provided to them, the contribution of each executive

officer during the course of the year and our financial condition and prospects for the upcoming year. Bonuses for the prior year, when

awarded, are finalized and paid in current fiscal year and are generally contingent upon our financial condition and the performance

of the executive officers during the prior fiscal year. No bonuses were awarded for fiscal 2021, fiscal 2020 or fiscal 2019.

The

aggregate value of all other perquisites and other personal benefits furnished to each of our executive officers was less than $10,000

in the 2021, 2020 and 2019 fiscal years.

Grants

of Plan-Based Awards for Fiscal 2021

During

the fiscal year ended January 1, 2022, no grants were made under our 2014 Equity Incentive Plan.

Long-Term

Incentive Plans-Awards in Last Fiscal Year

We

do not currently have any long-term incentive plans.

DIRECTOR

COMPENSATION

Our

non-employee directors earned director compensation in fiscal year ended January 1, 2022 based on the number of meetings attended. The

chairman of the audit committee receives $2,000 per audit committee meeting and other members of the audit committee receive $1,000 per

meeting attended. All other non-employee directors are entitled to $500 per meeting attended.

The

following table sets forth the compensation received by each of our non-employee directors for the year ended January 1, 2022. Each non-employee

director is deemed to be independent under the Exchange Act Rule 10A-3.

| Name | |

Fees Earned or Paid in Cash ($) | | |

Stock Awards ($) | | |

Option Awards ($) | | |

Non-Equity Incentive Plan Compensation ($) | | |

Nonqualified Deferred Compensation ($) | | |

All Other Compensation ($) | | |

Total ($) | |

| Joseph N. Himy | |

| 15,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 15,000 | |

| Scott Korman | |

| 15,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 15,000 | |

| Efraim Mintz | |

| 11,500 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 11,500 | |

| Franklyn Snitow | |

| 5,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 5,000 | |

OUTSTANDING

EQUITY AWARDS AT FISCAL YEAR END

As

of January 2, 2021 there were no outstanding equity awards.

TRANSACTIONS

WITH RELATED PERSONS

In

order to provide our company with additional working capital, on January 6, 2016, David Mintz, our then Chairman and Chief Executive,

provided us with a loan of $500,000, which has been extended to come due on December 31, 2022. Commencing March 31, 2016, interest of

5% is payable on a quarterly basis without compounding. The loan may be prepaid in whole or in part at any time without premium or penalty.

The loan is convertible into our common stock at a conversion price of $1.77 per share, the closing price of our common stock on the

OTCQB on the date the promissory note was extended. On December 22, 2021, the entire loan of $500,000 plus accrued interest of $25,000

was paid by the Company to Mr. Mintz’s estate, for which Mr. Efraim Mintz acts as executor.

During

fiscal 2021, we paid The CFO Squad $4,000 for financial services. Mr. Himy is the Managing Director of The CFO Squad.

AUDIT

COMMITTEE REPORT*

Our

Audit Committee, which operates pursuant to a written charter, assists the board of directors in fulfilling its oversight responsibilities

by reviewing Tofutti Brands’ financial reporting process on behalf of the board. Management is responsible for Tofutti Brands’

internal controls, the financial reporting process and compliance with laws and regulations and ethical business standards.

Mazars

USA LLP, our independent registered public accounting firm, is responsible for expressing opinions on the conformity of the company’s

consolidated financial statements with generally accepted accounting principles. The Audit Committee is responsible for overseeing and

monitoring these practices. It is not the duty or responsibility of the Audit Committee to conduct auditing or accounting reviews or

procedures.

In

this context, the Audit Committee reviewed and discussed with management and Mazars USA LLP, among other things, the scope of the audit

to be performed, the results of the audit performed and the independent registered public accounting firm’s fee for the services

performed. Management represented to the Audit Committee that our financial statements were prepared in accordance with generally accepted

accounting principles. Discussions about our audited financial

statements included the auditors’ judgments about the quality, not just the acceptability, of the accounting principles, the reasonableness

of significant judgments and the clarity of disclosures in our financial statements.

The

Audit Committee also discussed with Mazars USA LLP other matters required by Statement on Auditing Standards, (“SAS”) No.

61 “Communication with Audit Committees,” as amended. Mazars USA LLP provided to the Audit Committee written disclosures

and the letter required by required by the applicable requirements of the Public Company Accounting Oversight Board. The Audit Committee

discussed with Mazars USA LLP the registered public accounting firm’s independence from the company.

Based

on the Audit Committee’s discussion with management and Mazars USA LLP and the Audit Committee’s review of the representations

of management and the report of Mazars USA LLP to the Audit Committee, the Audit Committee recommended to the board that the audited

financial statements be included in our Annual Report on Form 10-K for the year ended January 1, 2022 filed with the Securities and Exchange

Commission and selected Mazars USA LLP as the independent registered public accounting firm for the company for fiscal 2021.

Submitted

by the Audit Committee of the Board of Directors of Tofutti Brands Inc.

| |

Scott

Korman |

| |

Efraim

Mintz |

| |

Franklyn

Snitow |

* The

Audit Committee Report above is not considered proxy-soliciting material, is not deemed to be filed with the SEC or subject to Regulation

14A or the liabilities of Section 18 of the Exchange Act and shall not be deemed incorporated by reference by any general statement incorporating

by reference this proxy statement into any filing with the SEC, except to the extent we specifically incorporate this information by

reference.

PROPOSAL

II

TO

APPROVE, BY NON-BINDING ADVISORY VOTE, THE RESOLUTION

APPROVING

NAMED EXECUTIVE OFFICER COMPENSATION

We

are asking that our shareholders approve a non-binding advisory resolution on the named executive officer compensation as reported in

this Proxy Statement.

In

accordance with Section 14A of the Exchange Act, and as a matter of good corporate governance, the Company is asking shareholders to

approve the following advisory resolution at the Annual Meeting:

RESOLVED,

that the shareholders of Tofutti Brands Inc. (the “Company”) approve, on an advisory basis, the compensation of the Company’s

named executive officer as disclosed in this proxy statement, including as discussed in the section entitled “Executive Compensation,”

the Summary Compensation Table and the related compensation tables, notes and narrative in the Proxy Statement for the Company’s

2022 Annual Meeting of Stockholders.

This

advisory resolution, commonly referred to as a “say-on-pay” resolution, is non-binding on the Board of Directors. Although

non-binding, the Board of Directors will carefully review and consider the voting results when evaluating our named executive officer

compensation program.

At

our 2013 annual meeting, a majority of our shareholders voted in favor of holding an advisory vote to approve executive compensation

every three years as recommended by the Board. Unless the Board modifies its policy on the frequency of holding “say on pay”

advisory votes, the next “say on pay” advisory vote and “say on pay” frequency vote will occur at the 2025 annual

meeting.

Vote

Required

The

affirmative vote of the holders of record of a majority in voting interest of the shares of stock entitled to be voted at the Annual

Meeting, present in person or by proxy are required for approval of this proposal.

Our

Board of Directors unanimously recommends a vote FOR the foregoing proposal.

PROPOSAL

III

ADVISORY

VOTE TO DETERMINE THE FREQUENCY OF

FUTURE

ADVISORY VOTES ON EXECUTIVE COMPENSATION

Under

Section 14A of the Exchange Act, our shareholders are also allowed to vote, on a non-binding, advisory basis, for their preference as

to how frequently we should seek future advisory votes on the compensation of our named executive officers as disclosed in accordance

with the compensation disclosure rules of the SEC, which we refer to as an advisory vote to approve executive compensation. By voting

with respect to this proposal, shareholders may indicate whether they would prefer that we conduct future advisory votes on executive

compensation every one, two, or three years. Shareholders also may, if they wish, abstain from casting a vote on this proposal.

At

our 2013 annual meeting, a majority of our shareholders voted in favor of holding an advisory vote to approve executive compensation

every three years as recommended by the Board. Unless the Board modifies its policy on the frequency of holding “say on pay”

advisory votes, the next “say on pay” frequency vote will occur at the 2025 annual meeting.

After

careful consideration, the Board of Directors believes that submitting the advisory vote to approve executive compensation every three

years is appropriate for the Company and its shareholders at this time. The Board of Directors believes that an advisory vote at this

frequency will provide shareholders with sufficient time to evaluate the effectiveness of our overall compensation philosophy, policies

and practices in the context of our long-term business results for the corresponding period. An advisory vote that occurs every three

years will also permit the Company’s shareholders to observe and evaluate the impact of any changes to its executive compensation

policies and practices that have occurred since the last advisory vote to approve executive compensation. The Board of Directors is therefore

recommending that shareholders vote for holding the advisory vote to approve executive compensation every three years.

The

Company recognizes that the shareholders may have different views as to the best approach for the Company, and therefore we look forward

to hearing from our shareholders as to their preference on the frequency of advisory votes to approve executive compensation.

This

vote is advisory and not binding on the Company or our Board of Directors in any way. The Board of Directors will take into account the

outcome of the vote, however, when considering the frequency of future advisory votes to approve executive compensation. The Board may

decide that it is in the best interests of our shareholders and the Company to hold an advisory vote to approve executive compensation

more or less frequently than the frequency selected by our shareholders.

The

proxy card provides shareholders with the opportunity to choose among four options (holding the vote every one, two or three years, or

abstaining) and, therefore, shareholders will not be voting to approve or disapprove the recommendation of the Board of Directors.

Vote

Required

The

affirmative vote, in person or by proxy, of the majority of the votes cast by the holders of the Company’s common stock at the

Annual Meeting is required to determine the frequency of future advisory votes on executive compensation. If none of the alternatives

receives the majority of votes cast, the Company will consider the alternative that receives the highest number of votes cast by shareholders

to be the frequency selected by shareholders. This is a non-binding advisory vote.

The

Board of Directors recommends that you vote “THREE YEARS” as the frequency for future advisory votes to approve executive

compensation.

PROPOSAL

IV

APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

Mazars

USA LLP has been our independent registered public accountants since March 3, 2021.

The

following resolution will be offered by the Board of Directors at the Annual Meeting.

“RESOLVED:

That the selection of Mazars USA LLP by the Board of Directors to act as our independent registered public accountants and conduct the

annual audit of the financial statements of Tofutti Brands Inc. for the fiscal year ending December 31, 2022 is ratified, confirmed and

approved.”

Our

Board of Directors believes that Mazars USA LLP has the necessary knowledge of our operations, and the personnel, professional qualifications

and independence to act as our independent registered public accountants.

In

the event this resolution does not receive the necessary votes for adoption, or if for any reason Mazars USA LLP ceases to act as our

independent registered public accountants, the Board of Directors will appoint other independent registered public accountants.

Our

Board of Directors unanimously recommends a vote FOR the foregoing proposal.

We

have been advised by Mazars USA LLP that they will have a representative available during the Meeting, either in person or telephonically,

who will be available to respond to appropriate questions and will have an opportunity to make a statement if they desire to do so.

Fees

Paid to Independent Registered Public Accountants

Set

forth below are the aggregate fees billed by Mazars, our independent registered accounting firm, for the fiscal years ended January 1,

2022 and January 2, 2021 for services rendered by them as our independent registered accounting firm for such years.

| | |

Fiscal 2021 | | |

Fiscal 2020 | |

| Audit fees | |

$ | 115,000 | | |

$ | - | |

| Audit-related fees | |

| - | | |

| - | |

| Total Audit & Audit-related fees | |

$ | 115,000 | | |

$ | - | |

| Tax fees | |

| - | | |

| | |

| All other fees | |

| - | | |

| - | |

| Total fees | |

$ | 115,000 | | |

$ | - | |

In

addition, set forth below are the aggregate fees billed by EisnerAmper LLP, our former independent registered accounting firm, for the

fiscal years ended January 1, 2022 and January 2, 2021 for services rendered by them as our independent registered accounting firm for

such years.

| | |

Fiscal 2021 | | |

Fiscal 2020 | |

| Audit fees | |

$ | 60,000 | | |

$ | 114,000 | |

| Audit-related fees | |

| - | | |

| - | |

| Total Audit & Audit-related fees | |

$ | 60,000 | | |

$ | 114,000 | |

| Tax fees | |

| - | | |

| | |

| All other fees | |

| - | | |

| - | |

| Total fees | |

$ | 60,000 | | |

$ | 114,000 | |

Audit

fees consist of fees billed for services rendered for the audit of our financial statements and review of our financial statements included

in our quarterly reports on Form 10-Q and services provided in connection with other statutory or regulatory filings.

Audit-related

fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review

of our financial statements and not reported under Audit fees. No such fees were billed in fiscal 2021 or 2020.

Tax

fees consist of fees billed for professional services related to the preparation of our U.S. federal and state income tax returns and

tax advice. No such fees were billed by Mazars in fiscal 2021 or 2020. The Audit Committee pre-approved all Audit-related fees. After

considering the provision of services encompassed within the above disclosures about fees, the Audit Committee has determined that the

provision of such services is compatible with maintaining Mazars’ independence.

The

Audit Committee’s policy is to pre-approve all audit and non-audit related services, tax services and other services. Pre-approval

is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services and is

generally subject to a specific budget. The Audit Committee has delegated the pre-approval authority to its chairperson when expedition

of services is necessary. The independent registered public accounting firm and management are required to periodically report to the

full Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with

this pre-approval and the fees for the services performed to date.

Audit

Committee Pre-Approval Policies and Procedures

Our

Audit Committee is responsible for the appointment, compensation and oversight of the work of our independent registered public accountants.

Our Audit Committee has established a policy for pre-approving the services provided by our independent registered public accountants

in accordance with the auditor independence rules of the Securities and Exchange Commission. The policy is designed to ensure that the

Audit Committee will not delegate to management the Audit Committee’s responsibilities, including the pre-approval of services

to be performed by the independent registered public accountants.

The

policy requires the review and pre-approval by the Audit Committee of all audit and permissible non-audit services provided by our independent

registered public accountants. A proposed service may either be pre-approved by the Audit Committee, or otherwise requires the specific

pre-approval of the Audit Committee, on a case-by-case basis. Any proposed services exceeding pre-approved levels will also require specific

pre-approval by the Audit Committee.

The

term of any general pre-approval is 12 months from the date of pre-approval, unless the Audit Committee considers a different period

and states otherwise. Our Audit Committee will annually review and pre-approve the services that may be provided by the independent registered

public accountants without obtaining specific pre-approval from the Audit Committee. The Audit Committee may add to or deduct from the

list of general pre-approved services from time to time, based on subsequent determinations. Our Audit Committee will monitor the audit

services engagement on a quarterly basis and will also approve, if necessary, any changes in terms, conditions and fees resulting from

changes in audit scope, company structure or other items. Requests or applications to provide services that require specific approval

by the Audit Committee will be submitted by our Chief Financial Officer to our Audit Committee.

All

of the audit services provided by the independent registered public accountants in fiscal year 2021 were approved by the Audit Committee

under its pre-approval policies, and the Audit Committee has determined that the provision of such services is compatible with maintaining

EisnerAmper’s independence.

ANNUAL

REPORT

Our

Annual Report on Form 10-K for the fiscal year ended January 1, 2021 (“2021 Annual Report”), as filed with the SEC, excluding

exhibits, is being mailed to shareholders with this proxy statement. We will furnish any exhibit to our 2021 Annual Report free of charge

to any shareholder upon written request to: STEVEN KASS, SECRETARY, TOFUTTI BRANDS INC., 50 JACKSON DRIVE, CRANFORD, NEW JERSEY 07016

or email a request to: info@tofutti.com.

The

2021 Annual Report is not incorporated in, and is not a part of, this proxy statement and is not proxy-soliciting material. We encourage

you to review the 2021 Annual Report together with any later information that we file with the SEC and other publicly available information.

Documents we file with the SEC may be reviewed and/or obtained through the SEC’s Electronic Data Gathering Analysis and Retrieval

System, or EDGAR, which is publicly available through the SEC’s website at http://www.sec.gov.

TIME

FOR SUBMISSION OF SHAREHOLDER PROPOSALS

Pursuant

to Rule 14a-8 under the Exchange Act, shareholders may present proper proposals for inclusion in a company’s proxy statement and

for consideration at the next annual meeting of its shareholders by submitting their proposals to our company in a timely manner.

Shareholders

interested in submitting a proposal for inclusion in the proxy materials for the annual meeting of shareholders in 2023 may do so by

following the procedures set forth in Rule 14a-8 of the Exchange Act. To be eligible for inclusion, shareholder proposals must be received

by us no later than January 19, 2023. Except in the case of proposals made in accordance with Rule 14a-8, for shareholder proposals to

be considered at the 2022 annual meeting of shareholders, the shareholder must have given timely notice thereof in writing to our corporate

secretary by December 23, 2021.

OTHER

MATTERS

Our

Board of Directors does not intend to bring any matters before the Annual Meeting other than those specifically set forth in the Notice

of the Annual Meeting and knows of no matters to be brought before the Annual Meeting by others. If any other matters properly come before

the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote such proxy in accordance with the judgment

of the Board of Directors.

Our

financial statements are included in our 2021 Annual Report, which is expected to be mailed to our shareholders beginning on or about

May 19, 2022.

| |

By

Order of the Board of Directors, |

| |

|

| |

Steven

Kass |

| |

Steven

Kass |

| |

Chief

Executive Officer |

| Dated:

May 19, 2022 |

|

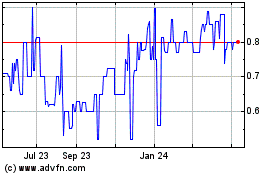

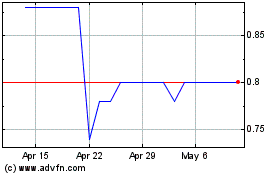

Tofutti Brands (QB) (USOTC:TOFB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tofutti Brands (QB) (USOTC:TOFB)

Historical Stock Chart

From Jul 2023 to Jul 2024