By Riva Gold and Akane Otani

U.S. stocks slumped Tuesday, reversing course after their

biggest weekly gain of the year, as crude oil prices tumbled and

government bond yields plumbed record lows.

After initial losses following the U.K. vote to leave the

European Union, global stocks rebounded, with the S&P 500 and

the Dow Jones Industrial Average both climbing more than 3% last

week. Major U.S. indexes pared those gains Tuesday, with some

investors and analysts questioning whether the previous week's

bounceback had been exaggerated.

Shares of commodity-linked companies led the day's losses as

U.S. crude oil, hit by concerns about production increases and the

impact of the U.K. vote, dropped 4.9% to $46.60 a barrel. Some

analysts said the selloff in oil was a sign of fresh concerns about

global economic strength.

The Dow Jones Industrial Average fell 109 points, or 0.6%, to

17841. The S&P 500 declined 0.7%, and the Nasdaq Composite

Index lost 0.8%.

"It definitely feels like the markets woke up on the wrong side

of the bed this morning," said Jason Bloom, director of research

and strategy for commodities and alternatives at PowerShares.

"Crude oil tends to be the epicenter of the global risk off

sentiment."

Oil prices were pressured by data from Friday showing the number

of U.S. rigs drilling for oil increased in the past week, as well

as the strengthening dollar, which makes dollar-traded oil more

expensive for foreign buyers. The WSJ Dollar Index advanced

0.7%.

Energy shares in the S&P 500 fell 1.9%, with shares of

Southwestern Energy declining 10%, and Murphy Oil dropping 7.9%.

The S&P 500 materials sector also declined, giving up 1.9%.

The declines in stocks came amid a rally in government debt, as

the yield on the 10-year U.S. Treasury note settled at a record low

of 1.367%. Yields move inversely to prices.

Financial shares in the S&P 500 slid 1.5% as yields fell and

hopes for an increase in interest rates continued to dim. J.P.

Morgan and Goldman Sachs shares were among the biggest decliners in

the Dow industrials, falling 2.8% and 2.6% respectively.

Financial stocks have suffered among the biggest declines in the

wake of the U.K. vote.

With questions lingering about global growth, the U.K.'s future

relationship with the EU, and politics abroad, U.S. assets like the

dollar and the 10-year Treasury look relatively attractive at the

moment, said Jon Adams, senior investment strategist for BMO Global

Asset Management.

"Uncertainty about policy is clearly driving the markets right

now," Mr. Adams said.

In Europe, the Bank of England warned that the outlook for

stability of the financial system had become "challenging" and took

steps to bolster bank lending.

The British pound slumped to a 31-year-low against the dollar,

recently trading at $1.3047, as analysts warned there was room for

further falls in the U.K. currency. The FTSE 100, whose shares have

benefited from a weaker pound, gained 0.4%. The Stoxx Europe 600

fell 1.7%.

As sterling falls, import-intensive companies that sell to the

U.K. domestic market are likely to suffer, while those primarily

reliant on export markets could benefit, she said.

Meanwhile, London's real-estate sector fell sharply after

M&G Investments, the U.K. fund management arm of Prudential

PLC, halted withdrawals from a U.K. property fund. It was the third

major asset manager to do so since the U.K. voted to leave the

EU.

Some analysts cautioned against becoming overly pessimistic

about the global economy as a result of the Brexit. Investors

shouldn't necessarily "get too concerned about global growth just

because the U.K. is slowing," said Michael Metcalfe, head of macro

strategy at State Street Global Markets.

A more meaningful slowdown from the Brexit vote would likely

require possible political contagion in the eurozone or an

acceleration of concerns about eurozone banks, Mr. Metcalfe

said.

In commodities, gold for July delivery rose 1.5% to $1,356.40 an

ounce, its highest settlement since March 18, 2014.

In Asia, Japan's Nikkei Stock Average fell 0.7%, snapping a

six-session winning streak as the yen climbed against the dollar.

The dollar was recently down 0.9% against the yen at

Yen101.655.

Hong Kong's Hang Seng Index fell 1.5%, while Australian shares

fell 1% after Australia's central bank left its cash rate

unchanged.

The Shanghai Composite Index gained 0.6%, on hopes for

state-owned enterprise reform and after a private gauge showed

activity in China's services sector expanded at a faster rate in

June.

--Nicole Friedman contributed to this story

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

July 05, 2016 16:27 ET (20:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

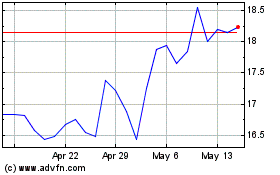

Taylor Wimpey (PK) (USOTC:TWODY)

Historical Stock Chart

From Jun 2024 to Jul 2024

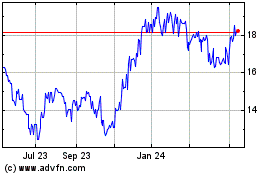

Taylor Wimpey (PK) (USOTC:TWODY)

Historical Stock Chart

From Jul 2023 to Jul 2024