S&P Warns Over Commercial Property Values if U.K. Leaves EU

April 07 2016 - 10:00AM

Dow Jones News

U.K. commercial real-estate values could fall if Britain votes

to end its European Union membership in June, credit-rating firm

Standard & Poor's Corp. said in a report on Thursday.

The U.K. is set to hold a referendum over its relationship with

the EU on June 23. Uncertainty leading up to the public vote "is

likely to have a paralyzing effect on investor decisions on U.K.

real-estate purchases," Marie-Aude Vialle, a credit analyst at the

credit-rating firm, said in a statement.

Exiting the EU "could potentially reverse the significant boost

to real-estate asset values that the U.K., and London in

particular, has experienced in recent years," S&P said in a

report.

Office buildings in London's main financial district, called the

City, would be worst hit, S&P said. Although less so than

commercial real estate, housing markets, especially in London, are

also susceptible.

S&P is the latest group to warn of a negative impact for the

U.K. property markets due to the referendum. The company has

previously said its stance on U.K. government credit could suffer

should Britain part ways with the EU.

Overseas investors have already been pulling back from London

commercial property, such as offices and shops, due to concerns

about slowing global economic growth and the collapse in oil

prices.

Foreign buyers have long perceived that U.K. property provides a

haven from political and financial volatility. A vote to leave the

EU in June "would likely threaten that perception of safety," the

S&P report said.

S&P has ratings on several U.K. property companies,

including Derwent London PLC, Kennedy Wilson Europe Real Estate

PLC, Grainger PLC and Taylor Wimpey PLC.

"Brexit would be overall a negative rating event that we would

need to evaluate versus the financial cushion they have amassed at

their current rating level," the report said.

In addition to weaker demand for property, banks and other

financial services firms could choose to reduce office space in

London, causing rents to fall.

However, large U.K. real-estate firms have benefited from the

recent property boom, and have lower levels of debt compared with

the value of their assets—the so-called loan-to-value ratio—than in

the 2008 financial crisis, S&P said.

"This provides a large degree of cushion to LTV ratios for large

office players in the U.K. should property valuations drop," the

report said. For instance, Derwent London had a loan-to-value ratio

of just 17.8% in December, compared with nearly 40% in December

2008, S&P said.

Write to Art Patnaude at art.patnaude@wsj.com

(END) Dow Jones Newswires

April 07, 2016 09:45 ET (13:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

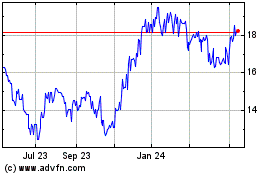

Taylor Wimpey (PK) (USOTC:TWODY)

Historical Stock Chart

From Jun 2024 to Jul 2024

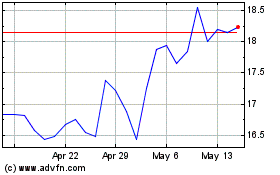

Taylor Wimpey (PK) (USOTC:TWODY)

Historical Stock Chart

From Jul 2023 to Jul 2024