TAYO Targets Commercial Cannabis Properties for Acquisition as Rental Rates Skyrocket

March 03 2015 - 12:31PM

Business Wire

As rental rates for commercial properties in cannabis-friendly

states like Washington, California, and Oregon rapidly climb

upward, Taylor Consulting, Inc. (OTCBB: TAYO) is targeting smart

acquisitions to capitalize in Colorado. The real estate company is

moving forward with talks to add multiple Denver-area properties to

its growing portfolio.

“Denver rent rates for commercial properties suitable for the

cannabis industry range from $15.50 - $19.20 per square foot, and

continue to rise,” said TAYO CEO Scott Wheeler. “We’re looking to

gain a foothold to develop our assets in this evolving industry.

It’s an opportunity to invest in a market that continues to

skyrocket.”

Denver’s low industrial vacancy rate, coupled with the

extraordinary demand for cannabis, has led to a rush to acquire

property. The real estate boom shows no signs of slowing down, with

the legal cannabis market projected to be valued at over $1 billion

by 2016. TAYO is working toward a number of new acquisitions and

partnerships in the Denver marketplace in order to bolster its

nationwide real estate portfolio.

TAYO subsidiary Third Avenue Development, a premier hybrid of

real estate investment and development, plans to move forward with

multiple potential acquisitions in Colorado in the coming

weeks.

About Taylor Consulting, Inc.

Taylor Consulting, Inc. (TAYO) recently created Third Avenue

Development, LLC as a new division whose primary goal is to invest

in promising real estate assets to compete alongside American Homes

4 Rent (NYSE: AMH), Silver Bay Realty Trust Corp. (NYSE: SBY),

Equity Residential (NYSE: EQR), Essex Property Trust Inc. (NYSE:

ESS) and others.

Third Avenue Development, a premier hybrid real estate and

development company, is building an emerging portfolio of real

estate assets for investment, rehabilitation and resale. The

company is focused on acquiring properties in the country’s

top-performing housing markets in order to capitalize on the

continued recovery and growth of the U.S. real estate marketplace.

For more information, visit www.ThirdAvenueDevelopment.com.

Notice Regarding Forward-Looking Statements

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995: This news release contains forward-looking

information within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, including statements that include the

words “believes,” “expects,” “anticipate” or similar expressions.

Such forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of the company to differ materially

from those expressed or implied by such forward-looking statements.

In addition, description of anyone’s past success, either financial

or strategic, is no guarantee of future success. This news release

speaks as of the date first set forth above and the company assumes

no responsibility to update the information included herein for

events occurring after the date hereof.

Taylor Consulting, Inc.Scott Wheeler, 713-840-6099President and

CEOinfo@tadcorp.com

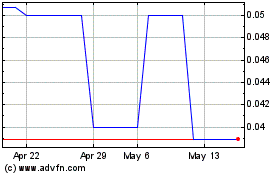

Taylor Consulting (CE) (USOTC:TAYO)

Historical Stock Chart

From Oct 2024 to Nov 2024

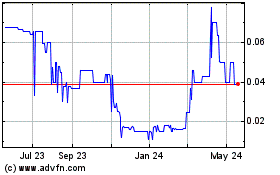

Taylor Consulting (CE) (USOTC:TAYO)

Historical Stock Chart

From Nov 2023 to Nov 2024