Swatch to Focus Smartwatch Technology on Its Plastic Swatch Brand

March 10 2016 - 8:10AM

Dow Jones News

BIEL, Switzerland—Swatch Group AG Thursday said it would focus

its smartwatch technology on its plastic Swatch brand in response

to devices launched by Apple Inc. and others before considering

installing it in its pricier brands.

The Biel-based company, which also owns Omega, Longines and

Tissot, launched its own watch with remote payment functions in

China in January, that had been received "really well" by consumers

there, Chief Executive Nick Hayek said.

The Swatch Bellamy, a version of its eponymous plastic Swatch

watch that uses near-field communication technology, sells for 80

euros ($88) to €100. Further introductions are scheduled for the

U.S., Brazil and Switzerland later this year.

"It's not that we have nothing in the pipeline, we are a huge

producer in every segment in every category," Mr. Hayek said at a

news conference in Biel.

Making progress in the smartwatch market is crucial for Swatch,

which is seen as the most vulnerable of the Swiss watchmakers to

the Apple Watch and similar watches produced by Samsung Electronics

Co. because many of the Swiss company's watches sell in the same

sub-$1,000 price category.

Smartwatches are expected to reach a total of 34.3 million units

shipped in 2016, up from the 21.3 million units expected to ship in

2015, according to International Data Corporation, a market

researcher. By 2019, it forecasts shipments to reach 88.3 million

units.

Jon Cox, an analyst at Kepler Chevreux, said it was very

important for Swatch to be involved in smartwatches. "I assume

around 20% of group operating profit comes from watches retailing

at $1,000 and below and that is where the smartwatch threat is

going to be—compared to much of the rest of the industry which is

just focused on the premium end," he said.

Smartwatches are an opportunity to sell more watches, Mr. Hayek

said, but he doesn't see Apple as a competitor to Swatch, as the

technology company sells through consumer-electronics stores rather

than jewelers or watch shops.

"We are not talking about competing with Apple," said the

colorful Mr. Hayek, who was dressed in a plaid shirt and scarf,

occasionally donned a pair of Swatch sunglasses and puffed on a big

cigar during the news conference. "They are consumer-electronics

people and we don't want to get into that sector.

"We are also competing with jewelry, it's two different

worlds."

Many industry figures also expect a subdued year for the Swiss

watch industry in 2016, after the sector reported a fall in exports

last year, the first drop for six years.

Earlier this year Swatch reported a 3% fall in sales for 2015 to

8.45 billion Swiss Francs ($8.47 billion) while net profit plunged

21% to 1.12 billion francs. Fellow watchmaker Cie. Financiè re

Richemont has responded to the downturn by cutting up to 350 jobs

in Switzerland because of tough market conditions and the strength

of the Swiss franc, which makes production more expensive in the

Alpine country.

Mr. Hayek said Swatch wouldn't be cutting jobs. "We don't hire

people short term and send them away when it is less good," he

said. "We do everything we can to maintain the units and value in

the company."

Write to John Revill at john.revill@wsj.com

(END) Dow Jones Newswires

March 10, 2016 07:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

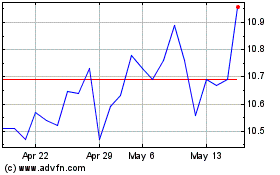

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

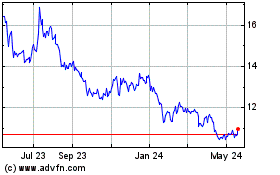

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Feb 2024 to Feb 2025