Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

January 04 2023 - 6:16AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-261754

Pricing Term Sheet – Senior Floating Rate Notes due 2026

|

|

|

| Issuer: |

|

Sumitomo Mitsui Financial Group, Inc. (“SMFG”) |

|

|

| Securities Offered: |

|

U.S.$300,000,000 aggregate principal amount of senior floating rate notes due 2026 (the “Notes”) |

|

|

| Offer and Sale: |

|

SEC registered |

|

|

| Expected Security Ratings: |

|

A1 (Moody’s) / A- (S&P) |

|

|

| Denomination: |

|

U.S.$200,000 and integral multiples of U.S.$1,000 in excess thereof |

|

|

| Offering Price: |

|

100.000% |

|

|

| Pricing Date: |

|

January 3, 2023 |

|

|

| Settlement Date: |

|

January 13, 2023 |

|

|

| Maturity Date: |

|

January 13, 2026 |

|

|

| Redemption: |

|

The Notes will only be redeemable at SMFG’s option, subject to prior confirmation of the Financial Services Agency of Japan (if such confirmation is required under applicable Japanese laws or regulations then in effect), upon

the occurrence of certain changes in tax law, as set forth in the preliminary prospectus supplement dated January 3, 2023 (the “Preliminary Prospectus Supplement”) |

|

|

| Ranking of the Notes: |

|

The Notes will constitute direct, unconditional, unsecured and unsubordinated general obligations of SMFG and will at all times rank pari passu without any preference among themselves and with all other unsecured obligations

of SMFG, other than subordinated obligations of SMFG and except for statutorily preferred obligations |

|

|

| Interest Basis: |

|

Compounded Daily SOFR + Margin |

|

|

| Compounded Daily SOFR: |

|

A compounded daily SOFR determined for each quarterly Interest Period in accordance with the specific formula described under “Description of the Notes—Principal, Maturity and Interest for the Floating Rate

Notes—Compounded Daily SOFR” in the Preliminary Prospectus Supplement |

|

|

| Margin: |

|

+ 1.43 per cent. per annum |

|

|

| Interest Payment Dates: |

|

January 13, April 13, July 13 and October 13 of each year, beginning on April 13, 2023, and ending on the Maturity Date

or, if redeemed early, the date of such redemption, subject to adjustment as explained below, (each, an “Interest Payment Date”) with interest accruing from (and including) the Settlement Date.

If any Interest Payment Date (other than the Maturity Date or any early redemption date

for taxation reasons) falls on a day that is not a Business Day, that Interest Payment Date will be adjusted in accordance with the Modified Following Business Day Convention.

If the Maturity Date or any early redemption date upon redemption for taxation reasons

would fall on a day that is not a Business Day, then any interest, principal or additional amounts, if any, as the case may be, will be paid on the next succeeding Business Day, and no interest shall accrue from and after the Maturity Date or such

redemption date. The term “Modified Following Business Day Convention”

means that the relevant date shall be postponed to the first following day that is a Business Day (and interest will continue to accrue to, but excluding, such succeeding Business Day) unless that day falls in the next calendar month in which case

that date will be the first preceding day that is a Business Day (and interest will accrue to, but excluding, such preceding Business Day). |

|

|

| Interest Periods: |

|

Each period beginning from (and including) the Settlement Date to (but excluding) the first Interest Payment Date, or from (and including)

any Interest Payment Date to (but excluding) the next Interest Payment Date, or from (and including) any Interest Payment Date immediately preceding the

applicable redemption date to (but excluding) such redemption date. |

|

|

| Interest Determination Date: |

|

The date that is five Business Days before each Interest Payment Date. |

|

|

| Reference Rate: |

|

SOFR, subject to fallback provisions |

|

|

| SOFR Observation Period: |

|

In respect of each Interest Period, the period from, and including, the date five Business Days preceding the first date in such Interest

Period to, but excluding, the date five Business Days preceding the Interest Payment Date for such Interest Period (or in respect of the payment of any interest in connection with any redemption of any

Notes, the period from, and including, the date that is five Business Days preceding the first date in the Interest Period in which such redemption occurs to,

but excluding, the date that is five Business Days before such redemption) |

|

|

| Day Count Basis: |

|

Actual number of days in the applicable Interest Period divided by 360 |

|

|

|

| Business Day: |

|

A day that is a U.S. Government Securities Business Day and that in New York, London and Tokyo, is not a day on which banking institutions

are authorized by law or regulation to close. The term “U.S. Government

Securities Business Day” shall mean any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for

purposes of trading in U.S. government securities. |

|

|

| Use of Proceeds: |

|

SMFG intends to use the net proceeds of the offering to extend unsecured loans, intended to qualify as internal TLAC, to Sumitomo Mitsui Banking Corporation (“SMBC”) and SMBC intends to use the proceeds of the loans for

general corporate purposes |

|

|

| Listing: |

|

Luxembourg Stock Exchange’s Euro MTF Market |

|

|

| Settlement: |

|

DTC, Euroclear and Clearstream |

|

|

| CUSIP: |

|

86562M CU2 |

|

|

| ISIN: |

|

US86562MCU27 |

|

|

| Common Code: |

|

257192717 |

|

|

| Legal Entity Identifier: |

|

35380028MYWPB6AUO129 |

|

|

Joint Lead Managers and

Joint Bookrunners: |

|

SMBC Nikko Securities America, Inc. Goldman

Sachs & Co. LLC J.P. Morgan Securities LLC Jefferies

LLC |

|

|

| Co-Managers: |

|

Barclays Capital Inc. BofA Securities, Inc.

Citigroup Global Markets Inc. Nomura Securities International,

Inc. Daiwa Capital Markets America Inc. HSBC Securities (USA)

Inc. Academy Securities, Inc. CastleOak Securities, L.P.

Samuel A. Ramirez & Company, Inc. Siebert Williams

Shank & Co., LLC |

|

|

| Stabilization Manager: |

|

SMBC Nikko Securities America, Inc. |

|

|

Trustee, Paying Agent,

Transfer Agent, Registrar

and Calculation Agent: |

|

The Bank of New York Mellon |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the SEC

for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete

information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send

you the prospectus and the preliminary prospectus supplement if you request it by calling SMBC Nikko Securities America, Inc. toll-free at

1-888-868-6856, Goldman Sachs & Co. LLC at 1-212-902-1171 (Prospectus Department), J.P. Morgan Securities LLC at

1-212-834-4533, Jefferies LLC at

1-212-284-2300 or by calling SMFG’s investor relations department at 81-3-3282-8111.

No PRIIPs KID - No PRIIPs key information document (KID) has been

prepared as not available to retail in EEA or U.K. See “PROHIBITION OF SALES TO EEA RETAIL INVESTORS” and “PROHIBITION OF SALES TO U.K. RETAIL INVESTORS” in the preliminary prospectus supplement dated January 3, 2023.

This communication is intended for the sole use of the person to whom it is provided by us.

This notice does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of Notes in any jurisdiction in Canada

where such offer or solicitation or advertisement would be unlawful. The Notes will be offered only to purchasers purchasing, or deemed to be purchasing, as principal that are both “accredited investors” as defined in National Instrument 45-106 Prospectus Exemptions or Section 73.3(1) of the Securities Act (Ontario) and “permitted clients” as defined in National Instrument 31-103 Registration

Requirements, Exemptions and Ongoing Registrant Obligations.

Any disclaimer or other notice that may appear below is not applicable to this

communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

Pricing Term Sheet – 5.464% Senior Notes due 2026

|

|

|

| Issuer: |

|

Sumitomo Mitsui Financial Group, Inc. (“SMFG”) |

|

|

| Securities Offered: |

|

U.S.$1,500,000,000 aggregate principal amount of 5.464% senior notes due 2026 (the “Notes”) |

|

|

| Offer and Sale: |

|

SEC registered |

|

|

| Expected Security Ratings: |

|

A1 (Moody’s) / A- (S&P) |

|

|

| Denomination: |

|

U.S.$200,000 and integral multiples of U.S.$1,000 in excess thereof |

|

|

| Offering Price: |

|

100.000% |

|

|

| Pricing Date: |

|

January 3, 2023 |

|

|

| Settlement Date: |

|

January 13, 2023 |

|

|

| Maturity Date: |

|

January 13, 2026 |

|

|

| Redemption: |

|

The Notes will only be redeemable at SMFG’s option, subject to prior confirmation of the Financial Services Agency of Japan (if such confirmation is required under applicable Japanese laws or regulations then in effect), upon

the occurrence of certain changes in tax law, as set forth in the preliminary prospectus supplement dated January 3, 2023 |

|

|

| Ranking of the Notes: |

|

The Notes will constitute direct, unconditional, unsecured and unsubordinated general obligations of SMFG and will at all times rank pari passu without any preference among themselves and with all other unsecured obligations

of SMFG, other than subordinated obligations of SMFG and except for statutorily preferred obligations |

|

|

| Coupon Payment Dates: |

|

Payable semiannually in arrears on January 13 and July 13 of each year beginning on July 13, 2023. Such semiannual interest will amount to U.S.$27.32 per U.S.$1,000 in nominal amount of the Notes for each interest payment

date |

|

|

| Spread to Benchmark: |

|

T+130 bps |

|

|

| Coupon: |

|

5.464% |

|

|

| Day Count Basis: |

|

30/360, unadjusted |

|

|

| Business Day: |

|

New York, London and Tokyo |

|

|

| Use of Proceeds: |

|

SMFG intends to use the net proceeds of the offering to extend unsecured loans, intended to qualify as internal TLAC, to Sumitomo Mitsui Banking Corporation (“SMBC”) and SMBC intends to use the proceeds of the loans for

general corporate purposes |

|

|

| Listing: |

|

Luxembourg Stock Exchange’s Euro MTF Market |

|

|

| Settlement: |

|

DTC, Euroclear and Clearstream |

|

|

| CUSIP: |

|

86562M CT5 |

|

|

| ISIN: |

|

US86562MCT53 |

|

|

| Common Code: |

|

257192687 |

|

|

| Legal Entity Identifier: |

|

35380028MYWPB6AUO129 |

|

|

Joint Lead Managers and

Joint Bookrunners: |

|

SMBC Nikko Securities America, Inc. Goldman

Sachs & Co. LLC J.P. Morgan Securities LLC Jefferies

LLC |

|

|

|

| Co-Managers: |

|

Barclays Capital Inc. BofA Securities, Inc.

Citigroup Global Markets Inc. Nomura Securities International,

Inc. Daiwa Capital Markets America Inc. HSBC Securities (USA)

Inc. Academy Securities, Inc. CastleOak Securities, L.P.

Samuel A. Ramirez & Company, Inc. Siebert Williams

Shank & Co., LLC |

|

|

| Stabilization Manager: |

|

SMBC Nikko Securities America, Inc. |

|

|

Trustee, Paying Agent,

Transfer Agent and

Registrar: |

|

The Bank of New York Mellon |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the

SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete

information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send

you the prospectus and the preliminary prospectus supplement if you request it by calling SMBC Nikko Securities America, Inc. toll-free at

1-888-868-6856, Goldman Sachs & Co. LLC at 1-212-902-1171 (Prospectus Department), J.P. Morgan Securities LLC at

1-212-834-4533, Jefferies LLC at

1-212-284-2300 or by calling SMFG’s investor relations department at 81-3-3282-8111.

No PRIIPs KID - No PRIIPs key information document (KID) has been

prepared as not available to retail in EEA or U.K. See “PROHIBITION OF SALES TO EEA RETAIL INVESTORS” and “PROHIBITION OF SALES TO U.K. RETAIL INVESTORS” in the preliminary prospectus supplement dated January 3, 2023.

This communication is intended for the sole use of the person to whom it is provided by us.

This notice does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of Notes in any jurisdiction in Canada

where such offer or solicitation or advertisement would be unlawful. The Notes will be offered only to purchasers purchasing, or deemed to be purchasing, as principal that are both “accredited investors” as defined in National Instrument 45-106 Prospectus Exemptions or Section 73.3(1) of the Securities Act (Ontario) and “permitted clients” as defined in National Instrument 31-103 Registration

Requirements, Exemptions and Ongoing Registrant Obligations.

Any disclaimer or other notice that may appear below is not applicable to this

communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

Pricing Term Sheet – 5.520% Senior Notes due 2028

|

|

|

| Issuer: |

|

Sumitomo Mitsui Financial Group, Inc. (“SMFG”) |

|

|

| Securities Offered: |

|

U.S.$1,500,000,000 aggregate principal amount of 5.520% senior notes due 2028 (the “Notes”) |

|

|

| Offer and Sale: |

|

SEC registered |

|

|

| Expected Security Ratings: |

|

A1 (Moody’s) / A- (S&P) |

|

|

| Denomination: |

|

U.S.$200,000 and integral multiples of U.S.$1,000 in excess thereof |

|

|

| Offering Price: |

|

100.000% |

|

|

| Pricing Date: |

|

January 3, 2023 |

|

|

| Settlement Date: |

|

January 13, 2023 |

|

|

| Maturity Date: |

|

January 13, 2028 |

|

|

| Redemption: |

|

The Notes will only be redeemable at SMFG’s option, subject to prior confirmation of the Financial Services Agency of Japan (if such confirmation is required under applicable Japanese laws or regulations then in effect), upon

the occurrence of certain changes in tax law, as set forth in the preliminary prospectus supplement dated January 3, 2023 |

|

|

| Ranking of the Notes: |

|

The Notes will constitute direct, unconditional, unsecured and unsubordinated general obligations of SMFG and will at all times rank pari passu without any preference among themselves and with all other unsecured obligations

of SMFG, other than subordinated obligations of SMFG and except for statutorily preferred obligations |

|

|

| Coupon Payment Dates: |

|

Payable semiannually in arrears on January 13 and July 13 of each year beginning on July 13, 2023. Such semiannual interest will amount to U.S.$27.60 per U.S.$1,000 in nominal amount of the Notes for each interest payment

date |

|

|

| Spread to Benchmark: |

|

T+160 bps |

|

|

| Coupon: |

|

5.520% |

|

|

| Day Count Basis: |

|

30/360, unadjusted |

|

|

| Business Day: |

|

New York, London and Tokyo |

|

|

| Use of Proceeds: |

|

SMFG intends to use the net proceeds of the offering to extend unsecured loans, intended to qualify as internal TLAC, to Sumitomo Mitsui Banking Corporation (“SMBC”) and SMBC intends to use the proceeds of the loans for

general corporate purposes |

|

|

| Listing: |

|

Luxembourg Stock Exchange’s Euro MTF Market |

|

|

| Settlement: |

|

DTC, Euroclear and Clearstream |

|

|

| CUSIP: |

|

86562M CR9 |

|

|

| ISIN: |

|

US86562MCR97 |

|

|

| Common Code: |

|

254762547 |

|

|

| Legal Entity Identifier: |

|

35380028MYWPB6AUO129 |

|

|

Joint Lead Managers and

Joint Bookrunners: |

|

SMBC Nikko Securities America, Inc. Goldman

Sachs & Co. LLC J.P. Morgan Securities LLC Jefferies

LLC |

|

|

|

| Co-Managers: |

|

Barclays Capital Inc. BofA Securities, Inc.

Citigroup Global Markets Inc. Nomura Securities International,

Inc. Daiwa Capital Markets America Inc. HSBC Securities (USA)

Inc. Academy Securities, Inc. CastleOak Securities, L.P.

Samuel A. Ramirez & Company, Inc. Siebert Williams

Shank & Co., LLC |

|

|

| Stabilization Manager: |

|

SMBC Nikko Securities America, Inc. |

|

|

Trustee, Paying Agent,

Transfer Agent and

Registrar: |

|

The Bank of New York Mellon |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the

SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete

information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send

you the prospectus and the preliminary prospectus supplement if you request it by calling SMBC Nikko Securities America, Inc. toll-free at

1-888-868-6856, Goldman Sachs & Co. LLC at 1-212-902-1171 (Prospectus Department), J.P. Morgan Securities LLC at

1-212-834-4533, Jefferies LLC at

1-212-284-2300 or by calling SMFG’s investor relations department at 81-3-3282-8111.

No PRIIPs KID - No PRIIPs key information document (KID) has been

prepared as not available to retail in EEA or U.K. See “PROHIBITION OF SALES TO EEA RETAIL INVESTORS” and “PROHIBITION OF SALES TO U.K. RETAIL INVESTORS” in the preliminary prospectus supplement dated January 3, 2023.

This communication is intended for the sole use of the person to whom it is provided by us.

This notice does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of Notes in any jurisdiction in Canada

where such offer or solicitation or advertisement would be unlawful. The Notes will be offered only to purchasers purchasing, or deemed to be purchasing, as principal that are both “accredited investors” as defined in National Instrument 45-106 Prospectus Exemptions or Section 73.3(1) of the Securities Act (Ontario) and “permitted clients” as defined in National Instrument 31-103 Registration

Requirements, Exemptions and Ongoing Registrant Obligations.

Any disclaimer or other notice that may appear below is not applicable to this

communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

Pricing Term Sheet – 5.710% Senior Notes due 2030

|

|

|

| Issuer: |

|

Sumitomo Mitsui Financial Group, Inc. (“SMFG”) |

|

|

| Securities Offered: |

|

U.S.$1,000,000,000 aggregate principal amount of 5.710% senior notes due 2030 (the “Notes”) |

|

|

| Offer and Sale: |

|

SEC registered |

|

|

| Expected Security Ratings: |

|

A1 (Moody’s) / A- (S&P) |

|

|

| Denomination: |

|

U.S.$200,000 and integral multiples of U.S.$1,000 in excess thereof |

|

|

| Offering Price: |

|

100.000% |

|

|

| Pricing Date: |

|

January 3, 2023 |

|

|

| Settlement Date: |

|

January 13, 2023 |

|

|

| Maturity Date: |

|

January 13, 2030 |

|

|

| Redemption: |

|

The Notes will only be redeemable at SMFG’s option, subject to prior confirmation of the Financial Services Agency of Japan (if such confirmation is required under applicable Japanese laws or regulations then in effect), upon

the occurrence of certain changes in tax law, as set forth in the preliminary prospectus supplement dated January 3, 2023 |

|

|

| Ranking of the Notes: |

|

The Notes will constitute direct, unconditional, unsecured and unsubordinated general obligations of SMFG and will at all times rank pari passu without any preference among themselves and with all other unsecured obligations

of SMFG, other than subordinated obligations of SMFG and except for statutorily preferred obligations |

|

|

| Coupon Payment Dates: |

|

Payable semiannually in arrears on January 13 and July 13 of each year beginning on July 13, 2023. Such semiannual interest will amount to U.S.$28.55 per U.S.$1,000 in nominal amount of the Notes for each interest payment

date |

|

|

| Spread to Benchmark: |

|

T+185 bps |

|

|

| Coupon: |

|

5.710% |

|

|

| Day Count Basis: |

|

30/360, unadjusted |

|

|

| Business Day: |

|

New York, London and Tokyo |

|

|

| Use of Proceeds: |

|

SMFG intends to use the net proceeds of the offering to extend unsecured loans, intended to qualify as internal TLAC, to Sumitomo Mitsui Banking Corporation (“SMBC”) and SMBC intends to use the proceeds of the loans for

general corporate purposes |

|

|

| Listing: |

|

Luxembourg Stock Exchange’s Euro MTF Market |

|

|

| Settlement: |

|

DTC, Euroclear and Clearstream |

|

|

| CUSIP: |

|

86562M CW8 |

|

|

| ISIN: |

|

US86562MCW82 |

|

|

| Common Code: |

|

257192695 |

|

|

| Legal Entity Identifier: |

|

35380028MYWPB6AUO129 |

|

|

Joint Lead Managers and

Joint Bookrunners: |

|

SMBC Nikko Securities America, Inc. Goldman

Sachs & Co. LLC J.P. Morgan Securities LLC Jefferies

LLC |

|

|

|

| Co-Managers: |

|

Barclays Capital Inc. BofA Securities, Inc.

Citigroup Global Markets Inc. Nomura Securities International,

Inc. Daiwa Capital Markets America Inc. HSBC Securities (USA)

Inc. Academy Securities, Inc. CastleOak Securities, L.P.

Samuel A. Ramirez & Company, Inc. Siebert Williams

Shank & Co., LLC |

|

|

| Stabilization Manager: |

|

SMBC Nikko Securities America, Inc. |

|

|

Trustee, Paying Agent,

Transfer Agent and

Registrar: |

|

The Bank of New York Mellon |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the

SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete

information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send

you the prospectus and the preliminary prospectus supplement if you request it by calling SMBC Nikko Securities America, Inc. toll-free at

1-888-868-6856, Goldman Sachs & Co. LLC at 1-212-902-1171 (Prospectus Department), J.P. Morgan Securities LLC at

1-212-834-4533, Jefferies LLC at

1-212-284-2300 or by calling SMFG’s investor relations department at 81-3-3282-8111.

No PRIIPs KID - No PRIIPs key information document (KID) has been

prepared as not available to retail in EEA or U.K. See “PROHIBITION OF SALES TO EEA RETAIL INVESTORS” and “PROHIBITION OF SALES TO U.K. RETAIL INVESTORS” in the preliminary prospectus supplement dated January 3, 2023.

This communication is intended for the sole use of the person to whom it is provided by us.

This notice does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of Notes in any jurisdiction in Canada

where such offer or solicitation or advertisement would be unlawful. The Notes will be offered only to purchasers purchasing, or deemed to be purchasing, as principal that are both “accredited investors” as defined in National Instrument 45-106 Prospectus Exemptions or Section 73.3(1) of the Securities Act (Ontario) and “permitted clients” as defined in National Instrument 31-103 Registration

Requirements, Exemptions and Ongoing Registrant Obligations.

Any disclaimer or other notice that may appear below is not applicable to this

communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

Pricing Term Sheet – 5.766% Senior Notes due 2033

|

|

|

| Issuer: |

|

Sumitomo Mitsui Financial Group, Inc. (“SMFG”) |

|

|

| Securities Offered: |

|

U.S.$1,500,000,000 aggregate principal amount of 5.766% senior notes due 2033 (the “Notes”) |

|

|

| Offer and Sale: |

|

SEC registered |

|

|

| Expected Security Ratings: |

|

A1 (Moody’s) / A- (S&P) |

|

|

| Denomination: |

|

U.S.$200,000 and integral multiples of U.S.$1,000 in excess thereof |

|

|

| Offering Price: |

|

100.000% |

|

|

| Pricing Date: |

|

January 3, 2023 |

|

|

| Settlement Date: |

|

January 13, 2023 |

|

|

| Maturity Date: |

|

January 13, 2033 |

|

|

| Redemption: |

|

The Notes will only be redeemable at SMFG’s option, subject to prior confirmation of the Financial Services Agency of Japan (if such confirmation is required under applicable Japanese laws or regulations then in effect), upon

the occurrence of certain changes in tax law, as set forth in the preliminary prospectus supplement dated January 3, 2023 |

|

|

| Ranking of the Notes: |

|

The Notes will constitute direct, unconditional, unsecured and unsubordinated general obligations of SMFG and will at all times rank pari passu without any preference among themselves and with all other unsecured obligations

of SMFG, other than subordinated obligations of SMFG and except for statutorily preferred obligations |

|

|

| Coupon Payment Dates: |

|

Payable semiannually in arrears on January 13 and July 13 of each year beginning on July 13, 2023. Such semiannual interest will amount to U.S.$28.83 per U.S.$1,000 in nominal amount of the Notes for each interest payment

date |

|

|

| Spread to Benchmark: |

|

T+200 bps |

|

|

| Coupon: |

|

5.766% |

|

|

| Day Count Basis: |

|

30/360, unadjusted |

|

|

| Business Day: |

|

New York, London and Tokyo |

|

|

| Use of Proceeds: |

|

SMFG intends to use the net proceeds of the offering to extend unsecured loans, intended to qualify as internal TLAC, to Sumitomo Mitsui Banking Corporation (“SMBC”) and SMBC intends to use the proceeds of the loans for

general corporate purposes |

|

|

| Listing: |

|

Luxembourg Stock Exchange’s Euro MTF Market |

|

|

| Settlement: |

|

DTC, Euroclear and Clearstream |

|

|

| CUSIP: |

|

86562M CS7 |

|

|

| ISIN: |

|

US86562MCS70 |

|

|

| Common Code: |

|

254771198 |

|

|

| Legal Entity Identifier: |

|

35380028MYWPB6AUO129 |

|

|

Joint Lead Managers and

Joint Bookrunners: |

|

SMBC Nikko Securities America, Inc. Goldman

Sachs & Co. LLC J.P. Morgan Securities LLC Jefferies

LLC |

|

|

|

| Co-Managers: |

|

Barclays Capital Inc. BofA Securities, Inc.

Citigroup Global Markets Inc. Nomura Securities International,

Inc. Daiwa Capital Markets America Inc. HSBC Securities (USA)

Inc. Academy Securities, Inc. CastleOak Securities, L.P.

Samuel A. Ramirez & Company, Inc. Siebert Williams

Shank & Co., LLC |

|

|

| Stabilization Manager: |

|

SMBC Nikko Securities America, Inc. |

|

|

Trustee, Paying Agent,

Transfer Agent and

Registrar: |

|

The Bank of New York Mellon |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the

SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete

information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send

you the prospectus and the preliminary prospectus supplement if you request it by calling SMBC Nikko Securities America, Inc. toll-free at

1-888-868-6856, Goldman Sachs & Co. LLC at 1-212-902-1171 (Prospectus Department), J.P. Morgan Securities LLC at

1-212-834-4533, Jefferies LLC at

1-212-284-2300 or by calling SMFG’s investor relations department at 81-3-3282-8111.

No PRIIPs KID - No PRIIPs key information document (KID) has been

prepared as not available to retail in EEA or U.K. See “PROHIBITION OF SALES TO EEA RETAIL INVESTORS” and “PROHIBITION OF SALES TO U.K. RETAIL INVESTORS” in the preliminary prospectus supplement dated January 3, 2023.

This communication is intended for the sole use of the person to whom it is provided by us.

This notice does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of Notes in any jurisdiction in Canada

where such offer or solicitation or advertisement would be unlawful. The Notes will be offered only to purchasers purchasing, or deemed to be purchasing, as principal that are both “accredited investors” as defined in National Instrument 45-106 Prospectus Exemptions or Section 73.3(1) of the Securities Act (Ontario) and “permitted clients” as defined in National Instrument 31-103 Registration

Requirements, Exemptions and Ongoing Registrant Obligations.

Any disclaimer or other notice that may appear below is not applicable to this

communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

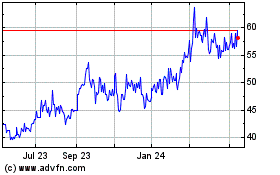

Sumitomo Mitsui Finl (PK) (USOTC:SMFNF)

Historical Stock Chart

From Nov 2024 to Dec 2024

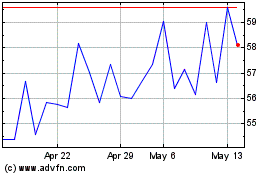

Sumitomo Mitsui Finl (PK) (USOTC:SMFNF)

Historical Stock Chart

From Dec 2023 to Dec 2024