Eco Allies

(OTC Pink: SVSN) Progresses on $90 million NYSE Listed Hemp

REIT

Eco

Allies(formerly

Stereo Vision) Report

released on EmergingGrowth.com

https://emerginggrowth.com/eco-allies-progresses-on-90-million-nyse-listed-hemp-reit/

Name change to Eco Allies, Inc. (OTC Pink: SVSN) to reflect new

direction of Company

Progresses on $90 million NYSE Listed Hemp REIT

Sale of environmental credits to finance the filing of the $90

million REIT

Expects to yield over $200 million through recent acquisition of

Climate Cure Capital Corp.

Miami, FL --

December 3, 2019 -- InvestorsHub NewsWire

-- EmergingGrowth.com, a leading independent small cap media

portal with an extensive history of providing unparalleled content

for the Emerging Growth markets and companies, reports on Eco

Allies, Inc. (OTC Pink: SVSN).

This could be the

biggest play in the Hemp space. See the full story on

http://www.EmergingGrowth.com

SVSN

may not be at these levels much longer.

See the Press

Release and more on Eco Allies, Inc. (OTC Pink: SVSN) at

EmergingGrowth.com

https://emerginggrowth.com/?s=svsn

Eco

Allies's,

Inc. (OTC Pink: SVSN)

bold foray into the lucrative global hemp market—a market projected

to hit $26.6

billion by 2025 according to a report by

ResearchAndMarkets—is

beginning to pay off.

Eco

Allies, Inc. (OTC Pink: SVSN) has formed Amalgamated

Agricultural Properties Inc. (http://hempreit.biz)

to acquire farms and properties for growing hemp, and establish a

mission critical foundation for its venture into hemp with its

planned registration, for a New York Stock Exchange (NYSE) listing,

to be filed with the SEC for a $90 million Real Estate Investment

Trust (REIT).

Eco

Allies, Inc. (OTC Pink: SVSN) has formed Amalgamated

Agricultural Properties Inc. (http://hempreit.biz)

to acquire farms and properties for growing hemp, and establish a

mission critical foundation for its venture into hemp with its

planned registration, for a New York Stock Exchange (NYSE) listing,

to be filed with the SEC for a $90 million Real Estate Investment

Trust (REIT).

Eco Allies, Inc.

(OTC Pink: SVSN) currently owns 500,000 shares

of Amalgamated's

5 million

authorized shares, with 90% of the remaining authorized shares

(4,500,000 shares) to be sold for $20.00 per share yielding

Amalgamated

$90 million to

complete letters of intent (LOI's) that Amalgamated

is

procuring.

Eco Allies,

Inc.'s shareholders will ultimately

be the beneficial owners of 10% of Amalgamated's

5 million shares

then outstanding for $10 million in shareholder equity.

Innovative Industrial Properties (NYSE: IIPR) grew from $20.00 to

$130.00 per share in 18 months.

"Innovative

Industrial Properties Inc., (NYSE: IIPR) has demonstrated that a

cannabis related

REIT can be a success as its stock has grown dramatically in price

from its IPO. Its management and founders reflect the rare

expertise required to be successful in this business and our

Farming Advisors, John Toth (member of the Eco Allies, Inc. Board

of Directors), and Shad Sullivan (Member of the Climate Cure Board

of Directors) are in the same league. Eco Allies, Inc. is another

pioneer following the success of, Innovative Industrial Properties

Inc., (NYSE: IIPR), Unlike

IIPR however, Eco Allies, Inc. seeks to advance the legal cannabis

REIT model to benefit Amalgamated,

and Eco Allies, Inc. through its relationship with

Amalgamated."

said Honour.

The

Amalgamated

REIT, of which

Eco Allies, Inc. (OTC Pink: SVSN) is the current principal

shareholder has already aroused sharp interest from Wall Street

investors who are keen on venturing into the legal cannabis

space.

In

order to assist with the development of Amalgamated,

Eco Allies, Inc. (OTC Pink: SVSN) has incorporated into its a

"Who's Who" of the hemp industry into its board of

directors.

You can view the full team here: http://www.hempreit.biz/

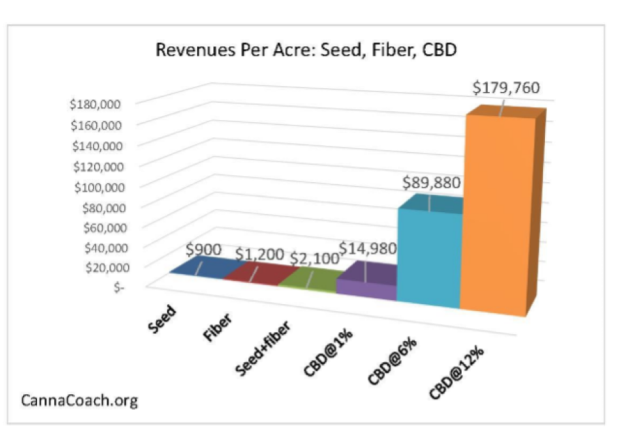

Acreage is

the Holy Grail

Among the many

products made from hemp, CBD can generate as much as $180,000

(CAD)/$140,000 (USD) per acre. This is according to research based

on the Canadian market, which research is more readily available

because at this time, Canada has more progressive cannabis laws

than the U.S. The chart below gives a detailed breakdown of the

potential revenue from one acre of hemp.

Clearly, acreage

is the Holy Grail in hemp cultivation. Revenues are a direct

function of how many acres that can be grown. But expanding

controlled acreage is easier said than done. Farmland is

increasingly expensive in the U.S. Prices have increased

consistently since the early 1990s and even defied the 2008

financial crisis. This is according to analysis

by The Motley Fool, and cited on USA

TODAY.

But here again,

Eco Allies, Inc.'s innovative strategy shines.

Targeting Florida's warm climate, allows 3 crops per year to be

cultivated from the same acreage. The high cost of farmland

presents a challenge to the vast majority of hemp cultivators as

legal cannabis is still a development stage industry and the vast

majority of companies in the space are currently not generating

sufficient revenues or cash flows to purchase irrigated

farmland.

U.S. farmland prices have increased consistently since early

1990s

The average price

of U.S. farmland is currently around $2,728, according to the

aforementioned Motley Fool analyst. Through the planned $90

million-dollar US REIT, Eco Allies, Inc. will be able to access a

considerable amount of acreage. This translates into an opportunity

to generate strong revenues long-term. This is not a typo, but a

calculation based on the average revenue per acre of hemp can be

$100,000+ for hemp.

"A

REIT is designed to raise capital to acquire real estate. In this

instance, Amalgamated

can

raise the cash it needs through a deal with a major Wall Street

Firm to purchase farmland to grow hemp. The Eco Allies, Inc.

strategy leverages conventional funding, expenditure reduction, and

innovative generation of revenue, to produce, and then vastly

increase legal cannabis cash flows for it and its shareholders,"

commented Jack Honour,

CEO of Eco Allies, Inc..

The Climate

Cure Acquisition

"Eco Allies,

Inc.'s recent acquisition of Climate Cure Capital Corporation added

another thoroughbred to the Eco Allies, Inc. stable and furnishes

Eco Allies, Inc. with the way to add a number of revenue generators

to increase Company profits." Stated Jack Honour Eco Allies, Inc. (OTC Pink: SVSN)

Eco Allies, Inc.

acquired 100% of Climate Cure Capital Corporation's stock in

exchange for five million shares of Eco Allies, Inc. restricted

common stock. Eco Allies, Inc.'s General Counsel, Arnold F. Sock,

is a founder, officer, and board member of Climate Cure Capital

Corporation.

Climate

Cure Capital®, the recently acquired

wholly owned subsidiary, is the result of more than 40 years of

combined experience in project design, management, and

implementation in GHG (Greenhouse Gas) reduction and renewable

energy arenas. Our strategy is to identify specific opportunities

to provide, emission reduction or energy efficiency opportunity in

the early stages of a development. Climate Cure provides its

innovative solutions and technologies

while it directs

and manages the necessary technical consultants and becomes the

repository for all of a carbon related project's data.

Climate Cure has

an experienced management team.

You can view the full team here: http://climatecurecapital.com/

The Climate Cure

Capital Corporation acquisition is another

example of management's determination to expand into eco-friendly

businesses with socially positive impacts and strong earnings

potential. Climate Cure Capital Corporation currently has over

295,000 environmental credits in its account. It provides

environmental commodities services to produce and broker carbon

offset credits, emissions offset credits, as well as other offset

credits that finance pollution mitigation.

These credits

have value. Depending on the market, the 295,000 credits held by

Climate Cure Capital can be sold for between $10.00 and $14.00

each, providing $295,000 to $413.000 in cash proceeds. Eco Allies,

Inc. will sell the credits to finance its ongoing progress to

have Amalgamated's

$90 million REIT

listed on the NYSE.

Climate Cure

Capital Corporation has farmed and harvested its proprietary

Paulownia trees for the Ortigalita

Power Plant in

California of which Climate Cure owns 30%. Climate Cure has in

stock 5,000,000 seeds for these proprietary trees it developed

through non-genetic modification. It will also be burning hemp

chaff and hemp by-products to create green gas, electricity, and

carbon and emission offset credits.

Our proprietary

Paulownia Trees, according to WF Billy Barnwell, CEO of Climate

Cure Capital Corporation and Eco Allies, Inc. Board of Directors

member, grow to 2 feet high in 6 weeks after planting and 20 feet

per year to a maximum of 60 feet in 3 years. Climate Cure's

proprietary Paulownia Tree can be harvested at any point after the

first year (at 20 feet) and then used for biomass to produce energy,

producing biochar (a soil amendment), phytoremediation (soil

clean-up), coal supplanting (when processed for such), and because

they are a carbon sink (breathing in CO2) they result in carbon and

emission offset credits that are sold for additional revenue at the

same time they produce revenue from their primary usage.

According to

Philip Scalzo, (https://www.linkedin.com/in/philip-scalzo-731a5830/)

who was instrumental in analyzing Climate Cure Capital

Corp.'s Paulownia trees, and their

potential market value to Eco Allies, Inc. concluded that a 2,000

lb. tree is 70% water and 30% dry matter. Climate Cure Capital

Corp. is

expected to recover 94% or 564 lbs. of the dry matter, (which will

still contain 10% moisture) and sell it to a customer for $140.00

per ton, or $43.86 for each tree.

Eco Allies,

Inc.'s now wholly owned

subsidiary Climate Cure Capital

Corp has

5,000,000 seeds in stock of which it expects to yield over

$200,000,000.

Grossly

undervalued

Jack

Honour, CEO, Eco Allies, Inc.

(OTC Pink: SVSN) stated "Eco Allies, Inc., which

has a 100% ownership stake in CannaFlora

Farms and Climate

Cure Capital is grossly undervalued in light of its current market

cap of around $9.81 million versus its subsidiaries' potential to

rake in revenues and income in the millions in the near term of

operation without land acquisition costs, debt financing costs, or

stock dilution."

Mr.

Honour

continued, "Eco

Allies, Inc.s potential to become a

billion-dollar company from revenue and income produced by

the Amalgamated

REIT, and its

subsidiaries cannot be downplayed. REITS require that 90% of their

income be distributed to their shareholders, and as a significant

shareholder in Amalgamated,

Eco Allies, Inc. (OTC Pink: SVSN) could look forward to

significant income from its Amalgamated

holdings (as well

as the potential benefit of holding Amalgamated

stock that may

significantly increase in value). Eco Allies, Inc. has a stable of

diversified companies to establish of tremendous shareholder

value."

"Talent

acquisition and retention is at the heart of Eco Allies, Inc.'s

strategy. While we love working with

people who are genuinely passionate about the possibilities our

business model offers, and we put an even greater premium on skill

and competence. Our talent pool is premier quality,"

concluded Honour.

Conclusion

When investors

look at the amazing success story of Innovative Industrial

Properties Inc. (NYSE: IIPR) they often get mesmerized by the

stock chart and forget that successful companies are built by

talented executives like , William Barnwell, James Gaspard (Eco

Allies, Inc. Board of Directors member and biochar [patent holder

and expert), Scientist John Toth (CEO of CannaFlora, Inc. and agriculture

expert), Shad Sullivan (patent holder and farming expert),

Arnold F. Sock

(LL.M), Esq., T.J. Culbertson (real estate expert and Eco Allies,

Inc. Board of Directors Member), Wayne Hunton, CRS (CEO and Director

of Amalgamated),

Ron Watson (Eco Allies, Inc. Board of Directors member and hemp

consultant), Glenn Kirk, CPA, and Jack Honour, who can all successfully

execute strategy.

Adding to this

critical resource are the capabilities and capacities of the wholly

owned current and future subsidiaries of Eco Allies, Inc. These

companies will grow, maintain and expand revenue and income

producing activities. Being "just a REIT," Innovative Industrial

Properties, Inc. (NYSE: IIPR), cannot take advantage of income

generating capabilities available to Eco Allies, Inc. through its

collaborative multi-faceted operations concept and its ability to

execute it.

Once the

Amalgamated

REIT draws much

deserved attention to Eco Allies, Inc. and its difference from just

being associated with an "ordinary REIT," the upside could be

tremendous – Possibly in the six to nine figures" Concluded

Jack Honour, CEO Eco Allies,

Inc.

Safe Harbor Statement: Except for historical information certain

statements in this

newsrelease

may contain forward-looking information within the meaning of Rule

175 under the Securities Act of 1933 and Rule 3b-6 under the

Securities Exchange Act of 1934, and those statements are subject

to the safe harbor created by those rules. All statements, other

than statements of fact, included in this release, including,

without limitation, statements regarding potential plans and

objectives of the Company, are forward-looking statements that

involve risks and

uncertainties.There

can be no assurance such statements will prove accurate and actual

results and future events could differ materially from those

anticipated in such statements. The Company cautions these

forward-looking statements are qualified by other factors and

undertakes no responsibility to update information.

Jack

Honour

CEO

818-326-6018

info@stereovision.com

Eco Allies,

Inc.

OTC Pink:

SVSN

SVSN

may not be at these levels much longer.

See the Press

Release and more on Eco Allies, Inc. (OTC Pink: SVSN) at

EmergingGrowth.com

https://emerginggrowth.com/?s=svsn

About

EmergingGrowth.com

EmergingGrowth.com is a

leading independent small cap media portal with an extensive

history of providing unparalleled content for the Emerging Growth

markets and companies. Through its evolution, EmergingGrowth.com

found a niche in identifying companies that can be overlooked by

the markets due to, among other reasons, trading price or market

capitalization. We look for strong management, innovation,

strategy, execution, and the overall potential for long- term

growth. Aside from being a trusted resource for the Emerging Growth

info-seekers, we are well known for discovering undervalued

companies and bringing them to the attention of the investment

community. Through our parent Company, we also have the ability to

facilitate road shows to present your products and services to the

most influential investment banks in the space.

All information

contained herein as well as on the EmergingGrowth.com website is

obtained from sources believed to be reliable but not guaranteed to

be accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should

not be construed as an offer or solicitation to buy or sell

securities. The information includes certain forward-looking

statements, which may be affected by unforeseen circumstances and /

or certain risks. This report is not without bias.

EmergingGrowth.com has motivation by means of either self-marketing

or EmergingGrowth.com has been compensated by or for a company or

companies discussed in this article. EmergingGrowth.com has been

compensated fifteen thousand dollars and four million five hundred

thousand restricted shares of Eco Allies, Inc., formerly Stereo

Vision, Inc. over one year ago in consideration for its work

with Eco Allies, Inc. Stereo Vision, Inc. EmergingGrowth.com may or

may not receive additional compensation, details about which can be

found in our full disclosure, which

can be found here, https://emerginggrowth.com/7876682-7/.

You can easily lose money investing in highly

speculative small cap stocks like the ones mentioned within. Please

consult an investment professional before investing in anything

viewed within. When EmergingGrowth.com is long shares it will sell

those shares. In addition, please make sure you read and understand

the Terms of Use, Privacy Policy and the Disclosure posted on the

EmergingGrowth.com website.

CONTACT:

Company:

EmergingGrowth.com - http://www.EmergingGrowth.com

Contact

Email: info@EmergingGrowth.com

SOURCE:

EmergingGrowth.com

Stereo Vision Entertainm... (CE) (USOTC:SVSN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Stereo Vision Entertainm... (CE) (USOTC:SVSN)

Historical Stock Chart

From Dec 2023 to Dec 2024