StereoVision

(SVSN) Filing $50 Million NYSE Listed Cannabis Focused

REIT

Miami, FL -- March 2, 2018 --

InvestorsHub NewsWire -- EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on StereoVision Entertainment, Inc. (OTC

Pink: SVSN).

See the full article at http://www.EmergingGrowth.com

StereoVision Entertainment, Inc.

(OTC

Pink: SVSN) just announced that it has retained Dieterich and

Associates to file a $50 million REIT (Real Estate Investment

Trust) with the SEC for listing on the NYSE (New York Stock Exchange) to purchase

irrigated farm land for long term favored nation leases to their

majority owned subsidiary CannaVision for their organic hemp

farming plan.

SVSN may

not be at these levels much longer.

See the Press Release and more on StereoVision (OTC Pink: SVSN) at EmergingGrowth.com

http://emerginggrowth.com/?s=svsn

StereoVision Entertainment, Inc.

(OTC

Pink: SVSN) formed a Florida C corporation OrganaCanna Property

Management (OPM) to

purchase irrigated farm land for long term favored nation leases

for our majority owned subsidiary CannaVision’s organic hemp

farming plan, and to generate management fees for the

Company.

Through the REIT, the Las Vegas based company will receive equity

in the REIT and management fees and purchase irrigated farm land

for long term favored nation leases to its majority owned

subsidiary, CannaVision. Stereovision, Inc. (OTC Pink: SVSN) has a

70% stake in CannaVision, which has a fully funded SEC S-1

registration statement being filed with the SEC.

CannaVision has an innovative organic hemp farming model. Leasing

land through the $50 million REIT, instead of buying it upfront in

the real estate market, will enable CannaVision to exponentially

expand its acreage overnight without having to compromise its cash

position or raise capital through debt and other dilutive equity

financing strategies.

The REIT, which has

already aroused sharp interest from Wall Street investors keen on

venturing into the legal cannabis space, will allow CannaVision to

rapidly expand its footprint. This expansion, which will be

explored in greater detail further in the article, will translate

into growth for SVSN since it is a majority shareholder. This could

unlock tremendous value in SVSN’s stock, which could

be considered to be grossly undervalued.

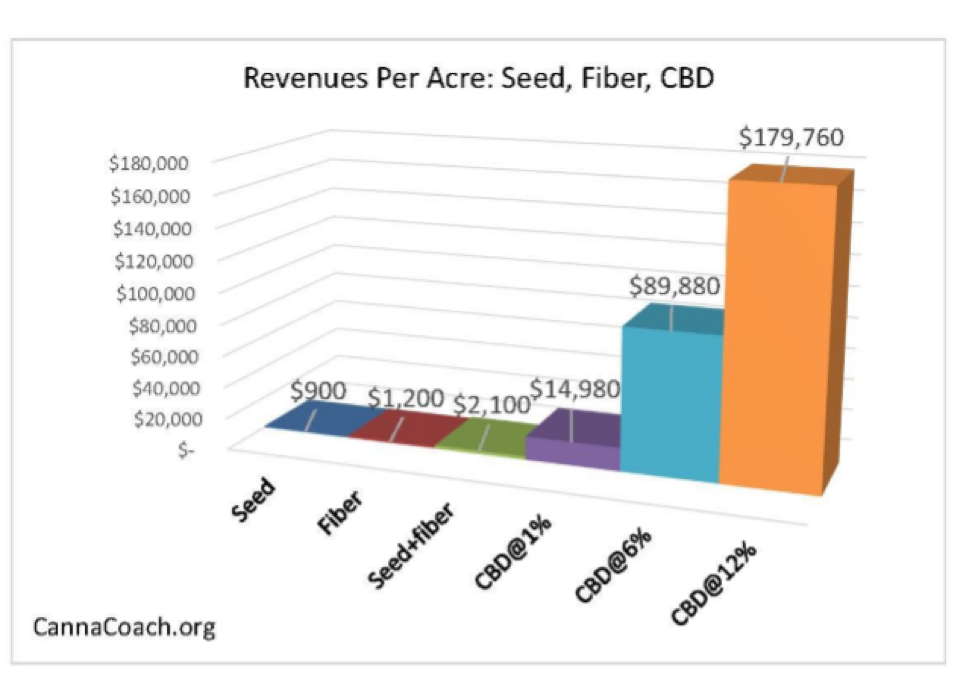

Among the many products

from hemp, CBD can generate as much as $180,000 (CAD)/$140,000

(USD) per acre. This is according to research based on the Canadian

market, which is more readily available due to the fact that the

country has more progressive cannabis laws than the U.S. The chart

below gives a detailed breakdown of the expected revenue from just

one acre of industrial hemp.

Evidently, acreage is the Holy Grail in hemp cultivation—revenues

are a direct function of how many acres you grow. However,

expanding acreage is easier said than done. Farmland is

increasingly expensive in the U.S., with prices having increased

consistently since the early 90s and even defying the 2008

financial crisis. This is according to analysis by The Motley Fool

cited on USA TODAY.

The high cost of farmland

presents a challenge to the vast majority of hemp cultivators as

legal cannabis is still a development stage industry and the vast

majority of companies in the space are currently not generating

sufficient revenues or cash flows to purchase irrigated farm

land.

U.S. farmland prices have increased consistently since

early 90s

Moreover, despite sustained hype over progressive cannabis

legislation in the U.S., most cannabis players are still operating

legally ambiguous businesses as far as Federal Law is concerned.

This introduces insurmountable challenges while seeking capital

from Wall Street, commercial banks and other mainstream financial

institutions.

As a result, some of the

most hotly traded stocks in the space, such as Terra Tech Corp

(OTCQX: TRTC), routinely dilute common

stockholders through toxic debt in order to raise short-term

capital. In our last analysis of the stock earlier in the year, we

presented a blow-by-blow analysis of how

the company has diluted stockholders through the years by

increasing shares outstanding from 76.89 million in 2012 to 903.17

million as at December 11th 2017. TRTC has dropped

30% since our analysis.

Unlike its peers, SVSN has

found a way to get the smart money into legal cannabis through an

NYSE-listed REIT. As earlier stated, the REIT will allow its

subsidiary—CannaVision—to gain inexpensive access to thousands of

acres of irrigated farmland for hemp cultivation without resorting

to shareholder-unfriendly financial acrobatics that peers such as

TRTC have grown accustomed to.

Only one company so far—Pacific Century Holdings—has successfully launched a cannabis

focused REIT, demonstrating the difficulty of accessing

cannabis funding on major exchanges while at the same time

underlining the rare expertise of managers such as CannaVision’s

Previch.

“We are the second company

to do so, but the first one in so far as our REIT will exclusively

benefit our majority owned subsidiary,” said

Honour.

The average price of U.S.

farmland is currently around $2,728, according to the

aforementioned analysis by The Motley Fool.

Through the $50 million REIT, CannaVision will ultimately be able

to access up to 18,328 acres. This translates into an opportunity

to rake in revenues of $2.6 billion in the long-term. This is not a

typo, but a calculation based on the average revenue per acre of

hemp of at least $140,000.

Read the full article on

EmergingGrowth.com

http://emerginggrowth.com/?s=svsn

When investors look at the amazing success story of GW

Pharmaceuticals (NASDAQ: GPWH), they often get mesmerized by the

five year stock chart and forget that successful companies are not

built by traders but talented executives who can execute on

strategy. The company has had the same CEO—Justin Gover—since

January 1999, shortly after

it was founded.

CannaVision has the same

dedication from its team, who are committed to drive the company’s

vision into the long-term. Through its parent company, it will be

able to access farmland without putting itself in financial

jeopardy, a feat that very few cannabis players have achieved. It

also has an incredible business case and could witness exponential

growth in revenue in coming years, leading to a potential big

ticket acquisition.

SVSN, which has a 70%

stake in CannaVision, again, could be considered grossly

undervalued in light of its current market cap of around $12.4

million versus CannaVision’s potential to rake in revenues of $20

million in the first year of operation without stock dilution, debt

financing costs and land acquisition costs. CannaVision’s potential

to become a billion-dollar company by revenue through the REIT can

also not be downplayed.

Once the REIT draws much

deserved attention to SVSN, which has other highly successful media

and production subsidiaries, the upside could be tremendous. The

stock is a value play!

Other Companies in the news and featured on

EmergingGrowth.com

Vet Online Supply, Inc.

Shares of Vet Online Supply, Inc. (OTC

Pink: VTNL) soared 275% on Wednesday and an additional 150%

yesterday before giving back half at the close. This was the

reaction to exceeding sales, which the company released on

Wednesday. It was a great two day run, however candlesticks

are bearish, and we are looking for a down open.

Have a look at Stereovision Entertainment, Inc. who just filed a

$50 million cannabis focused REIT (Real Estate Investment Trust)

with the NYSE (New York Stock Exchange).

PotNetwork Holding, Inc.

PotNetwork Holding, Inc. (OTC

Pink: POTN), which was the subject of another

EmergingGrowth.com article on February 6, 2018, just yesterday

announced that it generated over $3 million in sales over the first

45 days in 2018. Despite, shares continue to slide from its

high of .95, closing yesterday at less than half that value.

The Bollinger bands are tightening up, however as the candlesticks

continue to close below its SMA, we expect the slide to

continue.

WMIH

Corp.

WMIH Corp. (NASDAQ:

WMIH) Shares have stayed consistently above $1.00 per share

since its February 13th merger announcement, which

sparked its PR detailing its compliance with NASDAQ’s Minimum bid

price listing requirement.

We are wondering if this space has room for StereoVision, Inc.

(OTC

Pink: SVSN) with the filing of its $50 Million NYSE Listed

Cannabis Focused REIT

About

EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a

niche in identifying companies that can be overlooked by the

markets due to, among other reasons, trading price or market

capitalization. We look for strong management, innovation,

strategy, execution, and the overall potential for long- term

growth. Aside from being a trusted resource for the Emerging

Growth info-seekers, we are well known for discovering undervalued

companies and bringing them to the attention of the investment

community. Through our parent Company, we also have the

ability to facilitate road shows to present your products and

services to the most influential investment banks in the

space.

Disclosure:

All information contained herein as well as on the EmergingGrowth.com website is

obtained from sources believed to be reliable but not guaranteed to

be accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should

not be construed as an offer or solicitation to buy or sell

securities. The information may include certain forward-looking

statements, which may be affected by unforeseen circumstances and /

or certain risks. This report is not without bias.

EmergingGrowth.com has motivation by means of either self-marketing

or EmergingGrowth.com has been compensated by or for a company or

companies discussed in this article. Full details about which can

be found in our full disclosure, which can be found

here, http://www.emerginggrowth.com/7876682-7/. Please

consult an investment professional before investing in anything

viewed within. When EmergingGrowth.com is long shares it will sell

those shares. In addition, please make sure you read and understand

the Terms of Use, Privacy Policy and the Disclosure posted on the

EmergingGrowth.com website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact

Email: info@EmergingGrowth.com

SOURCE: EmergingGrowth.com

Stereo Vision Entertainm... (CE) (USOTC:SVSN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Stereo Vision Entertainm... (CE) (USOTC:SVSN)

Historical Stock Chart

From Dec 2023 to Dec 2024