false

0001426506

0001426506

2024-03-08

2024-03-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 8, 2024

SMG INDUSTRIES INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

000-54391 |

|

51-0662991 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 20475 State Hwy 249, Suite 450 |

|

|

| Houston, Texas |

|

77070 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code:

(713-955-3497)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Ticker symbol(s) |

|

Name of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On March

8, 2024, SMG Industries Inc. (the “Company”) issued a press release announcing its intent to voluntarily terminate the registration

of its common stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). A copy of the press release

is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The

information contained in this Item 7.01 and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18

of the Exchange Act, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any filings

made by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as may

be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On or

about March 15, 2024, the Company intends to file a Form 15 with the Securities and Exchange Commission (the “SEC”)

to voluntarily effect the deregistration of its common stock. The Company is eligible to deregister by filing Form 15 because

it has fewer than 300 holders of record of its common stock. Upon the filing of the Form 15, the Company’s obligation

to file certain reports with the SEC, including Forms 10-K, 10-Q and 8-K, will immediately be suspended. The Company expects the deregistration

to become effective 90 days after filing the Form 15 with the SEC.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits.

Forward-Looking

Statements

The statements contained

in this Current Report on Form 8-K that are not historical fact are forward-looking statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995), within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act.

Forward-looking statements may be identified by the use of forward-looking terminology such as “should,” “could,”

“may,” “will,” “expect,” “believe,” “estimate,” “anticipate,”

“intends,” “continue,” or similar terms or variations of those terms or the negative of those terms. All forward-looking

statements are the Company’s present expectations of future events and are subject to a number of risks and uncertainties that could

cause actual results to differ materially from those described in the forward-looking statements. These statements appear in a number

of places in this news release and include statements regarding the intent, belief or current expectations of SMG Industries Inc. Forward-looking

statements are merely management’s current predictions of future events. Investors are cautioned that any such forward-looking statements

are inherently uncertain, are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially

from the Company’s predictions. There are a number of factors that could negatively affect the Company’s business and the

value of its securities, including, but not limited to, fluctuations in the market price of its common stock; changes in its plans, strategies

and intentions; changes in market valuations associated with its cash flows and operating results; the impact of significant acquisitions,

dispositions and other similar transactions, including the acquisition of the Barnhart Transportation family of companies; the Company’s

ability to attract and retain key employees; changes in financial estimates or recommendations by securities analysts; asset impairments;

decreased liquidity in the capital markets; and changes in interest rates. Such factors could materially affect the Company’s future

operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the

Company. Although the Company has sought to identify the most significant risks to its business, it cannot predict whether, or to what

extent, any of such risks may be realized, nor is there any assurance that it has identified all possible issues that it might face.

In light of these assumptions,

risks and uncertainties, the results and events discussed in the forward-looking statements contained in this Current Report on Form 8-K

might not occur. Stockholders are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the

date of this Current Report on Form 8-K. The Company is not under any obligation, and it expressly disclaims any obligation, to update

or alter any forward-looking statements, whether as a result of new information, future events or otherwise except as may be required

by applicable law. All subsequent forward-looking statements attributable to the Company or to any person acting on its behalf are expressly

qualified in their entirety by the cautionary statements contained or referred to in this section. The Company urges readers to carefully

review and consider the various disclosures it makes in this Current Report on Form 8-K and its reports filed with the SEC that attempt

to advise interested parties of the risks, uncertainties and other factors that may affect its business, including the risk factors included

under Part I, Item 1A. “Risk Factors” in its Annual Report on Form 10-K filed with the SEC on April 17, 2023 and under Part

II, Item 1A. “Risk Factors” in its subsequent Quarterly Reports on Form 10-Q filed with the SEC.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Dated: March 8, 2024 |

SMG Industries Inc. |

| |

|

|

| |

By: |

/s/ Bryan S. Barnhart |

| |

Name: |

Bryan S. Barnhart |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

SMG Industries Inc. Announces Voluntary SEC

Deregistration

HOUSTON, TX, March 8, 2024 (GLOBE NEWSWIRE) –

via NewMediaWire – SMG Industries Inc. (“SMG” or the “Company”) (OTCQB: SMGI), a growth-oriented

transportation services company specializing in the full-service logistics market, today announced its strategic decision to voluntarily

deregister its common stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

SMG’s management believes that “going

dark” is a prudent step aligned with the Company’s short -term planning and long term vision. By eliminating the Company’s

Exchange Act reporting obligations, SMG aims to streamline its financial operations, reporting obligations, reducing administrative costs,

and allowing the business to focus on core business activities. The Company believes this decision will allow the back office to operate

more efficiently and allocate resources more effectively. With a more streamlined cost profile, SMG’s management will be better

able to invest in its business and mitigate excessive costs around public reporting requirements, thus providing a future benefit to the

Company’s stockholders.

On or about March 15,

2024, the Company intends to file a Form 15 with the Securities and Exchange Commission (the “SEC”) to voluntarily

effect the deregistration of its common stock. The Company is eligible to deregister by filing a Form 15 because it has

fewer than 300 holders of record of its common stock. Upon the filing of the Form 15, the Company’s obligation to file

certain reports with the SEC, including Forms 10-K, 10-Q and 8-K, will immediately be suspended. The Company expects the deregistration

to become effective 90 days after filing the Form 15 with the SEC.

“We remain committed to delivering value

to our stockholders. Going dark allows us to focus on the operations of the business and reduce costs by an estimated $1,000,000 per year.

Currently, we do not believe we are receiving meaningful benefit of being a public reporting company. We appreciate the continuing support

of our stockholders and look forward to achieving our long term vision including this short term plan,” stated Tim Barnhart, CFO.

As a result of this decision, the Company’s

common stock will be moved from the OTCQB to the Expert Market of the OTC Markets Group. The board of directors of SMG considered the

fact that the Company’s common stock would become more illiquid as a result of this decision and that stockholders may experience

difficulties in selling their shares of common stock. The decision to proceed, however, took into consideration the current as well as

potential future costs of remaining a reporting company versus the benefits to the longer-term health and future of the Company.

About SMG Industries Inc.

SMG Industries Inc. is a growth-oriented transportation

services company specializing in the full-service logistics market. As a family of transportation companies, SMG Industries offers comprehensive

logistics solutions, serving as a single service provider for shipments of all sizes, both domestically and internationally. Read more

about SMG Industries and our operating companies at www.SMGIndustries.com.

Forward-Looking

Statements

The statements contained

in this news release that are not historical fact are forward-looking statements (as such term is defined in the Private Securities Litigation

Reform Act of 1995), within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended. Forward-looking statements may be identified by the use of forward-looking terminology such as “should,”

“could,” “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,”

“intends,” “continue,” or similar terms or variations of those terms or the negative of those terms. All forward-looking

statements are the Company’s present expectations of future events and are subject to a number of risks and uncertainties that could

cause actual results to differ materially from those described in the forward-looking statements. These statements appear in a number

of places in this news release and include statements regarding the intent, belief or current expectations of SMG Industries Inc. Forward-looking

statements are merely management’s current predictions of future events. Investors are cautioned that any such forward-looking statements

are inherently uncertain, are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially

from the Company’s predictions. There are a number of factors that could negatively affect the Company’s business and the

value of its securities, including, but not limited to, fluctuations in the market price of its common stock; changes in its plans, strategies

and intentions; changes in market valuations associated with its cash flows and operating results; the impact of significant acquisitions,

dispositions and other similar transactions, including the acquisition of the Barnhart Transportation family of companies; the Company’s

ability to attract and retain key employees; changes in financial estimates or recommendations by securities analysts; asset impairments;

decreased liquidity in the capital markets, including as a result of the decision to go dark; and changes in interest rates. Such factors

could materially affect the Company’s future operating results and could cause actual events to differ materially from those described

in forward-looking statements relating to the Company. Although the Company has sought to identify the most significant risks to its business,

it cannot predict whether, or to what extent, any of such risks may be realized, nor is there any assurance that it has identified all

possible issues that it might face.

In light of these assumptions,

risks and uncertainties, the results and events discussed in the forward-looking statements contained in this news release might not occur.

Stockholders are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this news

release. The Company is not under any obligation, and it expressly disclaims any obligation, to update or alter any forward-looking statements,

whether as a result of new information, future events or otherwise except as may be required by applicable law. All subsequent forward-looking

statements attributable to the Company or to any person acting on its behalf are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section. The Company urges readers to carefully review and consider the various disclosures

it makes in this news release and its reports filed with the SEC that attempt to advise interested parties of the risks, uncertainties

and other factors that may affect its business, including the risk factors included under Part I, Item 1A. “Risk Factors”

in its Annual Report on Form 10-K filed with the SEC on April 17, 2023 and under Part II, Item 1A. “Risk Factors” in its subsequent

Quarterly Reports on Form 10-Q filed with the SEC.

SOURCE: SMG Industries Inc.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

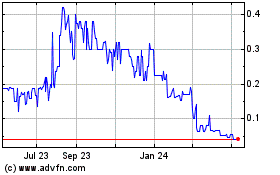

SMG Industries (CE) (USOTC:SMGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

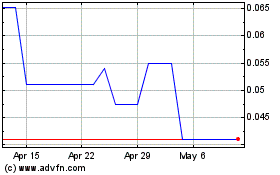

SMG Industries (CE) (USOTC:SMGI)

Historical Stock Chart

From Nov 2023 to Nov 2024