UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14C

INFORMATION

Information

Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment

No. ___)

Check

the appropriate box:

| ☒ |

Preliminary

Information Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14A-6(e)(2)) |

| |

|

| ☐ |

Definitive

Information Statement |

| SmartMetric,

Inc. |

| (Name of

Registrant as Specified In Its Charter) |

Copies

of communications to:

Lance

Brunson, Esq.

Brunson,

Chandler & Jones, PLLC

Walker

Center, 14th Floor

175

S. Main Street, Suite 1410

Salt

Lake City, UT 84111

Telephone:

(801) 303-5737

| Payment of Filing Fee (Check

the appropriate box): |

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee computed

on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

|

| |

1) |

Title of each class of

securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities

to which transaction applies: |

| |

|

|

| |

3) |

Per unit price or other

underlying value of transaction computed pursuant to Exchange Act 0-11 (set forth the amount on which the filing fee is calculated

and state how it was determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate

value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| ☐ |

Fee paid previously

with preliminary materials. |

| |

|

| ☐ |

Check box if

any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration

Statement No.: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

SMARTMETRIC,

INC.

3960

Howard Hughes Parkway, Suite 500

Las

Vegas, NV 89109

| To: |

The Holders of the Common

Stock of SmartMetric, Inc. |

| |

Re: |

Action

by Written Consent in Lieu of a Special Meeting of Shareholders |

This

Information Statement is furnished by the Board of Directors of SmartMetric, Inc., a Nevada corporation (the “Company”),

to holders of record of the Company’s common stock, $0.001 par value per share, at the close of business on March 3, 2023.

The purpose of this Information Statement is to inform the Company’s shareholders of an action taken by the written consent of

the holders of a majority of the Company’s voting stock, dated as of February 15, 2023, in lieu of a special meeting of shareholders,

to wit:

The

approval of an amendment to the Company’s Articles of Incorporation, as amended, to increase the authorized number of shares of

common stock of the Company from 2,400,000,000 shares to 5,000,000,000 shares, which amendment will be filed no sooner than the 20th

day after the definitive information statement is mailed to the shareholders of the Company who have not previously consented to the

change in corporate name and increase in authorized shares of common stock.

The

foregoing actions were approved on February 13, 2023, by the Company’s Board of Directors. In addition, on

February 15, 2023, the holders of approximately 52.7% of the Company’s outstanding voting securities (the

“Consenting Shareholders”) approved the foregoing action. The number of shares voting for the increase in authorized

common stock was sufficient for approval.

Section 78.320

of the Nevada Revised Statutes provides, in part, that any action required or permitted to be taken at a meeting of the shareholders

may be taken without a meeting if, before or after the action, a written consent thereto is signed by shareholders holding at least a

majority of the voting power, except that if a different proportion of voting power is required for such an action at a meeting, then

that proportion of written consents is required.

In

order to eliminate the costs and management time involved in obtaining proxies and, in order to effect the above action as early as possible

in order to accomplish the purposes of the Company as herein described, the Board of Directors consented to the utilization of, and did

in fact obtain, the written consent of the Consenting Shareholders who, collectively, own shares representing a majority of the Company’s

voting stock.

The

above action taken by the Company’s shareholders will become effective on or about ______, 2023, and is more fully described in

the Information Statement accompanying this Notice. Under the rules of the Securities and Exchange Commission, the above action cannot

become effective until at least 20 days after the accompanying Information Statement has been distributed to the shareholders of the

Company who have not previously consented to the corporate name change and the expansion of authorized shares of capital stock.

The

entire cost of furnishing this Information Statement will be borne by the Company. The Company may request brokerage houses, nominees,

custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Company’s

common stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

WE

ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No

action is required by you. The accompanying Information Statement is furnished only to inform the Company’s shareholders of the

action described above before it takes place, in accordance with Rule 14c-2 of the Securities Exchange Act of 1934. This Information

Statement will be first distributed to you on or about __________, 2023.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Chaya

Hendrick |

| |

Chaya Hendrick |

| |

Chairman |

[

* ], 2023

Las

Vegas, Nevada

SMARTMETRIC,

INC.

WE

ARE NOT ASKING YOU FOR A PROXY,

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

INFORMATION

STATEMENT

INFORMATION

STATEMENT PURSUANT TO SECTION 14C OF THE SECURITIES EXCHANGE ACT OF 1934.

THIS

IS NOT A NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS AND NO SHAREHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT HAVE BEEN APPROVED BY HOLDERS OF A MAJORITY OF THE COMPANY’S COMMON STOCK.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THERE ARE NO DISSENTERS’ RIGHTS WITH RESPECT TO

THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT.

INTRODUCTION

This

Information Statement is being mailed or otherwise furnished to the holders of common stock, $0.001 par value per share (the “Common

Stock”) of SmartMetric, Inc., a Nevada corporation (the “Company”), by the Board of Directors to notify them about

certain actions that the holders of a majority of the Company’s outstanding voting stock have taken by written consent in lieu

of a special meeting of the shareholders. The shareholder action was taken on February 15, 2023. Copies of this Information Statement

are first being sent on or about ________, 2023, to the holders of record on March 3, 2023, of the outstanding shares of the Company’s

common stock.

General

Information

Shareholders

of the Company owning a majority of the Company’s outstanding voting securities have approved the following actions by written

consent dated February 15, 2023, in lieu of a meeting of the shareholders:

| ● | The

approval of an amendment (the “Amendment”) to the Company’s Articles of

Incorporation, as amended, to increase the authorized number of shares of common stock of

the Company from 2,400,000,000 shares to 5,000,000,000 shares, which amendment will be filed

no sooner than the 20th day after the definitive information statement is mailed to the shareholders

of the Company who have not previously consented to the change in corporate name and increase

in authorized shares of common stock. |

The

Company may ask brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners

of the common stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding

such material.

Dissenters’

Right of Appraisal

No

dissenters’ or appraisal rights under the Nevada Revised Statutes are afforded to the Company’s shareholders as a result

of the approval of the Amendment, as set forth above.

Vote

Required

The

vote, which was required to approve the Amendment, was the affirmative vote of the holders of a majority of the Company’s voting

stock. Each holder of Company common stock is entitled to one (1) vote for each share of common stock held. The date used for purposes

of determining the number of outstanding shares of voting stock of the Company entitled to vote is February 15, 2023. The record

date for determining those shareholders of the Company entitled to receive this Information Statement is the close of business on March 3,

2023 (the “Record Date”). As of February 15, 2023, the Company had outstanding 1,643,695,878 shares of common

stock. Holders of the Company’s common stock have no pre-emptive rights. All outstanding shares are fully paid and non-assessable.

The transfer agent for the Company’s common stock is Worldwide Stock Transfer, LLC, One University Plaza, Suite 505, Hackensack,

New Jersey, 07601.

Vote

Obtained – Section 78.320 of the Nevada Revised Statutes

Section 78.320

of the Nevada Revised Statutes provides that any action required to be taken at any annual or special meeting of shareholders of a corporation,

or any action which may be taken at any annual or special meeting of such shareholders, may be taken without a meeting, without prior

notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of

outstanding stock, having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting

at which all shares entitled to vote thereon were present and voted.

To

eliminate the costs and management time involved in soliciting and obtaining proxies to approve the Amendment and to effectuate the Amendment

as early as possible to accomplish the purposes of the Company as hereafter described, the Board of Directors of the Company voted to

utilize and did, in fact, obtain, the written consent of the holders of a majority of the voting power of the Company.

This

Information Statement is being distributed pursuant to the requirements of Section 14(c) of the Securities Exchange Act of 1934

(the “Exchange Act”) to the Company’s shareholders on the Record Date. The corporate actions described herein will

be effective approximately 20 days (the “20-day Period”) after the distributing of this Information Statement. The 20-day

Period is expected to conclude on or about ___________, 2023.

The

entire cost of furnishing this Information Statement will be borne by the Company.

PRINCIPAL

SHAREHOLDERS

At

February 15, 2023, the Company had 1,643,695,878 shares of common stock issued and outstanding. The following table sets forth information

known to the Company as of February 15, 2023, relating to the beneficial ownership of shares of its voting securities by: each person

who is known by us to be the beneficial owner of more than 5% of our outstanding voting stock; each director; each named executive officer;

and all named executive officers and directors as a group.

Unless

otherwise indicated, the business address of each person listed is in care of SmartMetric, Inc., 3960 Howard Hughes Parkway, Suite 500,

Las Vegas, Nevada, 89109. The percentages in the table have been calculated on the basis of treating as outstanding for a particular

person, all shares of our common stock outstanding on that date and all shares of our common stock issuable to that holder in the event

of exercise of outstanding options, warrants, rights or conversion privileges owned by that person at that date which are exercisable

within 60 days of that date. Except as otherwise indicated, the persons listed below have sole voting and investment power with respect

to all shares of our common stock owned by them, except to the extent that power may be shared with a spouse.

Amount

and Nature of Beneficial Ownership

| Title of Class | |

Name and Address of Beneficial Owner | |

Director/Officer | |

Number of

Shares of

Common

Stock (1) | | |

Percentage

of Class (1) | |

| | |

| |

| |

| | | |

| | |

| | |

Directors and Executive Officers | |

| |

| | | |

| | |

| | |

| |

| |

| | | |

| | |

| Common Stock | |

Chaya Hendrick

| |

Chief Executive Officer,

Chairman of the Board of Directors | |

| 89,127,778 | (2) | |

| 5.3 | % |

| | |

| |

| |

| | | |

| | |

| Common Stock | |

Jay Needelman,

CPA 520

West 47th Street Miami

Beach, FL 33140 | |

Director; Chief Financial Officer | |

| -0- | | |

| 0 | % |

| | |

| |

| |

| | | |

| | |

| Common Stock | |

Elizabeth Ryba

73 Brown Road

Scarsdale, New York 10583 | |

Director | |

| 40,000 | | |

| * | % |

| | |

| |

| |

| | | |

| | |

| | |

All Executive Officers and Directors as a Group | |

| |

| 89,167,778 | | |

| 5.3 | % |

| | |

| |

| |

| | | |

| | |

| Series B Convertible Preferred Stock | |

Chaya Hendrick

| |

Chief Executive Officer,

Chairman of the Board of Directors | |

| 610,000 | (2) | |

| 100 | % |

| | |

| |

| |

| | | |

| | |

| Series B Convertible Preferred Stock | |

All Executive Officers and Directors as a Group | |

| |

| 610,000 | | |

| 100 | % |

| | |

| |

| |

| | | |

| | |

| | |

Other 5% Shareholders | |

| |

| | | |

| | |

| | |

| |

| |

| | | |

| | |

| | |

None | |

| |

| | | |

| | |

| * | Less than one percent (1%) |

| (1) | In determining beneficial ownership

of our common stock as of a given date, the number of shares shown includes shares of common stock which may be acquired on exercise

of warrants or options or conversion of convertible securities within 60 days of that date. In determining the percent of common stock

owned by a person or entity on February 15, 2023, (a) the numerator is the number of shares of the class beneficially owned by such person

or entity, including shares which may be acquired within 60 days on exercise of warrants or options and conversion of convertible securities,

and (b) the denominator is the sum of (i) 1,643,695,878, the total shares of common stock outstanding on February 15, 2023, and (ii)

the total number of shares that the beneficial owner may acquire upon conversion of any preferred stock and on exercise of the warrants

and options. Unless otherwise stated, each beneficial owner has sole power to vote and dispose of its shares. |

| (2) | The 89,127,778 shares of common

stock deemed to be beneficially owned by Chaya Hendrick include (i) 58,627,778 of common stock, and (ii) 610,000 shares of Series B Convertible

Preferred Stock convertible into 30,500,000 shares of common stock, held by Applied Cryptography, Inc. and Applied Cryptography International,

Inc. (49,127,778 shares of common stock held by Applied Cryptography, Inc., and 9,500,000 shares of common stock and 610,000 shares of

Series B Convertible Preferred Stock held by Applied Cryptography International, Inc. The outstanding shares of Series B

Convertible Preferred Stock are entitled to vote on any matter with the holders of common stock voting together as one (1) class and

shall have that number of votes (identical in every other respect to the voting rights of the holder of common stock entitled to vote

at any regular or special meeting of Stockholders) equal to that number of common shares which is not less than 51% of the vote required

to approve any action, which Nevada law provides may or must be approved by vote or consent of the common shares or the holders of other

securities entitled to vote, if any. Each share of Series B Convertible Preferred Stock is convertible, at the option of the holder,

into fifty (50) shares of common stock upon the satisfaction of certain conditions and for purposes of determining a quorum of a shareholder

meeting, the outstanding shares of Series B Convertible Preferred Stock shall be deemed the equivalent of 51% of all shares of the Company’s

common stock entitled to vote at such meetings. Our Chairman and Chief Executive Officer, Chaya Hendrick, has sole voting and dispositive

power over all of the shares held in the name of both Applied Cryptography, Inc. and Applied Cryptography International, Inc., and is

therefore deemed to be the beneficial owner of shares held in the name of those entities. |

ACTION

ONE — INCREASE IN AUTHORIZED COMMON STOCK

The

Company’s Board of Directors and holders of a majority of the voting power of the Company’s common stock have approved an

amendment (the Amendment) to the Company’s Articles of Incorporation to increase the authorized number of shares of common stock

from 2,400,000,000 shares to 5,000,000,000 shares. The form of Certificate of Amendment to be filed with the Secretary of the State of

Nevada is set forth as Appendix A to this Information Statement.

The

Company’s Board of Directors believes that it is in the best interest of the shareholders to adopt the increase in authorized common

stock.

Other

than the corporate name change and the increase in authorized common stock, the Amendment does not incorporate any other material changes.

Vote

Required

Pursuant

to the Nevada Revised Statutes, the Amendment to effect the increase in the authorized number of shares of the Company’s common

stock required the approval of a majority of the Company’s outstanding voting stock. As discussed above, holders of a majority

of the Company’s common stock have consented to the authorized share increase.

Purpose

of the Increase in Capital Shares

The

Board of Directors believes the authorized share increase is necessary and advisable in order to maintain the Company’s financing

and capital-raising ability. The Company’s authorized common stock would need to be increased to increase the number of shares

of Company common stock available for issuance to investors who provide the Company with funding required to continue operations, and/or

to persons in connection with potential acquisition transactions, warrant or option exercises and other transactions which our Board

of Directors may determine are in the best interests of the Company.

The

increase in authorized common stock will not have any immediate effect on the rights of existing stockholders, but it would have a dilutive

effect on our existing stockholders when the additional shares are issued. This increase in the authorized number of shares of common

stock and the subsequent issuance of such shares could have the effect of delaying or preventing a change in control of the Company without

further action by the Company’s stockholders. Shares of authorized and unissued common stock could (within the limits imposed by

applicable law and stock exchange regulations) be issued in one or more transactions which would make a change in control of the Company

more difficult, and therefore less likely. Management use of additional shares to resist or frustrate a third-party transaction favored

by a majority of the independent stockholders would likely result in an above-market premium being paid in that transaction. Any such

issuance of the additional shares of common stock would likely have the effect of diluting the earnings per share and book value per

share of outstanding shares of Company common stock, and such additional shares could be used to dilute the stock ownership or voting

rights of a person seeking to obtain control of the Company.

The

Board of Directors is not aware of any attempt to take control of the Company and has not presented this proposal with the intention

that the authorized share increase be used as a type of antitakeover device. Any additional authorized shares of common stock, when issued,

would have the same rights and preferences as the shares of common stock presently outstanding. Additional shares of common stock so

authorized will be available for issuance by the Board to honor for stock splits or stock dividends, acquisitions, raising additional

capital, conversion of Company debt into equity, stock options, or other corporate purposes. The Company has no other plans for the use

of any additional shares of authorized common stock. The Company does not anticipate that it would seek authorization from the stockholders

for issuance of any additional authorized shares unless required by applicable law or regulations.

The

Company’s increase in authorized common stock will become effective upon the filing of the Amendment with the Nevada Secretary

of State. Information with respect to the filing of the Amendment and the increase in authorized common stock will be included in a Current

Report on Form 8-K to be filed with the Securities and Exchange Commission.

ADDITIONAL

INFORMATION

We

are subject to the disclosure requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith, file reports,

information statements and other information, including annual and quarterly reports on Form 10-K and 10-Q, respectively, with the

Securities and Exchange Commission (the “SEC”). Reports and other information filed by the Company can be inspected

and copied at the public reference facilities maintained by the SEC at Room 1024, 50 Fifth Street, N.W., Washington, DC 20549. Copies

of such material can also be obtained upon written request addressed to the SEC, Public Reference Section, 450 Fifth Street, N.W., Washington,

D.C. 20549 at prescribed rates. In addition, the SEC maintains a web site on the Internet (http://www.sec.gov) that contains reports,

information statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering,

Analysis and Retrieval System.

The

following documents, as filed with the SEC by the Company, are incorporated herein by reference:

| (1) | Annual

Report on Form 10-K/A for the fiscal year ended June 30, 2022; |

| (2) | Annual

Report on Form 10-K/A for the fiscal year ended June 30, 2021; and |

| (3) | Quarterly

Report on Form 10-Q for the quarter ended September 30, 2022. |

You

may request a copy of these filings, at no cost, by writing Corporate Secretary, SmartMetric, Inc., 3960 Howard Hughes Parkway, Suite

500, Las Vegas, Nevada, 89109, or telephoning the Company at (702) 990-3687. Any statement contained in a document that is incorporated

by reference will be modified or superseded for all purposes to the extent that a statement contained in this Information Statement (or

in any other document that is subsequently filed with the SEC and incorporated by reference) modifies or is contrary to such previous

statement. Any statement so modified or superseded will not be deemed a part of this Information Statement except as so modified or superseded.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If

hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders

who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,”

is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate

copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered.

You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and

(iii) the address to which the Company should direct the additional copy of the Information Statement, to the Company at Corporate Secretary,

SmartMetric, Inc., 3960 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada, 89109, or telephoning the Company at (702) 990-3687.

If

multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would

prefer the Company to mail each stockholder a separate copy of future mailings, you may mail notification to, or call the Company at,

its principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information

Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared

address, notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

This

Information Statement is provided to the holders of common stock of the Company only for information purposes in connection with the

actions described herein, pursuant to and in accordance with Rule 14c-2 of the Exchange Act. Please carefully read this Information

Statement.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Chaya

Hendrick |

| |

Chaya Hendrick |

| |

Chairman |

[

* ], 2023

Las

Vegas, Nevada

Appendix

A

CERTIFICATE

OF AMENDMENT TO ARTICLES OF INCORPORATION

FOR

NEVADA PROFIT CORPORATIONS

(Pursuant

to NRS 78.385 and 78.390 - After Issuance of Stock)

Name

of entity as on file with the Nevada Secretary of State:

SmartMetric,

Inc.

Entity

or Nevada Business Identification Number (NVID): _____________________

| 2. | Restated

or Amended and Restated Articles: |

☐ Certificate

to Accompany Restated Articles or Amended and Restated Articles

☐ Restated

Articles - No amendments; articles are restated only and are signed by an officer of the corporation who has been authorized to execute

the certificate by resolution of the board of directors adopted on: _______

The

certificate correctly sets forth the text of the articles or certificate as amended to the date of the certificate.

☐ Amended

and Restated Articles

| * | Restated

or Amended and Restated Articles must be included with this filing type. |

| 3. | Type

of Amendment Filing Being Completed: |

☐ Certificate

of Amendment to Articles of Incorporation (Pursuant to NRS 78.380 - Before Issuance of Stock)

The

undersigned declare that they constitute at least two-thirds of the following:

(Check

only one box) ☐ incorporators ☐ Board of Directors

The

undersigned affirmatively declare that to the date of this certificate, no stock of the corporation has been issued

☒ Certificate

of Amendment to Articles of Incorporation (Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock)

The

vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power,

or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by

the provisions of the articles of incorporation* have voted in favor of the amendment is: 53.55%

☐ Officer’s

Statement (foreign qualified entities only) -

Name

of home state, if using a modified name in Nevada: ___________________

Jurisdiction

of formation: ___________________

Changes

to takes the following effect:

| |

☐ |

The entity name has been amended. |

|

☐ |

Dissolution |

| |

☐ |

The purpose of the entity has been amended. |

|

☐ |

Merger |

| |

☐ |

The authorized shares have been amended. |

|

☐ |

Conversion |

| |

☐ |

Other: (specify changes) |

|

|

| * | Officer’s

Statement must be submitted with either a certified copy of or a certificate evidencing the filing of any document, amendatory or otherwise,

relating to the original articles in the place of the corporation’s creation. |

| 4. |

Effective Date and Time: (optional) |

|

Date: |

|

|

Time: |

|

|

| |

|

|

(must

not be later than 90 days after the certificate is filed) |

| 5. | Information

Being Changed: (Domestic corporations only) |

| |

☐ |

The entity name has

been amended. |

| |

☐ |

The registered agent

has been changed. (attach Certificate of Acceptance from new registered agent) |

| |

☐ |

The purpose of the entity

has been amended. |

| |

☒ |

The authorized shares

have been amended. |

| |

☐ |

The directors, managers

or general partners have been amended. |

| |

☐ |

IRS tax language has

been added. |

| |

☐ |

Articles have been added. |

| |

☐ |

Articles have been deleted. |

| |

☐ |

Other. |

The

articles have been amended as follows: (provide article numbers, if available)

Article

III

The

total authorized capital stock of the Corporation shall be 5,005,000,000 shares, consisting of (a) 5,000,000,000 shares of Common Stock,

par value $0.001 per share (the “Common Stock”), and (b) 5,000,000 shares of preferred stock, par value $0.001 per share

(the “Preferred Stock”).

A

statement of the preferences, privileges, and restrictions granted to or imposed upon the respective classes of shares or the holders

thereof is as follows:

| A. | Preferred

Stock. The Preferred Stock, or any series thereof, shall have such designations, preferences

and relative, participating, optional or other special rights and qualifications, limitations

or restrictions thereof as shall be expressed in the resolution or resolutions providing

for the issue of such stock adopted by the Board of Directors and may be made dependent upon

facts ascertainable outside such resolution or resolutions of the Board of Directors, provided

that the matter in which such facts shall operate upon such designations, preferences, rights

and qualifications; limitations or restrictions of such class or series of stock is clearly

and expressly set forth in the resolution or resolutions providing for the issuance of such

stock by the Board of Directors. Prior designations of series of preferred stock, as amended,

shall be expressly retained. |

| B. | Common

Stock. The terms of the Common Stock of the Corporation shall be as follows: |

| (1) | Dividends.

Whenever cash dividends upon the Preferred Stock of all series thereof at the time outstanding,

to the extent of the preference to which such shares are entitled, shall have been paid in

full for all past dividend periods, or declared and set apart for payment, such dividends,

payable in cash, stock. or otherwise, as may be determined by the Board of Directors, may

be declared by the Board of Directors and paid from time to time to the holders of the Common

Stock out of the remaining net profits or surplus of the corporation. |

| (2) | Liquidation.

In the event of any liquidation, dissolution, or winding up of the affairs of the corporation,

whether voluntary or involuntary, all assets and funds of the corporation remaining after

the payment to the holders of the Preferred Stock of all series thereof of the full amounts

to which they shall be entitled as hereinafter provided, shall be divided and distributed

among the holders of the Common Stock according to their respective shares. |

| (3) | Voting

Rights. Each holder of a share of Common Stock shall have one vote in respect of each share

of such stock held by it. There shall not be cumulative voting. |

| 6. | Signature: |

|

|

|

|

| | |

Signature |

|

Title |

|

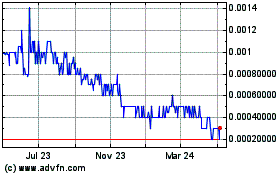

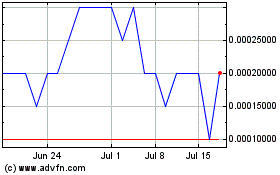

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Oct 2024 to Nov 2024

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Nov 2023 to Nov 2024