SING Is Setting Up For

Long-Term Success and a possible Short Squeeze as the solar

industry looks to rebound from recent declines;

March 24, 2021 -- InvestorsHub NewsWire -- via INS

Digital Media -- SinglePoint specializes in acquisitions of

small to mid-sized solar companies. Currently, operating in 38

states our unique solar model serves residential, commercial, and

structures capital.

SinglePoint acquired Direct Solar America to provide the

most cost effective solar power systems for any needs. Save money,

save energy and receive more predictable energy costs through

Solar. Energy costs can skyrocket at much as 300% during peak

months and hours.

SinglePoint Inc Just Secured $2,000,000 in Accretive

Financing to Drive Additional Acquisition Growth After Already The

Company Already Acquired Three Companies In The Past 18 Months

Which Means They are Keeping True To Their Word As an Acquisition

Based Company.

- The Company Has been building the most comprehensive

national solar network and portfolio of renewable energy solutions

On The OTC to meet rapidly growing demand And

SING is Arguably The Fastest Growing Solar Company On The OTC

Currently In 2021

- Single Point Inc Has Recently Strengthened the Company

Balance sheet Which We Believe will enhance the Company's position

to support additional Acquisitions

SING Recently Raised a NON TOXIC $2,000,000 with the Proceeds of

that financing being used for sales and marketing initiatives of

SING's subsidiaries. Those Newly acquired operations are of

course, Energy

Wyze, a exclusive distributor of an

industrial grade, American-made, high-proficiency energy-efficient

air purification technology Box

PureAir. Solar and CLean Air,

"GHS Investments has been a true partner in looking at the

long-term growth of the Company and working to achieve those goals

through financing. We are pleased to continue our work with them as

we build momentum and propel the Company forward. This is another

step in the right direction for SinglePoint to solidify operations,

improve the balance sheet and continue towards the overall goal of

up-listing to a national exchange," adds Wil Ralston President of

SinglePoint

2021 Is Packed With Bullish Catalysts For

SING

SinglePoint Inc Continues to Demonstrate The Ability To

Follow Its Growth Model with Renewable Energy Solutions and

Energy-Efficient Applications Companies in it Portfolio; The SING

Growth Strategy Aligns with The Potential Impact of the Adoption of

the $1.9 Trillion Stimulus Plan And The Energy Benefits That Were

Included.

SING recently closed a strategic acquisitions with a

solar lead generation company and then followed that Acquisition up

by purchasing a clean air technology company to drive revenue.

Sales are ramping up for AirBox and Orders are being Filled so

revenue numbers will be out in due course.

The American Rescue Plan is the most exciting thing to

happen in solar which directly benefits SING. The Plan passed

providing billions in funding in multiple categories including

renewable energy and clean air filtration systems for schools.

Since airBox is expanding under the leadership of SING, the company

expects that they will see significant reruns on this company

acquisition and that starts with the $50,000,000 in commercial bids

that AirBox currently has submitted.

- Completed acquisition of Energy Wyze,

LLC and Box

PureAir, LLC

- Energy Wyze expected to deliver 500 leads per day to

industry-leading clients

- Box PureAir has initially submitted over $50 million in bids to

schools within its exclusive territories and is actively preparing

to respond to additional RFPs related to increased ventilation and

indoor air quality

- Strategically positioned for 1:1 dividend spin-off 1606 Corp to

existing shareholders

- Planned near-term 75:1 reverse split expected to position the

Company to uplist

- Congress' adoption of the American Rescue Plan allocating $1.9

trillion in Stimulus Package aligns with Company's focus and

long-term strategy

"The first quarter of 2021 has been pivotal in establishing the

foundation to achieve our goals for the year. Completing the

acquisitions of Energy Wyze and Box PureAir has been a great start

and we are optimistic about revenue growth and potential for each.

In late December 2020, we eliminated one of our outstanding

convertible debt debentures and followed by successfully

eliminating all external convertible debt and the associated

derivative liabilities with those debt obligations in January 2021.

The elimination of the derivative liabilities coupled with the

corporate actions that were filed and expected to be effective

soon, fundamentally strengthens and well-positions SinglePoint to

advance towards uplisting to a premier national exchange. These

deliberate steps are critical in propelling SinglePoint to its next

phase of growth and to prepare the Company to compete with the

industry titans," commented Wil Ralston, President SinglePoint.

The leadership teams at Box PureAir and Energy Wyze are

currently producing revenue and targeting marque clients. Energy

Wyze is aggressively onboarding clients and is on target to meet or

exceed its near-term lead generation goals for its solar centric

clients. It is currently estimated that only about 4% of the

addressable homes in the US domestic market currently have solar.

Box PureAir has initially submitted over $50,000,000 in bids to

schools within its exclusive territories and has already started

shipping units as its products address the need and exceed all

standards for improving indoor air quality. The global air purifier

market size was valued at $7.59 billion in 2019 and expected to

grow at a compound annual growth rate (CAGR) 10.6% during the

forecast period 2020 to 2027. Previously, the demand for air

purifiers was mainly driven by the consumers suffering from

respiratory disorders. Today, rising health concerns among

consumers and business looking to reopen and provide a safe

environment free of pathogens and viruses like COVID-19 is expected

to positively influence the demand of air purifiers in the upcoming

years.

The Bottom Line

SinglePoint Inc Ticker SING has taken catalytic steps in

transforming the traditional solar energy model and is committed to

growing its national footprint with hopes of one day soon being

listed on a national exchange. Through the execution of its

highly scalable business model, the Company is leveraging

synergistic acquisitions and partnerships to generate revenue by

providing renewable energy solutions. SinglePoint expects to be at

the forefront of providing solutions to align with this growing

demand. See Full Disclaimer:

Disclaimer;

INS Digital Media is engaged in the business of marketing and

advertising public companies, investment funds and trading software

for companies in return for monetary compensation. Never invest in

any stock featured on this page unless you can afford to lose your

entire investment. INS Digital Media/INS/ Investor News Source and

its employees are not Registered Investment Advisers, Broker

Dealers, financial analysts or variation of any of these listed

professions or a member of any association. INS is compensated by

third party shareholders from time to time to feature certain

companies, in that even we encourage the company to issue a press

release highlighting such activities on their behalf. These third

parties may have shares and are assumed to liquidate the company's

shares which may very well negatively affect the stock price. This

compensation constitutes a conflict of interest as to our ability

to remain objective in our communication regarding the profiled

company. INS may, from time to time, purchase shares of public

companies that have been compensated to feature or profile in the

open market and INS does this at fair market value. Through the use

of this advertisement , additional marketing material, landing

pages, social media post or other affiliated platform marketing

presented by Investor News Source viewing you are using, you agree

to hold INS its operators owners and employees harmless to any and

all loss (monetary or otherwise), damage (monetary or otherwise),

or injury (monetary or otherwise) that you may incur. Trading stock

is very risky and you should never invest unless you are willing to

lose your entire investment. The information contained in

publications, advertisements and published opinions are always

based on publicly available information provided by the featured

company and based on sources which INS and it's members believe to

be reliable but that information is not guaranteed by INS as being

accurate and does not purport to be a complete statement or summary

of the Information. Publications, ads and opinion posts should NOT

be considered financial advice or a solicitation to buy or to

stock. INS has been compensated $35,000 for this content and

digital ads, email marketing and social media marketing of this

content. INS has a long Standing relationship with SING and has

been compensated a total of $186,500 previously for digital

marketing services for the company.

Derek C. McCarthy

216 246 5006

INS Digital Media

https://www.linkedin.com/in/derekcmccarthy/

Precautionary and Forward-Looking

Statements

This email and its attachments contain "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and such forward-looking statements are made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. "Forward looking statements" describe future

expectations, plans, results, or strategies and are generally

preceded by words such as "may," "future," "plan" or "planned,"

"will" or "should," "expected," "anticipates," "draft,"

"eventually" or "projected." You are cautioned that such statements

are subject to a multitude or risks and uncertainties that could

cause future circumstances, events, or results to differ materially

from those projected in the forward-looking statements, including

the risks that actual results may differ materially from those

projected in the forward-looking statements as a result of various

factors, and other risks identified in the Company's disclosures or

filings with the Securities Exchange Commission.

SOURCE: INS Digital Media

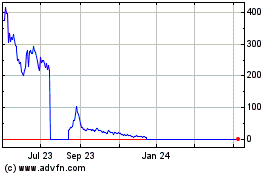

SinglePoint (PK) (USOTC:SING)

Historical Stock Chart

From Dec 2024 to Jan 2025

SinglePoint (PK) (USOTC:SING)

Historical Stock Chart

From Jan 2024 to Jan 2025