0001642159

true

S-1/A

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

P5Y

0001642159

2022-01-01

2022-06-30

0001642159

dei:BusinessContactMember

2022-01-01

2022-06-30

0001642159

2021-12-31

0001642159

2020-12-31

0001642159

2022-06-30

0001642159

2021-01-01

2021-12-31

0001642159

2020-01-01

2020-12-31

0001642159

2021-01-01

2021-06-30

0001642159

2022-04-01

2022-06-30

0001642159

2021-04-01

2021-06-30

0001642159

us-gaap:CommonStockMember

2019-12-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001642159

us-gaap:RetainedEarningsMember

2019-12-31

0001642159

2019-12-31

0001642159

us-gaap:CommonStockMember

2020-12-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001642159

us-gaap:RetainedEarningsMember

2020-12-31

0001642159

us-gaap:CommonStockMember

2021-03-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001642159

us-gaap:RetainedEarningsMember

2021-03-31

0001642159

2021-03-31

0001642159

us-gaap:CommonStockMember

2021-12-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001642159

us-gaap:RetainedEarningsMember

2021-12-31

0001642159

us-gaap:CommonStockMember

2022-03-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001642159

us-gaap:RetainedEarningsMember

2022-03-31

0001642159

2022-03-31

0001642159

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001642159

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001642159

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001642159

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001642159

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001642159

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001642159

2021-01-01

2021-03-31

0001642159

us-gaap:CommonStockMember

2021-04-01

2021-06-30

0001642159

us-gaap:AdditionalPaidInCapitalMember

2021-04-01

2021-06-30

0001642159

us-gaap:RetainedEarningsMember

2021-04-01

2021-06-30

0001642159

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001642159

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001642159

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001642159

2022-01-01

2022-03-31

0001642159

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001642159

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001642159

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001642159

us-gaap:CommonStockMember

2021-06-30

0001642159

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001642159

us-gaap:RetainedEarningsMember

2021-06-30

0001642159

2021-06-30

0001642159

us-gaap:CommonStockMember

2022-06-30

0001642159

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001642159

us-gaap:RetainedEarningsMember

2022-06-30

0001642159

SIGN:ShareExchangeAgreementMember

SIGN:SigynStockholderMember

2020-10-19

0001642159

SIGN:ShareExchangeAgreementMember

2020-10-18

2020-10-19

0001642159

SIGN:SigynStockholdersMember

SIGN:ShareExchangeAgreementMember

2020-10-19

0001642159

us-gaap:SubsequentEventMember

2022-03-14

0001642159

us-gaap:SubsequentEventMember

SIGN:NonAffiliateShareholdersMember

2022-03-14

0001642159

SIGN:ShareExchangeAgreementMember

SIGN:IssuedAndOutstandingSharesMember

2020-10-19

0001642159

us-gaap:SubsequentEventMember

2022-08-15

0001642159

us-gaap:SubsequentEventMember

SIGN:NonAffiliateShareholdersMember

2022-08-15

0001642159

us-gaap:GeneralAndAdministrativeExpenseMember

2020-01-01

2020-12-31

0001642159

us-gaap:GeneralAndAdministrativeExpenseMember

2021-01-01

2021-03-31

0001642159

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2021-12-31

0001642159

us-gaap:OfficeEquipmentMember

2021-01-01

2021-12-31

0001642159

us-gaap:OfficeEquipmentMember

2021-12-31

0001642159

us-gaap:OfficeEquipmentMember

2020-12-31

0001642159

us-gaap:ComputerEquipmentMember

2021-01-01

2021-12-31

0001642159

us-gaap:ComputerEquipmentMember

2021-12-31

0001642159

us-gaap:ComputerEquipmentMember

2020-12-31

0001642159

us-gaap:OfficeEquipmentMember

2022-01-01

2022-06-30

0001642159

us-gaap:OfficeEquipmentMember

2022-06-30

0001642159

us-gaap:ComputerEquipmentMember

2022-01-01

2022-06-30

0001642159

us-gaap:ComputerEquipmentMember

2022-06-30

0001642159

us-gaap:TrademarksMember

2021-01-01

2021-12-31

0001642159

us-gaap:TrademarksMember

2021-12-31

0001642159

us-gaap:TrademarksMember

2020-12-31

0001642159

SIGN:WebsiteMember

2021-01-01

2021-12-31

0001642159

SIGN:WebsiteMember

2021-12-31

0001642159

SIGN:WebsiteMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

2020-01-25

2020-01-28

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

2020-01-28

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

2020-06-20

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

2020-09-15

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-28

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-27

2021-10-28

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

2020-01-26

2020-01-28

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

2020-06-20

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

2020-09-15

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-28

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-27

2021-10-28

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

2022-03-23

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

2022-03-22

2022-03-23

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

2022-04-28

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

2022-04-27

2022-04-28

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

2022-05-10

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

2022-05-09

2022-05-10

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

2022-06-01

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

2022-05-31

2022-06-01

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

2020-06-22

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

2020-06-21

2020-06-22

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-01-26

2020-01-28

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-01-28

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-18

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-19

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-21

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:PreviousNoteholderOneMember

2020-06-21

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-06-21

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementTwoMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-18

2021-10-20

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-21

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-09-15

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-09-15

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-27

2021-10-28

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-28

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-06-21

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementTwoMember

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:PreviousNoteholderOneMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-18

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:PreviousNoteholderOneMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-12-02

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:PreviousNoteholderOneMember

2020-12-02

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderTwoMember

SIGN:SecuritiesPurchaseAgreementMember

2020-08-16

2020-08-18

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-08-18

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderTwoMember

SIGN:SecuritiesPurchaseAgreementMember

2020-08-18

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderTwoMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderTwoMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-18

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-10-28

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderTwoMember

us-gaap:CommonStockMember

2020-10-28

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderTwoMember

us-gaap:CommonStockMember

2021-02-19

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderThreeMember

SIGN:SecuritiesPurchaseAgreementMember

2020-09-16

2020-09-18

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-09-18

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderThreeMember

SIGN:SecuritiesPurchaseAgreementMember

2020-09-18

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderThreeMember

SIGN:AmendedConvertibleDebtAgreementTwoMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderThreeMember

SIGN:AmendedConvertibleDebtAgreementTwoMember

2020-10-18

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

2020-12-02

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderThreeMember

us-gaap:CommonStockMember

2020-12-02

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:SecuritiesPurchaseAgreementMember

2020-09-19

2020-09-21

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-09-21

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:SecuritiesPurchaseAgreementMember

2020-09-21

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:AmendedConvertibleDebtAgreementMember

2021-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-18

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-11-05

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:AmendedConvertibleDebtAgreementMember

2021-11-05

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:SecuritiesPurchaseAgreementMember

2020-09-26

2020-09-28

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-09-28

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:SecuritiesPurchaseAgreementMember

2020-09-28

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:AmendedConvertibleDebtAgreementMember

2021-10-18

2021-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-27

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

us-gaap:CommonStockMember

2020-10-27

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderSixMember

SIGN:SecuritiesPurchaseAgreementMember

2020-09-26

2020-09-29

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-09-29

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderSixMember

SIGN:SecuritiesPurchaseAgreementMember

2020-09-29

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderSixMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderSixMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-18

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderFiveMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-10-26

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-02-09

2021-02-10

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-02-10

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderSevenMember

SIGN:SecuritiesPurchaseAgreementMember

2021-02-10

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderSevenMember

us-gaap:CommonStockMember

2021-05-10

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderEightMember

SIGN:SecuritiesPurchaseAgreementMember

2021-05-04

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderEightMember

SIGN:SecuritiesPurchaseAgreementMember

2021-05-01

2021-05-04

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderSevenMember

SIGN:SecuritiesPurchaseAgreementMember

2021-02-08

2021-02-10

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:PreviousNoteholderSevenMember

2021-02-10

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:PreviousNoteholderSevenMember

us-gaap:CommonStockMember

2021-10-25

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

SIGN:OsherCapitalPartnersLLCMember

2022-06-21

2022-06-22

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

SIGN:OsherCapitalPartnersLLCMember

2022-06-22

0001642159

SIGN:ConvertiblePromissoryNoteEightMember

SIGN:OsherCapitalPartnersLLCMember

2020-06-21

2020-06-22

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

SIGN:OsherCapitalPartnersLLCMember

2022-05-31

2022-06-01

0001642159

SIGN:ConvertiblePromissoryNoteSevenMember

SIGN:OsherCapitalPartnersLLCMember

2022-06-01

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

SIGN:BrioCapitalMasterFundLtdMember

2022-05-09

2022-05-10

0001642159

SIGN:ConvertiblePromissoryNoteSixMember

SIGN:BrioCapitalMasterFundLtdMember

2022-05-10

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

SIGN:OsherCapitalPartnersLLCMember

2022-04-27

2022-04-28

0001642159

SIGN:ConvertiblePromissoryNoteFiveMember

SIGN:OsherCapitalPartnersLLCMember

2022-04-28

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

SIGN:OsherCapitalPartnersLLCMember

2022-03-22

2022-03-23

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

SIGN:OsherCapitalPartnersLLCMember

2022-03-23

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

SIGN:OsherCapitalPartnersLLCMember

2022-04-23

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

SIGN:BrioCapitalMasterFundLtdMember

2022-03-22

2022-03-23

0001642159

SIGN:ConvertiblePromissoryNoteFourMember

SIGN:BrioCapitalMasterFundLtdMember

2022-03-23

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteOneMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-20

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-06-23

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementTwoMember

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-10-18

2020-10-20

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-19

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-20

0001642159

SIGN:ConvertiblePromissoryNoteTwoMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-09-15

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:AmendedConvertibleDebtAgreementMember

2020-09-15

2020-09-17

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:SecuritiesPurchaseAgreementMember

2021-10-19

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:OsherCapitalPartnersLLCMember

SIGN:SecuritiesPurchaseAgreementMember

2021-10-20

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-27

2021-10-28

0001642159

SIGN:ConvertiblePromissoryNoteThreeMember

SIGN:SecuritiesPurchaseAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-28

0001642159

SIGN:OsherCapitalPartnersLLCMember

2021-10-27

2021-10-28

0001642159

SIGN:OsherCapitalPartnersLLCMember

2021-10-28

0001642159

SIGN:MarketingConsultingAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-25

0001642159

SIGN:MarketingConsultingAgreementMember

SIGN:OsherCapitalPartnersLLCMember

2021-10-24

2021-10-25

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:SecuritiesPurchaseAgreementMember

2021-10-18

2021-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:SecuritiesPurchaseAgreementMember

2021-10-20

0001642159

SIGN:ConvertiblePromissoryNoteMember

SIGN:SecuritiesPurchaseAgreementMember

2021-10-08

2021-10-20

0001642159

2021-10-12

2021-10-14

0001642159

2021-07-12

2021-07-14

0001642159

2021-05-01

2021-05-10

0001642159

2021-04-01

2021-04-30

0001642159

2021-04-30

0001642159

2021-05-10

0001642159

2021-04-01

2021-04-14

0001642159

SIGN:PreviousNoteholderMember

2021-02-19

0001642159

2021-01-12

2021-01-14

0001642159

SIGN:ThirdPartiesMember

2020-01-01

2020-12-31

0001642159

2020-10-18

2020-10-19

0001642159

SIGN:ConvertiblePromissoryNoteMember

2021-10-18

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteMember

2021-10-22

0001642159

SIGN:ConvertiblePromissoryNoteMember

2021-01-01

2021-12-31

0001642159

SIGN:ConvertiblePromissoryNoteMember

2020-01-01

2020-12-31

0001642159

SIGN:ConvertiblePromissoryNoteMember

2022-01-01

2022-06-30

0001642159

SIGN:ConvertiblePromissoryNoteMember

2021-01-01

2021-06-30

0001642159

2021-05-01

2021-05-27

0001642159

SIGN:ASC842Member

2021-06-15

0001642159

2021-05-26

2021-05-27

0001642159

SIGN:EmploymentAgreementsMember

SIGN:MrJoyceMember

2021-01-01

2021-12-31

0001642159

SIGN:EmploymentAgreementsMember

SIGN:MrJoyceMember

2020-12-31

0001642159

SIGN:EmploymentAgreementsMember

SIGN:MrJoyceMember

2020-01-01

2020-12-31

0001642159

SIGN:EmploymentAgreementsMember

SIGN:ChiefTechnologyOfficerMember

2021-01-01

2021-12-31

0001642159

SIGN:EmploymentAgreementsMember

SIGN:ChiefTechnologyOfficerMember

2020-01-01

2020-12-31

0001642159

SIGN:CEOAndCTOMember

2021-07-20

2021-07-21

0001642159

SIGN:EmploymentAgreementsMember

SIGN:MrFerrellMember

2022-03-08

2022-03-09

0001642159

SIGN:EmploymentAgreementsMember

SIGN:MrFerrellMember

2022-04-01

2022-06-30

0001642159

SIGN:EmploymentAgreementsMember

SIGN:MrFerrellMember

2022-01-01

2022-06-30

0001642159

SIGN:EmploymentAgreementsMember

SIGN:MrFerrellMember

2021-04-01

2021-06-30

0001642159

SIGN:EmploymentAgreementsMember

SIGN:MrFerrellMember

2021-01-01

2021-06-30

0001642159

us-gaap:SubsequentEventMember

2022-03-08

2022-03-09

0001642159

us-gaap:SubsequentEventMember

2022-03-09

0001642159

SIGN:OriginalIssueDiscountSeniorDebentureNoteMember

SIGN:OsherCapitalPartnersLLCMember

2022-03-22

2022-03-23

0001642159

SIGN:OriginalIssueDiscountSeniorDebentureNoteMember

SIGN:OsherCapitalPartnersLLCMember

2022-03-23

0001642159

SIGN:OriginalIssueDiscountSeniorDebentureNoteMember

SIGN:BrioCapitalMasterFundLtdMember

2022-03-22

2022-03-23

0001642159

SIGN:OriginalIssueDiscountSeniorDebentureNoteMember

SIGN:BrioCapitalMasterFundLtdMember

2022-03-23

0001642159

us-gaap:SubsequentEventMember

SIGN:ConvertiblePromissoryNoteMember

2022-07-01

2022-07-31

0001642159

us-gaap:SubsequentEventMember

SIGN:ConvertiblePromissoryNoteMember

2022-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

AS

FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION ON AUGUST 29, 2022

Registration

No. 333-265782

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT

NO. 1 TO

FORM S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

| SIGYN

THERAPEUTICS, INC. |

| (Exact

name of Registrant as specified in its charter) |

| Delaware

|

|

3841 |

|

47-2573116 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification

Code) |

|

(I.R.S.

Employer

Identification

No.) |

2468

Historic Decatur Road

Suite

140

San

Diego, California 92106

Telephone:

(619) 353-0800

(Address

and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

VCorp

Services

18

Lafayette Place

Woodmere,

NY 11598

Telephone:

(845) 425-0077

(Name,

Address, and Telephone Number for Agent of Service)

Copies

to:

Jolie

Kahn, Esq.

12

E. 49th Street, 11th Floor

New

York, NY 10017

Telephone:

(516) 217-6379

Fax:

(866) 705-3071

|

|

Patrick

J. Egan, Esq.

Leslie

Marlow, Esq.

Hank Gracin, Esq.

Blank

Rome LLP

1271

Avenue of the Americas

New

York, NY 10020

Phone:

(212) 885-5000

Fax:

(212) 885-5001 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable on or after the effective date of this registration statement.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, please check the following box: ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

Filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective

on such date as the Commission acting pursuant to said Section 8(a) may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange

Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY

PROSPECTUS SUBJECT TO COMPLETION DATED AUGUST 29, 2022

Sigyn

Therapeutics, Inc.

Class A Units

Each Class A Unit Consisting of

One Share

of Common Stock and

One Series A Warrant to Purchase One Share of

Common Stock

Class B Units

Each Class B Unit Consisting

of __ Shares of Series B Preferred Stock and One Series A Warrant to

Purchase One Share of

Common Stock

This is a firm commitment

public offering of ____ Class A Units (“Class A Units”), with each Class A Unit consisting of one share of our common

stock, par value $0.001 per share, and one Series A Warrant to purchase one share our common stock (and the shares issuable from time

to time upon exercise of the Series A Warrants) pursuant to this prospectus based on an assumed offer price of $____ for each Class A

Unit. Each Series A Warrant will have an exercise price of $____ (assumed) per share, will be exercisable upon issuance and will expire

five years from issuance. We expect the public offering price will be $______ per Class A Unit.

The Class A Units have no

stand-alone rights, will not be certificated or issued as stand-alone securities and there will be no trading market for the Class A

Units. The shares of common stock and the Series A Warrants comprising the Class A Units will separate immediately upon completion of

this offering and prior to any trading of the common stock and Series A Warrants.

We are also offering to those purchasers, whose purchase

of Class A Units in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following the consummation of this

offering, the opportunity to purchase, in lieu of the number of Class A Units that would result in ownership in excess of 4.99% (or,

at the election of the purchaser, 9.99%) of our outstanding common stock, a unit consisting of one share of Series B convertible preferred

stock, par value $.001 per share (“Series B Preferred Stock”), convertible at any time at the holder’s option

into a number of shares of common stock equal to $5,000 divided by $_____, the public offering price per Class A Unit (the “Conversion

Price”), and warrants to purchase a number of shares of common stock equal to the number of shares of common stock issuable upon

conversion of one share of Series B Preferred Stock (“Class B Unit”) at a public offering price of $5,000 per

Class B unit. The warrants included in the Class B Units will have the same terms as the warrants included in the Class A Units. For

each Class B Unit we sell, the number of Class A Units we are offering will be decreased on a dollar-for-dollar basis. Because we will

issue a Series A Warrant as part of the Class A Unit or Class B Unit, the number of Series A Warrants sold in this offering will not

change as a result of the change in the mix of Class A Units and Class B Units.

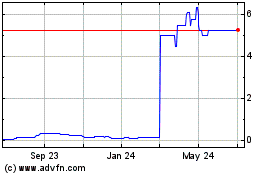

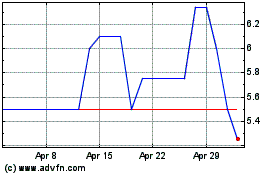

Our common stock trades

on the OTCQB® Venture Market under the symbol “SIGY”. On August 29, 2022, the last report sale price

of our common stock on the OTCQB® Venture Marketwas $_____. Prior to this offering, there has been no public market for our

Class A Units or our Series A Warrants. We plan to apply to

have our shares of common stock listed on the Nasdaq Capital Market under the symbol “SIGY”. No assurance can be given that

our application will be approved or that the trading price of our common stock on the OTCQB® Venture Market will be indicative

of the prices of our common stock if our common stock were traded on the Nasdaq Capital Market. If, for whatever reason, Nasdaq

does not confirm the listing of our common stock on Nasdaq prior to the pricing of the offering, we will not be able to consummate and

will terminate this offering. There is no established trading market for the Series A Warrants or the Series B Preferred Stock.

In addition, we do not intend to apply for the listing of the Series A Warrants or the Series B Preferred on any national securities

exchange or other trading market. Without an active trading market, the liquidity of the Series A Warrants and the Series B Preferred

Stock will be limited.

The number of Class A Units and Class B Unit offered

in this prospectus and all other applicable information has been determined based on an assumed public offering price of $ per

Class A Unit and $___ per Class B Unit, which is based on the last reported sales price of our common stock of $

on , 2022. The actual public offering price of the Class

A Units and Class B Units will be determined between the underwriters and us at the time of pricing, considering our historical performance

and capital structure, prevailing market conditions, and overall assessment of our business, and may be at a discount to the current

market price. Therefore, the assumed public offering price per Class A Unit and Class B Unit used throughout this prospectus may not

be indicative of the actual public offering price for the Class A Units and Class B Units. See “Determination of Offering Price”

for additional information.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this

prospectus for a discussion of information that should be considered in connection with an investment in our

securities.

We

are an “emerging growth company” under the federal securities laws and may elect to comply with certain reduced public company

reporting requirements for future filings.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

Class

A Unit |

|

Class B Unit |

|

Total |

|

| Public

offering price |

|

$ |

|

|

$ |

|

|

$ |

|

|

| Underwriting

discounts and commissions(1) |

|

$ |

|

|

$ |

|

|

$ |

|

|

| Proceeds

to us, before expenses (2) |

|

$ |

|

|

$ |

|

|

$ |

|

|

| (1) | We

have also agreed to issue warrants to purchase shares of our common stock to the representative

of underwriters and to reimburse the representative of the underwriters for certain expenses.

See “Underwriting” for additional information regarding total underwriter compensation. |

| (2) | The

amount of offering proceeds to us presented in this table does not give effect to any exercise

of the: (i) over-allotment option (if any) we have granted to the representative of the underwriters

as described below and (ii) warrants being issued to the representative of the underwriters

in this offering. The public offering price and underwriting discount corresponds to (i)

in respect of the Class A Units (a) a public offering price per share of common stock of

$__ and (b) a public offering price per Series A Warrant of $__, and (ii) in respect of the

Class B Units (a) a public offering price per share of Series B Preferred Stock of

$__ and (ii) a public offering price per Series A Warrant of $_____. |

We have granted a 45-day option to the underwriters,

exercisable one or more times in whole or in part, to purchase up to an additional ____ shares of common stock and/or __ shares of Series

B Preferred Stock and/or additional Series A Warrants (having the same terms as the Series A Warrants included in the Class

A Units in the offering) from us in any combination thereof at the public offering price per share of common stock equal to the

public offering price per Class A Unit minus $0.01 per share and $0.01 per Series A Warrant, respectively, less the underwriting discounts

payable by us, solely to cover over-allotments, if any.

The

underwriters expect to deliver the securities to purchasers in the offering on or about ,

2022.

The

date of this prospectus is , 2022

Table

of Contents

You

should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information.

We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information

contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

PROSPECTUS

SUMMARY

Except

as otherwise indicated, as used in this prospectus, references to the “Company,” “we,” “us,” or “our”

refer to Sigyn Therapeutics, Inc.

The

following summary highlights selected information contained in this prospectus, and it may not contain all of the information that is

important to you. Before making an investment decision, you should read the entire prospectus carefully, including “Risk Factors”

and our financial statements and related notes, included elsewhere in, or incorporated by reference into, this prospectus.

Our

Company

Sigyn Therapeutics, Inc.

(“Sigyn”, the “Company” “we,” “us,” or “our”) is a development-stage company focused on addressing unmet needs in global health

and biodefense. Sigyn Therapy™ is a broad-spectrum blood purification technology designed to extract viral pathogens,

bacterial toxins, and inflammatory mediators from the bloodstream. We are a development stage company with no approved medical

products.

Candidate indications for Sigyn Therapy include

pathogen-associated conditions that precipitate Sepsis (leading cause of hospital deaths worldwide1), Community Acquired Pneumonia

(a leading cause of death among infectious diseases2), Emerging Bioterror and Pandemic threats, and End-Stage Renal Disease

(ESRD) patients with endotoxemia and elevated inflammatory cytokine production.

1Global,

regional and national sepsis incidence and mortality The Journal Lancet, January 2020

2The

American Thoracic Society – Pneumonia Facts 2019

Risks

and Challenges That We Face

An

investment in our securities involves a high degree of risk. You should carefully consider the risks summarized below and the other risks

that are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary.

These risks include, but are not limited to, the following:

| |

● |

Demand

and market acceptance of our product offerings may be considerably less than what we currently anticipate. |

| |

|

|

| |

● |

We

may be unable to increase revenues in the manner in which we anticipate and generate profitability. |

| |

|

|

| |

● |

We

may face challenges in successfully completing U.S. Food and Drug Administration (“FDA”) testing requirements. |

| |

|

|

| |

● |

We

may not be able to meet increased and changing regulatory requirements. |

| |

|

|

| |

● |

Our

systems are not commercially tested. |

| |

|

|

| |

● |

We

will need to raise additional capital to fully commercialize our products. |

| |

|

|

| |

● |

Some

of our target products may face an uncertain regulatory environment. |

| |

|

|

| |

● |

We

may be unable to expand operations and manage growth. |

| |

|

|

| |

● |

We

may be unable to retain key members of our management and development teams and to recruit additional qualified personnel. |

| |

|

|

| |

● |

We

face competition from companies that have greater resources than we do and we may not be able to effectively compete against

these companies. |

| |

|

|

| |

● |

We

face risks as a result of the ongoing COVID-19 pandemic. |

| |

|

|

| |

● |

As

stated in their audit opinion for our audited financials for the year ended December 31, 2021, our auditors believe that we may not

be able to continue as a going concern. |

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, or the Securities Act, as modified

by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of certain exemptions

from various reporting requirements applicable to other public companies that are not “emerging growth companies” including,

but not limited to:

| |

● |

being permitted to present only two years of audited financial

statements and only two years of related disclosure in “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” in this prospectus; |

| |

|

|

| |

● |

being permitted to provide less extensive narrative disclosure

than other public companies including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley

Act of 2002 and reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration

statements; |

| |

|

|

| |

● |

being permitted to utilize exemptions from the requirements

of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously

approved; |

| |

|

|

| |

● |

being permitted to defer complying with certain changes in

accounting standards; and |

| |

|

|

| |

● |

being permitted to use test-the-waters communications with

qualified institutional buyers and institutional accredited investors. |

We

intend to take advantage of these and other exemptions available to “emerging growth companies.” We could remain an “emerging

growth company” until the earliest of (a) the last day of our fiscal year following the fifth anniversary of the closing of this

offering, (b) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (c) the last day of our

fiscal year in which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange

Act of 1934, or Exchange Act (which would occur if the market value of our equity securities that is held by non-affiliates exceeds $700

million as of the last business day of our most recently completed second fiscal quarter), or (d) the date on which we have issued more

than $1 billion in nonconvertible debt during the preceding three-year period.

The

JOBS Act permits an “emerging growth company” like us to take advantage of an extended transition period to comply with new

or revised accounting standards applicable to public companies. This means that an “emerging growth company” can delay the

adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to delay such

adoption of new or revised accounting standards.

Available

Information

We

file various reports with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form

8-K, which are available through the SEC’s electronic data gathering, analysis and retrieval system (“EDGAR”) by accessing

the SEC’s home page (http://www.sec.gov).

Corporate

Information

On

October 19, 2020, Sigyn Therapeutics, Inc, a Delaware corporation (the “Registrant”) formerly known as Reign Resources

Corporation, completed a Share Exchange Agreement (the “Agreement”) with Sigyn Therapeutics, Inc., a private entity

incorporated in the State of Delaware on October 19, 2019. Our mailing address is currently 2468 Historic Decatur Road., Suite 140,

San Diego, California, 92106. Our telephone number is (619) 353-0800.

THE

OFFERING

Class A Units offered by us: |

|

We

are offering Class A Units. Each Class A Unit consists of one share of our common stock and

a Series A Warrant to purchase one share of our common stock (together with the shares of

common stock underlying such warrants). The Class A Units will not be certificated or issued

in stand-alone form. The shares of our common stock and the Series A Warrants comprising

the Class A Units are immediately separable upon issuance and will be issued separately in

this offering. |

| |

|

|

| Assumed

Offering price: |

|

$[__]

per Class A Unit |

| |

|

|

| Class B Units offered by us: |

|

We are also offering to those purchasers, whose purchase

of Class A Units in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following the consummation of

this offering, the opportunity to purchase, in lieu of the number of Class A Units that would result in ownership in excess of 4.99%

(or, at the election of the purchaser, 9.99%) of our outstanding common stock, Class B Units. Each Class B Unit will consist of one

share of Series B Preferred Stock convertible into a number of shares of common stock equal to $5,000 divided by $____, the

public offering price per Class A Unit (the “Conversion Price”), and warrants to purchase a number of shares of common

stock equal to the number of shares of common stock issuable upon conversion of one share of Series B Preferred Stock (together

with the shares of common stock underlying such shares of Series B Preferred Stock and such warrants). The Class B Units are

immediately separable into their components upon closing of the offering contemplated hereby. For each Class B Unit we sell, the

number of Class A Units we are offering will be decreased on a dollar-for-dollar basis. Because we will issue a warrant as part of

each Unit, the number of warrants sold in this offering will not change as a result of a change in the mix of the Units sold. |

| |

|

|

| Offering price per Class B Unit: |

|

$ |

| |

|

|

| Description of Series B Preferred Stock: |

|

Each share of Series B Preferred

Stock is convertible at any time at the holder’s option into a number of shares

of common stock equal to $5,000 divided by the Conversion Price. Notwithstanding the foregoing,

we shall not effect any conversion of Series B Preferred Stock, with certain exceptions,

to the extent that, after giving effect to an attempted conversion, the holder of shares

of Series B Preferred Stock (together with such holder’s affiliates, and any

persons acting as a group together with such holder or any of such holder’s affiliates)

would beneficially own a number of shares of our common stock in excess of 4.99% (or, at

the election of the purchaser, 9.99%) of the shares of our common stock then outstanding

after giving effect to such exercise. The Series B Preferred Stock does not generally have

any voting rights. For additional information, see “Description of Securities—Series

B Preferred Stock” in this prospectus. |

| |

|

|

| Number

of shares of common stock outstanding after the offering:(1) |

|

_______

shares of common stock |

| |

|

|

| Market

for the common stock: |

|

Our

common stock trades on the OTCQB® Venture Market under the symbol “SIGY”. On August 29, 2022,

the last reported sale price for our common stock was $0.249 per share. Prior to this offering, there has been a limited market for

our common stock. While our common stock trades on the OTCQB® Venture Market, there has been negligible trading

volume. |

| |

|

|

| |

|

There

is no assurance that an active trading market will develop, or, if developed, that it will be sustained. Consequently, purchasers

of our common stock may find it difficult to resell the securities offered herein should the purchasers desire to do so when eligible

for public resale. |

| |

|

|

| |

|

Our

officers and directors are not purchasing securities in this offering. |

| |

|

|

| Use

of proceeds: |

|

We estimate

that we will receive approximately $___________ in gross proceeds if we sell all of the Class

A Units in the offering (based on an assumed offering price of $[__] per Class A Unit, which

was the last reported sales price of our common stock on the OTCQB® Venture Market

on , 2022), and we will receive estimated net proceeds (after deducting underwriting

discounts and estimated offering expenses) (assuming no exercise of the underwriter’s

over-allotment option, the Series A Warrants included in the Class A Units and Class B Units

or the Representatives’ Warrants offered hereby).

We currently intend to use the net proceeds from this offering, together with our existing cash and cash equivalents, to fund our research and development activities, clinical trials and the regulatory review process, and the remainder for working capital and other general corporate purposes. See “Use of Proceeds” for a more detailed explanation of how the proceeds from the Offering will be used. |

| |

|

|

| Over-allotment option: |

|

We have granted a 45-day option to the representative of

the underwriters to purchase up to additional shares of common stock and/or additional Series A Warrants, based on an assumed

public offering price of $ per Class A Unit or $__ per Class B Unit, which was the last reported sales price of our common stock

on the OTCQB® Venture Market on , 2022 (having

the same terms as the Series A Warrants included in the Class A Units and Class B Units in the offering) from us in any combination

thereof at a price per share of common stock equal to the public offering price per Class A Unit and Class B Unit minus $0.01 and

a price per warrant of $0.01, respectively, in each case, less the underwriting discounts payable by us, solely to cover over-allotments,

if any. |

| |

|

|

| Representative’s

Warrants |

|

The

registration statement of which this prospectus is a part also registers for sale warrants (the “Representative’s Warrants”)

to purchase shares of our common stock (based on an assumed offering price of $ per share, which was the last reported sales price

of our common stock as quoted on the OTCQB® Venture Market on , 2022) to Univest Securities, LLC (the “representative”),

as the representative of the several underwriters, as a portion of the underwriting compensation payable to the representative in

connection with this offering. The representative’s warrants will be exercisable at any time, and from time to time, in whole

or in part, during the four and one half period commencing 180 days following the commencement of sales of the securities in this

offering at an exercise price of $[__] (110% of the assumed public offering price of the Class A Units). Please see “Underwriting—Representative’s

Warrants” for a description of these warrants. |

| |

|

|

| Risk

Factors: |

|

See

“Risk Factors‚” and the other information in this prospectus for a discussion of the factors you should consider

before deciding to invest in shares of our securities. |

| |

|

|

| Trading

symbol: |

|

Our

common stock currently trades on the OTCQB® Venture Market under the symbol

“SIGY”. We plan to apply to have our shares of common stock listed on the Nasdaq

Capital Market under the symbol “SIGY”. No assurance can be given that our application

will be approved or that the trading prices of our common stock on the OTCQB® Venture

Market will be indicative of the prices of our common stock if our common stock were

traded on the Nasdaq Capital Market. If, for whatever reason, Nasdaq does not confirm the

listing of our common stock on Nasdaq prior to the pricing of the offering, we will not be

able to consummate and will terminate this offering.

There is no established trading market for the

Series B Preferred Stock or the Series A Warrants and we do not expect a market to develop. In addition, we do not intend to apply for

the listing of the Series B Preferred Stock or the Series A Warrants on any national securities exchange or other trading market. Without

an active trading market, the liquidity of the Series B Preferred Stock and the Series A Warrants will be limited. |

| Series

A Warrants |

|

The

exercise price of the Series A Warrants shall be 110% of the offering price of the Class A Units. The Series A Warrants have a

five-year term. The Series A Warrants are exercisable at any time after their original issuance and at any time up to the date that

is five years after their original issuance. The Series A Warrants will be exercisable, at the option of each holder, in whole or in

part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of the

shares of common stock underlying the Series A Warrants under the Securities Act is effective and available for the issuance of such

shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full

in immediately available funds for the number of shares of common stock purchased upon such exercise. If a registration statement

registering the issuance of the shares of common stock underlying the Series A Warrants under the Securities Act is not

effective or available and an exemption from registration under the Securities Act is not available for the issuance of such shares,

the holder may, in its sole discretion, elect to exercise the Series A Warrant through a cashless exercise, in which case the holder would

receive upon such exercise the net number of shares of common stock determined according to the formula set forth in the Series A Warrant. No

fractional shares of common stock will be issued in connection with the exercise of a Series A Warrant. In lieu of fractional shares, we will

pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price. |

| (1) |

The number of shares of our

common stock to be outstanding after this offering is based on shares of our common stock outstanding as August 29, 2022. |

| |

|

|

Unless we

indicate otherwise or the context otherwise requires, all information in this prospectus: |

| |

● |

assumes

no exercise by the underwriters of their option to purchase up to additional

shares of our common stock and/or Series A Warrants from us to cover over-allotments, if any; |

| |

● |

no

exercise of the Series A Warrants included in the Class A Units and Class B Units;

|

| |

● |

assumes

no exercise of the Representative’s Warrants to be issued upon consummation of this offering at an exercise price equal

to 110% of the initial offering price of the Class A Units; |

| |

● |

assumes

no shares of Series B Preferred Stock are sold in this offering;

|

| |

● |

assumes

no exercise of outstanding warrants to purchase shares

of our common stock at an exercise price of $[__]; and |

| |

● |

excludes

shares of common stock to be reserved for future issuance under our equity incentive plan, which will be effective upon the completion

of this offering. |

To

the extent we sell any Class B Units in this offering, the same aggregate number of common stock equivalents resulting from this offering

would be convertible under the Series B Preferred Stock issued as part of the Class B Units.

SUMMARY

FINANCIAL DATA

The following tables set forth

a summary of our historical financial data as of, and for the periods ended on, the dates indicated. The statements of operations data

for the years ended December 31, 2021, and 2020 and the six months ended June 30, 2022 and June 30, 2021, and

balance sheet data as of December 31, 2021, and December 31, 2020 and June 30, 2022 and June, 2021 are derived from

our audited and unaudited financial statements included elsewhere in this prospectus. The unaudited financial statements have

been prepared on a basis consistent with our audited financial statements included in this prospectus and include, in our opinion, all

adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of the financial information in those

statements.

The

following summary financial information should be read in connection with, and is qualified by reference to, our financial statements

related notes thereto and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” included elsewhere in this prospectus. Our historical results are not necessarily indicative of results to be expected

in any future period.

Statement

of Operations Data:

| | |

Year ended | | |

Year ended | |

| | |

December 31, | | |

December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Operating costs and expenses | |

| | | |

| | |

| General and administrative | |

$ | 1,274,203 | | |

$ | 497,072 | |

| Research and development | |

| 734,014 | | |

| 419,362 | |

| Total operating Expenses | |

| 2,008,217 | | |

| 916,434 | |

| Loss from operations | |

| (2,008,217 | ) | |

| (916,434 | ) |

| | |

| | | |

| | |

| Other expense | |

| | | |

| | |

| Impairment of assets | |

| 536,047 | | |

| - | |

| Interest expense | |

| 460,355 | | |

| 343,156 | |

| Total other income | |

| 996,402 | | |

| 343,156 | |

| Net loss | |

| (3,004,619 | ) | |

| (1,259,590 | ) |

| | |

| | | |

| | |

| Net loss per share, basic and diluted | |

$ | (0.08 | ) | |

$ | (0.17 | ) |

| | |

| | | |

| | |

| Weighted average number of shares of common stock outstanding, basic and diluted | |

| 36,396,585 | | |

| 7,351,272 | |

| Balance Sheet Data | |

| | |

| |

| | |

| | |

| |

| | |

December 31, | | |

December 31, | |

| | |

2021 | | |

2020 | |

| Cash | |

$ | 340,956 | | |

$ | 84,402 | |

| Other Current Assets | |

$ | 52,075 | | |

$ | 586,047 | |

| Total assets | |

$ | 710,259 | | |

$ | 694,082 | |

| Total liabilitiees | |

$ | 974,843 | | |

$ | 594,903 | |

| Preferred stock | |

$ | - | | |

$ | - | |

| Common stock | |

$ | 3,730 | | |

$ | 3,520 | |

| Additional paid-in-capital | |

$ | 3,997,445 | | |

$ | 1,356,799 | |

| Accumulated deficit | |

$ | (4,265,759 | ) | |

$ | (1,261,140 | ) |

| Total stockholders’ equity | |

$ | (264,584 | ) | |

$ | 694,082 | |

| Statement of Operations Data: | |

| | |

| |

| | |

| | |

| |

| | |

Six Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2021 | |

| | |

| | |

| |

| Operating costs and expenses | |

| | | |

| | |

| Marketing expenses | |

$ | 381 | | |

$ | 164,500 | |

| General and administrative | |

| 758,625 | | |

| 423,163 | |

| Research and development | |

| 383,025 | | |

| 256,252 | |

| Total operating Expenses | |

| 1,142,031 | | |

| 843,915 | |

| Loss from operations | |

| (1,142,031 | ) | |

| (843,915 | ) |

| | |

| | | |

| | |

| Other expense | |

| | | |

| | |

| Interest expense | |

| 31 | | |

| - | |

| Interest expense - debt discount | |

| 160,854 | | |

| 236,642 | |

| Interrest expense - original issuance costs | |

| 41,455 | | |

| 30,986 | |

| Total other income | |

| 202,340 | | |

| 267,628 | |

| Net loss | |

| (1,344,371 | ) | |

| (1,111,543 | ) |

| | |

| | | |

| | |

| Net loss per share, basic and diluted | |

$ | (0.04 | ) | |

$ | (0.03 | ) |

| | |

| | | |

| | |

| Weighted average number of common shareds outstanding, basic and diluted | |

| 37,295,803 | | |

| 35,841,627 | |

Balance Sheet Data

| | |

Six Months Ended | | |

Year Ended | |

| | |

June 30, | | |

December 31, | |

| | |

2022 | | |

2021 | |

| Cash | |

$ | 7,291 | | |

$ | 340,956 | |

| Other Current Assets | |

$ | 97,706 | | |

$ | 52,075 | |

| Total assets | |

$ | 395,908 | | |

$ | 710,259 | |

| Total liabilitiees | |

$ | 1,579,069 | | |

$ | 974,843 | |

| Preferred stock | |

$ | - | | |

$ | - | |

| Common stock | |

$ | 3,730 | | |

$ | 3,730 | |

| Additional paid-in-capital | |

$ | 4,423,239 | | |

$ | 3,997,445 | |

| Accumulated deficit | |

$ | (5,610,130 | ) | |

$ | (4,265,759 | ) |

| Total stockholders’ equity (deficit) | |

$ | (1,183,161 | ) | |

$ | (264,584 | ) |

RISK

FACTORS

You

should carefully consider the risks described below before investing in our securities. Additional risks not presently known to us or

that our management currently deems immaterial also may impair our business operations. If any of the risks described below were to occur,

our business, financial condition, operating results, and cash flows could be materially adversely affected. In such an event, the trading

price of our common stock could decline, and you could lose all or part of your investment. In assessing these risks, you should also

refer to the other information contained in this Prospectus, including our consolidated financial statements and related notes. The risks

discussed below include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking

statements.

Risks

Related to Financial Condition

We

are a development-stage therapeutic organization whose primary focus in the foreseeable future will be the clinical progression of Sigyn

Therapy toward market clearance.

We

are a development stage company with no approved medical products.

To date, we have devoted substantially all of our resources to support the development of Sigyn Therapy. This includes the completion

in vitro blood purification validation studies, animal studies, the establishment of initial manufacturing protocols, staffing

our organization, establishing our intellectual property portfolio, drafting regulatory documents and raising capital to support these

activities. However, there is no assurance that we will obtain the capital resources necessary to continue to advance Sigyn Therapy or

other product candidates toward market approval.

We

have incurred significant net losses since inception and do not anticipate that we will generate revenue in the near future. It is expected

that we will continue to incur substantial net losses in the foreseeable future and we may never achieve profitability.

We

are a development-stage medical technology company. Investment in development-stage therapeutic organizations is highly speculative based

on the need for substantial capital resources and the risk that therapeutic candidates will not receive regulatory approval or become

commercially viable if market cleared. We have incurred losses in each year since inception. Our net losses were approximately

$3.0 million and $1.3 million for the years ended December 31, 2021 and 2020, respectively, and our net losses for the six months

ended June 30, 2022 were approximately $1.3 million. As of December 31, 2021 and June 30, 2022, we had an accumulated deficit

of approximately $4.3 million and $5.6 million respectively. We expect to continue to spend significant resources to fund

the clinical progression of Sigyn Therapy and other potential product candidates.

Going

Concern Risk Factor.

As

described in our audited financial statements for the year ended December 31, 2021 contained elsewhere in this prospectus for

that same time period, our independent registered public accounting firm included an explanatory paragraph indicating that our current

liquidity position raises substantial doubt about our ability to continue as a going concern. It is anticipated that we will continue

to operate as a going concern until the completion of this offering; however, there are no assurances that we will be able to

continue our operations if this offering is delayed.

Upon

the completion of this offering, we may require additional capital in the future to fund the continuance of our operations. If we are

unable to raise additional capital when needed, we could be forced to delay, reduce or terminate our clinical development programs.

We

believe that the net proceeds from this offering will be approximately $____ million, based on an assumed public offering price of $[__]

per Class A Unit and Class B Unit, after deducting the estimated underwriting discounts and commissions and estimated offering expenses

payable by us. We believe that such proceeds will fund our operations plan for up to 24 months after the completion of the offering.

Accordingly, we acknowledge that there will be a need to raise additional capital to fund future operations, which may include the continued

clinical progression of Sigyn Therapy and other potential product candidates. However, our business or operations plan may change as

a result of factors currently unknown to us, and we may need to seek additional funds sooner than planned. However, there is no assurance

that we will be able to secure funding when we need it or on favorable terms. Additionally, our ability to raise additional capital

could be adversely impacted by market conditions or a worsening global economic climate.

Purchasers

of our stock will experience dilution.

At

June 30, 2022 and December 31, 2021, we had a net tangible book value of approximately $0.004 and $0.012 per share of

our common stock, respectively. If you purchase our common stock from us in our Offering, you will experience immediate and substantial