Losses at Sharp Drag on Foxconn -- WSJ

November 12 2016 - 3:02AM

Dow Jones News

By Liza Lin and Eva Dou

HONG KONG -- Foxconn Technology Group, the main manufacturer of

Apple Inc. devices, posted an 8.7% decline in third-quarter profit,

weighed down by recently acquired Japanese electronics maker Sharp

Corp.

Losses at Sharp were a drag on what was otherwise a quarter of

brisk sales because of production of the iPhone 7 for Apple,

Foxconn's largest customer.

Foxconn, which is formally known as Hon Hai Precision Industry

Co., said on Friday its profit fell to $34.6 billion New Taiwanese

dollars ($1.09 billion), but it still beat the NT$33.3 billion

average estimate of nine analysts polled by Capital IQ.

Revenue rose to NT$1.075 trillion from NT$1.066 trillion a year

earlier.

Foxconn completed its $3.8 billion acquisition of Sharp in

August after years of tumultuous negotiations and last-minute

hitches that almost derailed the deal. Sharp's advanced flat-screen

panel business fits into Foxconn's strategy to expand into high-end

components -- a more lucrative business than electronics

assembly.

Foxconn, the world's biggest electronics assembler, has said it

would help Sharp speed its efforts to mass-produce organic

light-emitting diode, or OLED, displays, a technology that holds

promise for next-generation gadgets with flexible screens. Apple is

considering adopting this technology for iPhones as early as next

year, The Wall Street Journal has reported.

But Sharp's new chief executive, Tai Jeng-wu, said recently that

he hasn't yet decided if his company will commit fully to OLED or

stick with more widely used liquid-crystal displays.

While manufacturing devices for Apple is still Foxconn's largest

source of revenue, the Taipei-based company increasingly has

diversified into other high-tech fields ranging from

telecommunications infrastructure to robotics and e-commerce.

Sharp, which remains listed on the Tokyo Stock Exchange, last

week reported a quarterly net loss of Yen17.9 billion ($170.8

million) but said it would return to profitability by the end of

the fiscal year, which ends March 31.

Write to Eva Dou at eva.dou@wsj.com

(END) Dow Jones Newswires

November 12, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

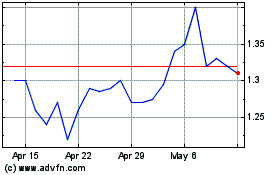

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

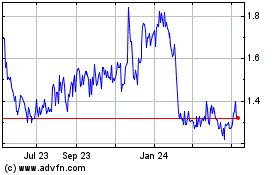

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Feb 2024 to Feb 2025