Table of Contents

Filed pursuant to Rule 253(g)(2)

File No. 024-11753

OFFERING CIRCULAR

SFLMaven Corp.

2,000,000,000 Shares of Common Stock

By this Offering Circular, SFLMaven Corp., a Wyoming corporation, is

offering for sale a maximum of 2,000,000,000 shares of its common stock (the “Offered Shares”), at a fixed price of $0.0008

per share, pursuant to Tier 1 of Regulation A of the United States Securities and Exchange Commission (the “SEC”). A minimum

purchase of $50,000 of the Offered Shares is required in this offering; any additional purchase must be in an amount of at least $10,000.

This offering is being conducted on a best-efforts basis, which means that there is no minimum number of Offered Shares that must be sold

by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. All proceeds from this offering will

become immediately available to us and may be used as they are accepted. Purchasers of the Offered Shares will not be entitled to a refund

and could lose their entire investments. Please see the “Risk Factors” section, beginning on page 4, for a discussion of the

risks associated with a purchase of the Offered Shares.

This offering commenced on January 26, 2022; this offering will terminate at the earliest of (a) the date on which the maximum offering

has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering

is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

|

Title of

Securities Offered

|

|

Number

of Shares

|

|

Price to

Public

|

|

Commissions (1)

|

|

Proceeds to

Company (2)

|

|

Common Stock

|

|

|

2,000,000,000

|

|

$0.0008

|

|

$-0-

|

|

$1,600,000

|

|

(1)

|

We may offer the Offered Shares through registered broker-dealers and we may pay finders. However, information as to any such broker-dealer

or finder shall be disclosed in an amendment to this Offering Circular.

|

|

(2)

|

Does not account for the payment of expenses of this offering estimated at $25,000. See “Plan of Distribution.”

|

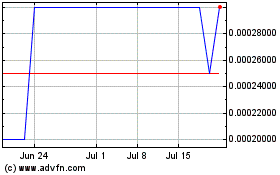

Our common stock is quoted in the over-the-counter under the symbol

“SFLM” in the OTC Pink marketplace of OTC Link. On January 26, 2022, the closing price of our common stock was $0.0018 per

share.

Investing in the Offered Shares is speculative and involves substantial

risks, including the superior voting rights of our outstanding shares of Series A Preferred Stock, which preclude current and future owners

of our common stock, including the Offered Shares, from influencing any corporate decision. The Series A Preferred Stock has the following

voting rights: each share of Series A Preferred Stock shall have voting rights equal to four times the sum of (a) all shares of our common

stock issued and outstanding at the time of voting plus (b) the total number of votes of all other classes of preferred stock which are

issued and outstanding at the time of voting, divided by the number of shares of Series A Preferred Stock issued and outstanding at the

time of voting. Our sole officer and director, as the owner of all outstanding shares of the Series A Preferred Stock, will, therefore,

be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including

the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate

transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares”).

THE SEC DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO,

ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER

SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC. HOWEVER, THE SEC HAS NOT

MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this offering is prohibited.

No person is permitted to make any oral or written predictions about the benefits you will receive from an investment in Offered Shares.

No sale may be made to you in this offering if you do not satisfy

the investor suitability standards described in this Offering Circular under “Plan of Distribution-State Law Exemption” and

“Offerings to Qualified Purchasers-Investor Suitability Standards” (page 4). Before making any representation that you satisfy

the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information

on investing, we encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure format of Form S-1, pursuant

to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this

Offering Circular is January 26, 2022.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information contained in this Offering Circular

includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include,

but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated

development of our company; and various other matters (including contingent liabilities and obligations and changes in accounting policies,

standards and interpretations). These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the

future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of

future events or circumstances, including any underlying assumptions, are forward-looking statements. The words anticipates, believes,

continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects, seeks, should, will, would and

similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this

Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot

guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking

statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual

results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to

us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also

described below in the Risk Factors section. Should one or more of these risks or uncertainties materialize, or should any of our assumptions

prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not

place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking

statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as may be required under applicable securities laws.

OFFERING CIRCULAR SUMMARY

The following summary highlights material information

contained in this Offering Circular. This summary does not contain all of the information you should consider before purchasing our common

stock. Before making an investment decision, you should read this Offering Circular carefully, including the Risk Factors section and

the unaudited consolidated financial statements and the notes thereto. Unless otherwise indicated, the terms we, us and our refer and

relate to SFLMaven Corp., a Wyoming corporation, including its wholly-owned subsidiary, SFL Maven of Florida, LLC, a Florida limited liability

company.

Our Company

Our company was incorporated on July 1, 1981, under

the laws of the State of Delaware as Multi-Tech Corporation. In May 2006, our corporate name changed to DNA Dynamics, Inc. In April 2018,

our company changed its domicile from Delaware to Wyoming. In April 2019, our corporate name changed to Sun Kissed Industries, Inc. In

March 2021, our corporate name changed to SFLMaven Corp.

We are a company that aggregates and curates unique,

pre-owned luxury supply across multiple categories, including women’s, men’s and children’s jewelry and watches. We

have built a vibrant online marketplace that is hosted on eBay. We believe our platform expands the overall luxury market, promotes the

re-circulation of luxury goods and contributes to a more sustainable world. During 2022, we intend to expand our business into the creation

and marketing of digital assets, as well as the purchasing of cryptocurrencies. (See “Business”).

Offering Summary

|

Securities Offered

|

2,000,000,000 shares of common stock, par value $0.0001 (the Offered Shares).

|

|

Offering Price

|

$0.0008 per Offered Share.

|

|

Shares Outstanding

Before This Offering

|

1,453,025,173 shares issued and outstanding as of the date hereof.

|

|

Shares Outstanding

After This Offering

|

3,453,025,173 shares issued and outstanding, assuming the sale of all of the Offered Shares hereunder.

|

|

Minimum Number of Shares

to Be Sold in This Offering

|

None

|

|

Disparate Voting Rights

|

Our outstanding shares of Series A Preferred Stock possess superior voting rights, which preclude current and future owners of our common stock, including the Offered Shares, from influencing any corporate decision. The Series A Preferred Stock has the following voting rights: each share of Series A Preferred Stock shall have voting rights equal to four times the sum of (a) all shares of our common stock issued and outstanding at the time of voting plus (b) the total number of votes of all other classes of preferred stock which are issued and outstanding at the time of voting, divided by the number of shares of Series A Preferred Stock issued and outstanding at the time of voting. Our sole officer and director, Joseph Ladin, as the owner of all outstanding shares of the Series A Preferred Stock, will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares” and “Security Ownership of Certain Beneficial Owners and Management”).

|

|

Investor Suitability Standards

|

The Offered Shares may only be purchased by investors residing in a state in which this Offering Circular is duly qualified who have either (a) a minimum annual gross income of $70,000 and a minimum net worth of $70,000, exclusive of automobile, home and home furnishings, or (b) a minimum net worth of $250,000, exclusive of automobile, home and home furnishings.

|

|

Market for our Common Stock

|

Our common stock is quoted in the over-the-counter market under the symbol “SFLM” in the OTC Pink marketplace of OTC Link.

|

|

Termination of this Offering

|

This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering circular being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion.

|

|

Use of Proceeds

|

We will

apply the proceeds of this offering for marketing and advertising expenses, luxury goods inventory, payroll expenses, general

and administrative expenses and working capital. (See “Use of Proceeds”).

|

|

Risk Factors

|

An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares.

|

|

Corporate Information

|

Our principal executive offices are located at 2485 East Sunrise Boulevard, 201A, Fort Lauderdale, Florida 33304; our telephone number is 954-951-0626; our corporate website is located at www.sflmavencorp.com. No information found on our company’s website is part of this Offering Circular.

|

Continuing Reporting Requirements Under Regulation A

As a Tier 1 issuer under Regulation A, we will

be required to file with the SEC a Form 1-Z (Exit Report Under Regulation A) upon the termination of this offering. We will not be required

to file any other reports with the SEC following this offering.

However, during the pendency of this offering and

following this offering, we intend to file quarterly and annual financial reports and other supplemental reports with OTC Markets, which

will be available at www.otcmarkets.com.

All of our future periodic reports, whether filed

with OTC Markets or the SEC, will not be required to include the same information as analogous reports required to be filed by companies

whose securities are listed on the NYSE or NASDAQ, for example.

RISK FACTORS

An investment in the Offered Shares involves substantial

risks. You should carefully consider the following risk factors, in addition to the other information contained in this Offering Circular,

before purchasing any of the Offered Shares. The occurrence of any of the following risks might cause you to lose a significant part of

your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties

that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this Offering

Circular, including statements in the following risk factors, constitute forward-looking statements. (See “Cautionary Statement Regarding Forward-Looking Statements”).

Risks Associated with the COVID-19 Pandemic

It is possible that the Coronavirus (“COVID-19”)

pandemic could cause long-lasting stock market volatility and weakness, as well as long-lasting recessionary effects on the United States

and/or global economies. Should the negative economic impact caused by the COVID-19 pandemic result in continuing long-term economic

weakness in the United States and/or globally, our ability to expand our business would be severely negatively impacted. It is possible

that our company would not be able to sustain during any such long-term economic weakness.

Risks Related to Our Company

We have incurred losses in prior periods,

and losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial

condition, our ability to pay our debts as they become due, and on our cash flows. We have incurred losses in prior periods. For

the nine months ended September 30, 2021, we incurred a net loss of $488,502 (unaudited) and, as of that date, we had an accumulated deficit

of $6,631,710 (unaudited). For the year ended December 31, 2020, we incurred a net loss of $4,450,475 (unaudited) and, as of that date,

we had an accumulated deficit of $6,158,802 (unaudited). Any losses in the future could cause the quoted price of our common stock to

decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash

flows.

There is doubt about our ability to continue

as a viable business. We have not earned a profit from our operations during recent financial periods. There is no assurance that

we will ever earn a profit from our operations in future financial periods.

We may be unable to obtain sufficient capital

to implement our full plan of business. Currently, we do not have sufficient financial resources with which to establish our full

business plan. There is no assurance that we will be able to obtain sources of financing, including in this offering, in order to satisfy

our working capital needs.

We do not have a successful operating history.

For the year ended December 31, 2020, and the nine months ended September 30, 2021, we generated a net loss from operations, which makes

an investment in the Offered Shares speculative in nature. Because of this lack of operating success, it is difficult to forecast our

future operating results. Additionally, our operations will be subject to risks inherent in the implementation of business strategies,

including, among other factors, efficiently deploying our capital, developing and implementing our marketing campaigns and strategies

and developing greater awareness. Our performance and business prospects will suffer if we are unable to overcome the following challenges,

among others:

|

|

•

|

our ability to attract greater numbers of consigners and customers

for our pre-owned luxury goods;

|

|

|

•

|

our dependence upon external sources for the financing of our operations, particularly given that there are concerns about our ability

to continue as a going concern;

|

|

|

•

|

our ability to execute our business strategies;

|

|

|

•

|

our ability to manage our expansion, growth and operating expenses;

|

|

|

•

|

our ability to finance our business;

|

|

|

•

|

our ability to compete and succeed in highly a competitive industry; and

|

|

|

•

|

future geopolitical events and economic crisis.

|

There are risks and uncertainties encountered

by under-capitalized companies. As an under-capitalized company, we are unable to offer assurance that we will be able to overcome

our lack of capital, among other challenges.

We may never earn a profit in future financial

periods. Because we lack a successful operating history, we are unable to offer assurance that we will ever earn a profit in future

financial periods.

If we are unable to manage future expansion

effectively, our business may be adversely impacted. In the future, we may experience rapid growth in our operations, which could

place a significant strain on our company’s infrastructure, in general, and our internal controls and other managerial, operating

and financial resources, in particular. If we are unable to manage future expansion effectively, our business would be harmed. There is,

of course, no assurance that we will enjoy rapid development in our business.

We currently depend on the efforts of our

sole executive officer; the loss of this executive could disrupt our operations and adversely affect the further development of our business.

Our business will depend, primarily, on the continued service of our sole executive officer, Joseph Ladin. The loss of service of Mr.

Ladin, for any reason, could seriously impair our ability to execute our business plan, which could have a materially adverse effect on

our business and future results of operations. We have entered into employment agreement with Mr. Ladin. We have not purchased any key-man

life insurance.

If we are unable to recruit and retain key

personnel, our business may be harmed. If we are unable to attract and retain key personnel, our business may be harmed. Our failure

to enable the effective transfer of knowledge and facilitate smooth transitions with regard to our key employees could adversely affect

our long-term strategic planning and execution.

Our business strategies are not based on

independent market studies. We have not commissioned any independent market studies with respect to pre-owned luxury retail goods

industry. Rather, our plans for implementing our ongoing business strategies and achieving profitability are based on the experience,

judgment and assumptions of our management. If these assumptions prove to be incorrect, we may not be successful in expanding our sales.

Our Board of Directors may change our policies

without shareholder approval. Our policies, including any policies with respect to investments, leverage, financing, growth, debt

and capitalization, will be determined by our Board of Directors or officers to whom our Board of Directors delegates such authority.

Our Board of Directors will also establish the amount of any dividends or other distributions that we may pay to our shareholders. Our

Board of Directors or officers to which such decisions are delegated will have the ability to amend or revise these and our other policies

at any time without shareholder vote. Accordingly, our shareholders will not be entitled to approve changes in our policies, which policy

changes may have a material adverse effect on our financial condition and results of operations.

Our financials are not independently audited,

which could result in errors and/or omissions in our financial statements if proper standards are not applied. Although we are

confident with our accountant, Whitley Penn, LP, we are not required to have our financials audited by a certified Public Company Accounting

Oversight Board (“PCAOB”). As such, our accountant does not have a third party reviewing the accounting. Our accountant may

also not be up to date with all publications and releases put out by the PCAOB regarding accounting standards and treatments. This could

mean that our unaudited financials may not properly reflect up to date standards and treatments resulting misstated financials statements.

Changes in the overall economy could have

a detrimental impact on our company’s operating results. Changes in the general economic climate could have a detrimental

impact on consumer expenditure and therefore on our company’s revenue. It is possible that recessionary pressures and other economic

factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases) may adversely affect

customers’ confidence and willingness to spend. Any of such events or occurrences could have a material adverse effect on our company’s

consolidated financial results and on your investment.

We possess inadequate

documentation for its financial statements from prior years and may have undiscovered liabilities and other items. Financial

statements from prior years are not supported by adequate documentation. For example, with regard to our liabilities from earlier

years, we are unable to document the amount of these liabilities, to whom they are owed, and the terms of these liabilities. As a

result of such deficiencies, we may be faced with as yet undiscovered liabilities and other items that might impact our financial statements. Additionally, we may be unable to produce audited financial statements.

Our management has a limited experience

operating a company and is subject to the risks commonly encountered by early-stage companies. Although our management has

experience in operating small companies, it has not had to manage expansion of a company. Many investors may treat us as an early-stage

company. In addition, management has not overseen a company with large growth. Because we have a limited operating history, our operating

prospects should be considered in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving

markets. These risks include:

|

|

•

|

risks that we may not have sufficient capital to achieve our growth strategy;

|

|

|

•

|

risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’

requirements;

|

|

|

•

|

risks that our growth strategy may not be successful; and

|

|

|

•

|

risks that fluctuations in our operating results will be significant relative to our revenues.

|

Risks Related to Our Luxury Goods Business

We may suffer sluggish or negative sales

growth as a result of the COVID-19 pandemic. Inasmuch as a majority of the global demand for luxury retail goods is from China,

it is possible that our company’s business will encounter difficulty in attracting buyers for its luxury retail goods. Should such

be the case, our operating results would be negatively affected.

If we fail to generate a sufficient amount

of new and recurring supply of pre-owned luxury goods by attracting and retaining sellers and consignors, our business would be harmed.

Our success depends on our ability, on a cost-effective basis, to attract, retain and grow relationships with sellers and consignors of

luxury goods (“Sale Sources”) and, in turn, our supply of luxury goods sold through our online marketplace. To expand our

Sale Sources base, we must appeal to and engage individuals new to sales of luxury goods and consignment, or who have sold or consigned

goods through traditional brick-and-mortar shops but are unfamiliar with our business. We find new Sale Sources by converting buyers utilizing

our online marketplace, referral programs, organic word-of-mouth and other methods of discovery, such as mentions in the press and internet

search engine results.

Our ability to achieve growth in our business also

depends on our success in continuing to generate a high volume of items from new and existing sellers and consignors. To accomplish this,

we rely on our sales professionals to drive our supply of luxury goods by identifying, developing and maintaining relationships with our

Sale Sources. Our sales professionals source high-quality, coveted luxury goods from Sale Sources through a variety of methods. The process

of identifying and hiring sales professionals with the combination of skills and attributes required in these roles can be difficult and

can require significant time. In addition, competition for qualified employees and personnel in the retail industry is intense and turnover

among our sales professionals within a few years is not uncommon. Any shortage in sales professionals or delay in identifying and hiring

quality sales professionals could have a negative impact on the business. If we are not successful in attracting and retaining effective

sales professionals, the quantity and quality of the luxury goods sold through our online marketplace may be negatively impacted, which

would have a material adverse effect on our business and operating results.

We may not be able to attract, train and

retain specialized personnel and skilled employees to effectively manage the merchandising operations required to authenticate, process

and sell luxury goods that enable us to effectively scale our operations. We lease facilities to store and accommodate the logistics

infrastructure required to merchandise and ship the pre-owned luxury goods we sell through our online marketplace. To expand our business,

we must continue to improve and expand our merchandising and fulfillment operations, information systems and skilled personnel in the

jurisdictions in which we operate, so that we have the skilled talent necessary to operate effectively our business. The operation of

our business is complex and requires the coordination of multiple functions that are highly dependent on numerous employees and personnel.

Each luxury item that we offer through our online marketplace is unique and requires multiple touch points, including inspection, evaluation,

authentication, photography, pricing, copywriting, application of a unique single-SKU and fulfillment. We have rapidly increased our operations

employee headcount to support the growth of our business. The market for these employees is increasingly competitive and is highly dependent

on geographic location. Some of our employees have specific knowledge and skills that would make it more difficult to hire replacement

personnel capable of effectively performing the same tasks without substantial training. We also provide specific training to our employees

in each of our business functions in order to provide our sellers and buyers with a consistent luxury experience. If we fail effectively

to locate, hire, train and retain such personnel, our operations would be negatively impacted, which would have an adverse effect on our

business, financial condition and operating results.

We may not be able to sustain our revenue

growth rate or effectively manage growth. Our recent revenue growth should not be considered indicative of our future performance.

It is possible that our future revenue rates may slow, due to a number of factors, including, without limitation, the maturation of our

business, increased market adoption against which future growth will be measured, increasing competition or our failure to capitalize

on growth opportunities. Additionally, consignors may opt to consign less with us, to the extent we take such steps, such as increasing

our commission rates, as may make our online marketplace appear less attractive to them. Alternatively, the emergence of direct competitors

may force us to decrease our take rates to remain appealing to potential consignors, which will have a negative impact on our financial

performance.

We have experienced, and expect to continue to

experience, rapid growth, which has placed, and will continue to place, significant demands on our management and our operational and

financial infrastructure. Continued growth could also strain our ability to maintain reliable service levels for our consignors and buyers,

develop and improve our operational, financial and management controls, enhance our reporting systems and procedures and recruit, train

and retain highly skilled personnel. To support anticipated growth, we are committing substantial financial, operational and technical

resources. Failure to effectively manage the growth of our business and operations would negatively affect our reputation and brand, business,

financial condition and operating results.

National retailers and brands set their own

retail prices and promotional discounts on new luxury goods, which could adversely affect our value proposition to consumers.

National retailers and brands set pricing for new luxury goods. Promotional pricing by these parties may adversely affect the value of

products sold by us and our inventory and operating results. In order to attract buyers to our online marketplace, the prices for the

pre-owned luxury goods sold through our online marketplace may need to be lowered in order to compete with these pricing strategies, which

could negatively affect gross merchandise value (“GMV”) and, in turn, our revenue. We have experienced a reduction in our

GMV in the past, due to fluctuations in the price of new luxury goods sold by retailers and brands, and we anticipate similar reductions

and fluctuations in the future. However, the timing and magnitude of such discounting is difficult to predict. Any of the foregoing risks

could adversely affect our business, financial condition and operating results.

We rely on consumer discretionary spending

and may be adversely affected by economic downturns and other macroeconomic conditions or trends. Our business and operating results

are subject to global economic conditions and their impact on consumer discretionary spending, particularly in the luxury goods market.

Some of the factors that may negatively influence consumer spending on luxury goods include high levels of unemployment, higher consumer

debt levels, reductions in net worth, declines in asset values and related market uncertainty, home foreclosures and reductions in home

values, fluctuating interest rates, inflation and credit availability, fluctuating fuel and other energy costs, fluctuating commodity

prices and general uncertainty regarding the overall future political and economic environment. Economic conditions in certain regions

may also be affected by natural disasters, such as earthquakes, hurricanes, wildfires and threats to public health, such as COVID-19.

Consumer purchases of new luxury goods have declined during periods of economic uncertainty, when disposable income is reduced or when

there is a reduction in consumer confidence. Such economic uncertainty and decrease in the rate of luxury purchases in the primary market

may slow the rate at which individuals choose to offer their goods for sale through us, which could result in a decrease of items available

in our online marketplace.

As an online marketplace for pre-owned luxury

goods, our success depends on the accuracy of our authentication process. Failure by us to identify counterfeit goods could adversely

affect our reputation, subject us to adverse publicity and expose us to liability for the sale of counterfeit goods. Our success

depends on our ability to accurately and cost-effectively determine whether an item offered for sale is an authentic product, a genuine

gemstone or piece of jewelry or work of art. From time to time, we receive counterfeit goods for sale or consignment. While we continue

to invest and innovate in our authentication processes, and we reject any goods we believe to be counterfeit, we cannot be certain that

we will identify every counterfeit item that is presented to us. As the sophistication of counterfeiters increases, it may be increasingly

difficult to identify counterfeit products. We refund the cost of a product to a buyer if the buyer questions its authenticity and returns

the item. The sale of any counterfeit goods may damage our reputation as a trusted online marketplace for authenticated, pre-owned luxury

goods which may impact our ability to attract and maintain Sale Sources and buyers. Additionally, we have been and may in the future be

subject to public allegations that our authentication processes are inadequate. Such controversy could negatively impact our reputation

and brand and harm our business and operating results. Any material failure or perceived failure in our authentication operations could

cause buyers and Sale sources to lose confidence in our platform and adversely affect our revenue.

We may not succeed in promoting and sustaining

our brand, which could have an adverse effect on our business and future growth. We believe that maintaining the SFL Maven brand

is critical to increasing Sale Sources and buyer engagement. An important goal of our brand promotion strategy is establishing trust with

our Sale Sources and buyers. Maintaining our brand will depend largely on our ability to continue providing our Sale Sources with service

that is consistent with the level of luxury associated with the goods they are selling and delivering value for the goods they provide,

all in a timely and consistent manner. Our success depends in part on the quality of our sales professionals who represent our brand to

new and existing Sale Sources. Sales professionals cultivate relationships with our Sale Sources base. While we require that all sales

professionals undergo a background check, this may not prevent illegal, improper or otherwise inappropriate actions by such employees,

such as theft or physical assault, from occurring in connection with our services. Any negative publicity related to the foregoing could

adversely affect our reputation and brand or public perception of our model of luxury consignment, which could negatively affect demand

for our services and harm our business, financial condition and operating results.

Our continued growth depends on attracting

new and retaining repeat buyers. To expand our buyer base, we must appeal to and attract buyers who do not typically purchase

luxury goods, who have historically purchased only new luxury goods or who used other means to purchase pre-owned luxury goods, such as

traditional brick-and-mortar consignment shops, auction houses and the websites of other secondary marketplaces. We reach new buyers through

our online marketplace at eBay Auctions, referral programs, organic word of mouth and other methods of discovery, such as converting Sale

Sources to buyers. We expect to continue investing heavily in these and other marketing channels in the future and cannot be certain that

these efforts will yield more buyers or be cost-effective. Moreover, new buyers may not purchase through our online marketplace as frequently

or spend as much with us as historically has been the case with existing buyers. As a result, the revenue generated from new buyer transactions

may not be as high as the revenue generated from transactions with our existing buyers. Failure to attract new buyers and to maintain

relationships with existing buyers would adversely affect our operating results and our ability to attract and retain consignors.

In the future, we may be party to lawsuits

and other claims that are expensive and time consuming, could lead to adverse publicity, and, if resolved adversely, could have a significant

impact on our business, financial condition or operating results. We rely on the fair use doctrine when we routinely refer to

third-party intellectual property, such as trademarks, on our platform. Third parties may dispute the scope of that doctrine and challenge

our ability to reference their intellectual property in the course of our business. For instance, from time to time, we are contacted

by companies controlling brands of goods Sale Sources sell, demanding that we cease referencing those brands in connection with such

sales, whether in advertising or on our website. We have consistently responded by reference to the holding in Tiffany (NY), Inc.

v. eBay that factual use of a brand to describe and sell a used good is not false advertising. These matters have generally been

resolved with no further communications. An unfavorable outcome in this type or similar litigation could adversely affect our business

and could lead to other similar lawsuits.

We are also at risk of claims by others that we

have infringed their copyrights, trademarks or patents or improperly used or disclosed their trade secrets. In particular, third parties

may allege that goods sold by us are counterfeit or that by offering goods of a particular brand we are suggesting that we are sponsored

by or affiliated with that brand. The costs of resolving any litigation or disputes related to these claims can be considerable, and we

cannot assure you that we will achieve a favorable outcome of any such claim. In addition, we have, in the past and could face in the

future, a variety of employee claims against us, including general discrimination, privacy, wage and hour, labor and employment, ERISA

and disability claims. Any claims could also result in litigation against us or regulatory proceedings being brought against us by various

federal and state agencies that regulate our business, including the U.S. Equal Employment Opportunity Commission. Often these cases raise

complex factual and legal issues and create risks and uncertainties.

Defending litigation is costly and can impose a

significant burden on management and employees, and there can be no assurances that favorable final outcomes will be obtained. The results

of any such litigation, investigations and other legal proceedings are inherently unpredictable and expensive. Although we have insurance,

it provides for a substantial retention of liability and is subject to limitations. As a result, it may not cover a significant portion,

or any, of the expenses we may incur or be subject to in connection with shareholder class action or other litigation to which we are

party. In addition, plaintiffs may seek, and we may become subject to, preliminary or provisional rulings in the course of any such litigation,

including potential preliminary injunctions requiring us to cease some or all of our operations. We may decide to settle such lawsuits

and disputes on terms that are unfavorable to us. Similarly, if any litigation to which we are a party is resolved adversely, we may be

subject to an unfavorable judgment that may not be reversed upon appeal. The terms of such a settlement or judgment may require us to

cease some or all of our operations or pay substantial amounts to the other party. In addition, we may have to seek a license to continue

practices found to be in violation of a third-party’s rights, which may not be available on reasonable terms or at all, and may

significantly increase our operating costs and expenses. As a result, we may also be required to develop alternative practices or discontinue

the practices. The development of alternative practices could require significant effort and expense or may not be feasible. Our business,

financial condition or operating results could be adversely affected as a result of an unfavorable resolution of the disputes and litigation

referred to above.

If we are unable to successfully leverage

technology to automate and drive efficiencies in our operations, our business could be adversely affected. We are building automation,

machine learning and other capabilities to drive efficiencies in our merchandising and fulfillment operations. As we continue to add capacity,

capabilities and automation, our operations will become increasingly complex and challenging. While we expect these technologies to improve

productivity in many of our merchandising operations, including pricing, copywriting, authentication, photography and photo retouching,

any flaws or failures of such technologies could cause interruptions in and delays to our operations which may harm our business. We are

increasing our investment in technology to support these efforts but they may not be effective in driving productivity, maintaining or

improving the experience for buyers and consignors or providing a positive return on investment. We have created our own purpose-built

technology to operate our business, but we also rely on technology from third parties. If these technologies do not perform in accordance

with our expectations, third parties change the terms and conditions that govern their relationships with us, or if competition increases

for the technology and services provided by third parties, our business may be harmed. In addition, if we are unable to add automation

to our operations, we may be unable to reduce the costs of processing consignments and fulfilling orders, which could cause delays in

buyers receiving their purchases. Any of these outcomes could harm our reputation and our relationships with our consignors and buyers.

Our advertising activity may fail to

drive growth in consignors and buyers. Our future growth and profitability will depend in large part upon the effectiveness

and efficiency of our advertising, promotion, public relations and marketing programs and we are investing heavily in these activities.

These brand promotion activities may not yield increased revenue and the efficacy of these activities will depend on a number of factors,

including our ability to do the following:

|

|

•

|

determine the effective creative message and media mix for advertising, marketing and promotional expenditures;

|

|

|

•

|

select the right markets, media and specific media vehicles in which to advertise;

|

|

|

•

|

identify the most effective and efficient level of spending in each market, media and specific media vehicle; and

|

|

|

•

|

efficiently manage marketing costs, to maintain acceptable consignor and buyer acquisition costs.

|

We closely monitor the effectiveness of our advertising

campaigns and changes in the advertising market, and adjust or re-allocate our advertising spend across channels, customer segments and

geographic markets in real-time to optimize the effectiveness of these activities. We expect to increase advertising spend in future periods

to continue driving our growth. Increases in the pricing of one or more of our marketing and advertising channels could increase our marketing

and advertising expenses or cause us to choose less expensive but possibly less effective marketing and advertising channels. If we implement

new marketing and advertising strategies, we may incur significantly higher costs than our current channels, which, in turn, could adversely

affect our operating results.

Implementing new marketing and advertising strategies

also could increase the risk of devoting significant capital and other resources to endeavors that do not prove to be cost effective.

We also may incur marketing and advertising expenses significantly in advance of the time we anticipate recognizing revenue associated

with such expenses and our marketing and advertising expenditures may not generate sufficient levels of brand awareness or result in increased

revenue. Even if our marketing and advertising expenses result in increased sales, the increase might not offset our related expenditures.

If we are unable to maintain our marketing and advertising channels on cost-effective terms or replace or supplement existing marketing

and advertising channels with similarly or more effective channels, our marketing and advertising expenses could increase substantially,

our consignor and buyer base could be adversely affected, and our business, operating results, financial condition and brand could suffer.

We have experienced seasonal and quarterly

variations in our revenue and operating results and, as a result, our quarterly results may fluctuate and could be below expectations.

Our business is seasonal and historically we have realized a disproportionate amount of our revenue and earnings for the year in the fourth

quarter as a result of the holiday season and seasonal promotions. We expect this to continue in the future. In anticipation of increased

ctivity during the fourth quarter, we incur significant additional expenses, including additional marketing and staffing in our sales

and customer support operations. In addition, we may experience an increase in our shipping costs due to complimentary upgrades, split-shipments

and additional long-zone shipments necessary to ensure timely delivery for the holiday season. At peak periods, there could also be further

delays in processing consigned goods or fulfilling buyer orders, which could lead to lower Sale Source and/or buyer satisfaction. As a

result of increased expenses or delays in shipping, if we experience lower than expected revenue during any fourth quarter, it may have

a disproportionately large impact on our operating results and financial condition for that year. Any factors that harm our fourth quarter

operating results, including disruptions in our Sale Sources’ willingness to sell or unfavorable economic conditions, or adverse

weather could have a disproportionate effect on our operating results for our entire fiscal year. In the future, our seasonal sales patterns

may become more pronounced, may strain our personnel and may cause a shortfall in revenue related to expenses in a given period, which

could substantially harm our business, operating results and financial condition.

Failure to comply with applicable laws or

regulations, including those relating to the sale of secondhand goods, may subject us to fines, penalties, loss of licensure, registration,

facility closures and approval or other governmental enforcement action. The sale of luxury goods through eBay’s online

marketplace is subject to regulation, including by regulatory bodies such as the U.S. Consumer Product Safety Commission, the Federal

Trade Commission, the U.S. Fish and Wildlife Service and other international, federal, state and local governments and regulatory authorities.

These laws and regulations are complex, vary from state to state and change often. We monitor these laws and regulations and adjust our

business practices as warranted to comply. We receive luxury goods from numerous Sale Sources located in all 50 U.S. states and Puerto

Rico, and the goods we receive from our Sale Sources may be subject to regulation. Our standard terms and conditions require Sale Sources

to comply with applicable laws when transferring their goods. Failure of our Sale Sources to comply with applicable laws, regulations

and contractual requirements could lead to litigation or other claims against us, resulting in increased legal expenses and costs. Moreover,

failure by us to effectively monitor the application of these laws and regulations to our business, and to comply with such laws and regulations,

may negatively affect our brand and subject us to penalties and fines.

Numerous U.S. states and municipalities, including

the States of California, New York and Florida, have regulations regarding the handling and sale of secondhand goods, and licensing requirements

for secondhand dealers. Such government regulations could require us to change the way we conduct business, or our buyers to conduct their

purchases in ways that increase costs or reduce revenues, such as prohibiting or otherwise restricting the sale or shipment of certain

items in some locations. We could also be subject to business interruption, fines or other penalties which in the aggregate could harm

our business. To the extent we fail to comply with requirements for secondhand dealers, we may experience unanticipated permanent or temporary

shutdowns of our facilities which may negatively affect our ability to increase the supply of our goods, result in negative publicity

and subject us to penalties and fines.

Additionally, the luxury goods our Sale Sources

sell could be subject to recalls and other remedial actions and product safety, labeling and licensing concerns may require us to voluntarily

remove selected goods from our online marketplace. Such recalls or voluntary removal of goods can result in, among other things, lost

sales, diverted resources, potential harm to our reputation and increased customer service costs and legal expenses, which could have

a material adverse effect on our operating results.

Some of the luxury goods sold through our online

marketplace on behalf of our consignors may expose us to product liability claims and litigation or regulatory action relating to personal

injury, environmental or property damage. We cannot be certain that our insurance coverage will be adequate for liabilities actually incurred

or that insurance will continue to be available to us on economically reasonable terms or at all. In addition, while all of our vendor

agreements contain a standard indemnification provision, certain vendors may not have sufficient resources or insurance to satisfy their

indemnity and defense obligations which may harm our business.

Shipping is a critical part of our business

and any changes in our shipping arrangements or any interruptions in shipping could adversely affect our operating results. We

currently rely on major vendors for our shipping. If we are not able to negotiate acceptable pricing and other terms with these vendors

or they experience performance problems or other difficulties, it could negatively impact our operating results and our Sale Sources’

and buyers’ experience. In addition, our ability to receive inbound shipments efficiently and ship luxury goods to buyers may be

negatively affected by inclement weather, fire, flood, power loss, earthquakes, labor disputes, acts of war or terrorism and similar factors.

Because of the seasonality of our business, we tend to ship more goods in the fourth quarter than any other quarter. Disruption to delivery

services due to winter weather in the fourth quarter could result in delays that could adversely affect our reputation or operational

results. If our goods are not delivered in a timely fashion or are damaged or lost during the delivery process, our Sale Sources or buyers

could become dissatisfied and cease using our services, which would adversely affect our business and operating results.

We may incur significant losses from fraud.

We have in the past incurred and may in the future incur losses from various types of fraudulent transactions, including the use of stolen

credit card numbers, claims that a sale of a good was not authorized and that a buyer did not authorize a purchase. In addition to the

direct costs of such losses, if the fraud is related to credit card transactions and becomes excessive, it could result in us paying higher

fees or losing the right to accept credit cards for payment. Under current credit card practices, we are liable for fraudulent credit

card transactions because we do not obtain a cardholder’s signature. Our failure to adequately prevent fraudulent transactions could

damage our reputation, result in litigation or regulatory action or lead to expenses that could substantially impact our operating results.

We could be required to pay or collect sales

taxes in jurisdictions in which we do not currently do so, with respect to past or future sales, to the detriment of our business and

operating results. An increasing number of states have considered or adopted laws that impose tax collection obligations on out-of-state

sellers of goods. Additionally, the Supreme Court of the United States recently ruled in South Dakota v. Wayfair, Inc. et al (“Wayfair”),

that online sellers can be required to collect sales tax despite not having a physical presence in the state of the customer. In response

to Wayfair, or otherwise, states or local governments and taxing authorities may adopt, or begin to enforce, laws requiring us to calculate,

collect and remit taxes on sales in their jurisdictions. While we collect and remit sales taxes in every state that requires sales taxes

to be collected, including states where we do not have a physical presence, the adoption of new laws by, or a successful assertion by

the taxing authorities of, one or more state or local governments requiring us to collect taxes where we presently do not do so, or to

collect more taxes in a jurisdiction in which we currently do collect some taxes, could result in substantial tax liabilities, including

taxes on past sales, as well as penalties and interest. The imposition by state governments and taxing authorities of sales tax collection

obligations on out-of-state ecommerce businesses could also create additional administrative burdens for us, put us at a competitive

disadvantage if they do not impose similar obligations on our competitors and decrease our future sales, which could have a materially

adverse impact on our business and operating results.

Application of existing tax laws, rules or

regulations are subject to interpretation by taxing authorities. The application of the income and tax laws is subject to interpretation.

Although we believe our tax methodologies are compliant, a taxing authority’s final determination in the event of a tax audit could

materially differ from our past or current methods for determining and complying with our tax obligations, including the calculation of

our tax provisions and accruals, in which case we may be subject to additional tax liabilities, possibly including interest and penalties.

Furthermore, taxing authorities have become more aggressive in their interpretation and enforcement of such laws, rules and regulations

over time, as governments are increasingly focused on ways to increase revenues. This has contributed to an increase in audit activity

and stricter enforcement by taxing authorities. As such, additional taxes or other assessments may be in excess of our current tax reserves

or may require us to modify our business practices to reduce our exposure to additional taxes going forward, any of which may have a material

adverse effect on our business, results of operations, financial condition and prospects.

Amendments to existing tax laws, rules or

regulations or enactment of new unfavorable tax laws, rules or regulations could have an adverse effect on our business and operating

results. Many of the underlying laws, rules and regulations imposing taxes and other obligations were established before the growth

of the internet and e-commerce. U.S. federal, state and local taxing authorities are currently reviewing the appropriate treatment of

companies engaged in internet commerce and considering changes to existing tax or other laws that could levy sales, income, consumption,

use or other taxes relating to our activities, and/or impose obligations on us to collect such taxes. If such tax or other laws, rules

or regulations are amended or if new unfavorable laws, rules or regulations are enacted, the results could increase our tax payments or

other obligations, prospectively or retrospectively, subject us to interest and penalties, decrease the demand for our services if we

pass on such costs to our buyers or consignors, result in increased costs to update or expand our technical or administrative infrastructure

or limit the scope of our business activities, if we decided not to conduct business in particular jurisdictions. As a result, these changes

may have a material adverse effect on our business, results of operations, financial condition and prospects.

Recently enacted legislation commonly referred

to as the Tax Cuts and Jobs Act of 2017 made a number of significant changes to the current U.S. federal income tax rules, including reducing

the generally applicable corporate tax rate from 35% to 21%, imposing additional limitations on the deductibility of interest, placing

limits on the utilization of net operating losses and making substantial changes to the international tax rules. Many of the provisions

of the Tax Cuts and Jobs Act still require guidance through the issuance and/or finalization of regulations by the U.S. Department of

the Treasury in order to fully assess their effect, and there may be substantial delays before such regulations are promulgated and/or

finalized, increasing the uncertainty as to the ultimate effect of the Tax Cuts and Jobs Act on us and our stockholders. There also may

be technical corrections legislation or other legislative changes proposed with respect to the Tax Cuts and Jobs Act, the effect of which

cannot be predicted and may be adverse to us or our stockholders.

We do not have a successful operating history;

we do not have any operating history with respect to our luxury retail business. While we have generated increasing sales period

to period since our October 2020 acquisition of privately-held SFL Maven Inc., we are without a profitable history of operations in the

luxury retail business, which makes an investment in our common stock speculative in nature. Because of this lack of a profitable operating

history, it is difficult to forecast our future operating results. Additionally, our operations will be subject to risks inherent in the

establishment of a new business, including, among other factors, efficiently deploying our capital, developing and implementing our marketing

campaigns and strategies and developing awareness and acceptance of our business. Our performance and business prospects will suffer,

in particular, if we are unable to:

|

|

•

|

obtain access to inventory on acceptable terms;

|

|

|

•

|

achieve market acceptance of the our business;

|

|

|

•

|

establish long-term customer relationships.

|

Natural disasters and other events beyond

our control could materially adversely affect us. Natural disasters or other catastrophic events may cause damage or disruption

to our operations, international commerce and the global economy, and thus could have a strong negative effect on us. Our business operations

are subject to interruption by natural disasters, fire, power shortages, pandemics and other events beyond our control. Although we maintain

crisis management and disaster response plans, such events could make it difficult or impossible for us to deliver our services to our

customers and could decrease demand for our services. In the spring of 2020, large segments of the U.S. and global economies were impacted

by COVID-19, a significant portion of the U.S. population are subject to “stay at home” or similar requirements. The extent

of the impact of COVID-19 on our operational and financial performance will depend on certain developments, including the duration and

spread of the outbreak, impact on our customers and our sales cycles, impact on our customer, employee or industry events, and effect

on our vendors, all of which are uncertain and cannot be predicted. At this point, the extent to which COVID-19 may impact our financial

condition or results of operations is uncertain. To date, the COVID-19 outbreak, has significantly impacted global markets, U.S. employment

numbers, as well as the business prospects of many small businesses (our potential clients). To the extent COVID-19 continues to wreak

havoc on the markets and limits investment capital or personally impacts any of our key employees, it may have significant impact on our

results and operations.

We may not be able to compete successfully

against companies with substantially greater resources. The luxury retail industry in which we operate in general is subject to

intense and increasing competition. Some of our competitors may have greater capital resources, facilities, and diversity of product lines,

which may enable them to compete more effectively in this market. Our competitors may devote their resources to developing and marketing

products that will directly compete with our product lines. Due to this competition, there is no assurance that we will not encounter

difficulties in obtaining revenues and market share or in the positioning of our products. There are no assurances that competition in

our respective industries will not lead to reduced prices for our products. If we are unable to successfully compete with existing companies

and new entrants to the market this will have a negative impact on our business and financial condition.

Our business may not achieve wide market

acceptance. Without significant funds with which to market our luxury retail goods, our business may not succeed in attracting

sufficient customer interest and follow-on sales to generate a profit. There is no assurance that, even with adequate funds with which

to market our luxury retail goods, our business will ever earn a profit from its operations.

We will remain in an illiquid financial position

and face a cash shortage, unless and until we obtain needed capital. Currently, we are in an illiquid financial position and will

remain in such a position, unless our business generates significant operating revenues, and/or we obtain needed capital through this

offering, of which there is no assurance. There is no assurance that we will ever achieve adequate liquidity.

We may not compete successfully with other

businesses in the luxury retail goods industry. Our business competes, directly or indirectly, with local, national and international

purveyors of luxury retail goods. Our business may not be successful in competing against its competitors, many of whom have longer operating

histories, significantly greater financial stability and better access to capital markets and credit than we do. We also expect to face

numerous new competitors offering goods and related services comparable to those offered by our business. There is no assurance that we

will be able to compete successfully against our competition.

The purchase of our products is discretionary,

and may be negatively impacted by adverse trends in the general economy which would make it more difficult for us to sell our products.

Our business is affected by general economic conditions since our products are discretionary and we depend, to a significant extent, upon

a number of factors relating to discretionary consumer spending. These factors include economic conditions and perceptions of such conditions

by consumers, employment rates, level of consumers’ disposable income, business conditions, interest rates, consumer debt levels

and availability of credit. Consumer spending on our products may be adversely affected by changes in general economic conditions.

The success of our business depends on our

ability to market and advertise our products effectively. Our ability to establish effective marketing and advertising campaigns

is the key to our success. Our advertisements promote our corporate image, our dietary and nutritional products and the pricing of such

products. If we are unable to increase awareness of our brands and our products, we may not be able to attract new distributors for our

products. Our marketing activities may not be successful in promoting the products we sell or pricing strategies or in retaining and increasing

our distributor base. We cannot assure you that our marketing programs will be adequate to support our future growth, which may result

in a material adverse effect on our results of operations.

Risks Related to Compliance and Regulation

We will not have reporting obligations under

Sections 14 or 16 of the Securities Exchange Act of 1934, nor will any shareholders have reporting requirements of Regulation 13D or 13G,

nor Regulation 14D. So long as our common shares are not registered under the Exchange Act, our directors and executive officers

and beneficial holders of 10% or more of our outstanding common shares will not be subject to Section 16 of the Exchange Act. Section

16(a) of the Exchange Act requires executive officers and directors and persons who beneficially own more than 10% of a registered class

of equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports

concerning their ownership of common shares and other equity securities, on Forms 3, 4 and 5, respectively. Such information about our

directors, executive officers and beneficial holders will only be available through periodic reports we file with OTC Markets.

Our common stock is not registered under the Exchange

Act and we do not intend to register our common stock under the Exchange Act for the foreseeable future; provided, however, that we will

register our common stock under the Exchange Act if we have, after the last day of any fiscal year, more than either (1) 2,000 persons;

or (2) 500 shareholders of record who are not accredited investors, in accordance with Section 12(g) of the Exchange Act.

Further, as long as our common stock is not registered

under the Exchange Act, we will not be subject to Section 14 of the Exchange Act, which, among other things, prohibits companies that

have securities registered under the Exchange Act from soliciting proxies or consents from shareholders without furnishing to shareholders

and filing with the SEC a proxy statement and form of proxy complying with the proxy rules.

The reporting required by Section 14(d) of the

Exchange Act provides information to the public about persons other than the company who is making the tender offer. A tender offer is

a broad solicitation by a company or a third party to purchase a substantial percentage of a company’s common stock for a limited

period of time. This offer is for a fixed price, usually at a premium over the current market price, and is customarily contingent on

shareholders tendering a fixed number of their shares.

In addition, as long as our common stock is not

registered under the Exchange Act, our company will not be subject to the reporting requirements of Regulation 13D and Regulation 13G,

which require the disclosure of any person who, after acquiring directly or indirectly the beneficial ownership of any equity securities

of a class, becomes, directly or indirectly, the beneficial owner of more than 5% of the class.

There may be deficiencies with our internal

controls that require improvements. Our company is not required to provide a report on the effectiveness of our internal controls

over financial reporting. We are in the process of evaluating whether our internal control procedures are effective and, therefore, there

is a greater likelihood of undiscovered errors in our internal controls or reported financial statements as compared to issuers that have

conducted such independent evaluations.

Risks Related to Our Organization and Structure

As a non-listed company conducting an exempt

offering pursuant to Regulation A, we are not subject to a number of corporate governance requirements, including the requirements for

independent board members. As a non-listed company conducting an exempt offering pursuant to Regulation A, we are not subject

to a number of corporate governance requirements that an issuer conducting an offering on Form S-1 or listing on a national stock exchange

would be. Accordingly, we are not required to have (a) a board of directors of which a majority consists of independent directors under

the listing standards of a national stock exchange, (b) an audit committee composed entirely of independent directors and a written audit

committee charter meeting a national stock exchange’s requirements, (c) a nominating/corporate governance committee composed entirely

of independent directors and a written nominating/ corporate governance committee charter meeting a national stock exchange’s requirements,

(d) a compensation committee composed entirely of independent directors and a written compensation committee charter meeting the requirements

of a national stock exchange, and (e) independent audits of our internal controls. Accordingly, you may not have the same protections

afforded to shareholders of companies that are subject to all of the corporate governance requirements of a national stock exchange.

Our holding company structure makes us dependent

on our subsidiaries for our cash flow and could serve to subordinate the rights of our shareholders to the rights of creditors of our

subsidiaries, in the event of an insolvency or liquidation of any such subsidiary. Our company acts as a holding company and,

accordingly, substantially all of our operations are conducted through our subsidiaries. Such subsidiaries will be separate and distinct

legal entities. As a result, substantially all of our cash flow will depend upon the earnings of our subsidiaries. In addition, we will

depend on the distribution of earnings, loans or other payments by our subsidiaries. No subsidiary will have any obligation to provide

our company with funds for our payment obligations. If there is an insolvency, liquidation or other reorganization of any of our subsidiaries,

our shareholders will have no right to proceed against their assets. Creditors of those subsidiaries will be entitled to payment in full

from the sale or other disposal of the assets of those subsidiaries before our company, as a shareholder, would be entitled to receive

any distribution from that sale or disposal.

Risks Related to a Purchase of the Offered Shares

The outstanding shares of our Series A Preferred

Stock preclude current and future owners of our common stock from influencing any corporate decision. Our sole officer and director,

Joseph Ladin, owns all of the outstanding shares of our Series A Preferred Stock. The Series A Preferred Stock has the following voting

rights: each share of Series A Preferred Stock shall have voting rights equal to four times the sum of (a) all shares of our common stock

issued and outstanding at the time of voting plus (b) the total number of votes of all other classes of preferred stock which are issued

and outstanding at the time of voting, divided by the number of shares of Series A Preferred Stock issued and outstanding at the time

of voting. Mr. Ladin, will, therefore, be able to control the management and affairs of our company, as well as matters requiring the

approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our

assets, and any other significant corporate transaction. (See “Security Ownership of Certain Beneficial Owners and Management”).

There is no minimum offering and no person

has committed to purchase any of the Offered Shares. We have not established a minimum offering hereunder, which means that we

will be able to accept even a nominal amount of proceeds, even if such amount of proceeds is not sufficient to permit us to achieve any

of our business objectives. In this regard, there is no assurance that we will sell any of the Offered Shares or that we will sell enough

of the Offered Shares necessary to achieve any of our business objectives. Additionally, no person is committed to purchase any of the

Offered Shares.

Our Articles of Incorporation and Bylaws

limit the liability of, and provide indemnification for, our officers and directors. Our Articles of Incorporation generally limit

our officers’ and directors’ personal liability to our company and our shareholders for breach of a fiduciary duty as an officer

or director except for breach of the duty of loyalty or acts or omissions not made in good faith or which involve intentional misconduct

or a knowing violation of law. Our Articles of Incorporation and Bylaws, provide indemnification for our officers and directors to the

fullest extent authorized by the Wyoming Statutes against all expense, liability, and loss, including attorney's fees, judgments, fines

excise taxes or penalties and amounts to be paid in settlement reasonably incurred or suffered by an officer or director in connection

with any action, suit or proceeding, whether civil or criminal, administrative or investigative (hereinafter a "Proceeding"),

to which the officer or director is made a party or is threatened to be made a party, or in which the officer or director is involved

by reason of the fact that he is or was an officer or director of our company, or is or was serving at our request whether the basis of

the Proceeding is an alleged action in an official capacity as an officer or director, or in any other capacity while serving as an officer

or director. Thus, we may be prevented from recovering damages for certain alleged errors or omissions by the officers and directors for

liabilities incurred in connection with their good faith acts for us. Such an indemnification payment might deplete the our assets. Shareholders

who have questions regarding the fiduciary obligations of our officers and directors should consult with independent legal counsel. It

is the position of the SEC that exculpation from and indemnification for liabilities arising under the Securities Act and the rules and

regulations thereunder is against public policy and therefore unenforceable.

Shareholders who hold unregistered “restricted

securities” will be subject to resale restrictions pursuant to Rule 144, due to the fact that we are deemed to be a former “shell

company.” Pursuant to Rule 144 promulgated under the Securities Act of 1933, as amended (the “Securities Act”),

a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting