Golden Anvil Concentrates Received and New Process Tested

January 31 2011 - 7:00AM

Marketwired

Royal Mines and Minerals Corp. (OTCBB: RYMM) (Royal Mines), an

exploration stage company focused on the development of mining

projects in North America, is pleased to announce that the first

concentrate shipment from the new Golden Anvil concentration plant

has arrived at our Phoenix facility. Under the terms of a

Memorandum of Understanding dated October 19, 2010 (the "MOU") with

Golden Anvil SA de CV, we provided financing for the construction

of the new concentration plant and are processing the concentrates

at our Phoenix Facility. We are currently assaying the concentrates

to determine the value per ton. Another shipment of concentrate of

approximately 7 tons is expected to ship this week. Approximately

150 truckloads (3,000 tons) of head ore has been stockpiled at the

concentration plant and is ready to run through the plant over the

next several weeks.

Under the MOU, we have agreed, subject to completion of a formal

agreement, to form a joint venture with Golden Anvil. Golden Anvil

will contribute the Golden Anvil Mine consisting of mineral claims

covering 47,618 acres in the state of Nayarit, Mexico (the "Golden

Anvil Mine") and the concentration plant. We will contribute

$3,000,000, of which $900,000 has been advanced, for the building

of the concentration plant. We have had several mining

professionals visit the Golden Anvil Mine recently and we are

continuing to make improvements to the concentration plant and

mining plan. A full time metallurgical engineer was hired by Golden

Anvil a few weeks ago and is assisting in the management of the

plant operations. Current process rates are at 100 tons of head ore

per day and it is expected that we will be at 200 tons per day

within 45 days. Please see our new video of the Golden Anvil mine

site and concentration plant on our website (www.royalmmc.com).

We also report that we have been testing a new chemical precious

metals extraction process licensed to us. We refer to this as "The

Cholla Process." This process was originally developed by a PhD

chemical engineer and has been researched for several years. We

have run over 75 lab scale tests as well as over 100 larger pilot

scale tests on various materials in our own facility. We have a

separate pilot plant running tests independent of our main plant to

help validate the process. We have also contracted with an

independent metallurgical laboratory to review and test the process

under chain of custody protocol. Initial results from these tests

appear compelling and warrant further testing to establish the

commercial viability of the process. If this process proves viable

it could help us in recovery of precious metals from a number of

materials, including ore from the Piute claims in Nevada. We expect

to have definitive results from these tests within 30 days.

About Royal Mines and Minerals Corp.:

Royal Mines and Minerals Corp. is a minerals exploration

company. Our primary objectives are to 1) commercially extract and

refine precious and base metals from our own and others mining

assets, 2) joint venture, acquire and develop mining projects in

North America, and 3) generate ongoing revenues from the licensing

of our proprietary, environmentally-friendly lixiviation process.

We have not yet realized significant revenues from our primary

objectives. Additional information is available on Royal Mines'

website at www.royalmmc.com and in its filings with the U.S.

Securities and Exchange Commission.

Forward-Looking Statements

Statements in this news release that are not historical facts

are forward-looking statements that are subject to risks and

uncertainties. Words such as "expects," "intends," "plans," "may,"

"could," "should," "anticipates," "likely," "believes" and words of

similar import also identify forward-looking statements.

Forward-looking statements are based on current facts and analyses

and other information that are based on forecasts of future

results, estimates of amounts not yet determined and assumptions of

management. The volume and value of concentrates from the Golden

Anvil concentration plant is subject to many uncertainties and

there is no assurance that positive cash flow will be achieved when

contemplated or at all. There is no assurance that Royal Mines will

be able to meet its required funding under the joint venture with

Golden Anvil or that a formal joint venture agreement will be

concluded. There is also no assurance that testing of the Cholla

process will be successful or result in a decision that the process

is commercially viable.

Cautionary Note to Investors

The United States Securities and Exchange Commission permits

mining companies, in their filings with the SEC, to disclose only

those mineral deposits that a company can economically and legally

extract or produce. We use certain terms on this press release,

such as "reserves," "resources," "geologic resources," "proven,"

"probable," "measured," "indicated," and "inferred," that the SEC

guidelines strictly prohibit us from including in our filings with

the SEC. Investors are urged to consider closely the disclosure in

our SEC filings, File No. 000-52391. You can review and obtain

copies of these filings from the SEC's website at

http://www.sec.gov/edgar.shtml.

Add to Digg Bookmark with del.icio.us Add to Newsvine

For more information contact: Royal Mines and Minerals Corp.

Jason S. Mitchell CFO, Secretary and Treasurer (702) 588-5973 Email

Contact

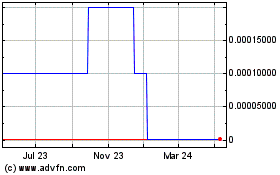

Royal Mines and Minerals (CE) (USOTC:RYMM)

Historical Stock Chart

From Dec 2024 to Jan 2025

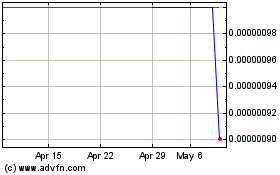

Royal Mines and Minerals (CE) (USOTC:RYMM)

Historical Stock Chart

From Jan 2024 to Jan 2025