Rolls-Royce Shares Soar After It Sticks to 2020 Earnings Target -- Update

March 07 2018 - 4:42AM

Dow Jones News

By Robert Wall

LONDON--Rolls-Royce Holdings (RR.LN) shares surged Wednesday

after the British blue-chip stuck to a closely watched 2020

earnings target despite problems with two of its highest-profile

plane engines powering Boeing Co. (BA) and Airbus SE (AIR.FR)

airliners.

The company also reported a swing to net profit in 2017.

Rolls-Royce has been struggling with component flaws on engines

powering some Boeing 787 Dreamliners and Airbus A380 superjumbos.

The blades are breaking more quickly than expected, forcing the

company to repair them more frequently than expected and resulting

in airline operators idling planes.

"This is causing significant disruption to some of our customers

and obviously we regret that disruption," Chief Executive Warren

East told reporters.

He said the company is making "good progress" on devising fixes

for the parts on the Trent 1000, used by some carriers on Boeing

787 Dreamliners, and the Trent 900 engines powering some Airbus

A380 double-deckers.

Rolls-Royce on Wednesday said the cash costs associated with the

problem will double this year compared with the 170 million pounds

($235.8 million) free cash-flow impact recorded in 2017. Despite

this, Mr. East said the company is sticking to its free cash-flow

target of delivering about GBP1 billion around 2020.

Shares in Rolls-Royce rose 8.20% in early London trading.

Rolls-Royce has made a big bet on powering long-range airplane

after exiting the market to power more numerous single-aisle planes

six years ago. It expects to power about half the world's long-haul

planes by 2020.

Rolls-Royce, which is no longer affiliated with the luxury car

maker, reported GBP4.2 billion net profit in 2017 compared with a

GBP4 billion loss, reflecting non-cash accounting adjustments to

its currency hedges. The more closely watched underlying pretax

profit, a figure that strips out one-time items and currency

fluctuations, rose 31% to GBP1.07 billion.

Rolls-Royce said it will take until 2022 for the Trent 1000s and

Trent 900s to be fully upgraded with more durable components.

Mr. East said the company will continue restructuring plans and

will shed white-collar jobs after a previous round of cuts saw 600

managers exit the company. The company hasn't set a cost savings

target or defined, yet, how many jobs may go, he said.

"There is more simplification we need to do to make ourselves

truly competitive and fit for the future," Mr. East said.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

March 07, 2018 04:27 ET (09:27 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

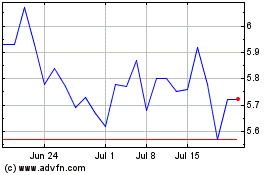

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024