Rolls-Royce Earnings Headwinds Far From Easing -- 3rd Update

November 16 2016 - 6:44AM

Dow Jones News

By Robert Wall

LONDON-- Rolls-Royce Holdings PLC faces sustained pressure on

earnings from new accounting rules and weak demand even as Chief

Executive Warren East said he is ready to start planning the

long-term future of the British aircraft engine maker.

Rolls-Royce, a flagship of U.K. industry, has rarely been under

as much strain as it is today.

Authorities in the U.S. and U.K. are investigating the company

for corruption. In a sweeping reorganization, Mr. East has pruned

the company's executive ranks--a fifth of management posts face the

ax--eliminated thousands of other jobs, and slashed the dividend

after a series of profit warnings, which unnerved shareholders.

The CEO, who joined in mid-2015, acknowledged on Wednesday that

the company has "a long way to go on improving the operational

performance of the business" after change has been slower than

hoped.

Mr. East signaled weak sales of business-jet engines, a segment

where Rolls-Royce has been struggling, would remain under pressure

in 2017. Sales of marine engines for vessels serving the oil and

gas market would remain depressed next year too.

Rolls-Royce, no longer affiliated with the luxury car maker,

forecasts a drop in revenue and profit for this year. Chief

Financial Officer David Smith said profit should improve modestly

in the coming years and that cash flow should improve in 2017.

Rolls-Royce, which could burn through GBP300 million in cash this

year, is targeting "something around or above break-even" for 2017,

Mr. Smith said.

Reported earnings are set to take a hit from new accounting

rules that will take effect in 2018 and alter how the company

reports earnings. The drag on sales and profit will last through

the decade.

Shares in Rolls-Royce fell almost 3% in mid-morning London

trading.

Rolls-Royce, typically sells aircraft engines at a loss and

makes up the money later on servicing them. Rolls-Royce masked the

early losses by booking some of the assured services revenue early.

Under new accounting rules those losses will need to be reflected

immediately and services revenue can't be booked until the work

takes place.

The company said sales for its new engines last year would have

been GBP700 million lower than reported and revenue for services to

maintain those engines would have been reduced by GBP200 million.

The company reported 2015 underlying revenue for new engines of

GBP3.3 billion and GBP3.7 billion for services.

Under the new accounting rules, called International Financial

Reporting Standard 15, long-term profits would be higher. Mr. Smith

said the accounting rules would weigh on earnings through 2020,

with reported earnings expected to benefit from the change possibly

by 2025.

Still, Mr. East said, it was time to look further ahead and

define "an appropriate vision for the future" for Rolls-Royce, Mr.

East said.

The strategic review could lead to more changes at Rolls-Royce

in 2017, though the company, which generates most of its profits

from selling and servicing commercial aircraft engines for Boeing

Co. and Airbus Group SE, would remain a diversified engine

provider, Mr. East said.

Some investors have urged Rolls-Royce to focus on commercial

aerospace and shed other activities, such as marine engines.

Activist investor ValueAct Capital Management LP this year joined

the Rolls-Royce board, though pledged not to push for strategy

changes until 2018.

For now, Rolls-Royce said it is on track to achieve promised

yearly cost savings toward the top end of a target range of GBP150

million ($187 million) to GBP200 million from next year.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

November 16, 2016 06:29 ET (11:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

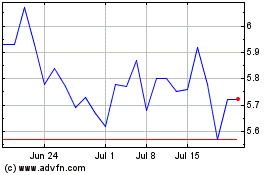

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024