U.K. Investor Neil Woodford Sells Rolls-Royce Stake

December 09 2015 - 8:10PM

Dow Jones News

One of Britain's best know long-term investors has exited his

holding in Rolls-Royce Holdings PLC citing a lack of confidence in

the prospects of the British engine maker.

The move is a further blow to Rolls-Royce, which has suffered a

series of profit warnings and last month warned investors it may

cut its dividend. The disclosure prompted the worst selloff in 15

years.

Neil Woodford, a highly regarded British investment fund

manager, who has held Rolls-Royce stock for almost a decade, said

his CF Woodford Equity Income Fund and the Woodford Patient Capital

Trust fund have sold their Rolls-Royce shares.

"The problems, which initially had affected the military

aerospace and marine businesses, now appear to have spread to the

core civil aerospace business. This has resulted in material

downgrades to profit and cash expectations, and to such an extent

that it is now likely that the dividend will be cut in 2016," Mr.

Woodford said on his company's website. "This has shaken my

confidence in the investment case and so the position has been sold

across all mandates," he added.

Mr. Woodford was Rolls-Royce's 12th largest investor with 1.6%

of the stock, according to FactSet. It held almost 35 million

shares at one point this year.

Rolls-Royce Chief Executive Warren East last month announced

plans for sweeping a restructuring at the company, including

cutting layers of management to become more responsive to changing

market conditions.

London-based Rolls-Royce, which makes aircraft engines for

Boeing Co.and Airbus Group SE widebody jets, on Wednesday said it

would not comment on the actions of individual investors, However,

it added in a statement that "we are strongly positioned in

attractive markets, with a record order book and are on course to

increase our share of the global installed base of widebody

aircraft to over 50%."

Mr. Woodford's decision to sell comes as U.S. activist investor

ValueAct Capital Management LP has become Rolls-Royce's largest

shareholder and is seeking a board seat. ValueAct's holding in

Rolls-Royce tops 10% of the company's stock.

Rolls-Royce has struggled to deliver on previous cost-cutting

efforts and been hit by weakening demand for some civil aircraft

engines, including aftermarket support. It also has lost market

share in the business jet engine market. Its marine engine business

has suffered from falling demand.

The company, which decades ago shed ties to the luxury car

maker, on Wednesday acknowledged it was undertaking business

transformation and said "while we are suffering the impact of

short-term headwinds in several of our markets, action is being

taken to make the business more resilient and sustainable through

our ongoing wide-ranging restructuring."

Shares in Rolls-Royce have slumped 32% this year.

Mr. Woodford said in the past he used share price dips as an

opportunity to add to his holdings in Rolls-Royce, betting the huge

order book would deliver profits and cash flows beyond 2017.

However, the latest profit warning last month "has changed this

view," he said.

Mr. East, who issued his first profit warning during the summer

on his second day in the chief executive job, last month indicated

that restructuring Rolls-Royce would take time.

The company suspended its medium-term earnings outlook

introduced only a year ago to give investors greater clarity and

said it would not be restored for at least a year. Mr. East said

the company first needed to fix excessively complex internal

accounting systems to improve its ability to judge Rolls-Royce's

likely fortunes. Still, he promised the company should generate

cash "comfortably" before 2020.

Mr., Woodford said he'd consider reinvesting in Rolls-Royce if

it turned out the caution in the business was misplaced.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

December 09, 2015 19:55 ET (00:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

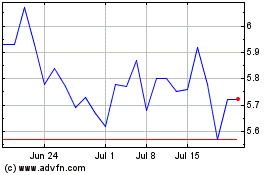

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Nov 2023 to Nov 2024