Rolls-Royce Shares Tumble As Costs Spiral

November 13 2015 - 3:03AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/13/15)

By Robert Wall

LONDON -- Rolls-Royce Holdings PLC warned it may cut its

dividend to cope with spiraling costs and profit shortfalls --

sending the jet engine maker's shares into their sharpest tailspin

in 15 years.

The company also disclosed for the first time on Thursday that

ValueAct Capital Management LP is seeking a board seat. The

activist investor revealed over the summer that it had built a

more-than-5% stake in the company.

Rolls-Royce has failed to deliver cost cuts across the business.

Orders for some of its older engine lines also have weakened, while

big capital outlays aimed at delivering newer engines won't

generate returns for years to come.

The company long ago split from the luxury car maker of the same

name, and makes the majority of its profit selling aircraft engines

for large commercial jets, like Boeing Co.'s 787 Dreamliner and

Airbus Group SE's A380. Those plane makers in recent years have

been delivering record numbers of planes and profits, but years of

failing to rein in spending damped the benefits for

Rolls-Royce.

The company remains one of the most recognized names on London's

blue-chip FTSE 100 stock market index and a mainstay of British

pension-fund portfolios.

Rolls-Royce's biggest competitor in commercial-aviation engines,

General Electric Co., has benefited from a boom in orders for

smaller, narrow-body jets. But Rolls-Royce exited the market to

power single-aisle jets several years ago to focus on other

markets.

Rolls-Royce said full-year underlying pretax profit, a measure

that excludes some costs, is expected to be at the low end of its

previously projected range of GBP 1.33 billion to GBP 1.48 billion

($2.02 billion to $2.25 billion). It also said its 2016 earnings

outlook had weakened. Further rattling investors, it suspended its

medium-term earnings guidance, which it started providing not much

more than a year ago.

The company said it would decide by February, when it reports

full-year earnings, whether to cut its dividend. Shares fell 20% to

GBP 5.37 in London. Shares in Rolls-Royce have retreated more than

50% since February 2014, when it issued the first in a string of

profit warnings.

"As a business, we carry too much fixed cost and are inflexible

in managing this in response to changes in market conditions,"

Chief Executive Warren East said in a statement. The company's

balance sheet and liquidity were strong, Mr. East said, but he

called the cost issues "unacceptable."

The company elevated Mr. East, a former CEO at microchip design

giant ARM Holdings PLC, to the top job in July, with a mandate to

turn the business around. Two days after joining, he issued his

first profit warning and initiated a broad operational review. The

same month ValueAct disclosed its holdings in Rolls-Royce.

Mr. East has engaged with ValueAct over his tenure, but it is

unclear if the investor has made any other requests aside from the

board seat. "They have some very good questions," Mr. East said on

Thursday, without detailing them. ValueAct couldn't immediately be

reached for comment.

Rolls-Royce faces upheavals across its product lines. Its

commercial aircraft engine business -- the biggest profit

contributor -- is moving from delivering well-established,

profit-generating engines, such as those powering Airbus A330

widebodies, to newer engines, like the TrentXWB, which powers

Airbus's latest long-haul plane.

Rolls-Royce has invested billions of dollars to develop the

engine and build production plants, but won't generate profit from

these new products for several years. The company's servicing

business also weakened as some of the older planes using its

engines are flying less. Its role in powering business jets was

hurt by its failure to invest in new products. And demand for

Rolls-Royce turbines, used to power ships and in electricity

generation, also has suffered.

Rolls-Royce disclosed initial findings of Mr. East's operational

review on Thursday. The review was aimed at finding ways to boost

Rolls-Royce's returns, though shies away from major shifts in

strategy.

The company said savings measures identified, including

streamlining senior management, should yield incremental gross cost

savings of between GBP 150 million and GBP 200 million a year from

2017. Rolls-Royce plans to spell out full details on these measures

in a Nov. 24 investor day.

Rolls-Royce said a previous cost-savings program was on track to

deliver a promised GBP 115 million in year-over-year savings in the

aerospace and marine businesses next year. The company has

announced big job cuts in both areas.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 13, 2015 02:48 ET (07:48 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

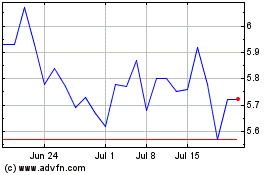

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024