UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): April 22, 2015

RIMROCK GOLD CORP.

(Exact name of registrant as specified

in its charter)

| Nevada |

|

333-149552 |

|

75-3266961 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3651 Lindell Rd. Suite D155

Las Vegas, NV 89103

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number,

including area code: 1-800-854-7970

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Item

1.01 Entry Into a Material Definitive Agreement

On

April 22, 2015, the Company entered into a Settlement and Release Agreement (the “Settlement Agreement”) with

Uptick Capital, LLC (“Uptick”) and Zahav Resources, Inc. (“Zahav”) in order to settle the disputes

over that certain consulting agreement between the Company and Uptick dated March 1, 2013. Pursuant to the Settlement

Agreement, the Company shall (i) pay to Uptick $25,502.59 as settlement amount plus legal fees and expenses incurred by

Uptick thereof (the “Cash Settlement Amount”); (ii) issue to Uptick 4,000,000 shares of the Company’s

common stock; and (iii) issue to Uptick and its assignees 400 shares of the Company’s newly designation class of

preferred stock named Series B Convertible Preferred Stock (the “Series B Preferred”).

In the event that any portion of the Cash Settlement

Amount remains outstanding following the date of the Settlement Agreement, the Company shall pay such outstanding portion of the

Cash Settlement Amount to Uptick in an amount which equals thirty percent (30%) of the funds raised from any debt or equity offering

of securities however if over $30,000 are raised by the Company the percentage payout increases to forty percent (40%) and such

payment shall be made prior to any other person or entity, including the Company, receiving any funds therefrom. As of the date

of this report, the Company has paid to Uptick $7,500 of the Cash Settlement Amount.

On July 8, 2015, the Company filed the certificate

of designation of the Series B Preferred with the Secretary of State of Nevada. The newly designation class of preferred stock

consists of five hundred (500) shares. Each holder of Series B Preferred may, from time to time and at any time, convert any or

all of such holder’s shares of Series B Preferred into fully paid and non-assessable shares of common stock of the Company

in an amount equal to one-tenth of one percent (0.10%) of the then issued and outstanding shares of the Company’s common

stock per share of Series B Preferred. Conversions of Series B Preferred shall be calculated and made on a post-conversion basis,

such that the number of the shares of common stock held by the holder immediately following the conversion of one share of Series

B Preferred would equal one-tenth of one percent (0.10%) of the total issued and outstanding shares of common stock immediately

following the conversion. Series B Preferred votes together with our common stock and is entitled to one (1) vote of common stock

for each preferred share held. In any liquidation, holders of our Series B Preferred will receive liquidation preference. Shares

of Series B Preferred have no dividend rights.

Of the 500 shares of Series B Preferred, 400

shares were issued to Uptick and its assignees and 100 shares were issued to Jordan Starkman, the President and Chief Executive

Officer of the Company.

The transaction includes customary representations, warranties and covenants. The foregoing description of

the transactions does not purport to be a complete statement of the parties’ rights and obligations under the Settlement

Agreement and is qualified in its entirety by reference to the Settlement Agreement, which is filed with this report as Exhibit

10.1.

Item

3.02 Unregistered Sale of Equity Securities.

The

disclosure set forth under Item 1.01 above is incorporated by reference into this Item 3.02.

The

shares of common stock and Series B Preferred were issued in reliance on the exemptions for the issuance of securities not involving

a public offering, as set forth in in Section 4(2) of the Securities Act of 1933, as amended.

Item

5.03 Amendments to Articles of Incorporation or Bylaws

The

disclosure set forth under Item 1.01 above is incorporated by reference into this Item 5.03.

On July 13, 2015, the Company filed a Certificate

of Amendment with the State of Nevada increasing the Company's authorized common stock from 1,900,000,000 to 2,900,000,000.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

Rimrock Gold Corp. |

| |

|

|

| Dated: July 17, 2015 |

By: |

/s/

Jordan Starkman |

| |

|

Name: Jordan Starkman |

| |

|

Title: President and Chief

Executive Officer |

RIMROCK GOLD CORP. 8-K

Exhibit 3.1

RIMROCK GOLD CORP. 8-K

Exhibit 3.2

RIMROCK GOLD CORP. 8-K

Exhibit 10.1

SETTLEMENT AND RELEASE AGREEMENT

THIS SETTLEMENT AND RELEASE AGREEMENT (this “Agreement”),

dated as of April 22, 2015, is entered into by and among (i) UPTICK CAPITAL, LLC, a limited liability company organized and existing

under the laws of the State of Connecticut (“Uptick”), (ii) ZAHAV RESOURCES, INC., a corporation incorporated under

the laws of the State of Delaware (“Zahav”); and (iii) RIMROCK GOLD CORP., a corporation incorporated under the laws

of the State of Nevada (“Rimrock”). Uptick, Zahav and Rimrock are collectively referred to herein as the “Parties,”

or each of them individually as a “Party”.

WHEREAS, a Consulting Agreement

has been executed on March 1, 2013 by and between Uptick and Rimrock and a subsequent verbal agreement has been consummated on

or about January 2015 (together, collectively, as amended, the “Consulting Agreements”), pursuant to which certain

consulting services were performed by Uptick, including, but not limited to, spending hundreds of hours making introductions to

investors (including, but not limited to, Redwood Fund LP (“Redwood”) and LH Financial Services Corp. (“LH”)),

making introductions to key executives, and lending substantial amounts of money to Rimrock from time to time in order to protect

Rimrock’s underlying business operations and mining claims;

WHEREAS, in consideration for Uptick’s

services and other consideration, Rimrock and Uptick discussed issuing to Uptick a non-dilutable preferred share of Rimrock stock

which is convertible into 80% of the issued and outstanding common stock of Rimrock (the “80% Non-Dilutable Share”)

and, in order for Rimrock to authorize the Non-Dilutable Share, Uptick executed certain documents permitting Rimrock to designate

a preferred class of Rimrock’s stock;

WHEREAS, Rimrock has refused to

issue the 80% Non-Dilutable Share to Uptick and, moreover, Rimrock has not paid Uptick anything as of the date hereof for Uptick’s

services rendered pursuant to the Consulting Agreements;

WHEREAS, subject to the terms and

conditions herein contained, the Parties have agreed to settle any and all disputes which may presently exist by and between them

upon Rimrock’s payment to Uptick of the following amounts: (i) Twenty Five Thousand Five Hundred Two and 59/100 United States

Dollars (US$25,502.59) plus legal fees and expenses incurred by Uptick as provided in Section 11 herein (the “Cash Settlement

Amount”); (ii) four million (4,000,000) shares of Rimrock common stock; (iii) four hundred (400) shares of Rimrock series

B preferred stock (the “Uptick Preferred Stock Settlement Amount”) (together, parts (ii) and (iii) herein, collectively,

the “Stock Settlement Amount”, and together with the Cash Settlement Amount, the “Settlement Amount”);

and (iv) such other covenants, terms and conditions as herein provided.

NOW, THEREFORE, IN CONSIDERATION OF THE

PROMISES, ACTS, RELEASES AND OTHER GOOD AND VALUABLE CONSIDERATION HEREINAFTER RECITED, THE SUFFICIENCY AND RECEIPT OF WHICH IS

HEREBY ACKNOWLEDGED, THE PARTIES HERETO, INTENDING TO BE LEGALLY BOUND, AGREE AS FOLLOWS:

1.

Conditions Precedent. The releases

contained in Section 4 hereof shall be effective immediately upon the satisfaction of the following to Uptick in its sole and absolute

discretion: (i) the full payment of the Settlement Amount to Lucosky Brookman LLP, as agent for Uptick (the “Agent”),

including, but not limited to share certificates evidencing the preferred and common stock to be delivered hereunder to Uptick

and Zahav, and in connection with Section 12 hereunder, to Redwood and LH; (ii) satisfaction of the covenants contained in Section

2 hereof; (iii) filing of the Certificate of Designation in the form attached hereto as Exhibit A (the “Certificate

of Designation”) with the Secretary of State of the state of incorporation of Rimrock; (iv) receipt by Uptick of a copy of

resolutions of the Board of Directors of Rimrock authorizing the execution of this Agreement, the filing of the Certificate of

Designation, the execution of the Transfer Agent Instruction Letter, the payment of the Cash Settlement Amount, and the issuance

and delivery of the Stock Settlement Amount (v) the execution and delivery by Rimrock and Rimrock’s Transfer Agent of the

Irrevocable Transfer Agent Instruction Letter in the form attached hereto as Exhibit B (the “Transfer Agent Instruction

Letter”). The Cash Settlement Amount shall be paid by wire transfer in immediately available funds to the attorney trust

account of the Agent. The share certificates representing the Stock Settlement Amount shall be physically delivered via overnight

courier and received by the Agent and such share certificates shall be in the applicable amounts in the name of Uptick.

2.

Covenants of Rimrock. In consideration

of Uptick and Zahav’s execution of this Agreement and their agreement to abide by the terms and conditions herein contained

(including, but not limited to, foregoing immediate enforcement of the Consulting Agreements), following the date hereof:

(i)

in the event that any portion of the Cash

Settlement Amount remains outstanding following the date hereof, Rimrock shall pay such outstanding portion of the Cash Settlement

Amount to Uptick in an amount which equals thirty percent (30%) of the funds raised from any debt or equity offering of securities

however if over $30,000 USD are raised by Rimrock the percentage payout increases to forty percent (40%) and such payment shall

be made prior to any other person or entity, including Rimrock, receiving any funds therefrom;

(ii)

neither Rimrock nor any of its subsidiaries

shall buy, sell, transfer and/or encumber in any way, any mining claim assets owned by Rimrock as of the date hereof without the

prior written consent of Uptick;

(iii)

Rimrock shall notify Uptick at least thirty

(30) business days prior to any payments due and owing by Rimrock with respect to any mining claims (including, but not limited

to, the Pescio payment, BLM fees, and county fees) and in the event that Rimrock fails to make such payments, Rimrock shall provide

Uptick a timely opportunity to either pay for or arrange for a third party to pay for those fees and, in the event that such fees

are paid for by Uptick or a third party (the “Paying Party”), Rimrock shall take any and all actions necessary or advisable

to immediately transfer ownership of the respective mining claims to the Paying Party. If the ownership of the mining claims are

transferred to the Paying Party of which Uptick or Zahav is a party, then, within fifteen (15) days of such transfer, Uptick shall

return the preferred shares being held by Uptick as of the date of such transfer to the treasury of Rimrock. Uptick shall not transfer

or sell more than ten percent (10%) of the preferred shares for a period of 6 months following the date hereof. In addition, the

Paying Party is responsible for all transfer fees of the mining claims;

(iv)

at any time following the conversion of

the Uptick Preferred Stock Settlement Amount by Uptick, or any portion thereof, Rimrock shall not, in any given calendar year,

without the prior written consent of Uptick, either directly or indirectly, issue or distribute, in the aggregate per calendar

year, an amount which equals more than thirty five percent (35%) of the issued and outstanding shares of Rimrock common stock (as

calculated as of the date hereof and as of January 1 of each subsequent calendar year) or issue any convertible securities or warrants

which, which when convertible or exercisable, would or may result in the issuance or distribution of an amount which equals more

than thirty five percent (35%) of the issued and outstanding shares of Rimrock common stock (as calculated as of the date hereof

and as of January 1 of each subsequent calendar year). Such restriction on share issuances shall exclude Rimrock’s obligation

to issue shares under existing outstanding promissory notes and warrants. Any future debt or equity offering of securities of Rimrock

over thirty five percent (35%), as provided above, will require the written consent of Uptick.; and

(v)

Rimrock shall not issue any additional

shares of preferred stock following the date hereof without the prior written consent of Uptick except as part of a financing.

3.

Covenant of Uptick. Uptick shall

return twenty percent (20%) of the Uptick Preferred Stock Settlement Amount which it receives pursuant to this Agreement in the

event that the mining claims are not maintained.

4.

Uptick/Zahav Release. Upon satisfaction

of the conditions precedent contained in Section 1 hereof in Uptick’s sole and absolute discretion, Uptick and Zahav, on

behalf of themselves and their respective direct or indirect predecessors, successors, parent companies, divisions, subsidiaries,

agents, affiliates, subrogees, insurers, trustees, trusts, administrators, representatives, personal representatives, legal representatives,

transferees, assigns and successors in interest of assigns, and any firm, trust, corporation, partnership, investment vehicle,

fund or other entity managed or controlled by Uptick and Zahav or in which Uptick and Zahav have or had a controlling interest

and the respective consultants, employees, legal counsel, officers, directors, managers, shareholders, stockholders, owners of

any of the foregoing (collectively, the “Uptick/Zahav Releasors”), in consideration of the satisfaction of the conditions

precedent contained in Section 1 hereof, hereby remise, release, acquit and forever discharge Rimrock and any and all of their

respective direct or indirect affiliates, parent companies, divisions, subsidiaries, agents, transferees, consultants, employees,

legal counsel, officers, directors, managers, shareholders, stockholders, stakeholders, owners, predecessors, successors, assigns,

successors in interest of assigns, subrogees, insurers, trustees, trusts, administrators, fiduciaries and representatives, legal

representatives, personal representatives and any firm, trust, corporation or partnership investment vehicle, fund or other entity

managed or controlled by Rimrock or in which Rimrock has or had a controlling interest, if any (collectively, the “Rimrock

Releasees”), of and from any and all federal, state, local, foreign and any other jurisdiction’s statutory or common

law claims (including claims for contribution and indemnification), causes of action, complaints, actions, suits, defenses, debts,

sums of money, accounts, covenants, controversies, agreements, promises, losses, damages, orders, judgments and demands of any

nature whatsoever, in law or equity, known or unknown, of any kind, including, but not limited to, claims or other legal forms

of action or from any other conduct, act, omission or failure to act, whether negligent, intentional, with or without malice, that

the Uptick/Zahav Releasors ever had, now have, may have, may claim to have, or may hereafter have or claim to have, against the

Rimrock Releasees, from the beginning of time up to and including the date hereof (the “Released Uptick/Zahav Claims”).

Nothing in the foregoing release shall release any claim to enforce this Agreement.

5.

Rimrock Release. Immediately upon

the execution hereof, Rimrock, on behalf of itself and its respective direct or indirect predecessors, successors, parent companies,

divisions, subsidiaries, agents, affiliates, subrogees, insurers, trustees, trusts, administrators, representatives, personal representatives,

legal representatives, transferees, assigns and successors in interest of assigns, and any firm, trust, corporation, partnership,

investment vehicle, fund or other entity managed or controlled by Rimrock or in which Rimrock has or had a controlling interest

and the respective consultants, employees, legal counsel, officers, directors, managers, shareholders, stockholders, owners of

any of the foregoing (collectively, the “Rimrock Releasors”), in consideration of Uptick and Zahav’s execution

of this Agreement and their agreement to abide by the terms and conditions herein contained, including, but not limited to, foregoing

immediate enforcement of the Consulting Agreements, hereby remise, release, acquit and forever discharge Uptick and Zahav and any

and all of their respective direct or indirect affiliates, parent companies, divisions, subsidiaries, agents, transferees, consultants,

employees, legal counsel, officers, directors, managers, shareholders, stockholders, stakeholders, owners, predecessors, successors,

assigns, successors in interest of assigns, subrogees, insurers, trustees, trusts, administrators, fiduciaries and representatives,

legal representatives, personal representatives and any firm, trust, corporation or partnership investment vehicle, fund or other

entity managed or controlled by Uptick and Zahav or in which Uptick or Zahav have or had a controlling interest, if any (collectively,

the “Uptick/Zahav Releasees”), of and from any and all federal, state, local, foreign and any other jurisdiction’s

statutory or common law claims (including claims for contribution and indemnification), causes of action, complaints, actions,

suits, defenses, debts, sums of money, accounts, covenants, controversies, agreements, promises, losses, damages, orders, judgments

and demands of any nature whatsoever, in law or equity, known or unknown, of any kind, including, but not limited to, claims or

other legal forms of action or from any other conduct, act, omission or failure to act, whether negligent, intentional, with or

without malice, that the Rimrock Releasors ever had, now have, may have, may claim to have, or may hereafter have or claim to have,

against the Uptick/Zahav Releasees, from the beginning of time up to and including the date hereof (the “Released Rimrock

Claims”). Nothing in the foregoing release shall release any claim to enforce this Agreement.

6.

Release of Unknown Claims: Upon satisfaction

of the conditions precedent contained in Section 1 hereof to the satisfaction of Uptick in its sole and absolute discretion and

upon the execution hereof by Rimrock, the following releases and provisions will be automatically effective:

(a)

The Parties stipulate and agree that the

Uptick/Zahav Releasors and the Rimrock Releasors expressly waive the provisions, rights and benefits conferred by any law of any

state or any territory of the United States or of any other nation, or principle of common law relating to claims which the Parties

did not know or suspect to exist in the other Party’s favor at the time of executing this Agreement, which, if known by Parties,

would have materially affected Uptick’s, Zahav’s and/or Rimrock’s settlement with the other Party; and

(b)

The Uptick/Zahav Releasors and the Rimrock

Releasors may hereafter discover facts in addition to or different from those that any of them now knows or believes to be true,

but the Uptick/Zahav Releasors and the Rimrock Releasors fully, finally, and forever settle and release any and all claims, known

or unknown, suspected or unsuspected, contingent or non-contingent, whether or not concealed or hidden, that now exist, or heretofore

have existed upon any theory of law or equity now existing or coming into existence in the future, including, but not limited to,

conduct that is negligent, reckless, intentional, with or without malice, or a breach of any duty, law or rule, without regard

to the subsequent discovery or existence of such different or additional facts. The Uptick/Zahav Releasors and the Rimrock Releasors

acknowledge that the inclusion of such “unknown claims” in this Agreement was separately bargained for and was a key

element of the Agreement, and that each of them assumes the risk of any mistake of fact or law on its own behalf. If the Parties

should subsequently discover that its understanding of the facts or of the law was or is incorrect, the Parties shall not be entitled

to relief in connection therewith, including without limitation of the generality of the foregoing, any alleged right or claim

to set aside or rescind this Agreement. This Agreement is intended to be, and is, final and binding upon the Parties hereto according

to the terms hereof regardless of any claims of mistake of fact or law.

7.

No Admission of Fault. Uptick,

Zahav and Rimrock, by entering into this Agreement, do not concede any fault, liability or wrongdoing, and expressly deny any fault,

liability or wrongdoing whatsoever. The execution of this Agreement, and the consideration and other terms and conditions thereof,

do not constitute and shall not be construed as or deemed to be evidence of, or an admission or concession on the part of Uptick,

Zahav or Rimrock with respect to any claim, fault or liability, or any wrongdoing or damage whatsoever. This Agreement may not

be used for any purpose other than to effectuate this settlement and the terms hereof.

8.

No Action. Upon satisfaction of the

conditions precedent contained in Section 1 hereof to the satisfaction of Uptick in its sole and absolute discretion, each of Uptick

and Zahav covenants and agrees not to commence or prosecute any action or proceeding against Rimrock based on the Released Uptick/Zahav

Claims. Upon the execution hereof by Rimrock, Rimrock covenants and agrees not to commence or prosecute any action or proceeding

against Uptick or Zahav based on the Released Rimrock Claims.

9.

Preparation of Agreement. Each Party

represents to the other that its counsel have negotiated and participated in the drafting of, and are legally authorized to negotiate

and draft, this Agreement. Each Party to this Agreement acknowledges that this Agreement was drafted jointly by the Parties hereto

and each Party has contributed substantially and materially to the preparation of this Agreement. The Agreement shall be construed

as having been made and entered into as the result of arms-length negotiations, entered into freely and without coercion or duress,

between parties of equal bargaining power.

10.

Confidentiality. Except as permitted

below, each Party shall maintain the confidentiality of the Agreement. The negotiations in connection with this Agreement were

and are intended by the Parties to be privileged settlement discussions, and are confidential; none of the Parties shall disclose

such negotiations unless compelled to do so by a court of competent jurisdiction. Neither this Agreement, its contents, terms and

conditions, nor any other information concerning this Agreement or the dispute between the Parties, shall be disclosed to third

parties (including, but not limited to, the media) without the express written approval of all the Parties, except as otherwise

provided in this Section or as required by federal or state securities law, rule or regulation. This Agreement shall not be introduced

in evidence or used for any purpose except: (a) in an action to enforce its provisions; (b) to prove a defense to a claim or other

legal form of action alleged to have been released herein; (c) in response to an order directed to a Party from a judicial or governmental

authority having jurisdiction over such Party, in which event the receiving party shall notify the other Parties of the order;

(d) in response to a subpoena or other process served on a Party (the “Served Party”) by a third party seeking to compel

the disclosure of this Agreement or its terms, in which event, however, the Served Party shall notify the other Party or Parties

of such subpoena or process as soon as possible and grant it or them the opportunity to notify the Served Party in writing within

ten (10) days if the other Party or Parties intend to move to quash, seek a protective order or take other appropriate action,

and, if so informed, the Served Party shall not make the disclosure sought by the subpoena or notice unless the relief sought is

denied or the other Party or Party – despite its or their notice to the contrary – fails to seek the noticed relief

within a reasonable time; (e) if appropriate in a future action, in an application for a determination that the settlement between

the Parties is a good faith settlement properly subject to a contribution bar, in which event this Agreement shall be filed under

seal; or (f) as required by federal or state law, rule or regulation. The Parties also may, to the minimum extent necessary, disclose

this Agreement to the Internal Revenue Service and/or any state taxing authorities and to the Parties’ respective attorneys,

accountants, auditors, professionals and other financial advisors/consultants who have a legal or ethical obligation to hold the

terms and information herein confidential, so that they may perform their professional, business, or financial duties and obligations.

To the extent possible under federal or state law, rule or regulation, any disclosure by either Party subject to the confidentiality

terms of this Section shall not reference the other Party. The determination of whether a federal or state law, rule or regulation

requires the disclosure of this Agreement or any term or provision hereof is left to the sole discretion of the Party making the

disclosure, in consultation with its attorneys, accountants, auditors, professionals or other financial advisors/consultants.

11.

Expenses. The Parties agree that

each shall be responsible for payment of its own costs and expenses, including attorneys’ fees, associated with the negotiation

and execution of this Agreement and any discussions leading thereto, provided however, that Rimrock will pay Uptick,

within ninety (90) days of the date hereof, Ten Thousand and No/100 United States Dollars (US$10,000) in partial satisfaction of

their legal fees and expenses associated with this Agreement.

12.

Designation and Assignment. Of the

Uptick Preferred Stock Settlement Amount to be paid by Rimrock to Uptick and Zahav in connection herewith, Uptick and Zahav hereby

designate and assign (i) thirty (30) shares of Rimrock series B preferred stock to Redwood and (ii) twenty (20) shares of Rimrock

series B preferred stock to LH. These shares are being designated and assigned by Uptick and Zahav to Redwood and LH in consideration

for services rendered to Uptick and Zahav by Redwood and LH in connection with the consulting services performed by Uptick and

Zahav.

13.

Appointment of Agent. Uptick and

Zahav hereby appoint Lucosky Brookman LLP as their agent for purposes of receiving and distributing the Settlement Amount to the

applicable parties.

14.

Amendments / Modifications. This

Agreement shall not be modified, amended, supplemented, or otherwise changed except by a writing signed by all Parties. The Parties

expressly intend and agree that there shall be no exceptions to this “oral modification” clause, including, but not

limited to, any present or future claims of partial performance or equitable estoppel. No parol or oral evidence shall be admitted

to alter, modify or explain the terms of this Agreement, which all Parties agree is clear and unambiguous.

15.

Entire Agreement. This Agreement

represents the entire agreement of the Parties as to the matters set forth herein and shall supersede any and all previous contracts,

arrangements or understandings among the Parties.

16.

Counterparts. This Agreement may

be executed in counterparts. The execution of this Agreement and the transmission thereof by facsimile or e-mail shall be binding

on the Party signing and transmitting same by facsimile or e-mail fully and to the same extent as if a counterpart of this Agreement

bearing such Party’s original signature has been delivered.

17.

Authorized Representative. Each signatory

on behalf of a Party to this Agreement represents and warrants that he or she is a duly authorized representative of that Party,

with full power and authority to agree to this Agreement and all the terms herein on behalf of that Party, which Party shall be

bound by such signature.

18.

Notices. Any notices, consents, waivers,

or other communications required or permitted to be given under the terms of this Agreement must be in writing and in each case

properly addressed to the Party to receive the same in accordance with the information below, and will be deemed to have been delivered:

(i) if mailed by certified mail, return receipt requested, postage prepaid and properly addressed to the address below, then three

(3) business days after deposit of same in a regularly maintained U.S. Mail receptacle; or (ii) if mailed by Federal Express, UPS

or other nationally recognized overnight courier service, next business morning delivery, then one (1) business day after deposit

of same in a regularly maintained receptacle of such overnight courier; or (iii) if hand delivered, then upon hand delivery thereof

to the address indicated on or prior to 5:00 p.m., EST, on a business day. Any notice hand delivered after 5:00 p.m., EST, shall

be deemed delivered on the following business day. Notwithstanding the foregoing, notice, consents, waivers or other communications

referred to in this Agreement may be sent by facsimile, e-mail, or other method of delivery, but shall be deemed to have been delivered

only when the sending Party has confirmed (by reply e-mail or some other form of written confirmation) that the notice has been

received by the other Party. The addresses and facsimile numbers for such communications shall be as set forth below, unless such

address or information is changed by a notice conforming to the requirements hereof. No notice to or demand on the Parties in any

case shall entitle the Parties to any other or further notice or demand in similar or other circumstances:

| |

If to Uptick or Zahav: |

|

Uptick Captial, LLC

708 Third Avenue, 6th Floor

New York, NY 10017

Attn: Ari Blaine

Email: ari@uptickcapital.com |

| |

|

|

|

| |

with a copy which shall

not constitute notice to: |

|

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Woodbridge, NJ 08830

Attn: Joseph Lucosky, Esq.

Facsimile: (732) 395-4401

Email: jlucosky@lucbro.com |

| |

|

|

|

| |

If to Rimrock: |

|

Rimrock Gold Corp.

3651 Lindell Road, Suite D155

Las Vegas, NV 89103

Email: rmicgold@frontiernet.net |

| |

|

|

|

| |

with a copy which shall

not constitute notice to: |

|

Szaferman Lakind Blumstein & Blader, PC

101 Grovers Mill Road, 2nd Floor

Lawrenceville, NJ 08648

Attn: Gregg Jaclin, Esq.

Facsimile: (609) 557-0969

Email: gjaclin@szaferman.com |

19.

Governing Law. THIS AGREEMENT

SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS (AND NOT THE LAW OF CONFLICTS) OF THE STATE OF NEVADA.

EACH OF THE PARTIES HERETO HEREBY CONSENTS TO THE EXCLUSIVE JURISDICTION OF, AND VENUE IN, ANY FEDERAL OR STATE COURT OF COMPETENT

JURISDICTION LOCATED IN NEW JERSEY, SOLELY IN RESPECT OF THE INTERPRETATION AND ENFORCEMENT OF THE PROVISIONS OF THIS AGREEMENT

AND IN RESPECT OF THE TRANSACTIONS CONTEMPLATED HEREIN, AND HEREBY WAIVES, AND AGREES NOT TO ASSERT, AS A DEFENSE IN ANY ACTION

FOR THE INTERPRETATION OR ENFORCEMENT HEREOF, THAT IT IS NOT SUBJECT THERETO OR THAT SUCH ACTION MAY NOT BE BROUGHT OR IS NOT MAINTAINABLE

IN SAID COURTS OR THAT THE VENUE THEREOF MAY NOT BE APPLICABLE OR THAT THIS AGREEMENT MAY NOT BE ENFORCED IN OR BY SAID COURTS,

AND THE PARTIES HERETO IRREVOCABLY AGREE THAT ALL CLAIMS WITH RESPECT TO SUCH ACTION SHALL BE HEARD AND DETERMINED IN SAID COURTS.

THE PARTIES HEREBY CONSENT TO AND GRANT ANY SUCH COURT JURISDICTION OVER THE PERSON OF SUCH PARTIES AND OVER THE SUBJECT MATTER

OF SUCH DISPUTE.

[signature page follows]

IN WITNESS WHEREOF, the Parties execute

this Settlement and Release Agreement as of the date first written above.

| UPTICK CAPITAL, LLC |

|

| |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| |

|

|

| ZAHAV RESOURCES, INC. |

|

| |

|

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| |

|

|

| RIMROCK GOLD CORP. |

|

| |

|

|

| |

|

|

| By: |

/s/ Jordan Starkman |

|

| Name: |

Jordan Starkman |

|

| Title: |

Chief Executive Officer |

|

EXHIBIT A

FORM OF CERTIFICATE

OF DESIGNATION

(see attached)

EXHIBIT B

FORM OF IRREVOCABLE

TRANSFER AGENT INSTRUCTION LETTER

(see attached)

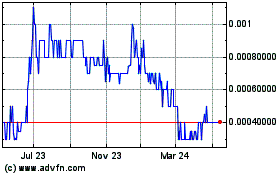

Rimrock Gold (PK) (USOTC:RMRK)

Historical Stock Chart

From Dec 2024 to Jan 2025

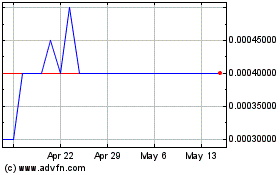

Rimrock Gold (PK) (USOTC:RMRK)

Historical Stock Chart

From Jan 2024 to Jan 2025