Moody's Cuts Canadian Oil Sands' Rating to Junk Status

February 12 2016 - 6:00PM

Dow Jones News

CALGARY, Alberta—The credit rating of Canadian Oil Sands Ltd.,

which was recently acquired by Suncor Energy Inc., was cut to

speculative grade on Friday, making it the first large Canadian oil

producer to receive a "junk" credit rating in at least a

decade.

Citing a high cost structure and low oil prices, Moody's

Investors Service slashed its assessment of Canadian Oil Sands'

senior unsecured debt by three notches to "Ba3," down from the

lowest level of investment-grade credit, or "Baa3."

Moody's also cut its rating of Canadian Oil Sands' parent Suncor

by one notch from "A3" to "Baa1," which remains in the higher

quality investment grade debt category. The ratings outlook for

both companies is now "stable," Moody's said.

Industry leader Suncor earlier this month acquired 73% of

Canadian Oil Sands' shares, giving it control of the company, which

is the largest owner of the Syncrude oil-sands mining consortium.

Together with its existing stake, Suncor now effectively owns 49%

of Syncrude.

Representatives for Suncor and Canadian Oil Sands weren't

immediately available for comment.

Canadian Oil Sands' status as an affiliate of Suncor kept its

credit two notches higher than Moody's stand-alone assessment of

the company, but the junk rating reflects Suncor's decision not to

guarantee about $1.5 billion in outstanding debt.

"In the last 10 years, it's the first time" a large Canadian oil

company has lost its investment-grade rating, said Terry Marshall,

a senior vice president at Moody's.

Calgary-based Nexen Inc. and Talisman Energy Inc. teetered on

the brink of junk status with "Baa3" ratings and negative outlooks

before each was acquired by companies with stronger balance sheets,

he said.

Chinese state-controlled energy giant Cnooc Ltd. bought Nexen in

2013 and Repsol SA of Spain purchased Talisman last year.

Moody's said that, with operating costs of 55 Canadian dollars

(US$39.69) a barrel, Canadian Oil Sands is suffering negative cash

flow at current spot market prices for its synthetic crude

processed from oil-sands asphalt.

"COS will need to rely on its committed liquidity and voluntary

support from Suncor to fund negative free cash flow of about $400

million through" 2017, Moodys' said, noting Syncrude has

experienced a series of operational problems that reduced its

output.

Moodys' said its decision to cut Suncor's rating reflected a

deterioration in the company's cash flow from low oil prices, its

high level of spending to complete a new multibillion-dollar

oil-sands mine and its increased stake in "the operationally

challenged Syncrude mine and upgrader," which producers synthetic

crude oil.

Mr. Marshall said the downgrade for Suncor resulted more from

the drop in crude prices rather than its controlling stake in

Canadian Oil Sands. "It's weighing on Suncor, but Suncor itself

would have got down one-notch in any event given the price

environment," he said.

Write to Chester Dawson at chester.dawson@wsj.com

(END) Dow Jones Newswires

February 12, 2016 17:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

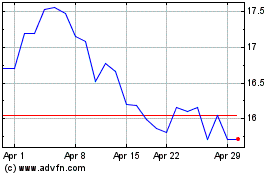

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Oct 2024 to Nov 2024

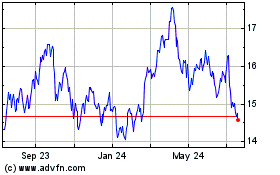

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Nov 2023 to Nov 2024