ReoStar Energy Corp. (OTCBB: REOS) today announced results of

operations for the second quarter of Fiscal Year 2010.

Second Quarter Fiscal Year 2010 Financial and Production

Summary

Oil sales during the quarter ended September 30, 2009, totaled

approximately 5,081 barrels, compared with approximately 11,565

barrels of oil for the quarter ended September 30, 2008. The

average price received for oil sold during the quarter ended

September 30, 2009 declined 45% to $64.16 per barrel, when compared

with an average price for the quarter ended September 30, 2008 of

$115.90 per barrel.

Natural gas sales during the quarter ended September 30, 2009

approximated 100,077 thousand cubic feet (Mcf), compared with

approximately 124,300 Mcf of gas sales in the same period a year

earlier. The price received for natural gas sold during the quarter

ended September 30, 2009 averaged $2.23 per Mcf (net of

transportation, compression and CO2 charges), compared with $7.57

per Mcf in the quarter ended September 30, 2009, a decrease of

approximately 70%.

Oil and gas revenues for the three months ended September 30,

2009 totaled $556,141, compared with $2,282,048 in the quarter

ended September 30, 2008. The primary reasons for the decrease in

revenue were lower production and lower average sales prices in the

second quarter of 2010 versus the same period the prior year.

On September 30, 2009, the Company had $105,000 in cash, and

total assets approximated $22.9 million. Liabilities consisted of

accounts and notes payable to non-related parties of $11 million,

of which $10.8 million was long-term. The Company also had accounts

and notes payable to related parties of $3.6 million.

During the quarter, the Company did not draw on the credit

facility secured by its assets. The material terms of the credit

facility were reported in the Company's Form 8-K filed on November

4, 2008. The remaining credit available under the credit facility

as of September 30, 2008 approximated $3.2 million.

Mark Zouvas, CEO of ReoStar, commented, "There are a number of

challenges we face during the remainder of the fiscal year.

Although we are disappointed with our second quarter results, much

of the production and revenue decline reflected our conservative

approach to managing cash reserves and slowing our drilling

expansion. We are comfortable with our financial outlook for the

remainder of Fiscal 2010, as we proceed with caution in our

expansion plans while remaining astute in managing budgets and

adjusting to uncertain industry and economic conditions. We

continue to seek strategic opportunities and valuable 'bolt-on'

acreage in our respective target areas, but we will remain

conservative with capital expenditures until management considers

it strategically appropriate to deploy our resources."

About ReoStar Energy Corporation

ReoStar Energy Corporation (OTCBB: REOS), headquartered in Fort

Worth, Texas, is an oil and gas company engaged in the acquisition,

development and production of natural gas and oil properties, with

operations primarily focused on developmental resource plays and

enhanced oil recovery projects. The Company has vertically

integrated its assets to remove potential obstacles to growth and

enable it to develop and produce assets without the risk, cost and

time involved in traditional exploration.

The Company's strategy is to cost effectively acquire an

attractive portfolio of oil reserves that have a high ratio of

possible, probable or proven undeveloped reserves. By converting

undeveloped reserves into proved producing reserves, the Company

seeks to realize an increase in overall value at low risk and

cost.

The Company's assets include approximately 9,500 gross mineral

leasehold acres located in Texas (Barnett & Corsicana).

ReoStar's assemblage of E&P assets allows for appreciable,

unimpeded growth into the foreseeable future.

Additional information is located on the company's website:

www.reostarenergy.com.

Certain statements in this news release may contain

forward-looking information within the meaning of Rule 175 under

the Securities Act of 1933 and Rule 3b-6 under the Securities

Exchange Act of 1934, and are subject to the safe harbor created by

those rules. All statements, other than statements of fact,

included in this release, including, without limitation, statements

regarding potential future plans and objectives of the company, are

forward-looking statements that involve risks and uncertainties.

There can be no assurance that such statements will prove to be

accurate and actual results and future events could differ

materially from those anticipated in such statements. Technical

complications which may arise could prevent the prompt

implementation of any strategically significant plan(s) outlined

above.

ReoStar Energy Corporation

Consolidated Balance Sheets

September 30, March 31,

2009 2009

(unaudited)

ASSETS

Current Assets:

Cash $ 105,457 $ 426,430

Accounts Receivable:

Oil & Gas - Related Party 382,987 337,879

Related Party 773,219 1,107,854

Other 41,554 15,760

Inventory 2,445 7,514

Hedging Account 6,317 6,317

------------ ------------

Total Current Assets 1,311,979 1,901,754

------------ ------------

Note Receivable 553,536 553,536

------------ ------------

Oil and Gas Properties - successful efforts

method 26,316,823 25,254,777

Less Accumulated Depletion and Depreciation (7,328,208) (6,206,558)

------------ ------------

Oil & Gas Properties (net) 18,988,615 19,048,219

------------ ------------

Other Depreciable Assets: 2,322,167 2,171,654

Less Accumulated Depreciation (425,303) (315,093)

------------ ------------

Other Depreciable Assets (net) 1,896,864 1,856,561

------------ ------------

Leasehold Held for Sale 150,000 150,000

------------ ------------

Total Assets $ 22,900,994 $ 23,510,070

============ ============

LIABILITIES

Current Liabilities:

Accounts Payable $ 59,466 $ 22,033

Payable to Related Parties 29,812 148,550

Accrued Expenses 132,902 106,141

Accrued Expenses - Related Party 109,664 130,870

Hedging Liabilities - Current 120,869

------------ ------------

Total Current Liabilities 452,713 407,594

------------ ------------

Notes Payable 10,119,270 8,955,202

Notes Payable - Related Parties 3,518,924 3,518,924

------------ ------------

Total Long-Term Debt 13,638,194 12,474,126

------------ ------------

Asset Retirement Obligation 387,353 344,079

Hedging Liability - Noncurrent 25,056 -

Deferred Tax Liability 1,010,794 1,702,782

------------ ------------

Total Liabilities 15,514,110 14,928,581

------------ ------------

Commitments & Contingencies: - -

------------ ------------

Stockholders' Equity

Common Stock, $.001 par, 200,000,000 shares

authorized and 81,643,912 shares outstanding

on September 30, 2009 and 80,353,912 shares

outstanding on March 31, 2009 81,643 80,353

Additional Paid-In-Capital 11,685,345 10,959,965

Retained Deficit (4,380,104) (2,458,829)

------------ ------------

Total Stockholders' Equity 7,386,884 8,581,489

------------ ------------

Total Liabilities & Stockholders' Equity $ 22,900,994 $ 23,510,070

============ ============

ReoStar Energy Corporation

Consolidated Statements of Operations

Three Months Ended

--------------------------

September 30, September 30,

2009 2008

(unaudited) (unaudited)

------------ ------------

Revenues

Oil & Gas Sales $ 556,141 $ 2,282,048

Sale of Leases 137,677 18,005

Other Income 90,119 109,568

------------ ------------

783,937 2,409,621

------------ ------------

Costs and Expenses

Oil & Gas Lease Operating Expenses 515,195 789,234

Workover Expenses 43,998 87,982

Severance & Ad Valorem Taxes 31,129 132,125

Depletion & Depreciation 684,361 381,660

ARO Accretion 11,031 -

General & Administrative:

Salaries & Benefits 201,935 135,068

Legal & Professional 648,979 193,129

Other General & Administrative 126,406 40,295

Interest, net of capitalized interest of

$132,375 and $151,343 for the three months

ended 9/30/09 and 9/30/08, respectively and

$254,273 and $312,919 for the six months

ended 9/30/09 and 9/30/08, respectively - 2,900

------------ ------------

2,263,034 1,762,393

------------ ------------

Other Income (Expense)

Interest Income 13,934 40

Loss on Equity Method Investments (142,395)

Hedging Gain (Loss) (103,643) (93)

------------ ------------

Income (Loss) from continuing operations

Before income taxes (1,568,806) 504,780

------------ ------------

Income Tax Benefit (Expense) 351,944 (211,323)

------------ ------------

Net Income (Loss) $ (1,216,862) $ 293,457

============ ============

Basic & Diluted Loss per Common Share $ (0.02) $ 0.00

------------ ------------

Weighted Average Common Shares Outstanding 80,998,912 80,181,310

============ ============

Contact: ReoStar Energy Corporation Teresa Wright

817-546-7718

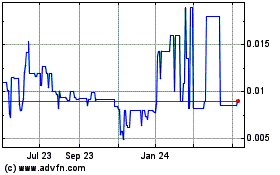

ReoStar Energy (PK) (USOTC:REOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

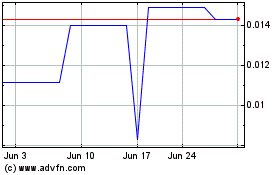

ReoStar Energy (PK) (USOTC:REOS)

Historical Stock Chart

From Jan 2024 to Jan 2025