UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 10, 2023

Commission File Number: 000-55992

Red White & Bloom Brands Inc.

(Exact name of registrant as specified in its charter)

789 West Pender Street, Suite 810

Vancouver BC Canada V6C 1H2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover

Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Red White & Bloom Brands Inc. |

|

| |

|

|

|

| |

By: |

/s/ Edoardo Mattei |

|

| |

|

Edoardo Mattei |

|

| |

|

Chief Financial Officer |

|

| Date: June 27, 2023 |

|

|

|

Exhibit 99.1

RWB’s Platinum Vape Launches

in Arizona in time for the “Big Game” and the “Greatest Show on Grass”

- Football and golf fans can now

experience why “Life is Better in Platinum™” -

- Platinum 510 Vapes and Disposable

Vapes are now stocked in AZ dispensaries -

- Arizona’s Cannabis market

is estimated to have reached over $1.4 billion in 20221 -

TORONTO,

ONTARIO February 10, 2023 (GLOBE NEWSWIRE) -- Red White & Bloom Brands Inc. (CSE: RWB and OTC: RWBYF) (“RWB” or

the “Company”) announces today that Platinum Vape (“Platinum’” or “PV”)

has launched in the thriving, adult use Arizona market with over twelve (12) flavor profiles of its premium 510 Vapes and Disposable Vape

products currently being stocked by dispensaries across the state. Additional high quality, PV branded offerings are expected to be introduced

over the course of the 2023 calendar year.

“The availability

of our trusted Platinum brand in Arizona provides access to another lucrative cannabis market for RWB as we continue to drive our asset

light growth strategy. The Platinum brand continues to be recognized as a market leader in product quality, safety and user experience.

We are focused on making Platinum one of the most frequently consumed cannabis brands in the United States in 2023,” stated Colby

De Zen, President of RWB.

RWB shipped millions of PV branded units throughout the United

States in the 2022 calendar year. Platinum is recognized for its popular distillate carts that leverage curated naturally derived flavor

terpenes. The initial launch in Arizona includes a range of Platinum’s most popular products, including 0.5-gram and 1.0-gram Premium

Distillate and Platinum Skybar Disposables. Live Resin cartridges and Gummy Coins are also planned for release to the lucrative adult-use

Arizona market. PV products are made with the highest quality ingredients; every batch is lab-tested for purity and potency. The

initial 510 Vape offering in Arizona will include the following flavors: Purple Punch; Platinum OG; Hellfire OG; Black Lime Reserve; Gorilla

Crack; Sunset Pie; Strawberry Sour Diesel; Divorce Cake; Lemon Jack; Jelly Donut; Limoncello; and Guava Haze. The entire range of Platinum’s

current and future product offerings in Arizona can be found using the following link: https://houseofplatinum.com/wp-content/uploads/2023/02/PV_ProductBook_AZ_.pdf.

“Platinum’s expansion into Arizona is a key part

of RWB’s latest series of moves to scale entry into new strategic legal markets,'' said De

Zen.

For more information about Platinum and its products, please visit the Company's

website at https://houseofplatinum.com/.

1Source Arizona Cannabis Information Portal | ArizonaStateCannabis.org

About Red White & Bloom Brands Inc.

Red White & Bloom is a multi-state cannabis operator

and house of premium brands in the U.S. legal cannabis sector. RWB is predominantly focusing its investments on the major U.S. markets,

including Arizona, California, Florida, Massachusetts, Missouri, Oklahoma, and Michigan.

For more information about Red White & Bloom Brands

Inc., please contact:

Brad Rogers, CEO and Chairman

IR@RedWhiteBloom.com

Visit us on the web: https://www.redwhitebloom.com/

Follow us on social media:

Twitter: @rwbbrands

Facebook: @redwhitebloombrands

Instagram: @redwhitebloombrands

Neither the CSE nor its Regulation Services Provider

(as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING INFORMATION

This press release contains forward-looking statements and information that

are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate",

"project", "belief", "anticipate", "intend", "expect", "plan", "predict",

"may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended

to identify forward-looking statements and information. There is no assurance that these transactions will yield results in line with

management expectations. Such statements and information reflect the current view of the Company with respect to risks and uncertainties

that may cause actual results to differ materially from those contemplated in those forward-looking statements and information.

By their nature, forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially

different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include,

among others, the following risks: risks associated with the implementation of the Company's business plan and matters relating thereto,

risks associated with the cannabis industry, competition, regulatory change, the need for additional financing, reliance on key personnel,

market size, and the volatility of the Company's common share price and volume. Forward-looking statements are made based on management's

beliefs, estimates and opinions on the date that statements are made, and the Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing

undue certainty to forward-looking statements.

There are several important factors that could cause the Company's actual results

to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others,

risks related to the Company's proposed business, such as failure of the business strategy and government regulation; risks related to

the Company's operations, such as additional financing requirements and access to capital, reliance on key and qualified personnel, insurance,

competition, intellectual property, and reliable supply chains; risks related to the Company and its business generally; risks related

to regulatory approvals. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's

forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and

other uncertainties and potential events. The Company has assumed a certain progression, which may not be realized. It has also assumed

that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ

materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can

be no assurance that such assumptions will reflect the actual outcome of such items or factors. While the Company may elect to, it does

not undertake to update this information at any particular time.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE REPRESENTS

THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD

NOT PLACE UNDUE IMPORTANCE ON FORWARD LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY

MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE

LAWS.

Exhibit 99.2

Red White & Bloom Brands Inc.

STATEMENT OF EXECUTIVE COMPENSATION

For the Financial Years ended December 31, 2021, and 2020

Definitions

“CEO” means an individual who acted as chief executive

officer of the Company, or acted in a similar capacity, for any part of the most recently completed financial year;

“CFO” means an individual who acted as chief financial

officer of the Company, or acted in a similar capacity, for any part of the most recently completed financial year;

“Company” or “RWB” means Red White

& Bloom Brands Inc.;

“compensation securities” includes stock options, convertible

securities, exchangeable securities, and similar instruments including stock appreciation rights, deferred share units and restricted

stock units granted or issued by the Company or one of its subsidiaries for services provided or to be provided, directly or indirectly,

to the Company or any of its subsidiaries;

“NEO” or “named executive officer”

means each of the following individuals:

| (c) | in respect of the Company and its subsidiaries, the most highly compensated executive officer other than

the individuals identified in paragraphs (a) and (b) at the end of the most recently completed financial year whose total compensation

was more than $150,000, as determined in accordance with subsection 1.3(5) of National Instrument 51-102F6V, for that financial year;

and |

| (d) | each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither

an executive officer of the Company, nor acting in a similar capacity, at the end of that financial year; |

“option-based award” means an award under an equity

incentive plan of options, including, for greater certainty, share options, share appreciation rights, and similar instruments that have

option-like features;

“plan” includes any plan, contract, authorization, or

arrangement, whether or not set out in any formal document, where cash, securities, similar instruments or any other property may be received,

whether for one or more persons;

“share-based award” means an award under an equity incentive

plan of equity-based instruments that do not have option-like features, including, for greater certainty, common shares, restricted shares,

restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent units, and stock; and

“underlying securities” means any securities issuable

on conversion, exchange or exercise of compensation securities.

Named Executive Officers

During the fiscal year ended December 31, 2021 and 2020, the Company had

three NEOs: Brad Rogers, Chief Executive Officer, interim Chief Financial Officer, Chris Ecken, former Chief Financial Officer and

Johannes P.M. van der Linde, former Chief Financial Officer and Corporate Secretary.

Named Executive Officer and Director Compensation

The following table summarizes the compensation paid to the directors and

NEOs of the Company for the last two completed financial years:

| Table of compensation excluding compensation securities |

| Name and principal position |

Year |

Salary, consulting fee, retainer, or commission

($) |

Bonus

($)

|

Committee or meeting fees

($)

|

Value of perquisites

($) |

Value of all other compensation

($) |

Total compensation

($) |

|

Brad Rogers(1)

CEO, interim CFO and Director

|

2021

2020 |

266,250

350,963

|

Nil

Nil |

Nil

Nil |

Nil

Nil |

Nil

195,138 |

266,250

545,831

|

|

Theo van der Linde (2)

Former CFO, Corporate Secretary and Director

|

2021

2020 |

66,082

140,858

|

Nil

Nil |

Nil

Nil |

Nil

Nil |

Nil

67,643 |

66,082

208,501

|

Brendan Purdy(3)

Director & Former Interim CEO |

2021

2020 |

Nil

2,341

|

Nil

Nil |

Nil

Nil |

Nil

Nil |

Nil

67,519 |

Nil

69,860

|

|

Michael Marchese(4)

Director

|

2021

2020 |

137,295

162,000

|

Nil

Nil |

Nil

Nil |

Nil

Nil |

Nil

67,370

|

137,295

229,370

|

|

William Dawson(5)

Former Director

|

2021

2020 |

Nil

77,460

|

Nil

Nil |

Nil

Nil |

Nil

Nil |

Nil

67,370

|

Nil

144,830

|

|

Ryan Costello(6)

Former Director

|

2021

2020

|

Nil

-

|

Nil

-

|

Nil

-

|

Nil

-

|

Nil

-

|

Nil

-

|

|

Chris Ecken(7)

Former Chief Financial Officer

|

2021

2020

|

61,884

-

|

Nil

-

|

Nil

-

|

Nil

-

|

Nil

-

|

61,884

-

|

| (1) | Mr. Rogers was appointed as a director of the Company of April 24, 2020. Mr. Rogers was appointed as the

interim CFO of the Company on April 18, 2022. |

| (2) | Mr. van der Linde was appointed as CFO and a director of the Company on July 20, 2017. Mr. van der Linde

was appointed as Corporate Secretary of the Company on August 16, 2018. All of the compensation received by Mr. van der Linde was in respect

of his position as CFO of the Company. Mr. van der Linde resigned as the CFO on October 21, 2021 |

| (3) | Mr. Purdy was appointed as a director of the Company on July 20. 2017. Mr. Purdy was appointed as the

interim CEO of the Company on February 22, 2019 and resigned as interim CEO on April 24, 2020. |

| (4) | Mr. Marchese was appointed as a director of the Company on April 24, 2020. |

| (5) | Mr. Dawson was appointed as a director of the Company on April 24, 2020, and resigned on September 19,

2022 |

| (6) | Mr. Costello was appointed as a director of the Company on November 3, 2021 and resigned on June 17, 2022 |

| (7) | Mr. Ecken was appointed as the Chief Financial Officer on October 25, 2021, and resigned on July 19, 2022. |

Other than as set forth in the foregoing table,

the named executive officers and directors have not received, during the most recently completed financial year, compensation pursuant

to any standard arrangement for the compensation of directors for their services in their capacity as directors, including any additional

amounts payable for committee participation or special assignments, any other arrangement, in addition to, or in lieu of, any standard

arrangement, for the compensation of directors in their capacity as directors, or any arrangement for the compensation of directors for

services as consultants or experts.

Stock Options and Other Compensation Securities

The following tables set forth the details of all compensation securities

granted or issued to each named executive officer and director by RWB (or any subsidiary, as applicable) in the most recently completed

financial year for services provided or to be provided, directly or indirectly, to RWB (or any subsidiary, as applicable):

| Compensation Securities |

| Name and position |

Type of compensation security |

Number of compensation securities, number of underlying securities, and percentage of class |

Date of issue or grant |

Issue, conversion, or exercise price

($) |

Closing price of security or underlying security on date of grant ($) |

Closing price of security or underlying security at year end

($) |

Expiry

date |

|

Chris Ecken

Former Chief Financial Officer

|

Stock options |

500,000 stock options

exercisable into

500,000

common shares

representing 0.19% of the common shares outstanding

|

November 12, 2021 |

$0.63 |

$0.63 |

$0.42 |

November 12, 2021 |

|

Ryan Costello

Former director

|

Stock options |

500,000 stock options

exercisable into

500,000

common shares representing 0.19% of the common shares outstanding

|

December 21, 2021 |

$0.40 |

$0.395 |

$0.42 |

December 21, 2026 |

Exercise of Compensation Securities by Directors and Named Executive

Officers

No compensation securities were exercised by any director or NEO during

the year ended December 31, 2021.

External Management Companies

None of the NEOs or directors of the Company have been retained or employed

by an external management company which has entered into an understanding, arrangement, or agreement with the Company to provide executive

management services to the Company, directly or indirectly.

Stock Option Plans and Other Incentive Plans

On July 27, 2020, the board of directors (the “Board”) approved

a restricted share unit plan (the “RSU Plan”) and a 20% rolling stock option plan (the “Option Plan” and together

with the RSU Plan, the “Plans”) to grant restricted share units (“RSU’s”) and incentive stock options (“Options”)

to directors, officers, key employees and consultants of the Company. Pursuant to the RSU Plan and the Option Plan, the Company may reserve

up to a maximum of 20% of the issued and outstanding Shares at the time of grant pursuant to awards granted under the Plans.

The Company’s directors, officers, employees and certain consultants

are entitled to participate in the Plans. The Option Plan and RSU Plan is designed to encourage share ownership and entrepreneurship on

the part of the senior management and other employees. The Board believes that the Plans align the interests of the NEO and the Board

with shareholders by linking a component of executive compensation to the longer-term performance of the common shares.

Options and RSUs are granted by the Board. In monitoring or adjusting the

Option allotments, the Board takes into account its own observations on individual performance (where possible) and its assessment of

individual contribution to shareholder value, previous Option grants and the objectives set for the NEOs and the Board. The scale of Options

is generally commensurate to the appropriate level of base compensation for each level of responsibility.

In addition to determining the number of Options to be granted pursuant

to the methodology outlined above, the Board also makes the following determinations:

(a) parties who are entitled to participate in the Plans;

(b) the exercise price for each Option or RSU granted, subject to the provision

that the exercise price cannot be lower than the prescribed discount permitted by the CSE from the market price on the date of grant;

(c) the date on which each Option or RSU is granted;

(d) the vesting period, if any, for each Option or RSU;

(e) the other material terms and conditions of each Option or RSU grant;

and

(f) any re-pricing or amendment to an Option grant.

The Board makes these determinations subject to and in accordance with

the provisions of the Option Plan and RSU Plan. The Board reviews and approves grants of Options and RSUs on an annual basis and periodically

during a financial year.

The following is a summary of the material terms of the Plans.

• the total number of common shares reserved for issuance under the

Option Plan and the RSU Plan, is up to a maximum of 20% of the issued and outstanding common shares at the time of grant, combined with

any equity securities reserved under all other compensation arrangements adopted by the Company, including the Option Plan;

• the total number of Options awarded to any one individual in any

12 month period shall not exceed 5% of the issued and outstanding common shares as at the Award Date (unless the Company becomes a Tier

1 issuer of the Toronto Stock Exchange or Toronto Stock Exchange – Venture (a “Tier 1 Issuer”) and has obtained disinterested

shareholder approval).

•the total number of Options awarded to any one Consultant in a 12-month

period shall not exceed 2% of the issued and outstanding common shares as at the award date.

•the total number of Options awarded in any 12 month period to Employees

performing investor relations activities for the Company shall not exceed 2% of the issued and outstanding Shares as at the award date.

Subject to any required approvals of the CSE or any other applicable stock

exchange, the Board may amend, suspend or terminate the Plans or any portion thereof at any time, but an amendment may not be made without

shareholder approval if such approval is necessary to comply with any applicable regulatory requirement.

Further, subject to any required approvals of the CSE or any other applicable

stock exchange, the Board may not do any of the following without obtaining, within 12 months either before or after the Board’s

adoption of a resolution authorizing such action, shareholder approval, and, where required, approval by Disinterested Shareholders, or

by the written consent of the holders of a majority of the securities of the Company entitled to vote:

1. increase the aggregate number of common shares which may be issued under

the Plans;

2. materially modify the requirements as to the eligibility for participation

in the Plans that would have the potential of broadening or increasing insider participation;

3. add any form of financial assistance or any amendment to a financial

assistance provision which is more favourable to participants under the Plans;

4. add a cashless exercise feature, payable in cash or securities, which

does not provide for a full deduction of the number of underlying securities from the Plans reserve; and

5. materially increase the benefits accruing to participants under the

Plans.

However, the Board may amend the terms of the Plans to comply with the

requirements of any applicable regulatory authority without obtaining shareholder approval, including:

• amendments to the Plans of a housekeeping nature;

• change the vesting provisions of an Option granted under the stock

option plan, if applicable;

• change to the vesting provisions of a security or the Plans;

• change to the termination provisions of a security or the Plans

that does not entail an extension beyond the original expiry date;

• make such amendments to the stock option plan as are necessary or

desirable to reflect changes to securities laws applicable to the Company;

• make such amendments as may otherwise be permitted by regulatory

authorities;

• if the Company becomes listed or quoted on a stock exchange or stock

market senior to the CSE, make such amendments as may be required by the policies of such senior stock exchange or stock market; and

• amend the stock option plan to reduce the benefits that may be granted

to Employees, Management Company Employees or Consultants.

Option Plan

The Option Plan is designed to give each Option holder an interest in preserving

and maximizing shareholder value in the longer term, to enable the Company to attract and retain individuals with experience and ability

and to reward individuals for current performance and expected future performance. The Board considers Option grants when reviewing executive

officer compensation packages as a whole.

The Board has sole discretion to determine the key employees to whom it

recommends that grants be made and to determine the terms and conditions of the Options forming part of such grants. The Board approves

ranges of Option grants for each level of executive officer. Individual grants are determined by an assessment of an individual’s

current and expected future performance, level of responsibilities and the importance of the position to the Company.

The number of Options which may be issued under the Option Plan in the

aggregate and in respect of any fiscal year is limited under the terms of the Option Plan and cannot be increased without shareholder

approval.

RSU Plan

The RSU Plan provides for granting of RSU’s for the purposes of advancing

the interests of the Company through motivation, attraction and retention of employees, officers, consultants and directors by granting

equity-based compensation incentives, in addition to the Option Plan.

RSUs granted pursuant to the RSU Plan will be used to compensate participants

for their individual performance based achievements and are intended to supplement stock option awards in this respect, the goal of such

grants is to more closely tie awards to individual performance based on established performance criteria.

The Plans have been used to provide stock options and RSU’s which

are granted in consideration of the level of responsibility of the executive as well as his or her impact or contribution to the longer-term

operating performance of the Company. In determining the number of Options or RSU’s to be granted to the executive officers, the

Board takes into account the number of Options or RSU’s, if any, previously granted to each executive officer, and the exercise

price of any outstanding Options to ensure that such grants are in accordance with the policies of the CSE and closely align the interests

of the executive officers with the interests of shareholders.

The Compensation Committee with consultation of the Board has the responsibility

to administer the compensation policies related to the executive management of the Company, including option-based and share-based awards.

Employment, consulting, and management agreements

Other than as set out below, the Company has not entered into any other

contract, agreement, plan or arrangement that provides for payments to a NEO or a director at, following or in connection with any termination

(whether voluntary, involuntary or constructive), resignation, retirement a change in control of the Company or a change in an NEOs or

directors’ responsibilities.

The Company entered into a management consulting agreement with Johannes

(Theo) van der Linde effective July 20, 2017 with regard to his services as Chief Financial Officer of the Company. Pursuant to the agreement,

the Company agreed to pay Mr. van der Linde a base salary of $72,000 per annum and shall continue indefinitely until terminated by either

party in accordance with the terms of the agreement. The agreement provides for a severance clause of three months’ notice for termination.

In the event that Mr. van der Linde resigns for “Good Cause” following a “Change of Control” (as those terms are

defined in the applicable agreement), Mr. van der Linde will be entitled to two times the annual pro-rated fee paid. Mr. van der Linde

resigned from acting as the Chief Financial Officer and Corporate Secretary of the Company on October 21, 2021, and the agreement was

subsequently terminated.

The Company entered into a management consulting agreement with Michael

Marchese effective May 1, 2019, with regard to marketing related services. The agreement is for a period of twenty-four months. The Company

agreed to pay Mr. Marchese fees in the amount of $162,500 for the calendar period ended December 31, 2020 and $137,295 for the calendar

year ended December 31, 2021.

Oversight and description of director and named executive officer compensation

The Board is responsible for determining, by way of discussions at board

meetings, the compensation to be paid to the NEOs and directors of the Company. The Board conducts reviews with regard to the compensation

of the directors and the executive officers once a year.

Director Compensation

For the financial year ended December 31, 2021, the Company did not employ

a nominating committee. All tasks related to developing and monitoring the approach to the nomination of directors to the Board were performed

by the members of the Board.

Other than as set forth in the foregoing, no director of the Company who

is not a Named Executive Officer has received, during the most recently completed financial year, compensation pursuant to:

| (a) | any standard arrangement for the compensation of directors for their services in their capacity as directors,

including any additional amounts payable for committee participation or special assignments; |

| (b) | any other arrangement, in addition to, or in lieu of, any standard arrangement, for the compensation of

directors in their capacity as directors; or |

| (c) | any arrangement for the compensation of directors for services as consultants or expert. |

Named Executive Officer Compensation

For the financial year ended December 31, 2021, the Company did not have

a formal compensation program with specific performance goals nor did it employ a compensation committee. All tasks related to developing

and monitoring the Company’s approach to the compensation of officers were performed by the members of the Board. The compensation

of each of the NEOs was reviewed, recommended, and approved by the Company’s independent directors.

The Board considers the performance of each NEO along with the Company’s

ability to pay compensation and the Company's results of operation for the period. As the objectives of the Company’s compensation

procedures are to align the interests of employees with the interests of shareholders, a significant portion of total compensation is

based upon overall corporate performance.

Compensation is designed to achieve the following key objectives:

| · | to support our overall business strategy and objectives; |

| · | to provide market competitive compensation that is substantially performance-based; |

| · | to provide incentives that encourage superior corporate performance and retention of highly skilled and

talented NEOs; and |

| · | to align executive compensation with corporate performance and therefore shareholders' interests. |

Our compensation package is comprised of short-term compensation in the

form of base salary or service fees, medium-term compensation in the form of discretionary cash bonuses and long-term compensation in

the form of option-based awards. The Company does not have a formal compensation program which sets benchmarks for performance by NEOs.

Base salary is determined by the Board largely based on market standards. In addition, the Board may consider, on an annual basis, an

award of bonuses to key executives and senior management. The amount and award of such bonuses is discretionary, depending on, among other

factors, the financial performance of the Company and the position of a participant. The Board considers that the payment of such discretionary

annual cash bonuses satisfies the medium-term compensation component. No bonuses were awarded for the financial year ended December 31,

2021. Lastly, the Company chooses to grant stock options or RSUs to executive officers to satisfy the long-term compensation component.

The Board has not directly considered the implications of the risks associated

with our compensation policies and practices. The Company does not have a set policy preventing any NEO or director from purchasing financing

instruments such as prepaid variable forward contracts, equity swaps, collars or units of exchange funds designed to hedge or offset a

decrease in market value of equity securities granted as compensation or held, directly or indirectly, by such person. The Company does

not use a peer group to determine compensation.

Pension Disclosure

The Company does not have a pension plan that provides for payments or

benefits to the NEOs or directors at, following, or in connection with retirement. The Company does not have any form of deferred compensation

plan.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets out those securities of the Company which have

been authorized for issuance under equity compensation plans, as of December 31, 2021:

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options,

warrants and rights

(a)

|

Weighted-average exercise price of outstanding options, warrants and

rights

(b)

|

Number of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in column (a))

(c)

|

| Equity compensation plans approved by the securityholders |

15,654,289 |

1.26 |

36,524,031 |

| Equity compensation plans not approved by the securityholders |

N/A |

N/A |

N/A |

| Total |

15,654,289 |

|

36,524,031 |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

None of the current or former directors, executive officers, employees

of the Company, or their respective associates or affiliates, are or have been indebted to the Company since the beginning of the most

recently completed financial year of the Company.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, nor any associate or affiliate

of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise since

the beginning of the Company’s last financial year in matters to be acted upon.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

None of the persons who were directors or executive officers of the Company

or a subsidiary at any time during the Company’s last completed financial year, any person or company who beneficially owns, directly

or indirectly, or who exercises control or direction over (or a combination of both) more than 10% of the issued and outstanding common

shares of the Company, nor the associates or affiliates of those persons, has any material interest, direct or indirect, by way of beneficial

ownership of securities or otherwise, in any transaction or proposed transaction which has materially affected or would materially affect

the Company.

MANAGEMENT CONTRACTS

Other than as disclosed below, no Management functions of the Company are

to any substantial degree performed by a person or company other than the directors or NEOs of the Company.

The Company entered into a corporate management agreement (the “Management

Agreement”) dated January 1, 2018, with Pender Street Corporate Consulting Ltd. which was subsequently assigned to Partum Advisory

Services Corp. (“Partum”) on April 1, 2019 and amended on March 1, 2021, to provide management, accounting and administrative

services to the Company in accordance with the terms of the Management Agreement for a monthly fee of $10,000 plus applicable taxes and

reimbursement of all out-of-pocket expenses incurred on behalf of the Company. The Management Agreement is for an initial term of 12 months,

to be automatically renewed for further 12-month periods, unless either party gives 30 days’ notice of non-renewal, in which case

the Management Agreement will terminate. The Management Agreement can be terminated by the Company for cause without prior notice or upon

the mutual consent in writing of both parties. If there is a take-over or change of control of the Company resulting in the termination

of the Management Agreement, Partum is entitled to receive an amount equal to 6 months of fees payable as a lump sum payment due on the

day after the termination date.

Mr. Johannes (Theo) van der Linde, a director of the Company and the former

Chief Financial Officer and Corporate Secretary is a shareholder of Partum.

Partum was not indebted to the Company during the Company’s last

completed financial year and the Management Agreement remains in effect.

During the most recently completed financial year, the Company paid or

accrued $222,953 in disbursements, management and accounting fees to Partum.

Red White and Bloom Brands (CE) (USOTC:RWBYF)

Historical Stock Chart

From Apr 2024 to May 2024

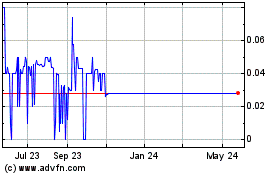

Red White and Bloom Brands (CE) (USOTC:RWBYF)

Historical Stock Chart

From May 2023 to May 2024