false

0000856984

0000856984

2024-05-13

2024-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (date of earliest event reported): May 13, 2024

QHSLab,

Inc.

(Exact

Name of Registrant as Specified in its Charter)

0-19041

(Commission

File No.)

| Nevada |

|

30-1104301 |

(State

of

Incorporation) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

901

Northpoint Parkway Suite 302 West Palm Beach

FL

33407 |

|

33407 |

| (Address

of Principal Executive Offices) |

|

(ZIP

Code) |

Registrant’s

telephone number, including area code: (929) 379-6503

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

USAQ |

|

N/A |

Item

7.01 Regulation FD Disclosure.

On

May 13, 2024, QHSLab, Inc. (the “Company”), announced strong first quarter 2024 results with significant reduction in operating

expenses and positive net operating income. The full text of this press release is furnished as Exhibit 99.1 to this Current Report on

Form 8-K.

The

information in this Current Report on Form 8-K (including the exhibit) is furnished pursuant to Item 7.01 and shall not be deemed to

be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the

liabilities of that section. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information

in the Report that is required to be disclosed solely by Regulation FD.

We

do not have, and expressly disclaim, any obligation to release publicly any updates or any changes in our expectations or any change

in events, conditions, or circumstances on which any forward-looking statement is based.

We

use, and will continue to use, our website (https://usaqcorp.com), press releases, and various social media channels, including our Twitter

account (https://twitter.com/qhslabinc), LinkedIn account (https://www.linkedin.com/company/65407282/), Facebook account

(https://www.facebook.com/QHSLabs) and Instagram account (https://www.instagram.com/qhslabs/) as additional means of disclosing

public information to investors, the media and others interested in the Company. It is possible that certain information we post on our

website, disseminate in press releases and on social media could be deemed to be material information, and we encourage investors, the

media and others interested in the Company to review the business and financial information that we post on our website, disseminate

in press releases and on the social media channels identified above, as such information could be deemed to be material information.

Item

9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d)

Exhibits.

The

exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this current report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| Date:

May 13, 2024 |

|

| |

|

|

| QHSLab,

Inc. |

|

| |

|

|

| |

/s/

Troy Grogan |

|

| Name: |

Troy

Grogan |

|

| Title: |

CEO

and Chairman |

|

Exhibit

99.1

QHSLab,

Inc. Announces Strong First Quarter 2024 Results with Significant Reduction in Operating Expenses and Positive Net Operating Income

Integrated

Service Program (ISP) Revenues Surge 268% in Q1 2024 Over Q1 2023

WEST

PALM BEACH, FL, May 13, 2024 (GLOBE NEWSWIRE) — QHSLab, Inc. (“the Company”) (OTCQB: USAQ), a leader in digital

health and point-of-care technologies designed to empower clinicians with proactive, value-based healthcare solutions, today released

detailed financial results for the first quarter ended March 31, 2024, showcasing not only revenue growth but also significant reductions

in operating expenses and a positive turn in net operating income.

Financial

Highlights:

| |

● |

First

Quarter Revenues of $488,587 for Q1 2024, marking a 38.6% increase over $352,799 in Q1 2023. This improvement was driven by robust

growth in Integrated Service Program (ISP) revenues, which surged 268% to $127,004 from $34,467 in the previous year, and a 21% increase

in sales of Allergy Diagnostic Kits to $237,066 from $195,507. |

| |

|

|

| |

● |

Gross

Profit of $286,158 with a gross margin of 58.6%, up from $187,342 with a 53.1% margin in Q1 2023. |

| |

|

|

| |

● |

Total

Operating Expenses decreased by 11.5% to $272,554 in Q1 2024 from $308,100 in the first quarter of 2023, reflecting the Company’s

successful cost management strategies. |

| |

|

|

| |

● |

Positive

Net Operating Income of $13,604 for Q1 2024, a significant improvement from a net operating loss of $120,758 in Q1 2023 |

Operational

and Financial Review:

| |

● |

Sales

and Marketing expenses were $121,946, showing a slight reduction from $123,953 in Q1 2023 due to more efficient marketing spend

and increased internal sales efforts. |

| |

|

|

| |

● |

General

and Administrative expenses decreased to $89,942 from $102,572, largely due to optimized investor relations and management consulting

services. |

| |

|

|

| |

● |

Research

and Development expenses were reduced to $42,638 from $63,547, as resources were reallocated towards the commercialization of

the QHSLab platform. |

Executive

Commentary: Troy Grogan, President and CEO of QHSLab, Inc., commented, “Our first quarter performance in 2024 illustrates not

only growth but also enhanced operational efficiency. The substantial reduction in operating expenses coupled with a turnaround to positive

net operating income underscores our commitment to sustainable growth and value creation for our shareholders. With continued focus on

strategic product integration and market expansion, we anticipate maintaining this positive trajectory.”

Strategic

Direction 2024: Enhancing QHSLab’s Growth and Operational Efficiency

As

we move further into 2024, the Company is poised to implement a robust strategy aimed at expanding our footprint and enhancing our service

offerings. Here are the key areas of focus for our strategic direction:

Corporate

Goals and Strategies:

| |

1. |

Increase

Income per Customer/Account: |

| |

● |

Enhance Digital Assessment Completion Rates: We are

implementing targeted strategies to increase patient engagement and completion rates of our health assessments, crucial for enhancing

primary care health management. |

| |

|

|

| |

● |

Expand Customer Income Opportunities: Integration of additional complementary service lines are currently being explored to maximize

revenue opportunities without compromising patient care. |

| |

|

|

| |

● |

Boost Allergy Service Line Usage: We are planning additional marketing strategies and educational programs to enhance the adoption

and utilization of our allergy-related services in line with our comprehensive digital mental health and allergic disease screening tools. |

| |

2. |

Expand Customer/Account Base: |

| |

● |

Enhance Marketing Efforts: We are evolving our marketing strategy involving partnerships, and physician referrals to broaden our

customer base. |

| |

|

|

| |

● |

Strengthen Sales and Customer Relationships: Investment in training and development for our sales and account management teams

will focus on improving engagement and retention rates. |

Operational

Improvements:

| |

● |

Identify and Address Operational Bottlenecks: Regular audits are being conducted to pinpoint inefficiencies. Solutions will be

implemented to streamline operations, enhance service delivery, and improve patient outcomes. |

| |

|

|

| |

● |

Strengthening Relationships: We will enhance engagement between QHSLab account managers and client administrative leadership to

ensure efficient operations and improved point of care service delivery. |

| |

|

|

| |

● |

Enhancing Provider Engagement: Increasing training and informational sessions for providers will boost their understanding of

and interest in our services. |

| |

|

|

| |

● |

Additional Digital Assessment Integration: We will closely monitor the introduction of new service lines to assess their impact

on insurance reimbursements and their practical implications for patients and providers. |

| |

|

|

| |

● |

Data Utilization: Data derived from QHSLab operations will be leveraged to demonstrate the correlation between our services and

improvements in practice efficiency, patient outcomes, and financial metrics. |

These

strategic initiatives are designed to not only expand QHSLab’s reach and improve operational efficiency but also to position our

company as a leader in enhancing healthcare quality and patient outcomes through innovative digital health solutions.

For

more information about QHSLab and our healthcare solutions, please visit www.qhslab.com.

About

QHSLab, Inc.

QHSLab,

Inc. (OTCQB: USAQ) is a medical device company providing digital healthcare solutions and point-of-care-diagnostic tests to primary care

physicians. Digital healthcare allows doctors to assess patient responses quickly and effectively using advanced artificial intelligence

algorithms. Digital healthcare can also remotely monitor patients’ vital signs and evaluate the effects of prescribed medicines

and treatments on patients’ health through real-time data transferred from patient to doctor. QHSLab, Inc. also markets and sells

point-of-care, rapid-response diagnostic tests used in the primary care practice. QHSLab, Inc.’s products and services are designed

to help physicians improve patient monitoring and medical care while also improving their revenues.

Forward-Looking

Statements

Certain

matters discussed in this press release are ‘forward-looking statements’ intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. In particular, the Company’s statements regarding trends in

the marketplace, future revenues, future products, and potential future results and acquisitions are examples of such forward-looking

statements. Forward-looking statements are generally identified by words such as ‘may,’ ‘could,’ ‘believes,’

‘estimates,’ ‘targets,’ ‘expects,’ or ‘intends,’ and other similar words that express

risks and uncertainties. These statements are subject to numerous risks and uncertainties, including, but not limited to, the timing

of the introduction of new products, the inherent discrepancy in actual results from estimates, projections, and forecasts made by management,

regulatory delays, changes in government funding and budgets, and other factors, including general economic conditions, not within the

Company’s control. The factors discussed herein and expressed from time to time in the Company’s filings with the Securities

and Exchange Commission could cause actual results and developments to be materially different from those expressed in or implied by

such statements. The forward-looking statements are made only as of the date of this press release. The Company undertakes no obligation

to publicly update such forward-looking statements to reflect subsequent events or circumstances.

Investor

Relations Contact:

Olivia

Giamanco

QHSLab,

Inc.

(929)

379-6503

ir@usaqcorp.com

https://twitter.com/QHSLabInc

v3.24.1.1.u2

Cover

|

May 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 13, 2024

|

| Entity File Number |

0-19041

|

| Entity Registrant Name |

QHSLab,

Inc.

|

| Entity Central Index Key |

0000856984

|

| Entity Tax Identification Number |

30-1104301

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

901

Northpoint Parkway

|

| Entity Address, Address Line Two |

Suite 302

|

| Entity Address, City or Town |

West Palm Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33407

|

| City Area Code |

(929)

|

| Local Phone Number |

379-6503

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value

|

| Trading Symbol |

USAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

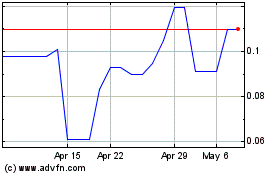

QHSLab (QB) (USOTC:USAQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

QHSLab (QB) (USOTC:USAQ)

Historical Stock Chart

From Nov 2023 to Nov 2024