false

0001006028

DE

0001006028

2024-06-14

2024-06-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 14,

2024

PURE

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-14468 |

|

33-0530289 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

771

Jamacha Rd., #512

El

Cajon, California |

|

92019 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

9669

Hermosa Avenue

Rancho

Cucamonga, California |

|

91730 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(Former

name or former address, if changed since last report)

Registrant’s

telephone number, including area code: (619)

596-8600

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

June 14, 2024, PURE Bioscience, Inc. (the “Company”) issued a press release announcing financial results for the fiscal quarter

ended April 30, 2024 and related information. A copy of the press release is attached as Exhibit 99.1.

The

information in this Item 2.02 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Item 2.02 shall not be incorporated

by reference into any registration statement or other document filed with the Securities and Exchange Commission.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

| * |

Exhibit

99.1 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934 or otherwise subject to the liabilities of that Section, nor shall it be incorporated by reference into any registration

statement or other document filed with the Securities and Exchange Commission. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

PURE

BIOSCIENCE, INC. |

| |

|

|

| Dated:

June 14, 2024 |

By:

|

/s/

Robert F. Bartlett |

| |

|

Robert

F. Bartlett |

| |

|

Chief

Executive Officer |

EXHIBIT

INDEX

Exhibit

99.1

PURE

Bioscience Reports Fiscal Third Quarter 2024

Financial

Results

Update

on Business and PURE’s SDC-Based Antimicrobial Food Safety Solutions

EL

CAJON, Calif. - (June 14, 2024) – PURE Bioscience, Inc. (OTCQB: PURE) (“PURE,” the “Company” or

“we”), creator of the patented non-toxic silver dihydrogen citrate (SDC) antimicrobial, today reported financial results

for the fiscal third quarter ended April 30, 2024.

Summary

of Results – Fiscal Third Quarter Operations

| ● | Net

product sales were $440,000 and $406,000 for the fiscal third quarter ended April 30, 2024

and 2023, respectively. The increase of $34,000 was attributable to increased sales across

our end-user network. |

| ● | Net

loss for the fiscal third quarter ended April 30, 2024, was $857,000, compared to $876,000

for the fiscal third quarter ended April 30, 2023. |

| ● | Net

loss, excluding share-based compensation, for the fiscal third quarter ended April 30, 2024,

was $825,000, compared to $832,000 for the fiscal third quarter ended April 30, 2023. |

| ● | Net

loss per share was ($0.01) for the fiscal third quarters ended April 30, 2024 and 2023, respectively. |

Nine

Months: Summary of Results of Operations

| ● | Net

product sales were $1,483,000 and $1,269,000 for the nine months ended April 30, 2024 and

2023, respectively. The increase of $214,000 was attributable to increased sales across our

end-user and distribution network. |

| ● | Net

loss for the nine months ended April 30, 2024, was $2,594,000, compared to $2,929,000 for

the nine months ended April 30, 2023. |

| ● | Net

loss, excluding share-based compensation, for the nine months ended April 30, 2024, was $2,418,000,

compared to $2,654,000 for the nine months ended April 30, 2023. |

| ● | Net

loss per share was ($0.03) for the nine months ended April 30, 2024 and 2023, respectively. |

Business

Update

We

believe the foundation for a sustainable and profitable organization is underway. Significant focus and resources have been built around

our shift in business strategy from a direct sales model to a distributor model.

Jeff

Kitchell, Vice President of Operations, said “Our leadership team has worked hard to develop a new Tier Pricing Agreement which

satisfies margin requirements for our distributors, as well as setting a minimum advertised price and manufacturer’s suggested

retail price. This new program is being met with great interest and enthusiasm from key distributors in the industry and discussions

are well underway and we plan to provide further updates as we continue to drive results under this program.”

| ● | Brand

Advertising and Marketing. Further development of our social media presence has been

a continued area of focus, and it is not going unnoticed. In the past 90 days, our platform

engagement has increased by 167%, and our followers are up by nearly 70%. This significant

increase in exposure to PURE’s product line and innovative solutions has led to new

leads and opened the door to discussions with industry experts and potential new distribution

partners. PURE’s brand is evolving as we continue working with our branding firm to

guide us in clearly communicating to the public that PURE’s team is trustworthy, our

premium solutions are truly innovative, and that SDC technology is a complete game changer

across multiple industries. Our growing customer base is comprised of companies that value

the health and safety of their customers and employees, as well as the commitment to protecting

their brand and the environment. |

| ● | Trade

Shows. The PURE team continues to exhibit, attend, and support customer and industry

events and trade shows as part of our continued growth initiatives. This involvement continues

to be an effective approach to meeting new customers and continuing networking and educating

the industry on our unique SDC solutions. In the past quarter, our team has attended or presented

at multiple customer and local events, along with the Cheese Expo – a global technology

event for the dairy industry, as well as the Penn State Dairy Expo. These shows and events

not only help us bring a spotlight to PURE’s product line but also allow for strategic

meetings with key stakeholders throughout the industry. PURE is again registered to exhibit

at the International Association for Food Protection (IAFP) annual meeting in Long Beach,

California (July 14-17, 2024). The IAFP annual meeting is attended by more than 3,500 of

the top industry, academic, and governmental food safety professionals. |

| ● | Distributor

Focus and Support. Our distributor program led by Tyler Mattson, Vice President of

Key Accounts and Technology, is gaining attention and interest. We believe this program will

help support our necessary growth once fully rolled out, and will also provide the needed

resources and expertise as we expand our business offerings and solutions. Tyler and his

team are proactively working with potential distributors on our new training and education

program. |

| ● | Continued

Innovation. Our R&D efforts led by Tom Myers, Executive Vice President of Technology

and Development, continue to address unmet needs using SDC across multiple industries such

as the dairy and animal health industry. We believe these initiatives driven by the need

for cost savings, ever-increasing food safety standards, and new cleaning and sanitizing

methods to meet corporate environmental sustainability goals will give a unique advantage

to our distribution partners and the end user. |

Robert

Bartlett, Chief Executive Officer, said, “While it is obvious sales growth has not been at the rate it needs to be, the team is

dedicated to building our foundation which takes time and patience. I am confident we are on the right track as we continue to transform

into an innovative customer solutions company using a distribution model for greater reach. Both momentum and industry interest are starting

to build. Under the direction of Tim Steffensmeier, Vice President of Sales and Marketing, the team is steadfast in building and promoting

our brand, supporting current industry offerings, and conducting R&D projects to address areas of concern in industries such as dairy

and animal health,” concluded Bartlett.

About

PURE Bioscience, Inc.

PURE

focuses on developing and commercializing our proprietary antimicrobial products primarily in food safety. We provide solutions to combat

the health and environmental challenges of pathogens and hygienic control. Our technology platform is based on patented, stabilized ionic

silver, and our initial products contain silver dihydrogen citrate, better known as SDC. This is a broad-spectrum, non-toxic antimicrobial

agent, and formulates well with other compounds. As a platform technology, SDC is distinguished from existing products in the marketplace

because of its superior efficacy, reduced toxicity, and mitigation of bacterial resistance. PURE’s mailing address is 771 Jamacha

Rd. #512, El Cajon, California 92019 (San Diego County area) serves as its official address for all business requirements. Additional

information on PURE is available at www.purebio.com.

Forward-looking

Statements: Any statements contained in this press release that do not describe historical facts may constitute forward-looking

statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Statements in this press release, including

quotes from management, concerning the Company’s expectations, plans, business outlook, future performance, future potential revenues,

expected results of the Company’s marketing efforts, the execution of contracts under negotiation, and any other statements concerning

assumptions made or expectations as to any future events, conditions, performance or other matters, are “forward-looking statements.”

Forward-looking statements inherently involve risks and uncertainties that could cause our actual results to differ materially from any

forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the Company’s

failure to implement or otherwise achieve the benefits of its proposed business initiatives and plans; acceptance of the Company’s

current and future products and services in the marketplace, including the Company’s ability to convert successful evaluations

and tests for PURE Control and PURE Hard Surface into customer orders and customers continuing to place product orders as expected and

to expand their use of the Company’s products; the Company’s ability to maintain relationships with its partners and other

counterparties; the Company’s ability to generate sufficient revenues and reduce its operating expenses in order to reach profitability;

the Company’s ability to raise the funding required to support its continued operations and the implementation of its business

plan; the ability of the Company to develop effective new products and receive required regulatory approvals for such products, including

the required data and regulatory approvals required to use its SDC-based technology as a direct food contact processing aid in raw meat

processing and to expand its use in OLR poultry processing; competitive factors, including customer acceptance of the Company’s

SDC-based products that are typically more expensive than existing treatment chemicals; dependence upon third-party vendors, including

to manufacture its products; and other risks detailed in the Company’s periodic report filings with the Securities and Exchange

Commission (the SEC), including its Form 10-K for the fiscal year ended July 31, 2023, Form 10-Q for the fiscal first quarter ended October

31, 2023, Form 10-Q for the fiscal second quarter ended January 31, 2024, and Form 10-Q for the fiscal third quarter ended April 30,

2024. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

By making these forward-looking statements, the Company undertakes no obligation to update these statements for revisions or changes

after the date of this release.

Contact:

Mark

Elliott, VP Finance

PURE

Bioscience, Inc.

Phone:

619-596-8600 ext.: 116

PURE

Bioscience, Inc.

Condensed

Consolidated Balance Sheets

| | |

April

30, 2024 | | |

July

31, 2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 442,000 | | |

$ | 1,095,000 | |

| Accounts receivable | |

| 234,000 | | |

| 285,000 | |

| Inventories, net | |

| 74,000 | | |

| 88,000 | |

| Restricted cash | |

| 75,000 | | |

| 75,000 | |

| Prepaid expenses | |

| 44,000 | | |

| 61,000 | |

| Total current assets | |

| 869,000 | | |

| 1,604,000 | |

| Property, plant and

equipment, net | |

| 51,000 | | |

| 221,000 | |

| Total assets | |

$ | 920,000 | | |

$ | 1,825,000 | |

| Liabilities and stockholders’

equity (deficiency) | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 506,000 | | |

$ | 422,000 | |

| Accrued liabilities | |

| 160,000 | | |

| 110,000 | |

| Total current liabilities | |

| 666,000 | | |

| 532,000 | |

| Long-term liabilities | |

| | | |

| | |

| Note payable to related

parties | |

| 2,400,000 | | |

| 1,021,000 | |

| Total long-term liabilities | |

| 2,400,000 | | |

| 1,021,000 | |

| Total liabilities | |

| 3,066,000 | | |

| 1,553,000 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity (deficiency) | |

| | | |

| | |

| Preferred stock, $0.01 par value: 5,000,000

shares authorized, no shares issued and outstanding | |

| — | | |

| — | |

| Common stock, $0.01 par value: 150,000,000

shares authorized, 111,856,473 shares issued and outstanding at April 30, 2024, and July 31, 2023 | |

| 1,119,000 | | |

| 1,119,000 | |

| Additional paid-in capital | |

| 132,574,000 | | |

| 132,398,000 | |

| Accumulated deficit | |

| (135,839,000 | ) | |

| (133,245,000 | ) |

| Total stockholders’

equity (deficiency) | |

| (2,146,000 | ) | |

| 272,000 | |

| Total liabilities

and stockholders’ equity (deficiency) | |

$ | 920,000 | | |

$ | 1,825,000 | |

PURE

Bioscience, Inc.

Condensed

Consolidated Statements of Operations

(Unaudited)

| | |

Nine Months

Ended | | |

Three months

Ended | |

| | |

April

30, | | |

April

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net product sales | |

$ | 1,483,000 | | |

$ | 1,269,000 | | |

$ | 440,000 | | |

$ | 406,000 | |

| Royalty revenue | |

| 6,000 | | |

| 6,000 | | |

| 1,000 | | |

| 1,000 | |

| Total revenue | |

| 1,489,000 | | |

| 1,275,000 | | |

| 441,000 | | |

| 407,000 | |

| Cost of goods sold | |

| 612,000 | | |

| 625,000 | | |

| 183,000 | | |

| 211,000 | |

| Gross profit | |

| 877,000 | | |

| 650,000 | | |

| 258,000 | | |

| 196,000 | |

| Operating costs and expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 3,136,000 | | |

| 3,342,000 | | |

| 998,000 | | |

| 997,000 | |

| Research

and development | |

| 233,000 | | |

| 227,000 | | |

| 77,000 | | |

| 74,000 | |

| Total operating costs

and expenses | |

| 3,369,000 | | |

| 3,569,000 | | |

| 1,075,000 | | |

| 1,071,000 | |

| Loss from operations | |

| (2,492,000 | ) | |

| (2,919,000 | ) | |

| (817,000 | ) | |

| (875,000 | ) |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Other income (expense),

net | |

| 1,000 | | |

| (4,000 | ) | |

| 1,000 | | |

| 1,000 | |

| Interest

expense, net | |

| (103,000 | ) | |

| (6,000 | ) | |

| (41,000 | ) | |

| (2,000 | ) |

| Total other income (expense) | |

| (102,000 | ) | |

| (10,000 | ) | |

| (40,000 | ) | |

| (1,000 | ) |

| Net loss | |

$ | (2,594,000 | ) | |

$ | (2,929,000 | ) | |

$ | (857,000 | ) | |

$ | (876,000 | ) |

| Basic and diluted net

loss per share | |

$ | (0.03 | ) | |

$ | (0.03 | ) | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| Shares used in computing

basic and diluted net loss per share | |

| 111,856,473 | | |

| 111,356,473 | | |

| 111,856,473 | | |

| 111,356,473 | |

PURE

Bioscience, Inc.

Condensed

Consolidated Statement of Stockholders’ Equity (Deficiency)

(Unaudited)

| | |

Nine

Months Ended April 30, 2024 | | |

Nine

Months Ended April 30, 2023 | |

| | |

Common

Stock | | |

Additional

Paid-In | | |

Accumulated | | |

Total

Stockholders’ | | |

Common

Stock | | |

Additional

Paid-In | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balances at beginning of period | |

| 111,856,473 | | |

$ | 1,119,000 | | |

$ | 132,398,000 | | |

$ | (133,245,000 | ) | |

$ | 272,000 | | |

| 111,356,473 | | |

$ | 1,114,000 | | |

$ | 132,079,000 | | |

$ | (129,284,000 | ) | |

$ | 3,909,000 | |

| Share-based compensation expense - stock options | |

| — | | |

| — | | |

| 176,000 | | |

| — | | |

| 176,000 | | |

| — | | |

| — | | |

| 213,000 | | |

| — | | |

| 213,000 | |

| Share-based compensation expense - restricted

stock units | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 62,000 | | |

| — | | |

| 62,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (2,594,000 | ) | |

| (2,594,000 | ) | |

| — | | |

| — | | |

| — | | |

| (2,929,000 | ) | |

| (2,929,000 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at end of period (Unaudited) | |

| 111,856,473 | | |

$ | 1,119,000 | | |

$ | 132,574,000 | | |

$ | (135,839,000 | ) | |

$ | (2,146,000 | ) | |

| 111,356,473 | | |

$ | 1,114,000 | | |

$ | 132,354,000 | | |

$ | (132,213,000 | ) | |

$ | 1,255,000 | |

| | |

Three

Months Ended April 30, 2024 | | |

Three

Months Ended April 30, 2023 | |

| | |

Common

Stock | | |

Additional

Paid-In | | |

Accumulated | | |

Total

Stockholders’ | | |

Common

Stock | | |

Additional

Paid-In | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balances at beginning of period

(Unaudited) | |

| 111,856,473 | | |

$ | 1,119,000 | | |

$ | 132,542,000 | | |

$ | (134,982,000 | ) | |

$ | (1,321,000 | ) | |

| 111,356,473 | | |

$ | 1,114,000 | | |

$ | 132,290,000 | | |

$ | (131,337,000 | ) | |

$ | 2,067,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation expense - stock options | |

| — | | |

| — | | |

| 32,000 | | |

| — | | |

| 32,000 | | |

| — | | |

| — | | |

| 44,000 | | |

| — | | |

| 44,000 | |

| Share-based compensation expense - restricted

stock units | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 20,000 | | |

| — | | |

| 20,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (857,000 | ) | |

| (857,000 | ) | |

| — | | |

| — | | |

| — | | |

| (876,000 | ) | |

| (876,000 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances at end of period (Unaudited) | |

| 111,856,473 | | |

$ | 1,119,000 | | |

$ | 132,574,000 | | |

$ | (135,839,000 | ) | |

$ | (2,146,000 | ) | |

| 111,356,473 | | |

$ | 1,114,000 | | |

$ | 132,354,000 | | |

$ | (132,213,000 | ) | |

$ | 1,255,000 | |

PURE

Bioscience, Inc.

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

| | |

Nine Months

Ended | |

| | |

April

30, | |

| | |

2024 | | |

2023 | |

| Operating activities | |

| | | |

| | |

| Net loss | |

$ | (2,594,000 | ) | |

$ | (2,929,000 | ) |

| Adjustments to reconcile net loss to net

cash used in operating activities: | |

| | | |

| | |

| Share-based compensation | |

| 176,000 | | |

| 275,000 | |

| Depreciation and amortization | |

| 110,000 | | |

| 102,000 | |

| Impairment of computer

software | |

| 60,000 | | |

| — | |

| Reserve for inventory

obsolescence | |

| — | | |

| 40,000 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 51,000 | | |

| 13,000 | |

| Inventories | |

| 14,000 | | |

| (10,000 | ) |

| Prepaid expenses | |

| 17,000 | | |

| (19,000 | ) |

| Interest on note payable | |

| 94,000 | | |

| — | |

| Accounts payable and

accrued liabilities | |

| 134,000 | | |

| (6,000 | ) |

| Net cash used in operating activities | |

| (1,938,000 | ) | |

| (2,534,000 | ) |

| Investing activities | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| — | | |

| (76,000 | ) |

| Net cash used in investing activities | |

| — | | |

| (76,000 | ) |

| Financing activities | |

| | | |

| | |

| Net proceeds from note payable to related

parties | |

| 1,285,000 | | |

| — | |

| Net cash provided by financing activities | |

| 1,285,000 | | |

| — | |

| Net decrease in cash, cash equivalents,

and restricted cash | |

| (653,000 | ) | |

| (2,610,000 | ) |

| Cash, cash equivalents, and restricted cash

at beginning of period | |

| 1,170,000 | | |

| 3,466,000 | |

| Cash, cash equivalents, and restricted cash

at end of period | |

$ | 517,000 | | |

$ | 856,000 | |

| | |

| | | |

| | |

| Reconciliation of cash,

cash equivalents, and restricted cash to the condensed consolidated balance sheets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 442,000 | | |

$ | 781,000 | |

| Restricted cash | |

$ | 75,000 | | |

$ | 75,000 | |

| Total cash, cash equivalents and restricted

cash | |

$ | 517,000 | | |

$ | 856,000 | |

| | |

| | | |

| | |

| Supplemental disclosure

of cash flow information | |

| | | |

| | |

| Cash paid for taxes | |

$ | — | | |

| 5,000 | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

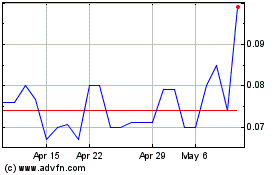

PURE Bioscience (PK) (USOTC:PURE)

Historical Stock Chart

From Dec 2024 to Jan 2025

PURE Bioscience (PK) (USOTC:PURE)

Historical Stock Chart

From Jan 2024 to Jan 2025