UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14C

of

the Securities Exchange Act of 1934, as amended

|

[X]

Filed by the Registrant

|

[ ]

Filed by a Party other than the Registrant

|

Check

the appropriate box:

|

[X]

|

Preliminary

Information Statement

|

|

[ ]

|

Definitive

Information Statement

|

|

[ ]

|

Confidential,

for Use of the Commission (as permitted by Rule 14c)

|

PETLIFE

PHARMACEUTICALS, INC.

(Name

of Registrant as Specified in its Charter)

Name

of Person(s) Filing Information Statement, if other than Registrant:

N/A

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

|

No

Fee Required.

|

|

|

|

|

|

[ ]

|

|

Fee

based on table below per Exchange Act Rules 14C-5(g) and 0-11

|

|

|

|

|

|

(1)

|

|

Title

of each class of securities to which transaction applies: _____________________________.

|

|

|

|

|

|

(2)

|

|

Aggregate

number of securities to which the transaction applies: _________________________.

|

|

|

|

|

|

(3)

|

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

|

|

|

|

(Set

forth the amount of the filing fee is calculated and state how it was determined: ____.

|

|

|

|

|

|

(4)

|

|

Proposed

maximum value of transaction: ____________________________________________.

|

|

|

|

|

|

(5)

|

|

Total

fee paid:_________________________________________________________________.

|

|

|

|

|

|

[ ]

|

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

|

[ ]

|

|

Check

box if any part of the fee is offset as provided by Exchange Rule 0-11 (a) (2) and identify the filing fee for which the offsetting

fees was paid previously. Identify the previous filing by registration number, or the Form or Schedule and the date of its

filing.

|

WE

ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

PETLIFE

PHARMACEUTICALS, INC.

10120

So. Eastern Avenue

Suite

213

Henderson,

NV 89052

INFORMATION

STATEMENT

This

Information Statement (the “

Information Statement

”) is being furnished to all holders of shares of Common Stock,

par value $0.001 per share (“

Common Stock”)

of record at the close of business on April 25, 2018 (collectively,

the “

Stockholders

”) of PetLife Pharmaceuticals, Inc., a Nevada corporation (the “

Company

”),

with respect to a proposed corporate action of the Company. This Information Statement is first being provided to the Stockholders

on or about __________________.

The

corporate action involves one (1) proposal (the “

Proposal

”) providing for the following:

1.

To approve the increase in the total number of authorized shares of common stock from Seven Hundred Fifty Million (750,000,000)

to Ten Billion (10,000,000,000).

ONLY

THE STOCKHOLDERS OF RECORD AT THE CLOSE OF BUSINESS ON APRIL 25, 2018 ARE ENTITLED TO NOTICE OF THE PROPOSAL. A PRINCIPAL STOCKHOLDER

WHO HOLDS FIFTY-FOUR AND 53/100 PERCENT (54.3%) OF THE COMPANY’S SHARES OF VOTING CAPITAL STOCK ENTITLED TO VOTE ON THE

PROPOSAL HAS VOTED IN FAVOR OF THE PROPOSAL. AS A RESULT, THE PROPOSALS HAVE BEEN APPROVED WITHOUT THE AFFIRMATIVE VOTE OF ANY

OTHER STOCKHOLDERS OF THE COMPANY.

BY

ORDER OF THE BOARD OF DIRECTORS

|

By:

|

/s/

Laura De Leon Castro

|

|

|

|

Laura

De Leon Castro, Secretary

|

|

Henderson,

Nevada

_____________________,

2018

TABLE

OF CONTENTS

PETLIFE

PHARMACEUTICALS, INC.

10120

So. Eastern Avenue

Suite

213

Henderson,

NV 89052

INFORMATION

STATEMENT

This

Information Statement (this “

Information Statement

”) contains information related to certain corporate actions

of PetLife Pharmaceuticals, Inc., a Nevada corporation (the “

Company

”), and is expected to be mailed on or

about _____________, 2018__ to all holders of shares of Common Stock, par value $0.001 per share (“

Common Stock

”)

of record at the close of business on April 25, 2018 (collectively, the “

Stockholders

”)

ABOUT

THE INFORMATION STATEMENT

What

Is The Purpose Of The Information Statement?

This

Information Statement is being provided pursuant to Section 14 of the Securities Exchange Act of 1934, as amended, to notify the

Stockholders, as of the close of business on April 25, 2018 (the “

Record Date

”), of the corporate actions taken

pursuant to the written consent of certain principal stockholders.

Specifically,

on April 25, 2018, a holder of Fifty-Four and 53/100 percent (54.3%) our Common Stock voted to approve the corporate matters outlined

in this Information Statement, consisting of: (i) To approve an increase in the number of authorized shares of Common Stock from

Seventy-five Million (75,000,000) to Ten Billion (10,000,000,000).

Who

Is Entitled To Notice?

All

holders of shares of Common Stock on the close of business on the Record Date will be entitled to notice of each matter

voted upon by a principal stockholder pursuant to the written consent of a principal stockholder. Specifically, the holder of

a majority of the outstanding shares of Common Stock, which constitute a majority of all shares eligible to vote, has voted

in favor of the Proposal listed in this notice. Under Nevada corporate law Section NRS 78.320, all the activities requiring

stockholder approval may be taken by obtaining the written consent and approval of more than a majority (greater than 50.00%)

of the holders of voting stock in lieu of a meeting of the stockholders.

Because

the holder of more than fifty percent, i.e., 54.3% of the collective voting rights of the Common Stock, voted in favor of the

Proposal no action by the minority stockholders in connection with the Proposal set forth herein is required.

PRINCIPAL

STOCKHOLDER

Who

Are The Principal Stockholders And How Many Votes Are They Entitled to Cast?

Delta

9 Pharmaceuticals, Inc. is the holder of 100,000,000 shares of Common Stock. The voting rights of Delta 9 Pharmaceuticals, Inc.

represent 54.3% of the total issued and outstanding voting rights of the Company.

What

Corporate Matters Have The Principal Stockholders Voted For?

The

principal stockholder that holds a greater than a majority, 54.3% of the total issued and outstanding voting rights of the Company

has voted by written consent for the approval and ratification of both of the Board of Directors proposal described in this Information

Statement. (1)

|

Series

of Stock

|

|

Shareholder

|

|

Shares

in Series

|

|

|

Percent

of

Ownership

in

Series

|

|

|

Percent

of

All

Voting

Rights

|

|

|

Common Stock

|

|

Delta 9 Pharmaceuticals, Inc.

|

|

|

100,000,000

|

|

|

|

54.3

|

%

|

|

|

54.3

|

%

|

Notes:

(1)

Based on a total of 183,358,884 shares of Common Stock issued and outstanding as of April 25, 2018. Under Rule 13d-3, certain

shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the

power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right

to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided.

In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares

beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of

outstanding shares of any person as shown in this table may not necessarily reflect the person’s actual ownership or voting

power with respect to the number of shares of common stock actually outstanding on April 25, 2018.

What

is the Recommendation of the Board of Directors?

On

April 24, 2018, the Board of Directors unanimously adopted resolutions approving the Proposal. The Board of Directors recommends

adoption of the Proposal.

What

Vote is Required to Approve the Proposal?

A

vote of the majority of the voting rights of capital stock is required to approve the Proposal. As a result, a vote to approve

the Proposal by a majority of the aggregate voting rights held by a holder of Common Stock is sufficient to approve the Proposal.

In this instance, 54.3% of the voting right of the outstanding shares of voting stock have approved the Proposal.

PRINCIPAL

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security

Ownership

The

following tables set forth certain information concerning the number of shares of our capital stock owned beneficially as of April

25, 2018 by: (i) each person (including any group) known to us to own more than five percent (5%) of any Series of our voting

securities, (ii) our directors, and our named executive officers. Unless otherwise indicated, the stockholders listed possess

sole voting and investment power with respect to the shares shown.

|

Title

of Series

|

|

Name

and Address of Beneficial Owner

|

|

Amount

and

Nature

of

Beneficial

Ownership

|

|

|

Percentage

of Ownership(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stock

|

|

Laura De

Leon Castro (2)

Chief Executive Officer, President,

Secretary, Treasurer, Principal Financial

Officer, and Director

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5%

SHAREHOLDERS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stock

|

|

Delta 9 Pharmaceuticals,

Inc.

333 City Blvd. West

Suite 1700

Orange, CA 92868

|

|

|

100,000,000

(Direct)

|

|

|

|

54.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stock

|

|

Grand Street Ventures

LLC

3 Grand Street

Hanock, MD 21750

|

|

|

18,700,000

(Direct)

|

|

|

|

10.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stock

|

|

Elite International

Partners, Inc.

8233 Roxbury Road

Los Angeles, CA 90069

|

|

|

3,100,000

(Direct)

|

|

|

|

7.14

|

%

|

Notes:

(1)

Based on 183,358,884 shares of our Common Stock, issued and outstanding on April 25, 2018. Under Rule 13d-3, certain shares may

be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose

of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the

shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing

the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially

owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding

shares of any person as shown in this table may not necessarily reflect the person’s actual ownership or voting power with

respect to the number of shares of common stock actually outstanding on April 25, 2018.

(2)

The address is 10120 So. Eastern Avenue, Suite 213, Henderson, NV 89052.

DIRECTORS,

EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

We

have no promoters and we have no control persons required to be disclosed other than those listed above.

Our

executive officers and directors and their ages and titles as of April 25, 2018 are as follows:

|

Name and Address of Officer/Director

(1)

|

|

Age

|

|

Position

|

|

Laura

De Leon Castro

|

|

43

|

|

Chief

Executive Officer, President, Secretary, Treasurer. Principal Financial Officer, and Chairman of the Board of Directors

|

Notes:

(1) The address is 10120 So. Eastern Avenue, Suite 213, Henderson, NV 89052.

Laura

De Leon Castro - Chief Executive Officer, President, Secretary, Treasurer, Principal Financial Officer, and Chairman of the Board

of Directors

Laura

De Leon Castro, age 43, was elected as Chief Executive Officer, President, Secretary, Treasurer, and Chairman of the Board of

Directors on March 19, 2018. She was born and raised in the City of Monterrey, Mexico. She is a graduate of the law School of

the University of Monterrey. Following her graduation in 1996, she was employed as attorney with a law firm in Monterrey, Mexico

from 1997 to 2000. Thereafter, she served as the Assistant to the Chief Executive Officer of Gatorade Mexico from 2001 to 2003.

During that period, she also became a certified Emergency Medical Technician. Following move to Spain in 2003, she has served

as a volunteer Emergency Medical Technician.

Term

of Office

Members

of our board of directors are appointed to hold office until the next annual meeting of our stockholders or until his or her successor

is elected and qualified, or until he or she resigns or is removed in accordance with the provisions of the Nevada Revised Statutes.

Our officers are appointed by our board of directors and hold office until removed by the board.

Involvement

in Certain Legal Proceedings

None

of our directors or executive officers has been, during the past ten years:

(i)

involved in any bankruptcy petition filed by or against such person or any business of which such person was a general partner

or executive officer, either at the time of the bankruptcy or within two years prior to that time;

(ii)

convicted of any criminal proceeding or subject to a pending criminal proceeding (excluding traffic violations and other minor

offenses);

(iii)

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction,

permanently or temporarily enjoined, barred, suspended or otherwise limited from involvement in any type of business, securities,

futures, commodities or banking activities;

(iv)

found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures

Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed,

suspended, or vacated;

(v)

found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities

law, and the judgment in such civil action or finding by the Commission has not been subsequently reverse, suspended, or vacated;

(vi)

subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently

reversed, suspended or vacated, related to an alleged violation of securities or commodities law or regulation; any law or regulation

respecting financial institutions or insurance companies; or any law or regulation prohibiting mail or wire fraud or fraud in

connection with any business entity; or

(vii)

the subject of, or a party to, any sanction or order, not subsequently reversed, suspending or vacated, of any self-regulatory

any registered entity of the Commodity Exchange Act or any equivalent exchange, association, entity or organization that has disciplinary

authority over its members or persons associated with a member.

Significant

Employees

We

have no significant employees, other than our executive officer.

Committees

of the Board of Directors

We

do not presently have a separately constituted audit committee, compensation committee, nominating committee, executive committee

or any other committees of our board of directors.

Audit

Committee Financial Expert

Not

applicable, as we do not presently have an audit committee.

Director

Independence

Quotations

for our common stock are entered on the OTC Bulletin Board inter-dealer quotation system, which does not have director independence

requirements. For purposes of determining director independence, we have applied the definitions set out in NASDAQ Rule 4200(a)(15).

Under NASDAQ Rule 4200(a)(15), a director is not considered to be independent if he or she is also an executive officer or employee

of the corporation. Our sole director acts as an executive officer of the corporation.

Board

Meetings and Committees, Annual Meeting Attendance

Although

we intend to establish an audit committee and compensation committee, our board of directors has not adopted any committees to

the board of directors. Our board of directors held no formal meeting during the most recently completed fiscal year. All other

proceedings of the board of directors were conducted by resolutions consented to in writing by all the directors and filed with

the minutes of the proceedings of the directors. Such resolutions consented to in writing by the directors entitled to vote on

that resolution at a meeting of the directors are, according to the corporate laws of the State of Nevada and our bylaws, as valid

and effective as if they had been passed at a meeting of the directors duly called and held.

At

each annual meeting of shareholders, directors will be elected by the holders of common stock to succeed those directors whose

terms are expiring. Directors will be elected annually and will serve until successors are duly elected and qualified or until

a director’s earlier death, resignation or removal. Our bylaws provide that the authorized number of directors may be changed

by action of the majority of the board of directors or by a vote of the shareholders of our Company. Vacancies in our board of

directors may be filled by a majority vote of the board of directors with such newly appointed director to serve until the next

annual meeting of shareholders, unless sooner removed or replaced. We currently do not have a policy regarding the attendance

of board members at the annual meeting of shareholders.

Code

of Ethics

Given

our limited operations, we have not adopted a Code of Ethic that applies to our officers, directors and employees in accordance

with applicable federal securities laws. We expect that our Board of Directors will adopt a Code of Ethics in the near future.

Compliance

with Section 16(a) of the Exchange Act

Section

16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than 10% of any publicly traded

class of our equity securities, to file reports of ownership and changes in ownership of our equity securities with the SEC. Officers,

directors, and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all

Section 16(a) forms that they file.

Based

solely on the reports received and on the representations of the reporting persons, we believe that our current officer and sole

director has not yet complied with all applicable filing requirements of Section 16(a) of the Exchange Act during the current

fiscal year, but is currently in the process of doing so.

EXECUTIVE

COMPENSATION

Summary

of Compensation

We

paid no compensation to our executive officers and directors during the two quarters ended February 28, 2018.

We

paid compensation to our executive officers and directors during the fiscal year ended August 31, 2017, as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option

and

|

|

|

All

|

|

|

|

|

|

Name

and

|

|

|

|

|

|

|

|

Deferred

|

|

|

|

|

|

Stock

|

|

|

Warrant

|

|

|

Other

|

|

|

|

|

|

Principal

Position

|

|

|

|

|

Salary

|

|

|

Compensation

|

|

|

Bonus

|

|

|

Awards

|

|

|

Awards

|

|

|

Compensation

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dr.

Ralph Salvagno (1)

|

|

|

2017

|

|

|

$

|

240,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

112,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

352,000

|

|

|

Chief

Executive Officer, Chief Financial Officer and Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dr.

Vivek Ramana (2)

|

|

|

2017

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Chief

Medical Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Dr.

Salvagno was appointed as CEO, CFO and Director on June 9, 2016 and resigned on March 22, 2018,

|

|

|

|

|

|

|

(2)

|

Dr.

Ramana was appointed as CMO on June 30, 2016.

|

|

Director

|

|

|

|

|

|

|

Fees Earned

or Paid in

Cash

|

|

|

|

Stock

Awards

|

|

|

|

Warrant

Awards (1)

|

|

|

|

Non-Equity

Incentive

Plan

Compensation

|

|

|

|

Change in Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

|

|

|

|

All Other

Compensation

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vyvyan Campbell (1)

|

|

|

2017

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

(1)

Ms. Campbell was appointed as Director on September 6, 2016 and resigned on March 22, 2018.

Outstanding

Equity Awards at Fiscal Year-End

The

Company has granted options to an employee and to a consultant. Options activity for the year ended August 31, 2017 is as follows:

|

|

|

|

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

|

|

|

|

Weighted

|

|

|

Average

|

|

|

|

|

|

|

|

|

|

|

Average

|

|

|

Remaining

|

|

|

Aggregate

|

|

|

|

|

Number

|

|

|

Exercise

|

|

|

Contractual

|

|

|

Intrinsic

|

|

|

|

|

of

Options

|

|

|

Price

|

|

|

Terms

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding at August 31, 2016

|

|

|

4,000,000

|

|

|

$

|

0.25

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Granted

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

Exercised

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

Forfeited

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

Expired

|

|

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding at August 31, 2017

|

|

|

4,000,000

|

|

|

$

|

0.25

|

|

|

|

1.77

|

|

|

$

|

369,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercisable at August 31, 2017

|

|

|

4,000,000

|

|

|

$

|

0.25

|

|

|

|

|

|

|

|

|

|

Employment

Contracts

As

of August 31, 2017 we terminated all employment agreement and, therefore, have no employment contracts, termination of employment

or change-in-control arrangements with any of our executive officers or other employees.

DESCRIPTION

OF SECURITIES

The

current authorized capital stock of our Company consists of Seventy Hundred Fifty Million (750,000,000) shares of Common Stock,

par value $0.001 per share, and Fifty Million (50,000,000) shares of Preferred Stock, par value $0.001 per share. As of April

25, 2018, One Hundred Eighty-three Million, Three Hundred Fifty-eight Thousand, Eight Hundred Eighty-four (183,358,884) shares

of Common Stock were issued and outstanding. As of April 25, 2018, no shares of Preferred Stock were issued and outstanding. The

following description is a summary of the capital stock of our Company and contains the material terms of our voting capital stock.

Additional information can be found in our Certificate of Incorporation and our Bylaws.

Common

Stock

On

April 25, 2018 (the “Record Date”), there were One Hundred Eighty-three Million Three Hundred Fifty-eight Thousand

Eight Hundred Eighty-four (183,358,884) shares of Common Stock issued and outstanding. Each share of Common Stock entitles the

holder to one (1) vote on each matter submitted to a vote of our stockholders, including the election of Directors. There is no

cumulative voting. The holders of our Common Stock are entitled to receive ratably such dividends, if any, as may be declared

from time to time by the Board. Common Stock holders have no preemptive, conversion or other subscription rights. There are no

redemption or sinking fund provisions related to the Common Stock. In the event of liquidation, dissolution or winding up of the

Company, our Common Stock holders are entitled to share ratably in all assets remaining after payment of liabilities, subject

to prior distribution rights of preferred stock, if any, then outstanding.

Preferred

Stock

We

had no shares of Preferred Stock issued and outstanding as of April 25, 2018.

Warrants

No

warrants are outstanding as April 25, 2018.

Anti-Takeover

Effects of Provisions of the Articles of Incorporation, Bylaws and Nevada Law

Authorized

and Unissued Stock

The

authorized but unissued shares of our Common Stock are available for future issuance without the approval of our stockholders.

These additional shares may be utilized for a variety of corporate purposes including but not limited to future public or direct

offerings to raise additional capital, corporate acquisitions and employee incentive plans. The issuance of such shares may also

be used to deter a potential takeover of the Company that may otherwise be beneficial to our stockholders by diluting the shares

held by a potential suitor or issuing shares to a stockholder that will vote in accordance with the desires of the Board. A takeover

may be beneficial to stockholders because, among other reasons, a potential suitor may offer stockholders a premium for their

shares of stock compared to the then-existing market price.

Nevada

Anti-Takeover Laws

Nevada

Revised Statutes (“NRS”) Sections 78.378 to 78.3793 provide state regulation over the acquisition of a controlling

interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions

of these sections do not apply. Our Articles of Incorporation and Bylaws do not state that these provisions do not apply.

The

statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting

down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The restrictions on the

acquisition of controlling interests contained in NRS Sections 78.378 to 78.3793 apply only to a Nevada corporation that: (a)

has 200 stockholders of record (at least 100 of whom have addresses in the State of Nevada appearing on the stock ledgers of the

corporation); and (b) does business in the State of Nevada, either directly or through an affiliated corporation. Currently, we

do not have 100 stockholders of record with addresses in the State of Nevada. Furthermore,

we do not conduct business in the State of Nevada and we do not intend to conduct business in the State of Nevada in the near

future. Accordingly, the anti-takeover provisions contained in NRS Sections 78.378 to 78.3793 do not apply to us, and are not

likely to apply to us in the foreseeable future.

Transfer

Agent and Registrar

Empire

Stock Transfer, Inc. is the transfer agent and registrar of our Common Stock and Preferred Stock. Their address is 1859 Whitney

Mesa Drive, Henderson, NV 89014 and their telephone number is (702) 818-5898.

INTEREST

OF CERTAIN PERSONS IN OPPOSITION TO MATTERS TO BE ACTED UPON

(a)

No officer or Director of the Company has any substantial interest in the matters to be acted upon, other than his role as an

officer or Director of the Company.

(b)

No Director in good standing with the Company has informed the Company that he intends to oppose the actions to be taken by the

Company as set forth in this Information Statement.

ADDITIONAL

INFORMATION

Additional

information concerning PetLife Pharmaceuticals, Inc., including its annual and quarterly reports filed with the SEC, may be accessed

through the SEC’s EDGAR archives at www.sec.gov.

PROPOSAL

1 – INCREASE AUTHORIZED NUBMER OF SHARES OF COMMON STOCK OF THE COMPANY

The

Company’s Board proposes to increase the authorized number of shares of Common Stock from Seventy-five Million (75,000,000)

to Ten Billion (10,000,000,000) $0.001 par value per share.

Purpose

of the Increase in Number of Authorized Shares of Common Stock

The

purpose of the proposed increase in the number of authorized shares of common stock is to (i) to provide authorized but unissued

shares which would be available for future acquisitions or capital raising efforts.

Potential

Effects of the Increase in Number of Authorized Shares of Common Stock

The

Company does not believe that there are any potential effects with respect to the increase of the number of authorized shares.

Summary

of Advantages and Disadvantages of Increase in Number of Authorized Shares of Common Stock

There

are certain advantages of voting for the Increase in Number of Authorized Shares. The advantages include:

To

provide authorized but unissued shares which would be available for future acquisitions or capital raising efforts.

There

are certain disadvantages of voting for the Increase in the Number of Authorized Shares of Common Stock. The disadvantages include:

The

authorized but unissued shares of our Common Stock are available for future issuance without the approval of our stockholders.

These additional shares may be utilized for a variety of corporate purposes including but not limited to future public or direct

offerings to raise additional capital, corporate acquisitions and employee incentive plans. The issuance of such shares may also

be used to deter a potential takeover of the Company that may otherwise be beneficial to our stockholders by diluting the shares

held by a potential suitor or issuing shares to a stockholder that will vote in accordance with the desires of the Board. A takeover

may be beneficial to stockholders because, among other reasons, a potential suitor may offer stockholders a premium for their

shares of stock compared to the then-existing market price.

Recommendation

of the Board of Directors

Our

Board unanimously recommended a vote “FOR” the approval to increase the authorized number of shares of Common Stock

from Seventy-five Million (75,000,000) to Ten Billion (10,000,000,000) $0.001 par value per share.

No

Voting of Stockholders Required

We

are not soliciting any votes with regard to the proposal to effectuate the increase in authorized. A certain principal stockholder

that has voted in favor of this Proposal holds 54.3% of the total issued and outstanding voting stock rights and, accordingly,

this principal stockholder has sufficient shares to approve the Proposal.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only

one (1) Information Statement is being delivered to multiple security holders sharing an address unless the Company has received

contrary instructions from one or more of the security holders. The Company shall deliver promptly upon written or oral request

a separate copy of the Information Statement to a security holder at a shared address to which a single copy of the documents

was delivered. A security holder can notify the Company that the security holder wishes to receive a separate copy of the Information

Statement by sending a written request to the Company at 10120 So. Eastern Avenue, Suite 213, Henderson, NV 89052; or by calling

the Company at (855) 682-7853 and requesting a copy of the Information Statement. A security holder may utilize the same address

and telephone number to request either separate copies or a single copy for a single address for all future Information Statements

and annual reports.

By

Order of the Board of Directors

|

/s/

Laura De Leon Castro

|

|

|

Laura

De Leon Castro, Secretary

|

|

Henderson,

NV 89052

________________,

2018

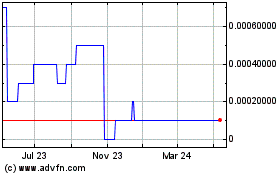

Petlife Pharmaceuticals (CE) (USOTC:PTLF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Petlife Pharmaceuticals (CE) (USOTC:PTLF)

Historical Stock Chart

From Jul 2023 to Jul 2024