UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant |

¨ |

| Filed by a Party other than the Registrant |

x |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

OCEAN POWER TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its Charter)

PARAGON TECHNOLOGIES, INC.

HESHAM M. GAD

SHAWN M. HARPEN

JACK H. JACOBS

SAMUEL S. WEISER

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and

0-11. |

On January 18, 2024, Paragon Technologies, Inc. issued a statement

relating to Ocean Power Technologies, Inc., a copy of which is set forth below:

Paragon Urges OPT Shareholders to Disregard

CEO Phillip Stratmann’s Continued Misleading Statements and Calls on Mr. Stratmann to Substantiate His Claims to Shareholders

EASTON, PA – January 18, 2024

Paragon Technologies, Inc.

(“Paragon”), a diversified holding company, owning approximately 4.8% of the outstanding shares of Ocean Power Technologies,

Inc. (NYSE American: OPTT), (“Company”) (“OPT”), calls on CEO Phillip Stratmann to immediately substantiate his

misleading statements about OPT’s future made in the Company’s January 17, 2024 press release.

Mr. Stratmann now claims, “OPT expects

that recent meaningful contract wins…. will enable [OPT] to reach profitability during calendar year 2025 using current capital

resources.” Yet the supporting slide presentation states that OPT expects to be “EBITDA breakeven, excluding extraordinary

expenses, in calendar 2025.”

Mr. Stratmann, is it profitability or EBITDA

breakeven in 2025? These are not equivalent terms. Or is that your way of covering yourself given the increasing financial disaster

you have created as CEO?

Mr. Stratmann, how will OPT finance itself

in 2025? With less than $19 million in cash, and quarterly expenses of $6 to $8 million, OPTT will likely have NO capital resources

by the end of 2024. Mr. Stratmann has failed to announce any numerical transparency cost reductions and as we have stated previously,

a modest decline in expenses from current levels will likely not be enough to generate any profitability.

As shareholders, we call on Stratmann to explain

and demonstrate to shareholders precisely how OPT will indeed reach profitability in 2025 with the current capital resources. Stratmann

has yet to announce a numerical and quantifiable cost cutting strategy or provide any projections reflecting how the company plans to

achieve what the company is now claiming.

Stratmann also says, “Now that OPT’s

research and development phase has been substantially completed, we have reallocated headcount towards execution and commercialization….we

have built a cutting-edge suite of products that… will help drive profitability in calendar year 2025….”

In case Mr. Stratmann has forgotten, here are

figures taken directly from OPT’s SEC fillings:

| FY |

|

2018 |

|

|

2019 |

|

|

2020 |

|

|

2021 |

|

|

2022 |

|

|

2023 |

|

| $ millions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

$ |

511,00 |

|

|

$ |

632,000 |

|

|

$ |

1.7 |

M |

|

$ |

1.2 |

M |

|

$ |

1.8 |

|

|

$ |

2.7 |

M |

| R&D |

|

$ |

4.3 |

M |

|

$ |

5.0 |

M |

|

$ |

4.3 |

M |

|

|

--- |

|

|

|

--- |

|

|

|

--- |

|

| Expenses |

|

$ |

7.0 |

M |

|

$ |

7.6 |

M |

|

$ |

6.9 |

M |

|

$ |

12.5 |

M |

|

$ |

21.5 |

M |

|

$ |

28.3 |

M |

After Mr. Stratmann became CEO in 2021. OPT

stopped disclosing R&D spending, leading us to conclude OPT stopped R&D expenditures in 2021.

Now Stratmann tells shareholders R&D is substantially

complete? Then why did OPT stop disclosing R&D expenses the same year he became CEO? Why did expenses balloon – more than

quadruple in the past four years?

We invite Mr. Stratmann to correct our assertions

outlined above by providing the transparency that shareholders deserve and require from their CEOs and board members. We believe Mr. Stratmann

has no answers and is only making these statements as a disguised attempt to obtain shareholder support.

The continued absence of a quantifiable and measurable

plan from OPT suggests:

| · | Stratmann and OPT have no real, viable

strategy. Despite 30 years of failing to commercialize a single product in the private sector, that somehow the government is

going to save OPT. So far, the results have been terrible. |

| · | OPT’s Board cares only about holding

on to their positions, where they are compensated handsomely. They have spent millions of the Company’s dollars putting the

Company through litigation to deny shareholders a fair and valid election of directors. |

| · | Given the continuing financial deterioration

under CEO Stratmann, the Board has resorted to making vague and misleading statements about OPT’s future in a desperate attempt

to give shareholders false hope in lieu of a viable plan. |

Rather than constructively engage with Paragon

and its nominees – who have a proven track record of delivering significant shareholder value from underperforming businesses –

OPT’s board continues to weaken OPT’s financial condition to entrench themselves further.

We believe OPT’s Board has continued to

take measures and make statements that are self-serving and highly misleading to shareholders. The results speak for themselves.

Paragon asks shareholders to think carefully about

whether OPT’s CEO and Board can be trusted with the future of the Company if they continue to make critical statements about OPT’s

future without ever providing numerical substantiation of any of their claims.

OPT is in dire need of change. Please only vote on the BLUE proxy card

so we can begin the work and effort that this Board appears incapable of doing.

By voting on Paragon’s

BLUE universal proxy card, you can send a message to OPT that you do not support their actions in relation to the Annual Meeting and attempting

to block the recognition of Paragon’s nominees.

Please email us at ir@pgntgroup.com

with any questions about how to vote your BLUE proxy card.

We appreciate the support from shareholders thus

far. If shareholders have any questions, please contact our Proxy Solicitor, Alliance Advisors at:

Alliance Advisors

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Toll-Free Phone: 855-200-8651

Email: OPTT@allianceadvisors.com

No matter how many shares you hold, we would

like to hear from you. Please email us at ir@pgntgroup.com if you need any help in voting

your BLUE proxy.

OPT has said that it will disregard proxy votes in favor of Paragon’s

director nominees. Whether OPT may lawfully disregard Paragon’s director nominees is an issue that Paragon expects will be resolved

by the Delaware courts.

Stockholders should review the section of Paragon’s proxy statement

titled “Questions And Answers Relating To This Proxy Solicitation--Why is OPT saying it will disregard Paragon’s director

nominations, and how does that impact proxies that stockholders provide to Paragon?”

Paragon Technologies, Inc., together with the other participants named

herein, intends to make a filing with the Securities and Exchange Commission (the “SEC”) of a proxy statement and an accompanying

proxy card to be used to solicit votes for the election of director nominees at the 2023 annual meeting of shareholders of Ocean Power

Technologies, Inc., a Delaware corporation (the “company”).

Paragon Technologies, Inc. is the beneficial owner of 2,649,141 shares

of common stock of the company, par value $0.001 per share (“common stock”).

Paragon Technologies, Inc., and Paragon’s director nominees Hesham

M. Gad, Shawn M. Harpen, Jack H. Jacobs, and Samuel S. Weiser, will be the participants in the proxy solicitation. Mr. Gad, Executive

Chairman of Paragon’s Board of Directors and Chief Executive Officer of Paragon, and Messrs. Jacobs and Weiser, directors of Paragon,

may be deemed to beneficially own the shares of the company’s common stock held by Paragon. Ms. Harpen does not own beneficially

or of record any securities of the company. Updated information regarding the participants and their direct and indirect interests in

the solicitation, by security holdings or otherwise, will be included in Paragon’s proxy statement and other materials filed with

the SEC.

SHAREHOLDERS OF THE COMPANY SHOULD READ THE PROXY STATEMENT AND OTHER

PROXY MATERIALS CAREFULLY AND IN THEIR ENTIRETY AS THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE COMPANY’S

ANNUAL MEETING, PARAGON’S SOLICITATION OF PROXIES AND PARAGON’S NOMINEES TO THE BOARD. SUCH PROXY MATERIALS WILL BE AVAILABLE

AT NO CHARGE ON THE SEC’S WEB SITE AT WWW.SEC.GOV OR FROM PARAGON TECHNOLOGIES,

INC. REQUESTS FOR COPIES, WHEN AVAILABLE, SHOULD BE DIRECTED TO PARAGON’S PROXY SOLICITOR.

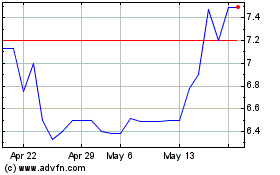

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Dec 2023 to Dec 2024