UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant |

¨ |

| Filed by a Party other than the Registrant |

x |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

OCEAN POWER TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its Charter)

PARAGON TECHNOLOGIES, INC.

HESHAM M. GAD

SHAWN M. HARPEN

JACK H. JACOBS

SAMUEL S. WEISER

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and

0-11. |

On January 4, 2024, Paragon Technologies,

Inc. issued a presentation relating to Ocean Power Technologies, Inc., a copy of which is set forth below:

Paragon Technologies Issues Presentation to OPT Shareholders to

Vote Blue Proxy Card

EASTON, PA - January 4, 2024

Paragon Technologies, Inc. (“Paragon”), a diversified holding

company, and the largest shareholder of Ocean Power Technologies, Inc. (NYSE American:OPTT), (“Company”) (“OPT”),

reminds OPT shareholders to DISREGARD any WHITE proxy from OPT and issued the following presentation on how to vote the BLUE proxy card

below.

Paragon Technologies, the largest shareholder of Ocean Power Technologies (OPT), owning approximately 4.9% of the outstanding shares of the Company. Earlier this year Paragon e xpressed s erious concerns about OPT’s alarming financial and share price u nderperformance u nder the current Board and CEO. Since raising those concerns OPT’s financial deterioration has gotten significantly worse. Under the leadership of the current Board and CEO, OPT’s share price has declined from $2.50 a share to $0.31, a decline of nearly 90%. Paragon believes the Board and CEO have been misleading shareholders by making positive statements about the Company’s future while the financial condition of the Company continues to deteriorate. OPT share price is very likely headed lower in 2024 unless a significant restructuring happens immediately, and change is made at the Board of Directors. Paragon believes OPT could be wo rth +$3 a share, or 10x return, with an improved o perating c ost s tructure, disciplined c apital a llocation, and a realigned focus on potential growth of Marine Advanced Robotics. Introduction

OPT’s Misleading Statements… OPT’s Board tells shareholders to protect their investment by voting for their Board. OPT’s Board tells shareholders votes for Paragon will not be counted. OPT’s Board claims to have taken decisive action to create shareholder value. The newly installed CEO and three directors, since 2020, have exponentially increased costs and losses while OPT continues to generate minimal revenues. The Board claims it seeks to work constructively with Paragon. …and the Evidence Under the current Board and CEO, OPT’s stock price has declined in value by 90%. The Delaware Courts will determine the votes that count Under the leadership of the Board and CEO, OPT has reported deteriorating financial condition each year. Management and the Board refuse to significantly cut costs while they pay themselves more money. Management and the Board continue to spend millions of dollars painting a false narrative of the business aiming to hold their Board seats by taking actions depriving shareholders a voice in OPT’s Board and CEO Continue to Mislead Shareholders Leading Them Down a Disastrous Path for Shareholders – Vote ONLY the BLUE Proxy Card to Send a Clear Message!

Disregard any WHITE proxy from OPT. Do NOT vote WITHHOLD. Instead send a strong message and ONLY vote the BLUE proxy. If you voted to withhold, you can change your vote and send a stronger message by voting the BLUE proxy card. The BLUE proxy card is the ONLY VOTE AGAINST the current Board. Do not cast any vote on the WHITE card. Make your vote count and send a clear message that the Board’s self - serving tactics have harmed shareholders – vote ONLY the BLUE Proxy Card

Your vote matters and it will not be up to OPT to determine if your vote counts. Please email us at ir@pgntgroup.com about how to vote your BLUE proxy card or contact our Proxy Solicitor, Alliance Advisors at OPTT@allianceadvisors.com . A vote on the BLUE proxy card is the ONLY VOTE AGAINST the current Board. Do not cast any vote on the WHITE proxy card. By voting on Paragon’s BLUE universal proxy card, you can send a message to OPT that you do not support their actions in relation to the Annual Meeting and attempting to block the recognition of Paragon’s nominees. OPT has said that it will disregard proxy votes in favor of Paragon’s director nominees. Whether OPT may lawfully disregard P ar agon’s director nominees is an issue that Paragon expects will be resolved by the Delaware courts. Stockholders should review the section of Paragon’s proxy statement titled “Questions And Answers Relating To This Proxy Soli cit ation -- Why is OPT saying it will disregard Paragon’s director nominations, and how does that impact proxies that stockholders provid e t o Paragon?” Make your vote count and send a clear message that the Board’s self - serving tactics have harmed shareholders – vote ONLY the BLUE Proxy Card

1. FINANCIAL DATA FROM PARAGON TECHNOLOGIES 2015 AND 2022 ANNUAL RE PORT FILED WITH THE OTC . 2. SHARE PRICE DATA PROVIDED BY MORGAN STANLEY/E - TRADE AND REFLECTS SHARE PRICE OF $0.85 AS OF 1/1/2015 AND $9.00 ON 1/38/2024 Paragon Technologies is a diversified holding company with business activities in automation, technology distribution, and real estate. In 2010, Paragon’s current Board was appointed and in 2015, Paragon Chairman/CEO Sham Gad was appointed CEO of automation subsidiary SI Systems. Insiders own nearly 30% of Paragon, with an approximate 28% stake owned by Sham Gad, Chairman and CEO. Over 93% of his holdings were purchased in the open market. Since Mr. Gad’s appointment as CEO in 2015, Paragon Technologies has evolved from a single subsidiary automation business to a diversified holding company with three profitable subsidiaries. From 2015 to 2022, Paragon’s revenues have grown from $11.6 million to $108 million and operating profit from $848,000 to $3.6 million, respectively. 1 Since 2015, Paragon shares have increased nine - fold, over 800%, an annualized return of approximately 35% per year versus 15% and 18% per year for the S&P 500 and Nasdaq, respectively. Our director nominees have a distinguished track record of delivering sustainable, significant shareholder value while remaining 100% aligned with ALL shareholders. We will do the same at OPT.

Please

email us at ir@pgntgroup.com with any questions about how to vote your BLUE proxy card.

Paragon Technologies, Inc., together with the other participants named

herein, has filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and an accompanying

proxy card soliciting votes for the election of director nominees at the 2023 annual meeting of shareholders of Ocean Power Technologies,

Inc., a Delaware corporation (the “company”).

Paragon Technologies, Inc. is the beneficial owner of 2,720,660 shares

of common stock of the company, par value $0.001 per share (“common stock”).

Paragon Technologies, Inc., and Paragon’s director nominees

Hesham M. Gad, Shawn M. Harpen, Jack H. Jacobs, and Samuel S. Weiser, are the participants in the proxy solicitation. Mr. Gad, Executive

Chairman of Paragon’s Board of Directors and Chief Executive Officer of Paragon, and Messrs. Jacobs and Weiser, directors of Paragon,

may be deemed to beneficially own the shares of the company’s common stock held by Paragon. Ms. Harpen does not own beneficially

or of record any securities of the company. Updated information regarding the participants and their direct and indirect interests in

the solicitation, by security holdings or otherwise, has been and will be included in Paragon’s proxy statement and other materials

filed with the SEC.

SHAREHOLDERS

OF THE COMPANY SHOULD READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION

RELATING TO THE COMPANY’S ANNUAL MEETING, PARAGON’S SOLICITATION OF PROXIES AND PARAGON’S NOMINEES TO THE BOARD. SUCH

PROXY MATERIALS ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV OR FROM PARAGON TECHNOLOGIES,

INC. REQUESTS FOR COPIES SHOULD BE DIRECTED TO PARAGON’S PROXY SOLICITOR.

CONTACT:

Alliance Advisors

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Toll-Free Phone: 855-200-8651

Email: OPTT@allianceadvisors.com

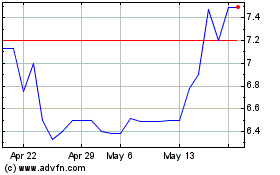

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Dec 2023 to Dec 2024