UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material under §240.14a-12 |

OCEAN POWER TECHNOLOGIES,

INC.

(Name of Registrant as Specified in Its Charter)

PARAGON TECHNOLOGIES, INC.

HESHAM M. GAD

SHAWN M. HARPEN

JACK H. JACOBS

SAMUEL S. WEISER

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11. |

On December 13, 2023, Paragon Technologies, Inc. issued a press release

relating to Ocean Power Technologies, Inc., a copy of which is set forth below:

Paragon Calls Out Ocean Power’s Contract

Award Announcements in Response to Paragon’s Campaign as Too Little, Too Late

EASTON, PA – December 13, 2023

Paragon Technologies, Inc.

(“Paragon”), a diversified holding company, owning approximately 4.9% of the outstanding shares of Ocean Power Technologies,

Inc. (NYSE American: OPTT), (“Company”) (“OPT”), calls out OPT’s recent contract award press releases in

response to Paragon’s criticism of the financial mismanagement of OPT as yet another attempt to divert shareholder attention from

the degrading financial condition of the Company.

When Paragon expressed its grave concerns to the

OPT Board regarding the Company’s alarming financial losses and rapid decline in shareholder value, Paragon requested that its three

directors be part of OPT’s six-member Board, thus contributing an equal voice on the Board. As the largest shareholder, owning 4.9%

of OPT, and with a proven track record of creating long-term shareholder value, we believe our inclusion was in the absolute best interest

of all OPT shareholders, and would provide them a more balanced shareholder aligned Board.

Ever since we voiced those concerns, the financial

degradation of OPTT has gotten drastically worse:

| FY Ended April 30, | |

2021 | | |

2022 | | |

2023 | | |

Q1 - 2024 | |

| Sales | |

$ | 1.2 | M | |

$ | 1.8 | M | |

$ | 2.7 | M | |

$ | 1.3 | M |

| Expenses | |

$ | 12.5 | M | |

$ | 21.5 | M | |

$ | 28.3 | M | |

$ | 8.1 | M |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (14.8 | )M | |

$ | (18.9 | )M | |

$ | (26.3 | )M | |

$ | (7.0 | )M |

| | |

| | | |

| | | |

| | | |

| | |

| Cash & ST Inv. | |

$ | 83.0 | M | |

$ | 57.3 | M | |

$ | 34.7 | M | |

$ | 26.6 | M |

On April 30th,

2021, OPT’s share price closed at $2.51. Today the share price is $0.30, a decline of 88%.

Perhaps more self-serving at the expense of shareholders

is that over the past three years Board and Executive Officer Compensation more than doubled and exceeded OPTT’s revenues!

| Fiscal Year Ended | |

2021 | | |

2022 | | |

2023 | | |

Total | |

| Revenues | |

$ | 1.2 | M | |

$ | 1.8 | M | |

$ | 2.7 | M | |

$ | 5.7 | M |

| Board and Exec. Comp | |

$ | 2.1 | M | |

$ | 3.0 | M | |

$ | 2.6 | M | |

$ | 7.7 | M |

| | |

| | | |

| | | |

| | | |

| | |

| % Total Compensation to Sales | |

| 175 | % | |

| 168 | % | |

| ~100 | % | |

| | |

Yet rather than work constructively with Paragon’s

director nominees – who have delivered an 800% return to shareholders over the last five years – OPT’s directors instead

have spent millions to protect their Board seats.

Over the past few months OPT has issued announcements

promoting potential sales opportunities or contract awards that we believe do not guarantee any definitive revenues at the stated time

but appear to require continued capital expenditure by OPT.

We believe OPT continues to mislead shareholders

with the Company’s latest December 11, 2023 press release announcing the “Letter Contract with a $6.5M Ceiling.” CEO

Phillip Stratmann again takes a victory lap without clearly telling shareholders that a letter contract is effectively a commitment by

OPT to manufacture products without ANY definitive commitment of a purchase order contract. Not surprisingly, the press release fails

to provide any details as to when revenue might be earned, the expected potential profitability or any other information that can give

shareholders confidence in the Company’s board and management.

After 30 years of OPT failing to profitably commercialize

a product, OPT’s Board and CEO can only manage to sign agreements that require OPT to take significant risk without any definitive

commitment of business.

Interestingly OPT’s share price declined

by approximately 10% on the same day that OPT announced the Letter Contract.

OPT shareholders can put a stop to this downward stock price spiral and ongoing mismanagement of shareholder assets. Vote Paragon’s

BLUE proxy card that will arrive in the mail and discard ANY white proxy card from OPT.

Please email us

at ir@pgntgroup.com with any questions about how to vote your BLUE proxy card.

We appreciate the support from shareholders thus

far. If shareholders have any questions, please contact our Proxy Solicitor, Alliance Advisors at:

Alliance

Advisors

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Toll-Free Phone: 855-200-8651

Email: OPTT@allianceadvisors.com

We would like to

hear from you. Please email us at ir@pgntgroup.com if you would like to learn more.

____________

Paragon Technologies, Inc., together with the other participants named

herein, intends to make a filing with the Securities and Exchange Commission (the “SEC”) of a proxy statement and an accompanying

proxy card to be used to solicit votes for the election of director nominees at the 2023 annual meeting of shareholders of Ocean Power

Technologies, Inc., a Delaware corporation (the “company”).

Paragon Technologies, Inc. is the beneficial owner of 2,909,445 shares

of common stock of the company, par value $0.001 per share (“common stock”).

Paragon Technologies, Inc., and Paragon’s director nominees Hesham

M. Gad, Shawn M. Harpen, Jack H. Jacobs, and Samuel S. Weiser, will be the participants in the proxy solicitation. Mr. Gad, Executive

Chairman of Paragon’s Board of Directors and Chief Executive Officer of Paragon, and Messrs. Jacobs and Weiser, directors of Paragon,

may be deemed to beneficially own the shares of the company’s common stock held by Paragon. Ms. Harpen does not own beneficially

or of record any securities of the company. Updated information regarding the participants and their direct and indirect interests in

the solicitation, by security holdings or otherwise, will be included in Paragon’s proxy statement and other materials filed with

the SEC.

SHAREHOLDERS OF THE COMPANY SHOULD READ

THE PROXY STATEMENT AND OTHER PROXY MATERIALS CAREFULLY AND IN THEIR ENTIRETY AS THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT

INFORMATION RELATING TO THE COMPANY’S ANNUAL MEETING, PARAGON’S SOLICITATION OF PROXIES AND PARAGON’S NOMINEES TO THE

BOARD. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT WWW.SEC.GOV OR FROM

PARAGON TECHNOLOGIES, INC. REQUESTS FOR COPIES, WHEN AVAILABLE, SHOULD BE DIRECTED TO PARAGON’S PROXY SOLICITOR.

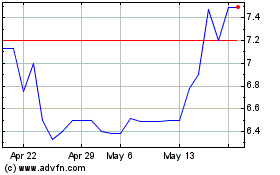

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Dec 2023 to Dec 2024