Current Report Filing (8-k)

October 25 2022 - 3:15PM

Edgar (US Regulatory)

false

0001017655

0001017655

2022-10-19

2022-10-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 19, 2022

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

0-28720

|

|

73-1479833

|

|

(State or Other Jurisdiction

of Incorporation

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

225 Cedar Hill Street Suite 200

Marlborough, Massachusetts

|

|

01752

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (617) 861-6050

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Type of each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common

|

PAYD |

None

|

Indicate by checkmark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) of Rule 12B-2 of the Securities Exchange act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement

On October 19, 2022, the Company entered into a Securities Purchase Agreement with respect to a secured $1.875 million convertible note made by Embolx, Inc., a California corporation.

Pursuant to the Securities Purchase Agreement, attached in substantial form as Exhibit 10.1, and associated Convertible Note, attached in substantial form as Exhibit 10.2, the Company loaned USD $1.5 million to Embolx. The Note is purchased at a 20% ($375,000) original issue discount and is subject to a 9-month maturity, after which, if unpaid, will then carry a 20% interest rate.

The Company has the option to convert the note into shares of common stock of Embolx. As additional consideration, the Company received a 5-year Warrant to purchase additional shares of common stock of Embolx, in the substantial form attached as Exhibit 10.3.

The shares are subject to certain piggyback registration rights under a Registration Rights Agreement, in the substantial form attached as Exhibit 10.4, and the note is secured by all assets of Embolx pursuant to a Security Agreement attached in substantial form as Exhibit 10.5.

Under the Securities Purchase Agreement, the Company has a right to purchase additional shares on the same terms for a total potential investment amount of $2 million.

Embolx is an emerging commercial-stage medical device company in Silicon Valley developing microcatheters for arterial embolization procedures. Embolx is committed to dramatically improving the treatment of a variety of conditions including cancerous tumors, benign prostatic hyperplasia and uterine fibroids. The Sniper® balloon occlusion microcatheter sets a new standard for precise embolic delivery and superior target filling by controlling pressure to direct blood flow while protecting non-target surrounding tissues. Embolx is a privately held company. Its management team consists of Michael Allen, President and Chief Executive Officer, Michael Lin, Director of Finance, and Tom Breton, Manager of Research and Development.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

10.1 Securities Purchase Agreement dated October 19, 2022, by and between Paid, Inc. and Embolx, Inc.

10.2 $1,500,000 Convertible Note dated October 19, 2022 by Embolx, Inc. for the benefit of Paid, Inc.

10.3 Warrant dated October 19, 2022 by and between Embolx, Inc. and Paid, Inc.

10.4 Registration Rights Agreement dated October 19, 2022 by and between Embolx, Inc. and Paid, Inc.

10.5 Security Agreement dated October 19, 2022 by and between Embolx, Inc. and Paid, Inc.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

Date: October 24, 2022

|

By:

|

/s/ W. Austin Lewis, IV

|

| |

|

W. Austin Lewis, IV, CEO, CFO

|

Exhibit Index

|

Exhibit Number

|

Description

|

| |

|

|

|

Securities Purchase Agreement dated October 19, 2022, by and between Paid, Inc. and Embolx, Inc.

|

| |

|

|

|

$1,500,000 Convertible Note dated October 19, 2022 by Embolx, Inc. for the benefit of Paid, Inc.

|

| |

|

|

|

Warrant dated October 19, 2022 by and between Embolx, Inc. and Paid, Inc.

|

| |

|

|

|

Registration Rights Agreement dated October 19, 2022 by and between Embolx, Inc. and Paid, Inc.

|

| |

|

|

|

Security Agreement dated October 19, 2022 by and between Embolx, Inc. and Paid, Inc.

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

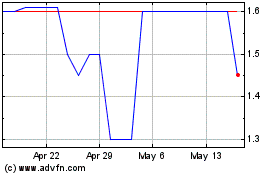

Paid (PK) (USOTC:PAYD)

Historical Stock Chart

From Jun 2024 to Jul 2024

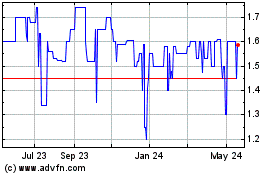

Paid (PK) (USOTC:PAYD)

Historical Stock Chart

From Jul 2023 to Jul 2024