Filed pursuant to

Rule 424(b)(3)

Registration

No. 333-276662

21,366,700 Shares of Common Stock

This

prospectus relates to the resale of up to 21,366,700 shares of common stock of One World Products, Inc., a Nevada corporation, which

may be resold by Tysadco Partners, LLC (which we refer to as Tysadco or the selling stockholder), consisting of up to 20,000,000 shares

of common stock issuable pursuant to an equity financing facility established by the terms of the Purchase Agreement described in this

prospectus, and 1,366,700 shares of common stock issuable to Tysadco upon the conversion into common stock of 13,667 shares of Series

B Preferred Stock we issued to Tysadco as a commitment fee for entering into the Purchase Agreement with us. We may draw on the equity

financing facility from time to time, as and when we determine appropriate in accordance with the terms and conditions of the Purchase

Agreement, by delivering “Request Notices” to Tysadco.

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the shares of our common

stock by the selling stockholder. We will, however, receive proceeds from the sale of common stock directly to Tysadco pursuant to the

Purchase Agreement. When we put shares of our common stock to Tysadco, the per-share purchase price that Tysadco will pay to us in respect

of the put will be equal to 88% of the of the lowest daily volume weighted average price of our common stock during the

period of 10 trading days beginning five trading days preceding the day we deliver the applicable put notice to Tysadco.

Tysadco

is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933. Tysadco may sell the shares of

common stock described in this prospectus at fixed prices, at prevailing market prices at the time of sale or at prices negotiated with

purchasers, to or through one or more underwriters, dealers or agents, or through any other means described in this prospectus under

“Plan of Distribution”.

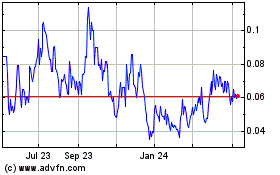

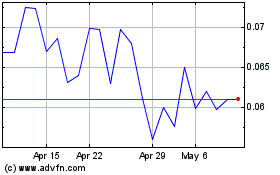

Our

common stock is quoted on the OTCQB tier of the OTC Markets under the symbol “OWPC”. On February 28, 2024, our common

stock closed at $0.0485 per share.

These

are speculative securities. Investing in these securities involves significant risks. You should purchase these securities only if you

can afford a complete loss of your investment. You should carefully consider the risk factors beginning on page 4 of this prospectus

before purchasing any of the shares offered by this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus

dated February 29, 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information contained in or incorporated by reference in this prospectus. We have not authorized any person to

provide you with different or inconsistent information. If anyone provides you with different or inconsistent information, you should

not rely on it. This is not an offer to sell or seeking an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus and the documents incorporated by reference is

accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since

such dates.

We

further note that the representations, warranties and covenants made by us in any document that is filed as an exhibit to the registration

statement of which this prospectus is a part and in any document that is incorporated by reference herein were made solely for the benefit

of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements,

and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants

were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our affairs.

Unless

the context otherwise requires, the terms “One World Products”, the “Company”, “we”, “us”,

“our” and similar terms used in this prospectus refer to One World Products, Inc. and its subsidiaries, including One World

Pharma SAS, a Colombian company.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference in this prospectus “forward-looking statements” about our business,

financial condition and prospects based on our current expectations, assumptions, estimates, and projections about us and our industry.

All statements other than statements of historical fact are “forward-looking statements”, including, but not limited to,

any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objections of management for

future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions

or performance; any statements or belief; and any statements of assumptions underlying any of the foregoing.

Forward-looking

statements may include the words “may,” “could,” “estimate,” “intend,” “continue,”

“believe,” “expect” or “anticipate” or other similar words. These forward-looking statements present

our estimates and assumptions only as of the date of this report. Unless otherwise required by law, we do not intend, and undertake no

obligation, to update any forward-looking statement.

Although

we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially

from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as

well as any forward-looking statements, are subject to change and inherent risks and uncertainties.

You

should read the matters described in “Risk Factors” below and disclosed in the documents incorporated by reference in this

prospectus and the other cautionary statements made in this prospectus and in the documents incorporated by reference in this prospectus

as being applicable to all related forward-looking statements wherever they appear in this prospectus and in the documents incorporated

by reference in this prospectus. We cannot assure you that the forward-looking statements in this prospectus and in the documents incorporated

by reference in this prospectus will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance

on forward-looking statements.

PROSPECTUS

SUMMARY

This

summary highlights certain information described in greater detail elsewhere or incorporated by reference in this prospectus. Before

deciding to invest in our securities you should read the entire prospectus carefully, including the “Risk Factors” section

contained in this prospectus, and our consolidated financial statements and the related notes, “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and the other documents incorporated by reference into this prospectus.

Company

Overview

One

World Products, Inc., a Nevada corporation (the “Company,” “we” or “us”) plans

to be a producer of raw cannabis and hemp plant ingredients for both medical and industrial uses across the globe. The Company is

a holding company and conducts its business in Colombia through One World Products Pharma SAS, its wholly-owned subsidiary (“OWP-Colombia”)

The Company, through OWP Colombia, has received licenses from Colombian regulators to cultivate, produce and distribute the

raw ingredients of the cannabis and hemp plant for medicinal, scientific and industrial purposes in the town of Esmeralda-Popayan,

Cauca, Colombia.

We

are in the process of acquiring another Colombian subsidiary within the Bogota free trade zone, which has all requisite

licenses for the cultivation, production, distribution and export of cannabis and hemp infused products, and will serve as the

Company’s primary base of operations in the Colombian market. Establishing operations within the free trade zone provides

favorable import/export commercial terms and taxation, and will improve the logistics and overall operating efficiencies for the

Company due to the close proximity of El Dorado International Airport and the commercial, economic and cultural center of the city

of Bogota itself.

We

planted our first crop of cannabis in Popayan, Colombia in 2018, and began initial harvesting in the first quarter of 2019 for the purpose

of further research and development activities and quality control testing of the cannabis produced. We commenced limited shipping

of non-psychoactive products to customers in May of 2020.

Our

first cultivation site is located in Popayan, Colombia, encompasses approximately 30 acres and includes a covered greenhouse

built specifically to cultivate high-grade cannabis and hemp. In addition, we entered into an agreement with a local farming

co-operative, under which they will cultivate cannabis on up to approximately

140 acres of land using our seeds and propagation techniques, and sell their harvested products to us on an exclusive basis.

We

employ modern propagation and cultivation techniques drawn from U.S. practices that allow us to rapidly multiply the cells of a specific

plant strain to produce large numbers of genetically consistent progeny plants using our own plant tissue culture method. We believe

this technique allows us to cultivate plants which are stable, robust and able to produce genetically superior cannabis and hemp derived

products. We intend to have our processes and products certified as compliant with international standards, including Good Agricultural

Practices (“GAP”), Good Manufacturing Practice (“GMP”) and the standards set forth in EU Pharmacopoeia, a publication

that sets forth quality standards applicable to the European pharmaceutical industry.

We intend to build out

an extraction and production facility in the Bogota free trade zone extension adjacent to the El Dorado international airport in Bogota

after we execute a lease for this location. Once the extraction equipment is placed in service,

we will be one of the few companies in Colombia to both hold licenses and possess the capability to extract high-quality CBD and THC

oils.

For

strategic and operational reasons, OWP-Colombia filed for protection under Colombian Law 1116 of 2006, which is the primary legislation

governing business insolvency proceedings (restructuring and liquidation) (“Reorganization Proceedings”) in Colombia on December

22, 2023. Subject to court approval, OWP-Colombia intends to continue its normal operations, which consists of providing cannabinoids

in bulk for the domestic and international markets, including the raw material for our brands and affiliate companies. In addition,

OWP-Colombia intends to satisfy its financial obligations to creditors of approximately $1.2 million during the Reorganization Proceedings.

At this time, the Company cannot predict the length of time of the Reorganization Proceeding.

We

expect to start exporting products in 2024, including CBD flower and distillate oil, while developing white label commercial agreements

with partners in Europe, USA, and Latin America. Our product pipeline also includes premium coffee certified by the Colombian National

Coffee Federation infused with CBD, teas infused with CBD and a series of wellness products, including sports CBD energy drinks for optimum

performance, CBD facial and body creams for anti-inflammatory and anti-aging use. We recently entered into strategic partnerships with

Smokiez Edibles and Stephen Marley’s Kx Family Care. There can be no assurances that these strategic partnerships will generate

revenues or be profitable for the Company.

Isiah L. Thomas III was

appointed to serve as our Chief Executive Officer on June 3, 2020. Mr. Thomas was a 12-time NBA All Star, two-time NBA champion,

and is an accomplished international business executive. In 2021, through ISIAH International, LLC, of which he is the sole member, Mr.

Thomas purchased $3,000,000 of our Series B Preferred Stock in installments over a period of time ending in July 2021.

Our principal offices are

located at 6605 Grand Montecito Pkwy, Suite 100, Las Vegas, Nevada 89149. Our telephone number is (800) 605-3210.

We maintain a website at www.oneworldproducts.com. Information contained on our website does not constitute part of this prospectus.

Tysadco

Purchase Agreement

This

prospectus relates to the resale of shares of our common stock that Tysadco has committed to purchase from us following our delivery

to Tysadco of “Request Notices” from time to time under the terms of a Purchase Agreement we entered into on September 1,

2022. Pursuant to the Purchase Agreement, subject to the effectiveness of the registration statement that includes this prospectus and

our compliance with other terms set forth therein, Tysadco has committed to purchase up to $10,000,000 of our common stock upon our delivery

of Request Notices, at a price equal to 88% of the lowest daily volume weighted average

price of our common stock during the period of 10 trading days beginning five trading days preceding

the applicable Request Notice. Each purchase under the Purchase Agreement will

be in a minimum amount of $25,000 and a maximum amount equal to the lesser of (i) $1,000,000 and (ii) 500% of the average daily trading

value of our common stock over the seven trading days preceding the delivery of the applicable Request Notice. Tysadco’s

commitment to purchase common stock under the Purchase Agreement will terminate approximately 36 months after we have satisfied all of

the conditions to effecting sales of common stock under the Purchase Agreement, which conditions include obtaining the effectiveness

of the registration statement that includes this prospectus. The Purchase Agreement also provides that Tysadco is not required to purchase

common stock to the extent that following such purchase, Tysadco would beneficially own in excess of 4.99% of our outstanding shares

of common stock.

In

connection with the Purchase Agreement, we issued to Tysadco as a commitment fee 13,667 shares of our Series B Preferred Stock convertible

into 1,366,667 shares of common stock. The resale of the shares we may issue to Tysadco upon conversion of the Series B Preferred Stock

issued to Tysadco under the Purchase Agreement is also covered by this prospectus.

The

Offering

The

following summary contains basic information about the offering and the securities being registered hereunder and is not intended to

be complete. It does not contain all the information that is important to you. For a more complete understanding of the securities we

are offering, please refer to the sections of this prospectus titled “Description of Capital Stock.”

| Securities

Being Registered: |

|

21,366,700

Shares of common stock. |

| |

|

|

| Shares

of Common Stock Outstanding Before the Offering: |

|

79,827,618 |

| |

|

|

| Shares

of Common Stock Outstanding After the Offering: |

|

101,194,318 |

| |

|

|

| Use

of Proceeds: |

|

The

shares offered by this prospectus will be sold by the selling stockholder. We will not receive any proceeds from the sale of shares

by the selling stockholder. However, we will receive proceeds from the sale of shares of our common stock to Tysadco under the Purchase

Agreement. These proceeds would be used for general working capital purposes. |

| |

|

|

| Risk

Factors: |

|

An

investment in our securities involves a high degree of risk and could result in the loss of your entire investment. Prior to making

an investment decision, you should carefully consider all of the information in this prospectus and, in particular, you should evaluate

the risk factors set forth under the caption “Risk Factors” beginning on page 4 of this prospectus. |

| |

|

|

| OTCQB

Trading Symbol: |

|

OWPC |

RISK

FACTORS

Investment

in our securities involves a high degree of risk. You should carefully consider the risks described below, as well as the other information

in this prospectus. Each of the risks could adversely affect our business, financial condition, results of operations and prospects,

and could result in a complete loss of your investment. This prospectus also contains forward-looking statements that involve risks and

uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain

factors, including the risks mentioned above.

Risks

Relating to our Company

Limited

Operating History

We

are an early stage company that has generated minimal revenues and we have a limited operating history upon which our business and future

prospects may be evaluated. We are subject to all of the business risks and uncertainties associated with any new business enterprise

in the cannabis industry, including the risk that we will not achieve our operating goals. In order for us to meet future operating

requirements, we will need to successfully grow, harvest and sell our cannabis products. Until such time as we are able to fund our business

from operations, we will be required to raise funds through various sources, including the sale of equity and debt securities, Failure

to generate cash from operations and to reach profitability may adversely affect our success.

We

have had a history of losses, we expect losses in the future, and there can be no assurance that we will become profitable in the future.

We have experienced operating losses on an ongoing

basis. For the nine months ended September 30, 2023, and for fiscal years ended December 31, 2022

and 2021, we incurred net losses of $1,513,374, $3,059,477 and $3,784,562, respectively. As of such dates, we had accumulated

deficits of $24,489,739, $22,976,365 and $19,916,888, respectively. We expect our losses to continue for the foreseeable future.

These continuing losses may be greater than current levels. If our revenues do not increase substantially or if our expenses exceed our

expectations, we may never become profitable. Even if we do achieve profitability, we may not sustain profitability on a quarterly or

annual basis in the future.

Our

auditor has given us a “going concern” qualification, which questions our ability to continue as a going concern without

additional financing.

Our

independent certified public accountant has added an emphasis paragraph to its report on our financial statements for the year ended

December 31, 2022 regarding our ability to continue as a going concern. Key to this determination is our recurring net losses,

an accumulated deficit, and a working capital deficiency. In the event sales do not materialize at expected levels, management

would seek additional financing or would conserve cash by further reducing expenses. No assurance

can be given that any future financing will be available or, if available, that it will be on terms that are satisfactory to us. Even

if we are able to obtain additional financing, it may contain undue restrictions on our operations or cause substantial dilution for

our stockholders. If we are unable to obtain additional funds, our ability to carry out and implement our planned business objectives

and strategies will be significantly delayed, limited or may not occur. We cannot guarantee that we will become profitable.

Our

Wholly-owned Colombian Subsidiary, OWP-Colombia, is Operating under Court Supervision Pursuant to a Reorganization Proceeding

OWP-Colombia

experienced significant operational and managerial challenges over the past several years, resulting in the accumulation of financial obligations

of approximately $1.2 million, which are substantially past due. OWP-Colombia filed for protection under Colombian Law 1116 of 2006,

which is the primary legislation governing business insolvency proceedings (restructuring and liquidation) (“Reorganization Proceedings”)

in Colombia on December 22, 2023. There are many risks attendant to the Reorganization Proceeding, including OWP-Colombia’s

ability to obtain approval from the court to conduct its normal business operations, maintain its cannabis licenses, satisfy its financial

obligations to its creditors, the availability of operating capital during the pendency of its Restructuring Proceeding, the length of

time that the Company will operate in the Reorganization Proceedings and the possibility that it may be unable to obtain any additional

funding. Failure to achieve any of these objectives could have a material adverse effect on the business of the Company and OWP-Colombia.

Change

of Cannabis Laws, Regulations and Guidelines

Cannabis

laws and regulations in Colombia and other jurisdictions where we intend to transact business are dynamic and subject to evolving

interpretations which could require us to incur substantial costs associated with compliance or alter certain aspects of our business

plan. Regulations may be enacted in the future that will be directly applicable to certain aspects of our cultivation, manufacturing

and exporting businesses for our cannabis and hemp related products. We cannot predict the nature of any future laws, regulations,

interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and

procedures, when and if promulgated, could have on our business. Management expects that the legislative and regulatory environment in

the cannabis industry in Colombia and internationally will continue to be dynamic and will require innovative solutions to comply

with this changing legal landscape in this nascent industry for the foreseeable future. Compliance with any such legislation may have

a material adverse effect on our business, financial condition and results of operations.

Public

opinion can also exert a significant influence over the regulation of the cannabis industry. A negative shift in the public’s perception

of the cannabis industry could affect future legislation or regulation in different jurisdictions.

Reliance

on Colombian Licenses, Authorizations and Quotas

Our

ability to import seeds, grow, manufacture, distribute and sell cannabis and hemp in Colombia or internationally is dependent

on our ability to sustain and/or obtain the necessary licenses and authorizations by certain authorities in Colombia and/or the importing

jurisdiction. The licenses and authorizations are subject to ongoing compliance and reporting requirements and our ability to obtain,

sustain or renew any such licenses and authorizations on acceptable terms is subject to changes in regulations and policies and to the

discretion of the applicable authorities or other governmental agencies in foreign jurisdictions. Failure to comply with the requirements

of the licenses or authorizations or any failure to maintain the licenses or authorizations would have a material adverse impact on our

business, financial condition and operating results. In addition, Colombian regulators limit the cultivation and sale of psychoactive

cannabis by quotas issued on an annual basis to licensed producers.

Although

we believe that we will meet the requirements to obtain, sustain or renew the necessary licenses and authorizations, there can be no

guarantee that the applicable authorities will issue these licenses or authorizations. In addition, to date we have not been issued quotas

from Colombian regulatory authorities that would allow us to commence the commercial sale of psychoactive cannabis products in

Colombia. Should the authorities fail to issue the necessary licenses or authorizations, including required quotas, we may

be curtailed or prohibited from the production and/or distribution of cannabis and hemp or from proceeding with the development of our

operations as currently proposed and our business, financial condition and results of the operation may be materially adversely affected.

Regulatory

Compliance Risks

Achievement

of our business objectives of becoming a producer of raw cannabis and hemp related products is contingent, in part, upon compliance

with regulatory requirements enacted by applicable governmental authorities and obtaining all regulatory approvals, where necessary,

for the sale of our products in Colombia and other jurisdictions where we intend to distribute and sell our products. We will incur ongoing

costs and obligations related to regulatory compliance. Failure to comply with applicable laws, regulations and permitting requirements

may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease

or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial

actions. Civil or criminal fines or penalties may be imposed on us for violations of applicable laws or regulations. Vigorous enforcement

of these laws could require extensive changes to our operations, increase our compliance costs or give rise to material liabilities,

which could have a material adverse effect on our business, results of operations and financial condition.

Competition

There

are many companies engaged in the cannabis business who we will compete with, including larger and more established companies with substantially

greater marketing, financial, human and other resources than we have. These companies include PharmaCielo, CannaVida, Empresa Colombiana

de Cannabis, Khiron Life Sciences Corp., MedCan, Canopy Growth Corporation, and Clever Leaves. Although we believe we are competitively

positioned to be a leader in the medicinal cannabis industry given our early entry into the market, the management team’s expertise

in medical product branding, marketing, quality control, and market relationships, competition in the medical cannabis industry is growing

quickly. As more competitors enter the market, prices may be reduced. We believe our approach in creating brand loyalty will allow us

to effectively compete in the market but there is no assurance that will be the case, and our competitors may adopt a similar or identical

approach. To date, we have obtained four licenses in Colombia that authorize us to engage in cannabis activities, and there are currently

few authorized Colombian producers. However, Colombia offers an open process to apply for licenses and there are no significant

barriers to entry. As a result, our ability to generate revenues and earnings may be reduced as competition intensifies, thereby causing

a material adverse effect on our business and financial condition.

Ability

to Establish and Maintain Bank Accounts

Many

banking institutions in countries where we or our prospective customers operate will not accept payments related to the cannabis industry

due to domestic laws and regulations or pressure exerted by the United States on banks with laws subject to the laws of the United

States (including, the Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001

(USA PATRIOT Act)). Failure to conduct our business through normal banking channels may impede our ability to make payments for goods

and services and transact business in the ordinary course. Failure to operate in normal banking channels may also increase our cost of

doing business and adversely impact our business. In the event financial service providers do not accept accounts or transactions

related to the cannabis industry, it is possible that we may be required to seek alternative payment solutions. If the industry was to

move toward alternative payment solutions, we would have to adopt policies and protocols to manage the Company’s exposure

to foreign exchange and interest rate risks. Our inability to effectively manage such risks may adversely affect our operations

and financial performance.

Anti-money

Laundering Laws and Regulations

We

are subject to a variety of laws and regulations within Colombia and internationally that are designed to prevent money laundering

and proceeds of crime through strict financial recordkeeping. In the event that any of our investments, or any proceeds thereof,

any dividends or distributions therefrom, or any profits or revenues accruing from such investments are found to be in violation of money

laundering legislation or otherwise, such transactions may be viewed as proceeds of crime under applicable legislation. Money laundering

laws could restrict or otherwise jeopardize our ability to declare or pay dividends, effect other distributions or subsequently cause

the repatriation of such funds to the United States or to any shareholders’ jurisdiction of residence. Furthermore, while we have

no current intention to declare or pay dividends on our common stock in the foreseeable future, in the event that a determination was

made that the revenues from our cannabis operations could reasonably be shown to constitute proceeds of crime, we may decide or be required

to suspend the declaration, and or, payment of dividends without advance notice and for an extended or indefinite period

of time.

Foreign

Trade Policies

Our

international operations are subject to inherent risks, including changes in the regulations governing the flow of cannabis products

between countries, fluctuations in cross-currency rates, discriminatory fiscal policies, unexpected changes in local regulations

and laws and the uncertainty of enforcement of remedies in foreign jurisdictions. In addition, foreign jurisdictions could impose tariffs,

quotas, trade barriers and other similar restrictions on our international sales and subsidize competing cannabis products. All of these

risks could result in increased costs or a reduction in revenues.

United

States Regulation

Although

we do not believe that our limited U.S. activity will subject us to regulation under U.S. federal or state laws applicable to the sale

of cannabis and marijuana products, we cannot assure you that current or future U.S. laws and regulations will not detrimentally

affect our business. Local, state and federal cannabis laws and regulations in the United States are constantly changing and they are

subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or to alter one or

more of our product or service offerings. In addition, violations of these laws, or allegations of such violations, could disrupt our

business and result in a material adverse effect on our revenues, profitability, and financial condition. We cannot predict the nature

of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations

or administrative policies and procedures, when and if promulgated, could have on our business.

Liability,

Enforcement, Complaints, etc.

Our

participation in the cannabis and hemp industries may lead to litigation, formal or informal complaints, enforcement actions, and inquiries

by third parties, other companies and/or various governmental authorities against us. Litigation, complaints, and enforcement actions

involving us could consume considerable amounts of financial and other corporate resources, which could have an adverse effect on our

future cash flows, earnings, results of operations and financial condition.

Legal

Proceedings

From

time to time, we may be a party to legal and regulatory proceedings, including matters involving governmental agencies, entities with

whom we transact business and other proceedings arising in the ordinary course of business. We will evaluate our exposure to these

legal and regulatory proceedings and establish reserves for the estimated liabilities in accordance with generally accepted accounting

principles. Assessing and predicting the outcome of these matters involves substantial uncertainties. Unexpected outcomes in these legal

proceedings, or changes in management’s evaluations or predictions and accompanying changes in established reserves, could have

an adverse impact on our financial results.

Environmental

Regulations

We

are subject to Colombian environmental laws governing the use of natural resources, which prohibit such use that causes harm to the interests

of the community or of third parties. Parties that cause environmental damage while acting under the authority of a permit and, or

license, are responsible for incurring the costs to rectify the damage. The imposition of environmental sanctions in addition

to civil and criminal penalties may be imposed. Environmental damage caused while a party is acting without a license may lead to

the imposition of sanctions, in addition to civil or criminal proceedings. Parties that cause environmental damage, in addition to sanctions

or penalties that apply, are also required to carry out studies to assess the characteristics of the damage. Colombian environmental

authorities may investigate potential claims, authorize preventative measures, or impose sanctions on parties breaching environmental

law. Any such measures imposed on us could have a material adverse effect on our business.

Demand

for Cannabis and Derivate Products

The

global sale of cannabis and hemp products is a new industry as a result of recent legal and regulatory changes. Although we expect demand

for licensed cannabis to exceed supply produced by licensed producers, there is a risk that such demand does not develop as anticipated.

Further, there is a risk that the adoption rate by pharmacies to sell medical cannabis is lower than expected or that such adoption rate

may take longer than anticipated. There is also a risk that the international export market for medicinal cannabis and extracts, such

as CBD, CBG and CBC, will not materialize as projected or not be commercially viable. Should any of such events materialize, the result

may have a material adverse effect on our business, operations and financial condition.

Weather,

Climate Change and Risks Inherent in an Agricultural Business

Our

business involves growing cannabis, which is an agricultural product. Although our medical cannabis is intended to be grown in greenhouses,

hemp used as feedstock for medicinal extracts and derivatives will be grown both outdoors and in greenhouses. Further, our prospective

Colombian medicinal cannabis operations will initially focus on outdoor production. The occurrence of severe adverse weather conditions,

especially droughts, hail, floods or frost, is unpredictable and may have a potentially devastating impact on agricultural production

and may otherwise adversely affect the supply of cannabis and hemp. Adverse weather conditions may be exacerbated by the effects of climate

change and may result in the introduction and increased frequency of pests and diseases. The effects of severe adverse weather conditions

may reduce our yields or require us to increase our level of investment to maintain yields. Additionally, higher than average temperatures

and rainfall can contribute to an increased presence of insects and pests, which could negatively affect cannabis crops. Future droughts

could reduce the yield and quality of our cannabis production, which could materially and adversely affect our business, financial condition

and results of operations.

The

occurrence and effects of plant disease, insects and pests can be unpredictable and devastating to agriculture, potentially rendering

all or a substantial portion of the affected harvests unsuitable for sale. Even if only a portion of the crop and, or,

production is damaged, our results of operations could be adversely affected as all or a substantial portion of the production

costs may have been incurred. Although some plant diseases are treatable, the cost of treatment can be high and such events could adversely

affect our operating results and financial condition. Furthermore, if we fail to control a given plant disease and the production is

threatened, we may be unable to supply our customers, which could adversely affect our business, financial condition and results of operations.

There can be no assurance that natural elements will not have a material adverse effect on any such production.

Product

Liability

As

a manufacturer and distributor of cannabis products designed to be ingested or inhaled by humans, we face an inherent risk of

exposure to product liability claims, regulatory action and litigation if our products are alleged to have caused damages, loss or injury.

In addition, the sale of our cannabis products involves the risk of injury to consumers due to tampering by unauthorized

third parties or product contamination. Adverse reactions resulting from human consumption of our cannabis products alone or in

combination with other medications or substances could occur. We may be subject to various product liability claims, including, among

others, that our products caused injury or illness, include inadequate instructions for use or include inadequate warnings concerning

health risks, possible side effects or interactions with other substances. A product liability claim or regulatory action against us

could result in increased costs, could adversely affect our reputation with our clients and consumers generally, and could have a material

adverse effect on our results of operations and financial condition. There can be no assurances that we will be able to obtain or maintain

product liability insurance on acceptable terms or with adequate coverage against potential liabilities. Such insurance is expensive

and may not be available in the future on acceptable terms, or at all.

Energy

Prices and Supply

We

require substantial amounts of diesel and electric energy and other resources for our harvest activities and to transport cannabis and

hemp. We rely upon third parties for our supply of energy resources used in our operations. The prices for and availability of energy

resources may be subject to change or curtailment, respectively, due to, among other things, new laws or regulations, imposition of new

taxes or tariffs, interruptions in production by suppliers, imposition of restrictions on energy supply by government, worldwide price

levels and market conditions. If our energy supply is curtailed for an extended period of time and we are unable to find replacement

sources at comparable prices, or at all, our business, financial condition and results of operations would be materially and adversely

affected.

Retention

and Acquisition of Skilled Personnel

We

will be required to attract and retain top quality talent to compete in the marketplace. We believe our future growth and success

will depend in part on our abilities to attract and retain highly skilled managerial, product development, sales and marketing, and finance

personnel. There can be no assurance of success in attracting and retaining such personnel. Shortages in qualified personnel could limit

our ability to be successful. At present and for the near future, we will depend upon a relatively small number of employees primarily

in Colombia to develop, manufacture, market, sell and distribute our products. As the size of our business increases, we will seek to

hire additional employees in other jurisdictions. Expansion of marketing and distribution of our products will require us to find, hire

and retain additional capable employees who can understand, explain, market and sell our products and/or our ability to enter into satisfactory

logistic arrangements to sell our products. There is intense competition for capable personnel in all of these areas and we may not be

successful in attracting, training, integrating, motivating, or retaining new personnel or subcontractors for these required functions.

Emerging

Market Risks

Emerging

market investment generally poses a greater degree of risk than investment in more mature market economies as developing market

economies are more susceptible to destabilization resulting from domestic and international developments.

Colombia’s

legal and regulatory requirements in connection with companies conducting agricultural activities, banking system and controls as well

as local business culture and practices are different from those in the United States. Our officers and directors must rely, to a great

extent, on our local legal counsel and local consultants retained by us in order to keep abreast of material legal, regulatory and governmental

developments as they pertain to and affect our business operations, and to assist us with our governmental relations. We also rely on the advice of local experts and professionals

in connection with current and new regulations that develop in respect of banking, financing and tax matters. Any developments or changes

in such legal, regulatory or governmental requirements or in local business practices are beyond our control and may adversely affect

our business.

We

also bear the risk that changes can occur to the Government in Colombia and a new government may void or change the laws and regulations

that we are relying upon. Currently, there are no restrictions on the repatriation from Colombia of earnings to foreign entities and

Colombia has never imposed such restrictions. However, there can be no assurance that restrictions on repatriation of earnings will not

be imposed in the future. Exchange control regulations for Colombia require that any proceeds in foreign currency originated on exports

of goods from Colombia be repatriated to Colombia. However, purchase of foreign currency is allowed through Colombian authorized financial

entities for purposes of payments to foreign suppliers, repayment of foreign debt, payment of dividends to foreign stockholders and other

foreign expenses.

Due

to our location in Colombia, our business, financial position and results of operations may be affected by the general conditions of

the Colombian economy, price instabilities, currency fluctuations, inflation, interest rates, regulatory changes, taxation changes, social

instabilities, political unrest and other developments in or affecting Colombia, over which we do not have control.

Risks

Related to Conducting Operations in Colombia

We

were recently granted medicinal cannabis licenses in Colombia. Over the past 10 to 15 years, the Government of Colombia has made

strides in improving the social, political, economic, legal and fiscal regimes. However, operations in Colombia remain subject

to risk due to the potential for social, political, economic, legal and fiscal instability. The Government of Colombia faces ongoing

problems including, but not limited to, unemployment and inequitable income distribution and unstable neighboring countries. The instability

in neighboring countries could result in an influx of immigrants resulting in a humanitarian crisis and/or increased illegal activities.

Colombia is also home to a number of insurgency groups and large swaths of the countryside are under guerrilla influence. In addition,

Colombia experiences narcotics-related violence, a prevalence of kidnapping, extortion and thefts and civil unrest in certain areas of

the country. Such instability may require us to suspend operations on our properties.

Other

risks exist relating to the conduct of business in Colombia. These risks include the future imposition of special taxes or similar charges,

as well as foreign exchange fluctuations and currency convertibility and controls. Other risks of doing business in Colombia include

our ability to enforce our contractual rights or the taking or nationalization of property without fair compensation, restrictions on

the use of expatriates in our operations, renegotiation or nullification of existing concessions, licenses, permits and contracts, changes

in taxation policies, or other matters.

The

Government of Colombia recently reached a peace accord with the country’s largest guerrilla group. The Government of Colombia also

entered into and dissolved formal discussions with the country’s second largest guerrilla group due to their unwillingness to cease

criminal and violent crimes. There is no certainty that the agreements will be adhered to by all of the members of the guerrilla groups

or that a peace agreement will be ultimately reached with the country’s second largest guerrilla group. There is a risk that any

peace agreement might contain new laws or change existing laws that could have a material adverse effect on us. Furthermore, the achievement

of peace with the country’s guerrilla groups could create additional social or political instability in the immediate aftermath,

which could have a material adverse effect on our operations.

Global

Economy

Financial

and commodity markets in Colombia are influenced by the economic and market conditions in other countries, including other South American

and emerging market countries and other global markets. Although economic conditions in these countries may differ significantly from

economic conditions in Colombia, investors’ reactions to developments in these other countries, such as the recent developments

in the global financial markets, may substantially affect the capital flows into, and the market value of securities of issuers with

operations in Colombia.

Insurance

Coverage

Our

production is, in general, subject to different risks and hazards, including adverse weather conditions, fires, plant diseases and pest

infestations, other natural phenomena, industrial accidents, labor disputes, changes in the legal and regulatory framework applicable

to us, and environmental contingencies. We will endeavor to obtain appropriate insurance covering these risks in amounts sufficient to

support a downturn in the sale of our products due to these potential production risks. The cost of such insurance may be high and we

may not be able to obtain sufficient amount of insurance to cover these risks.

Operations

in Spanish

As

a result of our conducting most of our operations in Colombia, our regulatory licenses and books and records, including key documents

such as material contracts and financial documentation, are principally negotiated and entered into in the Spanish language and English

translations may not exist or be readily available.

General

Business Risks

Inability

to Manage Growth

We

may not be able to effectively manage our growth as a producer, manufacturer and exporter of cannabis and hemp products. Our strategy

envisions growing our business. We plan to expand our production and manufacturing capability and create a global distribution

network. Any growth in or expansion of our business is likely to continue to place a strain on our management and administrative

resources, infrastructure and systems. As with other growing businesses, we expect that we will need to further refine and expand our

business development capabilities, our systems and processes and our access to financing sources. We also will need to hire, train, supervise

and manage new employees. These processes are time consuming and expensive, will increase management responsibilities and will divert

management attention. We cannot assure you that we will be able to:

| |

● |

cultivate our cannabis crops in Colombia and expand our manufacturing processes and systems in our facilities in

Colombia; |

| |

● |

execute

and perform under our current manufacturing and distribution agreements with Smokiez Edibles and Kx Family Care; |

| |

● |

raise additional capital to fund our operations; |

| |

● |

identify and hire qualified

employees or retain valued employees; or |

| |

● |

obtain and maintain necessary

licenses in relevant jurisdictions |

Our

inability, or failure to effectively manage, our growth and expansion could harm our business and materially

and adversely affect our operating results and financial condition.

Speculative

Forecasts

Any

forecasts we provide will be highly speculative in nature and we cannot predict results in a development stage company with a high degree

of accuracy. Any financial projections, especially those based on ventures with minimal operating history, are inherently subject to

a high degree of uncertainty, and their ultimate achievement depends on the timing and occurrence of a complex series of future events,

both internal and external to the enterprise. There can be no assurance that potential revenues or expenses we project will be accurate.

Limited

Management Team

Our

limited senior management team size may hamper our ability to effectively manage a publicly traded company while operating our business.

Our management team has experience in the management of publicly traded companies and complying with federal securities laws, including

compliance with recently adopted disclosure requirements on a timely basis. They realize it will take significant resources to meet these

requirements while simultaneously working on cultivating, developing and distributing our cannabis and hemp related products. Our management will be required

to design and implement appropriate programs and policies in responding to increased legal, regulatory compliance and reporting requirements,

and any failure to do so could lead to the imposition of fines and penalties and harm our business.

Risks

Related To Our Common Stock

The

issuance of such additional shares of common stock may depress the price of our common stock.

We

have outstanding obligations to issue additional shares of common stock in the future. These include the following:

| |

● |

We

may sell and issue to Tysadco up to $10,000,000 of shares of common stock under the Purchase Agreement; |

| |

● |

There

are 14,011,650 shares of common stock issuable pursuant to common stock warrants outstanding as of December 31, 2023; |

| |

● |

There

are 9,973,300 shares of common stock issuable upon conversion of our Series A Preferred Stock as of December 31, 2023; |

| |

● |

There

are 23,850,100 shares of common stock issuable upon conversion of our Series B Preferred Stock as of December 31, 2023; |

| |

● |

There

are 5,000,000 shares of common stock issuable pursuant to convertible debt instruments outstanding as of December 31, 2023, consisting of $750,000 of principal that is convertible into 50,000 shares

of Series B Preferred Stock; |

| |

● |

There are 10,892,000 shares of common stock issuable

pursuant to common stock options outstanding as of December 31, 2023. |

Any

shares of common stock issued pursuant to these securities would further dilute the percentage ownership of existing stockholders. The

terms upon which we may obtain additional capital during the life of these securities may be adversely affected due

to such potential dilution. Finally, we may issue additional shares in the future other than as listed above. There are no preemptive

rights in connection with our common stock. Thus, the percentage ownership of existing stockholders may be diluted if we issue additional

shares in the future. Future issuances of additional shares pursuant to grants, options, warrants other convertible securities

could cause immediate and substantial dilution to the net tangible book value of shares of common stock issued and outstanding immediately

before such issuances. Any future decrease in the net tangible book value of such issued and outstanding shares could materially and

adversely affect the market value of the shares.

Limited

Trading

Although

prices for shares of our common stock are quoted on the OTCQB tier of the OTC Markets, there is limited trading and no assurance

can be given that an active public trading market will develop or, if developed, that it will be sustained. The OTC Markets is generally

regarded as a less efficient and less prestigious trading market than other national markets. There is no assurance if or when our common

stock will be quoted on another more prestigious exchange or market. The market price of our common stock is may be volatile as

there will likely be a limited trading market for the stock, which may cause transactions of small blocks of stock

to have a disproportionate impact on the stock price.

We

may issue additional stock without stockholder consent.

Our

Board of Directors has authority, without action or vote of the stockholders, to issue all or part of our authorized but unissued shares.

Additional shares may be issued in connection with future financing, acquisitions, employee stock plans, or otherwise. Any such issuance

will dilute the percentage ownership of existing stockholders. The Board of Directors can also issue preferred stock in one or more series

and fix the terms of such stock without stockholder approval. Preferred stock may include the right to vote as a series on particular

matters, preferences as to dividends and liquidation, conversion and redemption rights and sinking fund provisions. The issuance of preferred

stock could adversely affect the rights of the holders of common stock and reduce the value of the common stock. In addition, specific

rights granted to holders of preferred stock could discourage, delay or prevent a transaction involving a change in control of our company,

even if doing so would benefit our stockholders. Such issuance could also discourage proxy contests and make it more difficult for you

and other stockholders to elect directors of your choosing and to cause us to take other corporate actions you desire.

Broker-dealers

may be discouraged from effecting transactions in our common stock because it is considered a penny stock and is subject to the penny

stock rules.

Our

common stock currently constitutes “penny stock.” Subject to certain exceptions, for the purposes relevant to us, “penny

stock” includes any equity security that has a market price of less than $5.00 per share. Rules 15g-1 through 15g-9 promulgated

under the Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on certain brokers-dealers who

engage in certain transactions involving a “penny stock.” In particular, a broker-dealer selling penny stock to anyone other

than an established customer or “accredited investor” (generally, an individual with net worth in excess of $1,000,000 or

an annual income exceeding $200,000, or $300,000 together with his or her spouse), must make a special suitability determination for

the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the

transaction is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction

involving a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission relating to the penny stock market,

unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to

the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to

send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information

with respect to the limited market in penny stocks.

The

additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions

in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

Because

our Board of Directors does not intend to pay dividends on our common stock in the foreseeable future, stockholders may have to sell

their shares of our common stock to realize a return on their investment in the company.

Holders

of our common stock are entitled to receive dividends if, and when, declared by our Board of Directors out of funds

legally available. To date, we have paid no dividends. Our Board of Directors does not intend to declare any dividends in the foreseeable

future, but instead intends to retain all earnings, if any, for use in our business operations. Accordingly, a return on an investment

in shares of our common stock may be realized only through a sale of such shares, if at all.

Control

of Common Stock will Influence Decision Making

Our

officers, directors and principal stockholders are able to exert significant influence over us and may make decisions that are not in

the best interests of all stockholders. Our officers, directors and principal stockholders (greater than 5% stockholders) collectively

own approximately 87.0% of our fully-diluted common stock. As a result of such ownership, these stockholders are able to affect

the outcome of, or exert significant influence over, all matters requiring stockholder approval, including the election and removal of

directors and any change in control. In particular, this concentration of ownership of our common stock could have the effect of delaying

or preventing a change of control of our company or otherwise discouraging or preventing a potential acquirer from attempting to obtain

control of our company. This, in turn, could have a negative effect on the market price of our common stock. It could also prevent our

stockholders from realizing a premium over the market prices for their shares of our common stock.

We

are an Emerging Growth Company Within the Meaning of the Securities Act.

We

are an “emerging growth company” within the meaning of the Securities Act, as modified by the JOBS Act, and we may take advantage

of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth

companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the

Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden

parachute payments not previously approved. As a result, our stockholders may not have access to certain information they may deem important.

We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier, including

if the market value of our common stock held by non-affiliates exceeds $700 million as of the end of any second quarter of a fiscal year,

in which case we would no longer be an emerging growth company as of the end of such fiscal year. We cannot predict whether investors

will find our securities less attractive because we will rely on these exemptions. If some investors find our securities less attractive

as a result of our reliance on these exemptions, the trading prices of our securities may be lower than they otherwise would be, there

may be a less active trading market for our securities and the trading prices of our securities may be more volatile.

Further,

Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting

standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do

not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting

standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements

that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended

transition period which means that when a standard is issued or revised and it has different application dates for public or private

companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised

standard. This may make comparison of our financial statements with another public company which is neither an emerging growth company

nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential

differences in accountant standards used.

Antitakeover

Protections

Anti-takeover

provisions may limit the ability of another party to acquire us, which could cause our stock price to decline. Our articles of incorporation,

as amended, bylaws and Nevada law contain provisions that could discourage, delay or prevent a third party from acquiring us, even if

doing so may be beneficial to our stockholders. In addition, these provisions could limit the price investors would be willing to pay

in the future for shares of our common stock.

Risks

Relating to Our Agreements with Tysadco Partners, LLC

The

sale of our common stock to Tysadco may cause dilution, and the sale of the shares of common stock acquired by Tysadco, or the perception

that such sales may occur, could cause the price of our common stock to fall.

Pursuant

to the Purchase Agreement, Tysadco has committed to purchase up to an aggregate of $10,000,000 of our common stock. The shares that may

be sold pursuant to the Purchase Agreement in the future may be sold by us to Tysadco at our discretion from time to time, commencing

after the SEC has declared effective the registration statement that includes this prospectus and until approximately three years after

such date. The per share purchase price for the shares that we may sell to Tysadco under the Purchase Agreement will fluctuate based

on the price of our common stock, and will be equal to 88% of the of the lowest daily volume weighted average price of our common stock

during the period of 10 trading days beginning five trading days preceding the day we deliver the

applicable put notice to Tysadco. Depending on market liquidity at the time, sales of shares of common stock to Tysadco may cause

the trading price of our common stock to fall.

We

generally have the right to control the timing and amount of any sales of our shares to Tysadco, except that, pursuant to the Purchase

Agreement, we may not sell shares to Tysadco if the sale would result in its beneficial ownership of more than 4.99% of our outstanding

common stock. Tysadco may ultimately purchase all, some or none of the shares of our common stock that may be sold pursuant to the Purchase

Agreement and, after it has acquired shares, Tysadco may sell all, some or none of those shares. Therefore, sales to Tysadco by us could

result in substantial dilution to the interests of other holders of our common stock. Additionally, the sale of a substantial number

of shares of our common stock to Tysadco, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise wish to effect sales.

Tysadco

will pay less than the then-prevailing market price for our common stock for purchases under the Purchase Agreement.

The

common stock to be issued to Tysadco pursuant to the Purchase Agreement will be purchased at a 12% discount to the lowest volume weighted

average price of our common stock during the during the period of 10 trading days beginning five

trading days preceding the day we deliver the applicable put notice to Tysadco. Tysadco has a financial incentive to sell our

common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the

market price. If Tysadco sells the shares, the price of our common stock could decrease. If our stock price decreases, Tysadco may have

a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

We

may not be able to put to Tysadco all $10,000,000 of shares available under the Purchase Agreement.

The

Purchase Agreement provides for the purchase by Tysadco of up to $10,000,000 of shares of our common stock. Our ability to draw down

funds and sell shares under the Purchase Agreement requires the satisfaction of a number of conditions, including that the registration

statement of which this prospectus is a part be declared effective by the SEC and continue to be effective at the time of the put, as

well as Tysadco’s compliance with its obligations under the Purchase Agreement. Accordingly, there can be no guarantee that we

will be able to draw down all or any portion of the $10,000,000 available to us under the Purchase Agreement.

USE

OF PROCEEDS

The

Shares offered by this prospectus will be sold by the selling stockholder. We will not receive any proceeds from the sale of common stock

by the selling stockholder. However, we will receive proceeds from the sale of shares of our common stock to Tysadco under the Purchase

Agreement, and upon the exercise of warrants held by the selling stockholder. These proceeds would be used for general working capital

purposes.

SELLING

STOCKHOLDER

This prospectus relates to the

possible resale from time to time by the selling stockholder of our common stock, including shares of common stock that may be issued

by us to Tysadco under the Purchase Agreement, and upon the conversion of shares of Series B Preferred Stock we issued to Tysadco under

the Purchase Agreement. In addition, on September 1, 2022, we entered into a Securities Purchase

Agreement with Tysadco (the “SPA”) under which Tysadco agreed to purchase an aggregate of 20,000 shares of our Series B Preferred

Stock for a total purchase price of $300,000 in two closings of 10,000 Series B Preferred Shares each. The first closing of 10,000 Series

B Shares occurred following the execution of the SPA. On October 12, 2022, we sold the second tranche of 10,000

shares of Series B Preferred Stock to Tysadco for proceeds of $150,000. We paid $15,000 out of the proceeds of the investment

to Garden State Securities, Inc. as financing costs. Except for the transactions contemplated by the SPA and the Purchase Agreement,

including our obligations under the related Registration Rights Agreement pursuant to which we have filed the registration statement

of which this prospectus is a part, Tysadco has not had any material relationship with us within the past three years.

The

table below presents information regarding the selling stockholder and the shares of common stock that they may offer from time to time

under this prospectus. This table is prepared based on information supplied to us by the selling stockholder, and reflects holdings as

of December 31, 2023. As used in this prospectus, the term “selling stockholder” includes the selling stockholder

named below and any donees, pledgees, transferees or other successors in interest selling shares received after the date of this prospectus

from the selling stockholder as a gift, pledge, or other non-sale related transfer. The number of shares in the column “Maximum

Number of Shares of common stock to be Offered Pursuant to this prospectus” represents all of the shares of common stock that the

selling stockholder may offer under this prospectus. The selling stockholder may sell some, all or none of its shares in this Offering.

We do not know how long the selling stockholder will hold the shares before selling them, and we currently have no agreements, arrangements

or understandings with the selling stockholder regarding the sale of any of the shares.

Beneficial

ownership is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act, and includes shares of common

stock with respect to which the selling stockholder has voting and investment power. The percentage of shares of common stock beneficially

owned by the selling stockholder prior to the Offering shown in the table below is based on an aggregate of 79,827,618 shares

of our common stock outstanding on December 31, 2023. The fourth column assumes the sale of all of the shares offered by the selling

stockholder pursuant to this prospectus.

| | |

Beneficially Owned

Prior to Offering | | |

Number of Shares Being Offered by Selling | | |

Beneficially Owned

After Offering | |

| Selling Stockholder | |

Number of Shares | | |

Percent | | |

Stockholder in Offering | | |

Number of Shares(1) | | |

Percent | |

| Tysadco Partners,

LLC (2) | |

| 3,000,000 | (3) | |

| 3.80 | % | |

| 21,366,700 | | |

| 2,000,000 | | |

| 2.00 | % |

| * |

Less

than one percent. |

| |

|

| (1) |

Assumes

the sale of all shares being offered pursuant to this prospectus. Shares owned after the offering consist of shares of common stock

issuable upon conversion of 20,000 shares of Series B Preferred Stock. |

| |

|

| (2) |

The

business address of Tysadco Partners, LLC is 210 West 77th Street, #7W, New York, NY 10024. Tysadco’s principal

business is that of a private investment firm. We have been advised that Tysadco is not a member of FINRA, or an independent broker-dealer,

and that neither Tysadco nor any of its affiliates is an affiliate or an associated person of any FINRA member or independent broker-dealer.

We have been further advised that Brian Loper is the Managing Member of Tysadco, and that Mr. Loper has definitive

power to vote or to direct the vote and definitive power to dispose or to direct the disposition of all securities owned directly

by Tysadco. |

| |

|

| (3) |

Includes

shares of common stock issuable upon conversion of shares of Series B Preferred Stock described above, which are subject to the limitation

that Tysadco may not convert such securities to the extent that Tysadco would beneficially own more than 4.99% of our outstanding common

stock. In accordance with Rule 13d-3(d) under the Exchange Act, we have excluded from the number of shares beneficially owned prior to

the Offering all of the shares that Tysadco may be required to purchase under the Purchase Agreement, because the issuance of such shares

is solely at our discretion and is subject to certain conditions, the satisfaction of all of which are outside of Tysadco’s control,

including the Registration Statement of which this prospectus is a part becoming and remaining effective. |

This

prospectus also covers any additional shares of our common stock which become issuable in connection with the shares being registered

by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration

which results in an increase in the number of our outstanding shares of common stock.

PLAN

OF DISTRIBUTION

This

prospectus relates to the resale of up to 21,366,700 shares of our common stock by the selling stockholder.

The

selling stockholder and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of the shares

covered hereby on any stock exchange, market or trading facility on which our common stock is traded or in private transactions. These

sales may be at fixed or negotiated prices. The selling stockholder may use any one or more of the following methods when selling shares:

| |

● |

ordinary

brokerage transactions and transactions in which the broker dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker dealer will attempt to sell the shares as agent but may position and resell a portion of the block as

principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker dealer as principal and resale by the broker dealer for its account; |

| |

|

|

| |

● |

an exchange

distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales entered into after the effective date of the registration statement of which this prospectus is a part; |

| |

|

|

| |

● |

in transactions

through broker dealers that agree with the selling stockholder to sell a specified number of shares at a stipulated price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a combination

of any such methods of sale; or |

| |

|

|

| |

● |

any other

method permitted pursuant to applicable law. |

The

selling stockholder may also sell Shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker

dealers engaged by the selling stockholder may arrange for other brokers dealers to participate in sales. Broker dealers may receive

commissions or discounts from the selling stockholder (or, if any broker dealer acts as agent for the purchaser of shares, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or

markdown in compliance with FINRA IM-2440.

In

connection with the sale of the shares or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the shares in the course of hedging the positions they assume.

The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or create

one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by

this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented

or amended to reflect such transaction).

Tysadco

is an “underwriter” within the meaning of the Securities Act and any broker-dealers or agents that are involved in selling

the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In

such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may