Amended Statement of Beneficial Ownership (sc 13d/a)

June 08 2022 - 6:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No. 1)*

NOCOPI

TECHNOLOGIES, INC.

(Name

of Issuer)

COMMON

STOCK, $0.01 PAR VALUE

(Title

of Class of Securities)

655212207

(CUSIP

Number)

Michael

S. Liebowitz

4400

Biscayne Blvd,

Miami,

FL 33137,

(917)

592-7979

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May

23, 2022

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

|

* |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1. |

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Michael

S. Liebowitz |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) ☒

(b)

☐ |

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

PF |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER

18,288,020 |

| 8. |

SHARED

VOTING POWER

0 |

| 9. |

SOLE

DISPOSITIVE POWER

18,288,020 |

| 10. |

SHARED

DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

18,288,020* |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

27.10%** |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

| * |

The

securities are held directly by MSL 18 HOLDINGS LLC (“Holdings”) and indirectly by Michael S. Liebowitz, who has sole

voting and dispositive control of Holdings. |

|

** |

Percentage

calculated based on 67,495,055 shares of common stock, par value $0.01 per share, outstanding as of May 3, 2022, as reported in the

Form 10-Q of NOCOPI TECHNOLOGIES, INC., filed with the Securities and Exchange Commission on May 6, 2022. |

| 1. |

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Matthew

C. Winger |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☒

(b)

☐ |

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (see instructions)

PF |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7. |

SOLE

VOTING POWER

620,000 |

| 8. |

SHARED

VOTING POWER

0 |

| 9. |

SOLE

DISPOSITIVE POWER

620,000 |

| 10. |

SHARED

DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

620,000 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.92%* |

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

|

* |

Percentage

calculated based on 67,495,055 shares of common stock, par value $0.01 per share, outstanding as of May 3, 2022, as reported in the

Form 10-Q of NOCOPI TECHNOLOGIES, INC., filed with the Securities and Exchange Commission on May 6, 2022. |

This

Amendment No. 1 to Schedule 13D amends and supplements the statements on the previously filed Schedule 13D, as amended, filed by Michael

S. Liebowitz and Matthew C. Winger (collectively the “Reporting Persons”). Except as supplemented herein, such statements,

as heretofore amended and supplemented, remain in full force and effect. Information given in response to each item shall be deemed incorporated

by reference in all other items, as applicable. Each capitalized term used but not defined herein has the meaning ascribed to such term

in the Schedule 13D, as amended.

Item

3. Source or Amount of Funds or Other Consideration.

Item

3 of this Amendment No. 1 is supplemented and superseded, as the case may be, as follows:

The

aggregate purchase price for the shares of Common Stock currently beneficially owned by the Reporting Persons was $3,300,956.39. The

source of these funds was the personal funds of each of the Reporting Persons.

Item

4. Purpose of Transaction.

Item

4 of Amendment No. 1 is supplemented and superseded, as the case may be, as follows:

This

Amendment No. 1 is being filed to report the acquisition of common stock, par value $0.01 (the “Common Stock”), of Nocopi

Technologies, Inc., a Maryland corporation (the “Issuer”) reported in Item 5(c) that resulted in a more than 1 percent change

in beneficial ownership. The disclosure regarding the purchases in Item 5(c) below is incorporated herein by reference.

The

Funds hold securities of the Issuer for investment purposes. The Reporting Persons or their affiliates may purchase additional securities

or dispose of securities in varying amounts and at varying times depending upon the Reporting Persons’ continuing assessments of

pertinent factors, including the availability of shares of Common Stock or other securities for purchase at particular price levels,

the business prospects of the Issuer, other business investment opportunities, economic conditions, stock market conditions, money market

conditions, the attitudes and actions of the Board and management of the Issuer, the availability and nature of opportunities to dispose

of securities of the Issuer and other plans and requirements of the particular entities. The Reporting Persons may discuss items of mutual

interest with the Issuer’s management, other members of the Board and other investors, which could include items in subparagraphs

(a) through (j) of Item 4 Schedule 13D.

Depending

upon their assessments of the above factors, the Reporting Persons or their affiliates may change their present intentions as stated

above and they may assess whether to make suggestions to the management of the Issuer regarding financing, and whether to acquire additional

securities of the Issuer (by means of open market purchases, privately negotiated purchases, or otherwise) or to dispose of some or all

of the securities of the Issuer under their control.

Except

as otherwise disclosed herein, at the present time, the Reporting Persons do not have any plans or proposals with respect to any extraordinary

corporate transaction involving the Issuer including, without limitation, those matters described in subparagraphs (a) through (j) of

Item 4 of Schedule 13D.

Item

5. Interest in Securities of the Issuer.

(a)

and (b)

| |

|

|

|

Michael

S. Liebowitz |

|

Matthew

C. Winger |

|

| (a) |

Amount

Beneficially Owned: |

|

18,288,020 |

|

620,000 |

|

| (b) |

Percent

of Class: |

|

27.10% |

|

0.92% |

|

| (c) |

Number

of Shares to Which Reporting Person Has: |

|

|

|

|

|

| |

(i) |

Sole

Voting Power: |

|

18,288,020 |

|

620,000 |

|

| |

(ii) |

Shared

Voting Power: |

|

0 |

|

0 |

|

| |

(iii) |

Sole

Dispositive Power: |

|

18,288,020 |

|

620,000 |

|

| |

(iv) |

Shared

Dispositive Power: |

|

0 |

|

0 |

|

The

percentages in this paragraph relating to beneficial ownership of shares of Common Stock, based on 67,495,055 shares outstanding as of

May 6, 2022.

(c)

The following transactions in the Issuer’s Common Stock were effected by the Reporting Persons since the date of the previously

filed Schedule 13D. All purchase transactions were effected in the open market directly with a broker-dealer. Except as disclosed herein,

none of the Reporting Persons or their affiliates has effected any other transactions in securities of the Issuer since the date of the

previously filed Schedule 13D.

| Name |

|

Date |

|

Number

of

Shares |

|

|

Transaction |

|

Price/Share |

|

|

| Michael

S. Liebowitz |

|

5/11/2022 |

|

|

97,274 |

|

|

Purchase |

|

|

0.16 |

|

|

| Michael

S. Liebowitz |

|

5/12/2022 |

|

|

72,500 |

|

|

Purchase |

|

|

0.16 |

|

|

| Michael

S. Liebowitz |

|

5/13/2022 |

|

|

100,570 |

|

|

Purchase |

|

|

0.16 |

|

|

| Matthew

C. Winger |

|

5/13/2022 |

|

|

25,000 |

|

|

Purchase |

|

|

0.16 |

|

|

| Michael

S. Liebowitz |

|

5/23/2022 |

|

|

8,545,742 |

|

|

Purchase |

|

|

0.169 |

(1) |

|

| Michael

S. Liebowitz |

|

5/24/2022 |

|

|

184,700 |

|

|

Purchase |

|

|

0.159 |

(2) |

|

| Michael

S. Liebowitz |

|

5/25/2022 |

|

|

445,845 |

|

|

Purchase |

|

|

0.162 |

(3) |

|

| Matthew

C. Winger |

|

5/23/2022 |

|

|

25,000 |

|

|

Purchase |

|

|

0.15 |

|

|

| Michael

L. Liebowitz |

|

6/1/2022 |

|

|

200 |

|

|

Purchase |

|

|

0.16 |

|

|

| Michael

L. Liebowitz |

|

6/1/2022 |

|

|

45,000 |

|

|

Purchase |

|

|

0.17 |

|

|

| Michael

L. Liebowitz |

|

6/2/2022 |

|

|

65,333 |

|

|

Purchase |

|

|

0.16 |

|

|

| Michael

L. Liebowitz |

|

6/2/2022 |

|

|

35,454 |

|

|

Purchase |

|

|

0.17 |

|

|

| (1) | The

price reported is a weighted average price. The shares were purchased in multiple transactions

at prices ranging from $0.14 to $0.17, inclusive. The reporting person undertakes to provide

to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange

Commission, upon request, full information regarding the number of shares sold at each separate

price within the ranges set forth in this footnote. |

| (2) | The

price reported is a weighted average price. The shares were purchased in multiple transactions

at prices ranging from $0.15 to $0.17, inclusive. The reporting person undertakes to provide

to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange

Commission, upon request, full information regarding the number of shares sold at each separate

price within the ranges set forth in this footnote. |

| (3) | The

price reported is a weighted average price. The shares were purchased in multiple transactions

at prices ranging from $0.16 to $0.17, inclusive. The reporting person undertakes to provide

to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange

Commission, upon request, full information regarding the number of shares sold at each separate

price within the ranges set forth in this footnote. |

(d)

No other person is known to the Reporting Persons to have the right to receive or the power to direct the receipt of dividends from,

or the proceeds from the sale of, the shares of Common Stock covered by this Statement.

(e)

Not applicable.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| |

Michael

S. Liebowitz |

| |

|

| |

/s/

Thomas R. Martin |

| |

Thomas

R. Martin, Attorney-in-Fact |

| |

|

| |

June

7, 2022 |

| |

Date |

| |

Matthew

C. Winger |

| |

|

| |

/s/

Thomas R. Martin |

| |

Thomas

M. Martin, Attorney-in-Fact |

| |

|

| |

June

7, 2022 |

| |

Date |

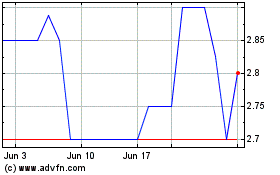

Nocopi Technologies Inc MD (QB) (USOTC:NNUP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nocopi Technologies Inc MD (QB) (USOTC:NNUP)

Historical Stock Chart

From Nov 2023 to Nov 2024