UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of

1934

For the month of February, 2014

Commission File Number 1-8910

NIPPON TELEGRAPH AND TELEPHONE

CORPORATION

(Translation of registrant’s name into English)

OTEMACHI FIRST SQUARE, EAST TOWER

5-1, OTEMACHI 1-CHOME

CHIYODA-KU, TOKYO 100-8116 JAPAN

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

NOTICE REGARDING IMPLEMENTATION OF NEW INCENTIVE PROGRAM

On February 6, 2014, the registrant filed with the Tokyo Stock Exchange a notice regarding its implementation of a performance-based

equity compensation program for certain overseas subsidiaries.

The information included herein contains forward-looking

statements. The registrant desires to qualify for the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause

the registrant’s actual results to differ materially from those set forth in the attachment.

The registrant’s

forward-looking statements are based on a series of assumptions, projections, estimates, judgments and beliefs of the management of the registrant in light of information currently available to it regarding the registrant and its subsidiaries and

affiliates, the economy and telecommunications industry in Japan and overseas, and other factors. These projections and estimates may be affected by the future business operations of the registrant and its subsidiaries and affiliates, the state of

the economy in Japan and abroad, possible fluctuations in the securities markets, the pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the

telecommunications industry in Japan and elsewhere, other changes in circumstances that could cause actual results to differ materially from any future results that may be derived from the forward-looking statements, as well as other risks included

in the registrant’s most recent Annual Report on Form 20-F and other filings and submissions with the United States Securities and Exchange Commission.

No assurance can be given that the registrant’s actual results will not vary significantly from any expectation of future results that may be derived from the forward-looking statements included

herein.

The information on any website referenced herein or in the attached material is not incorporated by reference herein

or therein.

The attached material is a translation of the Japanese original. The Japanese original is authoritative.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

|

|

|

|

|

By

|

|

/s/ Kazuhiko Nakayama

|

|

|

|

Name:

|

|

Kazuhiko Nakayama

|

|

|

|

Title:

|

|

General Manager

|

|

|

|

|

|

Investor Relations Office

|

Date: February 6, 2014

February 6, 2014

Company Name: Nippon Telegraph and Telephone Corporation

Representative: Hiroo Unoura, President and Chief Executive Officer

(Code No.: 9432, First section of Tokyo Stock Exchange)

Implementation of the New Incentive Program Towards the Promotion of Global Cloud Business

~ Implementation of a Performance-based Equity Compensation Program

Using NTT Shares for Overseas Subsidiaries ~

Nippon Telegraph and Telephone Corporation (“NTT”) announced that it has decided to implement a performance-based equity compensation program (the

“Program”) for its subsidiary, Dimension Data Holdings plc (“Dimension Data”), using NTT shares. Dimension Data plans to move the Program forward by making a decision regarding the specific procedures relating to the

implementation of the Program.

|

1.

|

Background of the Implementation of the Program:

|

Based on NTT’s Medium-Term Management Strategy,

“Towards the Next Stage,” NTT’s business objective is to reach US$20 billion in proceeds from overseas sales by the fiscal year ending March 31, 2017. NTT Group is proactively working to drive the development of its global

business forward and is projecting proceeds from overseas sales to be US$13 billion for the fiscal year ending March 31, 2014. As companies with important responsibilities within NTT Group’s global cloud business, each Dimension Data group

company is expected to accelerate its development by further strengthening collaboration efforts within NTT Group.

In light of the foregoing, NTT has

decided to implement a compensation program that distributes NTT shares to executives and key talent of Dimension Data group companies worldwide through a long-term incentive plan, with awards based on the business performance of Dimension Data, in

order to incentivize each executive and key talent, as members of NTT Group, to conduct business while being conscious of the corporate value of Dimension Data and NTT Group, and to reward success.

|

2.

|

Details of the Program:

|

The Program will distribute NTT

shares

*1

to eligible persons based on the business performance of Dimension Data, commencing during its current fiscal year ending September 30, 2014 and continuing for three years through

the fiscal year ending September 30, 2016 (“Business Performance Measurement Period”). Eligible persons will be designated each fiscal year, and the Program is expected to be conducted in the same manner each fiscal year, including

and after the fiscal year ending September 30, 2015.

Under the Program, each eligible person is given the right to choose from either the

Full Value Plan or the Option Plan. Under the Full Value Plan, NTT shares are distributed at no charge, and their exercise value is based on virtual shares whose value is based on Dimension Data’s enterprise value (“Units”). Under the

Option Plan, eligible persons receive the option to acquire NTT shares, and upon the exercise of such option, they receive NTT shares at no charge based on the increase in value of the Units. Each eligible person may choose to participate in one or

both of these plans, and the rights under these plans vest when the eligible person satisfies the continued service requirements established by the Program. Under both plans, the number of Units to be provided is initially determined based on the

position of the eligible person, and after the Business Performance Measurement Period, assuming that the continued service requirements are satisfied, the number of Units to be provided to each eligible person is fixed based on the status of

achievement of the performance target predetermined by Dimension Data. Under the Full Value Plan, a certain number of NTT shares, which number is calculated using a predetermined method of calculation based on the total value of the Units whose

rights have vested, are distributed to eligible persons. Under the Option Plan, a certain number of NTT shares, which number is calculated using a pretermined method of calculation based on the increase in the total value of Units for which eligible

persons exercised options after their rights vested, are distributed to eligible persons. Options can be exercised at a point in time established by the Program within two years after the rights have vested.

Eligible persons for purposes of the Program are scheduled to be designated

in advance by Dimension Data. Eligible persons will consist of executives and key talent of Dimension Data group companies (approximately 700 persons). Eligibility will be reviewed every year.

|

|

(3)

|

Establishment of the Trust

|

Under the Program, a Trust in which the eligible person is the

named trustee will be established (“Trust”). The Trust, under instructions from the trust executor, will acquire NTT shares on the open market and distribute a fixed number of such NTT shares to eligible persons following predetermined

procedures.

|

|

(4)

|

Acquisition Method of NTT Shares

|

NTT shares are scheduled to be purchased by the Trust on the

Tokyo Stock Exchange or New York Stock Exchange.

|

|

(5)

|

Acquisition Period and Acquisition Price of NTT Shares

|

After the Business Performance

Measurement Period, the Trust will acquire NTT shares over a predetermined two-year period and distribute the shares to eligible persons. As a general rule, Dimension Data is expected to pay the total purchase price of US$70 million

*2

, which is the acquisition price when using the three-year period from the fiscal year ending September 30, 2014 as the Business Performance Measurement Period.

|

*1:

|

American Depositary Receipts (ADR) may be distributed instead of NTT shares.

|

|

*2:

|

Purchase price may vary depending on the business performance of Dimension Data.

|

[Note]

The information in this material is based on certain current assumptions, and is subject to change in the future.

|

|

|

|

|

For further inquiries, please contact:

|

|

|

|

Ken Katsuyama

|

|

|

|

General Affairs Department (HR)

|

|

Nippon Telegraph and Telephone Corporation

|

|

Phone:

|

|

+81-3-6838-5538

|

|

Fax:

|

|

+81-3-6838-5529

|

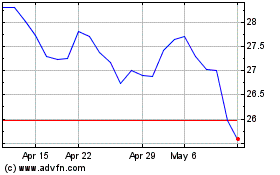

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Jun 2024 to Jul 2024

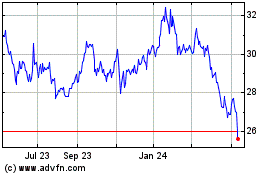

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Jul 2023 to Jul 2024