Report of Foreign Issuer (6-k)

November 08 2019 - 6:15AM

Edgar (US Regulatory)

FORM 6-K

U.S.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of November 2019

Commission File Number: 333-228135

NIPPON STEEL CORPORATION

(Translation of registrant’s name into English)

6-1, Marunouchi 2-chome

Chiyoda-ku, Tokyo 100-8071

Japan

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ☐

Information furnished on this form:

EXHIBIT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NIPPON STEEL CORPORATION

|

|

|

|

|

|

|

Date: November 8, 2019

|

|

|

|

By:

|

|

/s/ Kazumasa Shinkai

|

|

|

|

|

|

|

|

Kazumasa Shinkai

|

|

|

|

|

|

|

|

Executive Officer, Head of General Administration Division

|

November 8, 2019

|

|

|

|

|

|

|

|

|

|

|

Company Name

|

|

:

|

|

Nippon Steel Corporation

|

|

|

|

Representative

|

|

:

|

|

Eiji Hashimoto

|

|

|

|

|

|

|

|

Representative Director and President

|

|

|

|

Stock listing

|

|

:

|

|

First Section of Tokyo Stock Exchange, and

|

|

|

|

|

|

|

|

Nagoya, Fukuoka and Sapporo Stock Exchanges

|

|

|

|

Code Number

|

|

:

|

|

5401

|

|

|

|

Contact

|

|

:

|

|

Public Relations Center, General Administration Div.

|

|

|

|

Telephone

|

|

:

|

|

+81-3-6867-2135

|

Announcement of Revision to Subsidiary’s Earnings Forecasts

Today, GEOSTR Corporation, a subsidiary of Nippon Steel Corporation (the “Company”), announced revision to its earnings forecasts, as per the

attachment.

The impact of the revision is immaterial with regard to the Company’s consolidated financial results.

November 8, 2019

|

|

|

|

|

|

|

|

|

Company Name:

|

|

GEOSTR Corporation

|

|

|

|

Representative:

|

|

Shingo Hayama

Representative Director and President

|

|

|

|

Code Number:

|

|

5282 (Tokyo Stock Exchange, Second Section)

|

|

|

|

Contact:

|

|

Yoshitaka Furuhashi, Executive Director,

Finance and Accounting Team,

Business

Management Headquarter

|

|

|

|

Telephone:

|

|

+81-3-5844-1201

|

Notice Concerning Revision to Earnings Forecasts

Considering recent trends in performance, GEOSTR Corporation (the “Company”) hereby notifies that it has revised its earnings

forecasts (consolidated and non-consolidated) for the full year of fiscal 2019 ending March 31, 2020, which were announced on August 9, 2019.

1. Revision to Full-Year Fiscal 2019 Earnings Forecasts (April 1, 2019 – March 31, 2020)

(i) Revision to Full-Year Consolidated Earnings Forecasts

(Million yen)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

|

Operating

profit

|

|

|

Ordinary

profit

|

|

|

Profit attributable

to owners of parent

|

|

|

Earnings per

share

(Yen)

|

|

|

Previous forecasts (A)

|

|

|

29,000

|

|

|

|

800

|

|

|

|

800

|

|

|

|

100

|

|

|

|

3.20

|

|

|

Revised forecasts (B)

|

|

|

29,000

|

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

200

|

|

|

|

6.39

|

|

|

Increase/Decrease (B-A)

|

|

|

—

|

|

|

|

200

|

|

|

|

200

|

|

|

|

100

|

|

|

|

—

|

|

|

Change (%)

|

|

|

—

|

|

|

|

25.0

|

|

|

|

25.0

|

|

|

|

100.0

|

|

|

|

—

|

|

|

(For reference)

Results for fiscal 2018 ended March 31, 2019

|

|

|

34,266

|

|

|

|

3,504

|

|

|

|

3,507

|

|

|

|

2,022

|

|

|

|

64.65

|

|

|

|

|

|

|

|

|

|

(ii) Revision to Full-Year Non-Consolidated Earnings

Forecasts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Million yen)

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

|

Operating

profit

|

|

|

Ordinary

profit

|

|

|

Net profit

|

|

|

Earnings per

share

(Yen)

|

|

|

Previous forecasts (A)

|

|

|

28,100

|

|

|

|

960

|

|

|

|

960

|

|

|

|

160

|

|

|

|

5.11

|

|

|

Revised forecasts (B)

|

|

|

28,100

|

|

|

|

1,050

|

|

|

|

1,050

|

|

|

|

230

|

|

|

|

7.35

|

|

|

Increase/Decrease (B-A)

|

|

|

—

|

|

|

|

90

|

|

|

|

90

|

|

|

|

70

|

|

|

|

—

|

|

|

Change (%)

|

|

|

—

|

|

|

|

9.4

|

|

|

|

9.4

|

|

|

|

43.8

|

|

|

|

—

|

|

|

(For reference)

Results for fiscal 2018 ended March 31, 2019

|

|

|

33,134

|

|

|

|

3,516

|

|

|

|

3,536

|

|

|

|

2,044

|

|

|

|

65.34

|

|

2. Reasons for the Revisions to Earnings Forecasts

In terms of the consolidated operating results, net sales are expected to be 29,000 million yen, unchanged compared to the previous

forecasts.

With regard to profit and loss, operating profit and ordinary profit are both expected to be 1,000 million yen (up 25.0%

from the previous forecasts), and profit attributable to owners of parent is expected to be 200 million yen (up 100.0% from the previous forecasts), due to an improvement in the gross margin ratio resulting from increased production and

thorough cost reduction.

As for the non-consolidated operating results, net sales are expected to

be 28,100 million yen (unchanged compared to the previous forecasts), operating profit and ordinary profit are both expected to be 1,050 million yen (up 9.4% from the previous forecasts), and net profit is expected to be 230 million

yen (up 43.8% from the previous forecasts), due to the same reasons as those for the revision to the consolidated operating results.

|

Note:

|

The above forecasts are based on information that was available on the announcement date of this release.

Actual results may differ from the forecasts due to various risks and uncertainties.

|

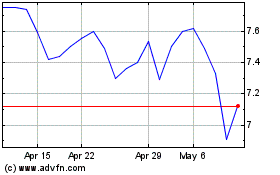

Nippon Steel (PK) (USOTC:NPSCY)

Historical Stock Chart

From Jun 2024 to Jul 2024

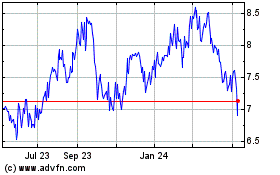

Nippon Steel (PK) (USOTC:NPSCY)

Historical Stock Chart

From Jul 2023 to Jul 2024