UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2015.

Commission File Number: 001-36898

FIRSTSERVICE CORPORATION

(Translation of registrant's name into English)

1140 Bay Street, Suite 4000

Toronto, Ontario, Canada

M5S 2B4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ x]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes [ ] No [ x ]

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

EXHIBIT INDEX

|

Exhibit

|

Description of Exhibit

|

|

|

|

|

99.1

|

Press release dated May 19, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

FIRSTSERVICE CORPORATION

(Registrant)

|

| Date: May 19, 2015 |

|

/s/ JOHN B. FRIEDRICHSEN

John B. Friedrichsen

Senior Vice President and Chief Financial Officer |

EXHIBIT 99.1

FirstService Announces Final Steps to Separate Into Two Public Companies

Tax Rulings Have Been Obtained, Application for Final Court Order Has Been Scheduled and Final Completion is Expected on June 1, 2015

Shares of Colliers International and New FirstService Corporation Will Commence Trading on June 2, 2015

TORONTO, May 19, 2015 (GLOBE NEWSWIRE) -- FirstService Corporation (TSX:FSV) (Nasdaq:FSRV) ("FirstService") today announced that the application seeking a final order approving the previously disclosed proposed spin-off transaction, to be implemented through a tax efficient statutory plan of arrangement (the "Arrangement"), has been scheduled to be heard at the Ontario Superior Court of Justice (Commercial List) at 330 University Avenue, Toronto, Ontario at or around 10:00 a.m. on May 28, 2015. FirstService also announced that it has received satisfactory advance income tax rulings from the Canada Revenue Agency.

If the final order is granted and all other conditions precedent to the Arrangement are satisfied or waived, FirstService expects that the Arrangement will be completed on June 1, 2015. Under the terms of the Arrangement, each holder of FirstService Subordinate Voting Shares will continue to hold one Subordinate Voting Share of Colliers International Group Inc. ("Colliers International") (which shares will continue to be represented by the existing FirstService Subordinate Voting Share certificates, until replaced against transfer) and will receive one Subordinate Voting Share of "new" FirstService Corporation ("New FirstService") for every FirstService Subordinate Voting Share held as of the close of business on May 29, 2015, the distribution record date (the "Record Date").

FirstService has been advised by the Toronto Stock Exchange ("TSX") that "if, as and when issued" trading will commence for New FirstService (symbol: NFS) and Colliers International ex-distribution (symbol: CIG) at the commencement of trading on May 27, 2015, and will continue through to the date that the New FirstService Subordinate Voting Shares are distributed (the "Distribution Date"), which will take place on June 1, 2015. Persons trading in the "if, as and when issued" market should be aware that the acquisition and beneficial ownership reporting rules under Canadian securities laws will apply to purchases of "if, as and when issued" shares of New FirstService and Colliers International. For purposes of calculating the applicable ownership thresholds of the early warning requirements, purchasers should use the number of New FirstService and Colliers International shares expected to be outstanding on completion of the Arrangement as described in the Circular. U.S. beneficial ownership reporting rules will also apply.

A "due bill" trading market is also expected to commence on May 27, 2015 on both the TSX and The NASDAQ Stock Market ("NASDAQ"), and will continue through to the Distribution Date, in which FirstService shareholders may sell their FirstService Subordinate Voting Shares with the right to receive New FirstService Subordinate Voting Shares in connection with the distribution in the "regular-way" market (that is, the normal trading market on the TSX or NASDAQ under the symbols FSV and FSRV, respectively).

If the Arrangement becomes effective on June 1, 2015, FirstService expects that the "due bill" trading market of Subordinate Voting Shares of FirstService with an entitlement to the Subordinate Voting Shares of New FirstService will cease trading on the TSX and NASDAQ at the close of trading on June 1, 2015, and the New FirstService Subordinate Voting Shares and Colliers International Subordinate Voting Shares will begin regular trading on the TSX and NASDAQ at the commencement of trading on June 2, 2015. The New FirstService Subordinate Voting Shares will trade under the symbol FSV on both the TSX and NASDAQ and the Colliers International Subordinate Voting Shares will trade under the symbol CIG on the TSX and the symbol CIGI on NASDAQ.

On the Distribution Date, certificates for the Subordinate Voting Shares of New FirstService will be sent to shareholders of record as at the close of business on the Record Date. Investors are encouraged to consult with their financial advisors regarding the specific implications of buying or selling shares of FirstService, Colliers International or New FirstService on or before the Distribution Date.

About FirstService

FirstService is a global leader in the rapidly growing real estate services sector, one of the largest markets in the world. FirstService manages more than 2.5 billion square feet of residential and commercial properties through its three industry-leading service platforms: Colliers International - one of the largest global players in commercial real estate services; FirstService Residential - North America's largest manager of residential communities; and FirstService Brands – one of North America's largest providers of essential property services delivered through individually branded franchise systems and company-owned operations.

FirstService generates more than US$2.7 billion in annual revenues and has more than 24,000 employees world-wide. With significant insider ownership and an experienced management team, FirstService has a long-term track record of creating value and superior returns for shareholders since becoming a publically listed company in 1993. The Subordinate Voting Shares of FirstService trade on NASDAQ under the symbol "FSRV" and on the TSX under the symbol "FSV". More information is available at www.firstservice.com.

Advisory Regarding Forward-Looking Information

Information in this press release that is not a historical fact is "forward-looking information". Words such as "plans", "intends", "outlook", "expects", "anticipates", "estimates", "believes", "likely", "should", "could", "will", "may" and similar expressions are intended to identify statements containing forward-looking information. Forward-looking information in this press release is based on current objectives, strategies, expectations and assumptions which management considers appropriate and reasonable at the time. The forward-looking information in this press release includes, but is not limited to, statements with respect to: the proposed Arrangement and expected future attributes of each of New FirstService and Colliers International following the completion of the Arrangement; the timing and expectations with respect to the granting of the final court order; the anticipated Record Date and Distribution Date for the New FirstService Subordinate Voting Shares; expected commencement dates of "due bill" trading and "if, as and when issued" trading for FirstService, New FirstService and Colliers International ex-distribution on the TSX and NASDAQ, as applicable; the expected completion date of the Arrangement; the expected dates when the Subordinate Voting Shares of FirstService with an entitlement to the Subordinate Voting Shares of New FirstService will cease trading on the TSX and on the NASDAQ; and the expected dates when New FirstService and Colliers International shares will begin trading for regular settlement on the TSX and NASDAQ.

By its nature, forward-looking information is subject to risks and uncertainties which may be beyond the ability of FirstService to control or predict. The actual results, performance or achievements of Colliers International or New FirstService could differ materially from those expressed or implied by forward-looking information. Factors that could cause actual results, performance, achievements or events to differ from current expectations include, among others, risks and uncertainties related to: obtaining approvals, waivers, rulings, court orders and consents, or satisfying other requirements, necessary or desirable to permit or facilitate completion of the Arrangement (including regulatory approvals and a Canadian tax ruling); future factors that may arise making it inadvisable to proceed with, or advisable to delay, all or part of the Arrangement; the operations and financial condition of Colliers International and New FirstService as separately traded public companies, including the reduced industry and geographical diversification resulting from this separation; the impact of the Arrangement on the trading prices for, and market for trading in, the shares of FirstService, Colliers International and New FirstService; the potential for significant tax liability for a violation of the tax-deferred spinoff rules; the potential benefits of the Arrangement; business cycles, including general economic conditions in the countries in which Colliers International and New FirstService operate, which will, among other things, impact demand for services and the cost of providing services; the ability of each of Colliers International and New FirstService to implement its business strategy, including their ability to acquire suitable acquisition candidates on acceptable terms and successfully integrate newly acquired businesses with its existing businesses; changes in or the failure to comply with government regulations; changes in foreign exchange rates; increased competition; credit of third parties; changes in interest rates; and the availability of financing. Additional information on certain of these factors and other risks and uncertainties that could cause actual results or events to differ from current expectations can be found in FirstService's Annual Information Form for the year ended December 31, 2014 under the heading "Risk Factors" (which factors are adopted herein and a copy of which can be obtained at www.sedar.com). Certain risks and uncertainties specific to the proposed Arrangement, Colliers International and New FirstService are further described in the Circular. Other factors, risks and uncertainties not presently known to FirstService or that FirstService currently believes are not material could also cause actual results or events to differ materially from those expressed or implied by statements containing forward-looking information.

Readers are cautioned not to place undue reliance on statements containing forward-looking information that are included in this press release, which are made as of the date of this press release, and not to use such information for anything other than their intended purpose. FirstService disclaims any obligation or intention to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law.

CONTACT: COMPANY CONTACTS:

Jay S. Hennick

Founder & CEO

(416) 960-9500

John B. Friedrichsen

Senior Vice President & CFO

(416) 960-9500

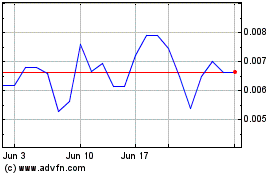

Nexus Energy Services (PK) (USOTC:IBGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

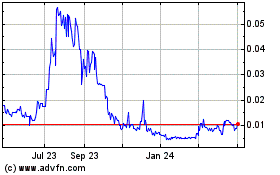

Nexus Energy Services (PK) (USOTC:IBGR)

Historical Stock Chart

From Dec 2023 to Dec 2024