National Australia Bank Plans A$2.5 Billion On-Market Share Buyback

July 29 2021 - 7:30PM

Dow Jones News

By Alice Uribe

SYDNEY--National Australia Bank Ltd. plans a 2.5 billion

Australian-dollar (US$1.85 billion) on-market share buyback and to

purchase shares on-market alongside its dividend reinvestment

plan.

The lender on Friday said the buyback will start in mid-to-late

August and would help move its Common Equity Tier 1 capital ratio

towards its target range of 10.75-11.25%.

"Our target CET1 range reflects a balance between retaining a

strong balance sheet through the cycle, supporting growth and

recognizing the importance of capital discipline to improve

shareholder returns," NAB Chief Executive Ross McEwan said.

"We consider the on-market buyback to be the most appropriate

mechanism to achieve our previously stated bias towards reducing

share count."

NAB had a reported CET1 capital ratio of 12.37% at Level 2 and

12.40% at Level 1 at the end of March. The buyback will reduce the

CET1 capital ratio at Level 2 by around 60 basis points, the lender

said.

The timing and number of shares purchased under the buyback will

depend on market conditions, the prevailing share price and other

considerations, NAB said.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

July 29, 2021 19:15 ET (23:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

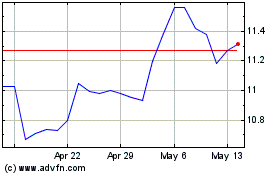

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Nov 2024 to Dec 2024

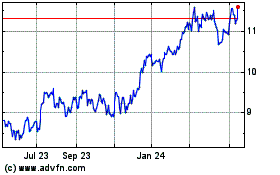

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Dec 2023 to Dec 2024