NAB Quarterly Profit Benefits From Flat Costs, Revenue Growth -- Update

August 13 2019 - 7:42PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--National Australia Bank Ltd. (NAB.AU)

managed modest earnings growth in the recent quarter as it kept

costs in check and revenue rose slightly despite subdued

home-lending growth in the country.

The bank also saw said its closely watched net interest margin

improve, though it flagged the prospect of additional provisions

for customer compensation costs.

NAB, the country's fourth-largest bank by market value and the

biggest business lender, recorded an unaudited net profit of 1.70

billion Australian dollars (US$1.16 billion) for the three months

through June. No comparable figure was disclosed, but it compares

with a profit of A$1.65 billion reported by the bank a year

ago.

Cash earnings, a measure adjusted for fair value and hedging

movements and is the basis for calculating dividend payouts, was

A$1.65 billion, which NAB said was 1% higher that the quarterly

average of the first half of the financial year and against a year

earlier.

Third-quarter revenue was also up 1% on the average of the first

half, and the bank said expenses for the quarter were flat.

It has been a tumultuous year for the bank after it was singled

out for criticism by a government-ordered probe into misconduct in

the financial industry, leading to the sudden departure of its

chief executive and resignation of its chairman. In May, NAB cut

its dividend for the first time in a decade to shore up its balance

sheet as customer compensation costs continue to climb.

NAB said its third-quarter net interest margin, a measure of the

difference between interest income generated and the amount of

interest paid, widened on the first-half quarterly average due

mainly to lower short-term wholesale funding costs.

However, credit impairment charges increased by 10% to A$247

million. And while NAB said its overall credit quality remained

broadly sound, there was a rise in the ratio of impaired assets and

loans overdue by 90 days or more against gross loans and

acceptances to 0.85% from 0.79%.

The bank said potential remained for additional costs from

customer remediation programs and regulatory compliance

investigations, with additional provisions expected to be booked

for the second half of the financial year, including service fees

for self-employed advisers.

For the first half of the year, when net profit rose 4.3%

year-over-year to A$2.69 billion, the bank booked a further A$525

million in customer-related remediation costs

Last month, the bank hired New Zealand-born Ross McEwan, the

outgoing boss of Royal Bank of Scotland PLC (RBS.LN), as its next

chief executive. In May, it appointed director and interim CEO

Philip Chronican as successor to Chairman Ken Henry.

Former high court judge Kenneth Hayne, who led a yearlong

investigation into the financial industry, was highly critical of

former CEO Andrew Thorburn and Mr. Henry in a three-volume final

report released in February that highlighted widespread charging of

fees-for-no-service and other misconduct in the industry. NAB

stands apart from the country's other three major banks, Mr. Hayne

wrote, adding he wasn't confident lessons had been learned from

past misconduct or that the bank was willing to accept

responsibility.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 13, 2019 19:27 ET (23:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

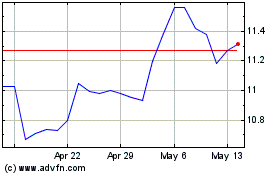

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Dec 2024 to Jan 2025

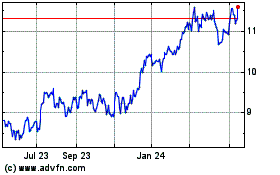

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Jan 2024 to Jan 2025