0001440799false--04-30FY202200.0012000000003251641212046820.001100000001500100010001000NevadaTexasTexasTexasTexasLouisianaTexas027283414046900002250012500228621610733937416921588355140000500007850011000090000800008200096993000.10.18The note into shares of common stock (i) during the first 180 days, at a price of $3.00 per share of common stock and (ii) thereafter at a 40% discount from the lowest trading price during the 20 days prior to conversion.GS, at its option, may convert the unpaid principal balance of, and accrued interest on, the note into shares of common stock at a 40% discount from the lowest trading price during the 20 days prior to conversion (with a floor of $3.00 per share during the first six months after issuance.)the note into shares of common stock at a price of $0.015 per share and thereafter at 34% discount from the average of the two lowest trading prices during the 15 prior trading days including the day of conversion. The Company could redeem the note at redemption prices ranging from 110% to 118% during the first 180 days after issuance2020-11-202020-11-302020-02-04450035001301004227741402359020P10M28D00000P0YP0YP0YP10Y0.5010.0500014407992021-05-012022-04-300001440799us-gaap:SubsequentEventMembermmex:SeriesDWarrantsMember2022-06-070001440799us-gaap:SubsequentEventMembermmex:SeriesCWarrantsMember2022-06-070001440799mmex:JackHanksMember2022-04-300001440799us-gaap:SubsequentEventMember2022-06-012022-06-070001440799us-gaap:SubsequentEventMember2022-06-070001440799mmex:SeriesAWarrantsMember2022-04-300001440799mmex:SeriesAWarrantsMember2021-05-012022-04-300001440799us-gaap:SeriesAPreferredStockMember2021-05-012022-04-300001440799mmex:AugustSixteenTwoThousandTwentOneMember2021-05-012022-04-300001440799mmex:AugustSixteenTwoThousandTwentOneMember2022-04-300001440799us-gaap:AccruedLiabilitiesMembermmex:StockIssuancesMember2020-05-012021-04-300001440799us-gaap:AccruedLiabilitiesMembermmex:StockIssuancesMember2021-05-012022-04-300001440799us-gaap:SeriesBPreferredStockMember2021-05-012022-04-300001440799mmex:GSPledgeAgreementMember2018-10-012018-10-050001440799mmex:GSPledgeAgreementMember2018-10-050001440799us-gaap:OptionMember2022-04-300001440799us-gaap:OptionMember2021-05-012022-04-300001440799us-gaap:OptionMember2020-05-012021-04-300001440799us-gaap:OptionMember2020-04-300001440799us-gaap:OptionMember2021-04-300001440799mmex:WarrantsMember2022-04-300001440799mmex:WarrantsMember2021-05-012022-04-300001440799mmex:WarrantsMember2020-05-012021-04-300001440799mmex:WarrantsMember2021-04-300001440799mmex:WarrantsMember2020-04-300001440799mmex:MaximumsMember2021-05-012022-04-300001440799mmex:MinimumsMember2021-05-012022-04-300001440799mmex:OptionsAndWarrantsMember2020-05-012021-04-300001440799mmex:OptionsAndWarrantsMember2021-05-012022-04-300001440799us-gaap:ConvertibleNotesPayableMember2020-05-012021-04-300001440799us-gaap:ConvertibleNotesPayableMember2021-05-012022-04-300001440799mmex:ExpressBridgeLoanPilotProgramMember2020-07-012020-07-140001440799mmex:PaycheckProtectionProgramMember2021-05-012022-04-300001440799mmex:PaycheckProtectionProgramMember2021-01-012021-01-250001440799us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2011-03-012011-03-230001440799us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2011-01-280001440799us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2021-01-282021-02-020001440799mmex:GSCapitalMember2021-05-012022-04-300001440799mmex:FifthamendmentMember2020-12-310001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2019-02-012019-02-200001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2018-09-012018-09-180001440799mmex:JuneTwentyTwoTwoThousandTwentyOneMemberus-gaap:ConvertibleNotesPayableMember2021-02-012021-03-260001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2020-12-012020-12-310001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2020-12-012020-12-150001440799mmex:JuneTwentyTwoTwoThousandTwentyOneMemberus-gaap:ConvertibleNotesPayableMember2021-05-012022-04-300001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2022-04-012022-04-120001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2018-09-012018-09-130001440799mmex:JSJInvestmentsIncMembermmex:March82021Member2021-05-012022-04-300001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2020-02-012020-02-040001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2021-01-282021-02-020001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2020-03-012020-03-310001440799mmex:OscarAndIldaGonzalesMembermmex:Februar282022Member2021-05-012022-04-300001440799mmex:VistaCapitalInvestmentsIncMembermmex:March112021Member2021-05-012022-04-300001440799mmex:GSCapitalMember2022-04-300001440799mmex:FourthamendmentMember2020-12-012020-12-3100014407992020-05-012021-01-3100014407992020-11-012021-01-3100014407992021-11-012022-01-310001440799mmex:DecemberTwentySevenTwoThousandNineteenOneMember2021-05-012022-04-300001440799mmex:JuneTwentyTwoTwoThousandTwentyOneMemberus-gaap:ConvertibleNotesPayableMember2022-04-300001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2021-03-260001440799mmex:FourthamendmentMember2022-04-300001440799mmex:FourthamendmentMember2020-12-150001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2020-02-040001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2020-03-310001440799mmex:JanuauryTwoTwoThousandNineteenMember2022-04-300001440799mmex:DecemberTwentySevenTwoThousandNineteenMember2022-04-300001440799mmex:AuctusFundLLCMember2020-04-300001440799mmex:AuctusFundLLCMember2019-04-300001440799mmex:AuctusFundLLCMember2022-04-300001440799mmex:AuctusFundLLCMember2019-01-310001440799mmex:SabbyVolatilityWarrantMasterFundMembermmex:March032022Member2022-04-300001440799mmex:OscarAndIldaGonzalesMembermmex:Februar282022Member2022-04-300001440799mmex:VistaCapitalInvestmentsIncMembermmex:March112021Member2022-04-300001440799mmex:JSJInvestmentsIncMembermmex:March82021Member2022-04-300001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2021-02-220001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2019-02-200001440799mmex:FifthamendmentMember2018-09-180001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2018-09-180001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2018-09-130001440799mmex:FourthamendmentMember2018-10-050001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2022-04-120001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2019-04-300001440799mmex:FourthamendmentMember2018-09-130001440799mmex:FourthamendmentMember2018-09-180001440799mmex:SeptemberNineTwoThousandTwentyMember2021-09-300001440799mmex:SeptemberNineTwoThousandTwentyMember2022-04-300001440799mmex:MatFouteenTwoThousandTwentyMember2022-04-300001440799mmex:GSCapitalPartnersLLCMembermmex:ConvertibleNoteMember2021-02-012021-03-260001440799mmex:FourthamendmentMember2020-12-012020-12-150001440799mmex:AuctusFundLLCMember2019-01-012019-01-310001440799us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2010-03-012010-03-080001440799mmex:FourthamendmentMember2019-02-012019-02-2000014407992022-04-012022-04-1200014407992020-05-012020-10-310001440799mmex:SeptemberNineTwoThousandTwentyMember2021-09-012021-09-3000014407992021-06-012021-06-300001440799mmex:MatFouteenTwoThousandTwentyMember2020-05-012021-04-300001440799mmex:DecemberTwentySevenTwoThousandNineteenMember2020-05-012021-04-300001440799mmex:SeptemberNineTwoThousandTwentyMember2021-05-012022-04-300001440799mmex:DecemberTwentySevenTwoThousandNineteenOneMember2020-05-012021-04-300001440799mmex:InvestorFourMemberus-gaap:ConvertibleNotesPayableMember2021-04-300001440799mmex:InvestorFiveMemberus-gaap:ConvertibleNotesPayableMember2021-04-300001440799mmex:InvestorFiveMemberus-gaap:ConvertibleNotesPayableMember2022-04-300001440799mmex:InvestorFourMemberus-gaap:ConvertibleNotesPayableMember2022-04-300001440799mmex:InvestorTwoMemberus-gaap:ConvertibleNotesPayableMember2021-04-300001440799mmex:InvestorThreeMemberus-gaap:ConvertibleNotesPayableMember2022-04-300001440799mmex:InvestorThreeMemberus-gaap:ConvertibleNotesPayableMember2021-04-300001440799mmex:InvestorTwoMemberus-gaap:ConvertibleNotesPayableMember2022-04-300001440799mmex:InvestorOneMemberus-gaap:ConvertibleNotesPayableMember2021-04-300001440799mmex:InvestorOneMemberus-gaap:ConvertibleNotesPayableMember2022-04-300001440799us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2021-04-300001440799us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2022-04-300001440799mmex:NotesPayableSevenMember2021-04-300001440799mmex:NotesPayableSevenMember2022-04-300001440799mmex:NotesPayableThreeMember2021-04-300001440799mmex:NotesPayableSixMember2021-04-300001440799mmex:NotesPayableFiveMember2021-04-300001440799mmex:NotesPayableFourMember2021-04-300001440799mmex:NotesPayableSixMember2022-04-300001440799mmex:NotesPayableFiveMember2022-04-300001440799mmex:NotesPayableFourMember2022-04-300001440799mmex:NotesPayableThreeMember2022-04-300001440799mmex:NotesPayableTwoMember2021-04-300001440799mmex:NotesPayableTwoMember2022-04-300001440799mmex:NotesPayableOneMember2021-04-300001440799mmex:NotesPayableOneMember2022-04-300001440799mmex:NotePayableMember2021-04-300001440799mmex:NotePayableMember2022-04-300001440799mmex:LeaseObligationMember2021-04-300001440799mmex:LeaseObligationMember2022-04-300001440799mmex:AccruedInterestMember2021-04-300001440799mmex:AccruedInterestMember2022-04-300001440799mmex:AccruedConsultingMember2021-04-300001440799mmex:AccruedConsultingMember2022-04-300001440799mmex:AccruedPayrollMember2021-04-300001440799mmex:AccruedPayrollMember2022-04-300001440799mmex:TotalMember2021-04-300001440799mmex:TotalMember2022-04-300001440799mmex:PROPERTYANDEQUIPMENTMember2021-05-012022-04-300001440799mmex:PROPERTYANDEQUIPMENTMember2020-05-012021-04-300001440799mmex:LandEasementsMember2021-04-300001440799mmex:LandEasementsMember2022-04-300001440799us-gaap:LandImprovementsMember2021-04-300001440799us-gaap:LandImprovementsMember2022-04-300001440799mmex:LandsMember2021-04-300001440799mmex:LandsMember2022-04-300001440799us-gaap:FurnitureAndFixturesMember2021-04-300001440799us-gaap:FurnitureAndFixturesMember2022-04-300001440799mmex:ComputerEquipmentAndSoftwareMember2021-04-300001440799mmex:ComputerEquipmentAndSoftwareMember2022-04-300001440799mmex:ConvertibleNoteTwoMember2021-10-310001440799mmex:ConvertibleNotesOneMember2020-05-012021-04-300001440799mmex:ConvertibleNoteMember2020-05-012021-04-300001440799mmex:ConvertibleNoteFiveMember2021-04-300001440799mmex:ConvertibleNoteFourMember2021-04-300001440799mmex:ConvertibleNoteThreeMember2021-04-300001440799mmex:ConvertibleNoteTwoMember2021-04-300001440799mmex:ConvertibleNotesOneMember2021-04-300001440799mmex:ConvertibleNoteMember2021-04-300001440799mmex:ConvertibleNoteFiveMember2021-05-012022-04-300001440799mmex:ConvertibleNoteFourMember2021-05-012022-04-300001440799mmex:ConvertibleNoteThreeMember2021-05-012022-04-300001440799mmex:ConvertibleNoteTwoMember2021-05-012022-04-300001440799mmex:ConvertibleNotesOneMember2021-05-012022-04-300001440799mmex:ConvertibleNoteMember2021-05-012022-04-3000014407992021-06-300001440799mmex:ConvertibleNoteTwoMember2022-04-300001440799mmex:ConvertibleNotesOneMember2022-04-300001440799mmex:ConvertibleNoteFiveMember2022-04-300001440799mmex:ConvertibleNoteFourMember2022-04-300001440799mmex:ConvertibleNoteThreeMember2022-04-300001440799mmex:ConvertibleNotesOneMember2021-10-310001440799mmex:ConvertibleNoteMember2021-10-310001440799mmex:ConvertibleNoteMember2022-04-300001440799mmex:MapleResourcesCorporationMember2021-05-012022-04-300001440799mmex:MapleResourcesCorporationMember2021-02-172021-03-010001440799mmex:FebruaryOneTwoThousandTwentOneMember2021-05-012022-04-300001440799mmex:MapleResourcesCorporationMembermmex:ConsultantsMember2020-05-012021-01-310001440799mmex:MapleResourcesCorporationMembermmex:ConsultantsMember2021-05-012022-04-300001440799mmex:MapleResourcesCorporationMembermmex:PresidentAndCeoMember2021-05-012022-04-300001440799mmex:MapleResourcesCorporationMembermmex:CommonStocksMember2021-05-012022-04-300001440799mmex:OctoberOneTwoThousandEighteenMembermmex:RelatedPartyMembermmex:CommonStocksMember2021-05-012022-04-300001440799mmex:MapleResourcesCorporationMembermmex:PresidentAndCeoMember2022-04-300001440799mmex:SeptemberOneTwoThousandEighteenMembermmex:RelatedPartyMembermmex:CommonStocksMember2021-05-012022-04-300001440799mmex:SeptemberOneTwoThousandEighteenMembermmex:RelatedPartyMembermmex:CommonStocksMember2021-10-310001440799mmex:OctoberOneTwoThousandEighteenMembermmex:RelatedPartyMembermmex:CommonStocksMember2021-04-300001440799mmex:OctoberOneTwoThousandEighteenMembermmex:RelatedPartyMembermmex:CommonStocksMember2022-04-300001440799mmex:MapleResourcesCorporationMembermmex:FormerOfficerMember2021-04-300001440799mmex:MapleResourcesCorporationMembermmex:FormerOfficerMember2022-04-300001440799mmex:SeptemberOneTwoThousandEighteenMembermmex:RelatedPartyMembermmex:CommonStocksMember2022-04-300001440799mmex:FebruaryOneTwoThousandTwentOneMember2021-04-300001440799mmex:FebruaryOneTwoThousandTwentOneMember2022-04-300001440799mmex:MapleResourcesCorporationFourMember2021-04-300001440799mmex:MapleResourcesCorporationFourMember2022-04-300001440799mmex:MapleResourcesCorporationThreeMember2021-04-300001440799mmex:MapleResourcesCorporationThreeMember2022-04-300001440799mmex:MapleResourcesCorporationTwoMember2021-04-300001440799mmex:MapleResourcesCorporationTwoMember2022-04-300001440799mmex:MapleResourcesCorporationOneMember2021-04-300001440799mmex:MapleResourcesCorporationOneMember2022-04-300001440799mmex:BNLFamilyTrustBNLMember2021-04-300001440799mmex:BNLFamilyTrustBNLMember2022-04-300001440799mmex:MapleResourcesCorporationMember2021-04-300001440799mmex:MapleResourcesCorporationMember2022-04-300001440799us-gaap:FairValueInputsLevel3Member2021-04-300001440799us-gaap:FairValueInputsLevel2Member2021-04-300001440799us-gaap:FairValueInputsLevel1Member2021-04-300001440799us-gaap:FairValueInputsLevel3Member2022-04-300001440799us-gaap:FairValueInputsLevel2Member2022-04-300001440799us-gaap:FairValueInputsLevel1Member2022-04-300001440799us-gaap:FurnitureAndFixturesMember2021-05-012022-04-300001440799mmex:LandEasementsMember2021-05-012022-04-300001440799us-gaap:LandImprovementsMember2021-05-012022-04-300001440799mmex:ComputerEquipmentAndSoftwareMember2021-05-012022-04-300001440799mmex:HydrogenGlobalLLCMember2022-04-300001440799mmex:RollingStockMarineLlcMember2022-04-300001440799mmex:LouisianaGulfRefiningAndTradingLlcMember2022-04-300001440799mmex:HydrogenUltraLLCMember2022-04-300001440799mmex:MmexSolarResourcesLlcMember2022-04-300001440799mmex:PecosRefiningTransportLLCMember2022-04-300001440799mmex:MmexResourcesCorporationMember2022-04-300001440799mmex:RollingStockMarineLlcMember2021-05-012022-04-300001440799mmex:LouisianaGulfRefiningAndTradingLlcMember2021-05-012022-04-300001440799mmex:HydrogenUltraLLCMember2021-05-012022-04-300001440799mmex:MmexSolarResourcesLlcMember2021-05-012022-04-300001440799mmex:HydrogenGlobalLLCMember2021-05-012022-04-300001440799mmex:PecosRefiningTransportLLCMember2021-05-012022-04-300001440799mmex:MmexResourcesCorporationMember2021-05-012022-04-300001440799us-gaap:NoncontrollingInterestMember2022-04-300001440799us-gaap:RetainedEarningsMember2022-04-300001440799us-gaap:AdditionalPaidInCapitalMember2022-04-300001440799mmex:SeriesBPreferredStocksMember2022-04-300001440799us-gaap:PreferredStockMember2022-04-300001440799us-gaap:CommonStockMember2022-04-300001440799us-gaap:NoncontrollingInterestMember2021-05-012022-04-300001440799us-gaap:RetainedEarningsMember2021-05-012022-04-300001440799us-gaap:AdditionalPaidInCapitalMember2021-05-012022-04-300001440799mmex:SeriesBPreferredStocksMember2021-05-012022-04-300001440799us-gaap:PreferredStockMember2021-05-012022-04-300001440799us-gaap:CommonStockMember2021-05-012022-04-300001440799us-gaap:NoncontrollingInterestMember2021-04-300001440799us-gaap:RetainedEarningsMember2021-04-300001440799us-gaap:AdditionalPaidInCapitalMember2021-04-300001440799mmex:SeriesBPreferredStocksMember2021-04-300001440799us-gaap:PreferredStockMember2021-04-300001440799us-gaap:CommonStockMember2021-04-300001440799us-gaap:RetainedEarningsMember2020-05-012021-04-300001440799us-gaap:AdditionalPaidInCapitalMember2020-05-012021-04-300001440799mmex:SeriesBPreferredStocksMember2020-05-012021-04-300001440799us-gaap:PreferredStockMember2020-05-012021-04-300001440799us-gaap:CommonStockMember2020-05-012021-04-3000014407992020-04-300001440799us-gaap:NoncontrollingInterestMember2020-04-300001440799us-gaap:RetainedEarningsMember2020-04-300001440799us-gaap:AdditionalPaidInCapitalMember2020-04-300001440799mmex:SeriesBPreferredStocksMember2020-04-300001440799us-gaap:PreferredStockMember2020-04-300001440799us-gaap:CommonStockMember2020-04-3000014407992020-05-012021-04-300001440799us-gaap:ConvertiblePreferredStockMember2021-04-300001440799us-gaap:ConvertiblePreferredStockMember2022-04-300001440799us-gaap:SeriesBPreferredStockMember2021-04-300001440799us-gaap:SeriesBPreferredStockMember2022-04-300001440799us-gaap:SeriesAPreferredStockMember2021-04-300001440799us-gaap:SeriesAPreferredStockMember2022-04-3000014407992021-04-3000014407992022-04-3000014407992022-07-1300014407992021-10-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2022

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________.

Commission file number 333-152608

MMEX RESOURCES Corporation |

(Exact name of registrant as specified in charter) |

Nevada | | 26-1749145 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | |

3600 Dickinson Fort Stockton, Texas 78735 | | (855) 880-0400 |

(Address of principal executive offices, including zip code) | | (Issuer’s telephone number, including area code) |

Securities registered under Section 12(g) of the Exchange Act: Class A Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the issuer is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at October 31, 2021 (the second quarter end date) was approximately $8,276,000.

As of July 13, 2022, there were 23,312,484 shares of the issuer’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

MMEX RESOURCES CORPORATION

TABLE OF CONTENTS TO ANNUAL REPORT ON FORM 10-K

YEAR ENDED APRIL 30, 2022

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report contains certain forward-looking statements. When used in this Annual Report or in any other presentation, statements which are not historical in nature, including the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” “may,” “project,” “plan” or “continue,” and similar expressions are intended to identify forward-looking statements. They also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this Annual Report are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to them. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. These forward-looking statements are based on our current plans and expectations and are subject to a number of uncertainties and risks that could significantly affect current plans and expectations and our future financial condition and results.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Annual Report might not occur. We qualify any and all of our forward-looking statements entirely by these cautionary factors. As a consequence, current plans, anticipated actions and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein.

Item 1: Business

Corporate Information

MMEX was formed as a Nevada corporation in 2005. The current management team led an acquisition of the Company (then named Management Energy, Inc.) through a reverse merger completed in 2010 and changed the Company’s name to MMEX Mining Corporation in 2011 and then to MMEX Resources Corporation in 2016. Our mailing address is 3616 Far West Blvd #117-321, Austin, Texas 78731. Our physical office address is 3600 Dickinson, Fort Stockton, Texas 79735. The Company has adopted a fiscal year end of April 30.

Company Overview

MMEX is focused on the development, financing, construction and operation of clean fuels infrastructure projects powered by renewable energy. We have formed two operating sub-divisions of the Company - one sub-division to transition from legacy refining transportation fuels by producing them as ultra clean fuels with carbon capture or as stand-alone renewable or clean fuels projects, and the second sub-division which plans to produce green and/or blue hydrogen with the option of hydrogen conversion to ammonia or methanol. These two sub-divisions will be operating respectively as Clean Energy Global, LLC and Hydrogen Global, LLC. The planned projects are designed to be powered by solar and wind renewable energy.

Our portfolio contains the following pipeline of planned projects:

Clean Energy Global, LLC

Project 1: Pecos Clean Fuels & Transport, LLC -Ultra Clean Fuels Refining-Pecos County, Texas

We have teamed with Polaris Engineering to develop an ultra-clean transportation fuel, up to 11,600 barrel per day feedrate crude oil refining facility at our Pecos County, Texas site to produce 87° gasoline, ultra-low sulphur diesel and low-sulphur fuel oil, utilizing the Polaris Ultra FuelsTM patented concept, which removes over 95% emissions of a standard refinery. Added to this patented process, the Company plans to incorporate carbon capture with the CO2 marketed to enhanced oil recovery projects in the area. We have signed the term sheet for the CO2 purchase with a super major international oil company and agreed to a proposal with the world’s largest U.S. utility for solar development. The Ultra FuelsTM concept, with capex and technical details completed in the Front-End Load-2 (“FEL-2”) study, features small size facilities to take advantage of proximity to smaller markets and/or locate directly near crude oil production areas near the Company’s owned 126-acre site. Because equipment is fabricated in modular units and shipped to site, this allows for an 18 month project completion time and more rapid implementation than traditional facilities. The smaller size and footprint, as well as lower emissions, also allows for faster permitting which we obtained for this facility from the Texas Commission on Environmental Quality on February 18, 2022.

Project 2: Tierra del Fuego Province Argentina Gas Turbine Power Project.

The Company has proposed with the Provincial Government of Tierra del Fuego (“Tierra del Fuego”) to supply two natural gas turbine packages with a rating of 12.9 MWe each with generator packages. The Company has a commercial and technical proposal with Siemens Energy, the manufacturer of these turbine and generators (the “Turbine Gen Sets”) for delivery to Tierra del Fuego. These turbine packages are designed to provide additional power in locations of Tierra del Fuego that have potential power shortages. The proposed financing of the project is to be supplied by Tierra del Fuego with a completion date of nine months from the notice to proceed. The Company will provide technical expertise along with that of Siemens Energy and Tierra del Fuego for instillation and conditioning of the Turbine Gen Sets designed with capability to switch over to 100% hydrogen fuel, as it potentially becomes available from the Company’s Green Hydrogen Project in Tierra del Fuego.

Project 3: Arroyo Cabral, Cordoba Province Argentina Solar Power Project.

The Company along with its international partners have entered a proposal with EPEC, the local utility in Cordoba Province to build potentially the Arroyo Cabral 48 MWe solar park for local power demand following the Company’s completion of a confidential information memorandum and pre-feasibility study for the project completed in June 2021. The local utility, EPEC, has proposed a Build Own Transfer structure with EPEC contributing 15% of the project costs as an equity contribution. The financing of the project potentially is to be provided by the Company’s international partners and other third parties.

Hydrogen Global, LLC

Project 4: Hydrogen Global- Pecos County, Texas- Green Hydrogen Project

This planned project to utilize the proprietary electrolyzer technology of Siemens Energy, a major international technology provider to the Company, plans to convert water to hydrogen through electrolysis. The facility will utilize solar power, with the Company’s water supply to produce up to 55 tons of hydrogen production per day. The Company and Siemens have completed the Front-End Engineering and Design (“FEED”) study in April 2022, which outlines the capex of the electrolyzer complex on the Company’s 321-acre site. The Company is in discussions with the same renewable power utility for the Ultra Fuels project to become the technology provider for 160 MWe solar power component. In addition, the Company is in discussions with two potential product off-takes (i) international partners to provide turn-key mobility markets to include hydrogen fueling stations and buses utilizing hydrogen fuel cells. The potential markets would be the major metropolitan areas in Texas to include Austin, Dallas, Houston, and San Antonio; (ii) with a technology provider for the Ammonia complex, for conversion of the hydrogen to ammonia to facilitate transportation of the finished product for marketing in the U.S. domestic ammonia market; and (ii) with international partners to provide turn-key hydrogen fueling stations and buses utilizing hydrogen fuel cells . The potential market would be the major metropolitan areas in Texas.

Project 5: Hydrogen Global- Tierra del Fuego Province Argentina-Green Hydrogen Project

On April 28, 2022, the Province of Tierra del Fuego and the Company announced the potential joint development of a green hydrogen project in the Río Grande, Tierra del Fuego area powered by wind energy. The Company has signed an amendment with Siemens Energy to adapt the Green H2 electroylzer FEED Study completed for Pecos County to this Project. In addition, the Company has a preliminary understanding with Siemens Gamesa as the technology provider for the wind energy. The Company estimates the land requirement of up to 10,000 hectares for the wind farm and the Green H2 facilities. The Company is in discussions with the same technology provider for the Ammonia complex as for Pecos County. The potential market for the Ammonia is Europe or Asia and the project location is ideal for ocean borne shipping east or west.

Project 6: Hydrogen Global- Tangier Morocco- Green Hydrogen Project

The Company has identified sea-based land assets in Tangier Morocco and is in negotiations for the supply of 160MWe of certified renewable power with local utility. The Company has international partners with local prescence in Morocco. Tangier has developed what is now the largest trading hub in Africa with ten major ports (https://www.marineinsight.com/know-more/10-major-ports-in-morocco/) including multi-modal deep seaports, multiple free-zones areas with substantial tax and trade incentives and it is located 15km from Europe ports (Spain and Gibraltar). Tangier and the neighboring coastal area benefit from some of the best wind conditions in the world, which can also be associated with solar power generation. The Kingdom of Morocco is strongly pushing the use of renewable energy and has recently issued a Green Hydrogen regulatory framework. The principal off-take markets are the shipping and terminal companies present in the Tangier Port Med including APM Terminals (https://www.apmterminals.com/en/medport-tangier/about/our-terminal), and CGM-CMA (https://www.cma-cgm.com).

Project 7: Hydrogen Global- Southern Coast of Peru-Green Hydrogen Project

The Company has entered advanced discussions with Peru’s principal electric power distribution company to develop potentially a Green Hydrogen project to produce up to 55 tons per day of hydrogen, requiring 160 MWe of constant and certified renewable power load. The Company plans to use its Siemens Energy Electrolyzer FEED template and adapt it for Peru. The Peru distribution company will also provide the land area as part of the transaction – approximately 5 hectares, by the sea to facilitate exports of green Hydrogen/Ammonia/Methanol to Asia and the U.S. West Coast. Peru’s mining industry with its use of heavy extraction and transportation equipment has significant market potential for the Company's hydrogen production.

Project 8: Hydrogen Global- Pecos County, Texas-Blue Hydrogen Project

The Company is in planning discussions with a super major oil company (the “Super Major”) to develop jointly a Blue Hydrogen project at the Company’s Pecos County, Texas site. The Project plans to utilize potentially a portion of the Super Major’s 2 billion cubic feet per day natural gas production and transportation from the area to produce hydrogen utilizing an autothermal reformer (“ATR”) technology along with carbon capture. In turn, the hydrogen will be used in Siemens Energy turbines and generator sets to produce 265 MWe of electric power which are projected to utilize initially a 75% hydrogen-25% natural gas feed and moving to a 100% hydrogen feed, with the electric power to be marketed by the power commodity trading desk of the Super Major. Solar and wind power will be utilized in the ATR and under discussions with the renewable utility developing the Company’s other solar projects in the area.

Completion of these projects is dependent upon our obtaining the necessary capital for planning, construction and start-up costs. There is no assurance that such financing can be obtained on favorable terms.

Energy Transition

We believe that the world’s energy consumers will need and demand legacy petroleum derived fuels such as ultra-low sulfur diesel and gasoline for an interim period that may last for the next 15 years as the electric transportation sectors and hydrogen markets evolve. Our mission is to help meet this demand by producing these transitional fuels in the most environmentally compatible way with rapidly permitted, greenfield modular smaller footprint refineries that reduce emission by over 95% and which employ carbon capture and to be powered by renewable energy.1 That has led the Company to join with Polaris Energy to employ its Ultra FuelsTM Refinery patented process. To this the patented configuration, the Company has added carbon capture and for the entire project to be powered with solar energy.

____________________________________

1 We note the following comment regarding new legacy large scale refinery capacity: “Oil companies will almost certainly never build another new refinery in the U.S., said Robert Yawger, an analyst at Mizuho. The last new U.S. refinery was built in the 1970s, and the industry now considers them too expensive, and burdensome to invest in due to strict environmental rules. Some are expanding capacity at existing facilities, but that process can’t easily be sped up, Mr. Yawger said.” Andrew Restuccia and Collin Eaton, “Biden Pushes Fuel Makers to Boost Capacity, Criticizes Profits”, https://www.wsj.com/articles/biden-pushes-oil-companies-to-boost-capacity-criticizes-profits-11655297130?st=m4x22q74oti1m5f&reflink=article_email_share, Wall Steet Journal, June 15, 2022.

This business plan underscores our decision to form two sub-divisions of the Company that will be operating respectively as Clean Energy Global, LLC and Hydrogen Global, LLC. The planned clean fuels and hydrogen projects are designed to be powered by solar and wind renewable energy. Our business plan of producing potential transitional clean fuels and hydrogen establishes our footprint in the current clean fuels demand and for the future clean fuels demand and most importantly, we can develop these concepts on a global basis.

Evolution of The New Hydrogen Economy

Last year in our 10K Item 1 Business, we outlined “The New Hydrogen Economy” and why we think the Company should make hydrogen the cornerstone of our future. Since passage of one year, the global hydrogen outlook has increased and evolved, and so has that of the Company. As noted, we are increasing our hydrogen footprint on a global scale with projects being developed in Texas, Argentina, Peru and Morocco.

Why hydrogen?

“After years of dabbling, major oil companies are finally planning the kind of large-scale investments that would make green hydrogen a serious business” reports Bloomberg.2 “They’re chasing a very particular vision of a low-carbon future — multibillion dollar developments that generate vast concentrations of renewable electricity and convert it into chemicals or clean fuels that can be shipped around the world to power trucks, ships or even airplanes.”3

“Hydrogen is a versatile and clean-burning fuel many believe could be the key to addressing some of the obstacles the global economy is facing in its race to decarbonize. Green hydrogen is an emission-free fuel produced using renewable energy that powers an electrolyzer to turn water into hydrogen and oxygen. Meanwhile, blue hydrogen is made from natural gas and can be emissions-free with carbon capture technology. Many believe that hydrogen could replace natural gas as a fuel for power plants and other industrial processes. The energy industry could utilize a significant portion of its existing infrastructure to transport and store hydrogen, which would flow into existing power plants to produce emissions-free electricity. Given the fuel's versatility, ability to utilize existing infrastructure, and carbon emissions profile, analysts see a bright future for hydrogen. For example, investment bank Goldman Sachs believes that hydrogen could be a $1 trillion a year market by 2050.” 4

Major green hydrogen investments have been announced by three international super major petroleum companies and a major utility in the past month. On June 14, 2022, British Petroleum announced a $30 billion green hydrogen project in Australia5. Also on June 14, 2022, Total Energies announced an investment in India’s Adani to produce 1 million tons of green hydrogen by 2030. The first project to produce green hydrogen and related products will cost around $5 billion. Longer term, the project sponsors plan to invest more than $50 billion over the next 10 years in green hydrogen and its ecosystem6 Chevron announced its $2.5 billion investment in hydrogen on June 16, 2022. 7

_________________________________

2 Will Mathis, Laura Hurst and Francois De Beaupuy, “Big Oil Bets that Green Hydrogen is the Future of Energy”, https://www.bloomberg.com/news/articles/2022-06-19/big-oil-bets-that-green-hydrogen-is-the-future-of-energy, June 19,2022.

3 Bloomberg, “Big Oil”.

4 Matthew DeLallo,https://www.msn.com/en-us/money/companies/chevron-is-betting-dollar25-billon-on-hydrogen-will-it-pay-off-for-investors/ar-AAYCYvg?li=BBnb7Kz, The Motley Fool, June 17, 2022.

5 Jenny Strasburg, “BP Bets Big on Giant ‘Green Hydrogen’ Project in Australia, https://www.wsj.com/articles/bp-bets-big-on-giant-green-hydrogen-project-in-australia-11655240401?mod=djem_EnergyJournal

6 TotalEnergies Press Release, “TotalEnergies and Adani Join Forces to Create a World-Class Green Hydrogen Company, June 14, 2022,

https://totalenergies.com/media/news/press-releases/india-totalenergies-and-adani-join-forces-create-world-class-green.

7 Will Mathis, “Chevron Eyes $2.5 Billion Investments in Low-Carbon Hydrogen”, Bloomberg, June 16, 2022.

As noted by British Petroleum, the hub is one of a handful of hydrogen megaprojects attracting increasingly bigger investment, including from companies traditionally focused on fossil fuels. Hydrogen is emerging as a potential way to cut carbon emissions from industries such as trucking, shipping, steelmaking and fertilizer manufacturing that contribute to climate change but are hard to reduce8.

The Russian invasion of Ukraine is a catalyst for review of energy policy around the globe. Recent high natural-gas prices, exacerbated by Russia’s war in Ukraine, and Europe’s subsequent efforts to wean itself off Russian fossil fuels have accelerated government support for green hydrogen across the globe. Analysts and investors say the fuel is needed to supplement and ultimately supplant natural gas, including the liquefied form called LNG that countries in Europe and elsewhere are rushing to import. 9

Major power generation companies are joining the hydrogen evolution. On June 15, 2022, NextEra Energy, technology provider for MMEX West Texas projects, announced its RealZero goal to eliminate carbon emissions from number of its operations including its power generation facilities. 10 The Press Release stated: “NextEra Energy has created the Zero Carbon Blueprint™, a comprehensive plan to significantly increase renewable energy deployment and lead the $4 trillion market opportunity to decarbonize the U.S. economy. Plan would generate only carbon-emissions-free energy from a diverse mix of wind, solar, battery storage, nuclear, green hydrogen and other renewable sources. Real Zero is the most ambitious carbon emissions reduction goal ever set by an energy producer, and the sector's only one to not require carbon offsets for success. Natural gas would be displaced by green hydrogen in some of its existing generating units: FPL would convert 16,000 MW of existing natural gas units to run on green hydrogen. The conversion of these modern, efficient units to green hydrogen is expected to be a cost-effective solution for customers and their operation would serve as an important and diverse generation source. Importantly, reaching FPL's Real Zero goal would not result in any stranded generation assets.”

RBN Energy analysis of the NextEra announcement stated “NextEra announced yesterday its Real Zero strategy, which envisions the company reaching full decarbonization by 2045. While the vision is multi-faceted, the plans for NextEra’s Florida Power and Light (FPL) subsidiary caught our attention. As part of Real Zero, FPL’s 16,000 megawatts (MW) of natural gas-powered electric generating capacity would be converted to run on 100% green hydrogen by 2045. How much hydrogen would that require, you may ask? The answer is, well, a lot. At 100% utilization and an assumed heat rate of 7.2 megawatt-hours per million British Thermal Units (MMBtus), we estimate the FPL gas plants can consume a peak rate of about 2,500,000 MMBtus per day, roughly 2.5 billion cubic feet per day of natural gas. If all that natural gas were replaced by hydrogen, and assuming an equivalent heat rate for the power plants when burning H2, the hydrogen requirement of 2,500,000 MMBtus per day would require about 50,000 MW of electrolysis capacity to produce it. That is an enormous amount of electrolysis, the scale of which dwarfs anything we have heard of in the U.S., or the world, for that matter.”11

The forecasts for the hydrogen economy are robust. In a recent report, an international assurance and risk management company DNV forecasts the use of hydrogen in the energy transition through to 2050. The report states:

| · | “Renewable and low-carbon hydrogen is crucial for meeting the Paris Agreement goals to decarbonize hard-to-abate sectors. To meet the targets, hydrogen would need to meet around 15% of world energy demand by mid-century. |

| | |

| · | We forecast that global hydrogen uptake is very low and late relative to Paris Agreement requirements — reaching 0.5% of global final energy mix in 2030 and 5% in 2050, although the share of hydrogen in the energy mix of some world regions will be double these percentages. |

_____________________________

8 TotalEnergies Press Release, “TotalEnergies and Adani Join Forces”.

9 Strasburg, Wall Street Journal

10 NextEra Energy Press Release, June 14, 2022, https://newsroom.nexteraenergy.com/2022-06-14-NextEra-Energy-sets-industry-leading-Real-Zero-TM-goal-to-eliminate-carbon-emissions-from-its-operations,-leverage-low-cost-renewables-to-drive-energy-affordability-for-customers.

11 Jason Ferguson, RBN Hydrogen Billboard Report, June 15, 2022, https://rbnenergy.com/hydrogen-billboard/report/2022-06-15.

| · | Global spend on producing hydrogen for energy purposes from now until 2050 will be USD 6.8trn, with an additional USD 180bn spent on hydrogen pipelines and USD 530bn on building and operating ammonia terminals. |

| | |

| · | Hydrogen will be transported by pipelines up to medium distances within and between countries, but almost never between continents. Ammonia is safer and more convenient to transport, e.g. by ship, and 59% of energy-related ammonia will be traded between regions by 2050. |

| | |

| · | Direct use of hydrogen will be dominated by the manufacturing sector, where it replaces coal and gas in high-temperature processes. These industries, such as iron and steel, are also where the uptake starts first, in the late 2020s. |

| | |

| · | Hydrogen derivatives like ammonia, methanol and e-kerosene will play a key role in decarbonizing the heavy transport sector (aviation, maritime, and parts of trucking), but uptake only scales in the late 2030s.12 |

The Company’s Hydrogen Initiatives-A Significant Global Footprint

The Company has initiated development of hydrogen projects in three of the top ten countries with hydrogen projects- U.S., Morocco and Argentina.

13

13

Management Expertise in Oil, Gas, Refining and Electric Power Project Development and Project Finance Development

MMEX management has over 30 years of experience in natural resource project development and project financing in North and South America and the U.K. In addition, MMEX directors and principal stockholders with oil, gas, refining and electric power experience will bring this expertise into the Company.

MMEX principals formed Maple Resources Corporation (“Maple Resources”) in 1986 to engage in the evaluation, acquisition and development of oil & gas, refining, power generation, natural gas transmission and processing energy projects in the western United States and Latin America. Maple Resources and its principals have engaged in a number of oil and gas acquisitions and dispositions and ultimately acquired assets that included 10 gas processing plants and approximately 770 miles of natural gas gathering lines and transmission infrastructure. In 1992, Maple Resources sold substantially all of its existing US-based assets and began to pursue energy projects in Latin America, particularly in Peru through its affiliate The Maple Gas Corporation del Peru Ltd (“Maple Peru”). In 1993, Maple Peru began developing the Aguaytía Project, an integrated natural gas and electric power generation and transmission project. This US$273 million project involved the first commercial development of a natural gas field in Peru, as well as the construction and operation of approximately 175 miles of hydrocarbon pipelines, a gas processing plant, a fractionation facility, a 153 MW power plant and the related 392 km of electricity transmission lines. The Aguaytía Project began commercial operation in 1998. Maple Peru also acquired a 4,000-bpd refinery in Pucallpa along with 3 producing oil fields.

_______________________________

12 DNV, “Hydrogen Forecast to 2050, Energy Transition Outlook 2022, June 14, 2022.

13 Strasburg, Wall Street Journal

Jack Hanks, our President and CEO, is no longer engaged in the active business operations of Maple Peru and is able to devote substantially all of his business time to his duties on behalf of the Company. Further, we do not anticipate that Maple Resources will present any conflicts of interest for the MMEX principals in carrying out their responsibilities on behalf of the Company.

Proposed Organizational Structure

The Company expects to operate its planned projects through subsidiaries. The construction of the planned projects will require substantial equity and debt financing, far beyond the expected resources of the Company, and we anticipate that the subsidiaries will obtain equity and debt financing to finance the cost of construction. To the extent these subsidiaries raise money through the issuance of equity securities, our ownership in the subsidiaries will be diluted and our economic ownership of such entities may be a minority interest. As such, we will be entitled to only a portion of any future distributions made by these subsidiaries. In addition, while intend to retain managerial control of the subsidiaries, it is likely that equity investors will require representation on the board of managers in connection with their equity investments.

We anticipate these subsidiaries will be able to finance a majority of the total costs of the planned projects through debt financing, and the remaining portion of the total costs would be financed through equity investments. We intend to pursue the required debt financing from banks or other large institutional investors. Traditionally, such debt financing is in the form of project financing, which among other terms will require the project subsidiary to restrict its activities to the operation of the project financed by the lender, to pledge all assets of the project to the lender and to be subject to restrictive financial covenants. Such lenders further typically require engineering, marketing and feasibility studies as a condition precedent to the financing. The Company will have to fund the cost of these reports and studies.

Regulation

Although we do not believe our planned blue hydrogen and green hydrogen projects will have any significant environmental or ecological impact, we will be subject to numerous environmental laws and regulations relating to the release of hazardous substances or solid wastes into the soil, groundwater, and surface water, and measures to control pollution of the environment. These laws generally regulate the generation, storage, treatment, transportation, and disposal of solid and hazardous waste. They also require corrective action, including investigation and remediation, at a facility where such waste may have been released or disposed. There are risks of accidental releases into the environment associated with our operations, such as releases of crude oil or hazardous substances from our pipelines or storage facilities. To the extent an event is not covered by our insurance policies, accidental releases could subject us to substantial liabilities arising from environmental cleanup and restoration costs, claims made by neighboring landowners and other third parties for personal injury and property damage, and fines or penalties for any related violations of environmental laws or regulations.

We expect to file with the Texas Commission on Environmental Quality (“TCEQ”) for construction and operation permits. We expect to employ carbon capture with the clean fuels and blue hydrogen facilities. We are studying the options for sequestration for the CO2 in the various saline formations under our sites, which will require permits from the EPA or the Texas Railroad Commission (which, we understand, is in the process of seeking primacy for sequestration permitting).

Our planned operations may also be subject to the Department of Homeland Security’s Chemical Facility Anti-Terrorism Standards, which are designed to regulate the security of high-risk chemical facilities, and to the Transportation Security Administration’s Pipeline Security Guidelines and Transportation Worker Identification Credential program. If applicable, we will have to have an internal program of inspection designed to monitor and enforce compliance with all of these requirements, and we will need to develop a Facility Security Plan as required under the relevant law. We will also have to have in place procedures to monitor compliance with all applicable laws and regulations regarding the security of all our facilities.

Our planned operations will also be subject to the requirements of the Occupational Safety and Health Act (“OSHA”) and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. We may also become subject to OSHA Process Safety Management regulations, which are designed to prevent or minimize the consequences of catastrophic releases of toxic, reactive, flammable or explosive chemicals. We will take measures to ensure that our operations are in substantial compliance with OSHA requirements, including general industry standards, record keeping requirements, and monitoring of occupational exposure to regulated substances.

Employees

As of April 30, 2022, we had no employees but rather to reduce costs our key management team is working under consulting agreements. We contract for all professional services when needed.

Legal Proceedings

See Item 3 of this Report.

Item 1A: Risk Factors

As a smaller reporting company, we are not required to provide the information required by this Item.

Item 1B: Unresolved Staff Comments.

None.

Item 2: Properties

Our office address for mailing purposes is 3616 Far West Blvd. #117-321, Austin, Texas 78731. Our executive physical office is located at 3600 Dickinson, Fort Stockton, Texas, 79735 near the sites of our proposed clean fuels and hydrogen projects.

We own a total of approximately 1,043.25 acres in Pecos County, Texas that are the sites for our planned clean fuels and hydrogen projects.

Item 3: Legal Proceedings

None

Item 4: Mine Safety Disclosures

Not Applicable.

PART II

Item 5: Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

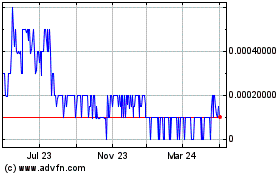

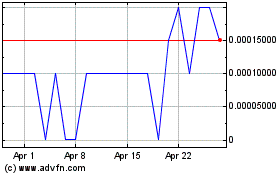

Since April 10, 2018, our common stock has been listed on the OTC Pink under the symbol "MMEX". The OTC Market is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current “bids” and “asks”, as well as volume information. From November 2, 2017 through April 9, 2018, our Class A common stock was listed on the OTCQB and prior to November 2, 2017, our Class A common stock was quoted on the OTC Pink tier. The following table indicates the quarterly high and low bid price for our common stock for the fiscal years ending April 30, 2022 and 2021. Such inter-dealer quotations do not necessarily represent actual transactions and do not reflect retail mark-ups, mark-downs or commissions.

| | High | | | Low | |

Fiscal year ended April 30, 2021 | | | | | | |

Quarter ended July 31, 2020 | | $ | 395.57 | | | $ | 294.96 | |

Quarter ended October 31, 2020 | | $ | 325.27 | | | $ | 236.94 | |

Quarter ended January 31, 2021 | | $ | 374.99 | | | $ | 245.03 | |

Quarter Ended April 30, 2021 | | $ | 452.06 | | | $ | 335.73 | |

| | | | | | | | |

Fiscal year ended April 30, 2022 | | | | | | | | |

Quarter ended July 31, 2021 | | $ | 17.00 | | | $ | 1.00 | |

Quarter ended October 31, 2021 | | $ | 1.10 | | | $ | 0.48 | |

Quarter ended January 31, 2022 | | $ | 0.59 | | | $ | 0.13 | |

Quarter Ended April 30, 2022 | | $ | 0.30 | | | $ | 0.11 | |

On July 13, 2022, the closing bid price of our common stock as reported on the OTC Pink was $0.09.

The number of holders of record of the Company's common stock as of April 30, 2022 was 171 as reported by our transfer agent. This number does not include an undetermined number of stockholders whose stock is held in "street" or "nominee" name.

We have not declared or paid any cash or other dividends on our common stock to date for the last two (2) fiscal years and have no intention of doing so in the foreseeable future.

We did not repurchase any of our equity securities during the fourth quarter of fiscal 2022.

Recent Sales of Unregistered Securities not previously reported in the Company's Form 10-Q

On February 15, 2022 the Company issued 250,000 shares of its common stock for the exercise of prefunded warrants.

On March 1, 2022 the Company issued 250,000 shares of its common stock for the exercise of prefunded warrants.

On March 10, 2022 the Company issued 300,000 shares of its common stock for the exercise of prefunded warrants.

On March 16, 2022 the Company issued 375,000 shares of its common stock for the exercise of prefunded warrants.

On March 18, 2022 the Company issued 25,611 shares of its common stock to extinguish $15,000 of accrued liabilities and issued 78,709 shares of its common stock to extinguish $40,000 of accrued liabilities owed to related parties.

On April 4, 2022 the Company issued 400,000 shares of its common stock for the exercise of its Series A warrants and received proceeds of $40.

On April 13, 2022 the Company issued 100,000 shares of its common stock valued at $14,091 for a debt discount.

On April 19, 2022 the Company issued 330,000 shares of its common stock for the exercise of its Series A warrants and received proceeds of $33.

On May 25, 2022 the Company issued 500,000 shares of its common stock for the exercise of its Series A warrants and received proceeds of $50.

On June 1, 2022 the Company issued 710,802 shares of its common stock for the conversion of $90,000 of note principal and $19,677 of accrued interest.

On June 7, 2022 the Company entered into a $105,000 convertible note with a maturity date of June 7, 2023. The note has an interest rate of 10% and is convertible into shares of the Company’s common stock at a conversion price of $0.11 per share for the first 180 days following the issuance date. After the first 180 days has passed the note will have a variable conversion price equal to 58% of the Company’s lowest trading price during the ten days prior to the conversion date.

On June 13, 2022 the Company issued 497,000 shares of its common stock for the exercise of its Series A warrants and received proceeds of $50.

On June 30, 2022 the Company issued 400,000 shares of its common stock for the exercise of its Series A warrants and received proceeds of $40.

Outstanding Equity Awards at Fiscal Year-End

Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) | | | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities in Column (a) | |

| | | | | | | | | |

Equity Compensation Plans Approved by Security Holders | | | 0 | | | | 0 | | | | 0 | |

Equity Compensation Plans Not Approved by Security Holders | | | 35,508,000 | | | $ | 0.06 | | | | 0 | |

Total | | | 35,508,000 | | | $ | 0.06 | | | | 0 | |

Penny Stock

Our stock is considered to be a penny stock. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Item 6: Selected Financial Data

As a smaller reporting company, we are not required to provide the information required by this Item.

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under Special Note Regarding Forward-Looking Statements and Business sections in this Annual Report. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

The following discussion and analysis constitutes forward-looking statements for purposes of the Securities Act and the Exchange Act and as such involves known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. The words “expect”, “estimate”, “anticipate”, “predict”, “believes”, “plan”, “seek”, “objective” and similar expressions are intended to identify forward-looking statements or elsewhere in this report. Important factors that could cause our actual results, performance or achievement to differ materially from our expectations are discussed in detail in Item 1 above. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by such factors. We undertake no obligation to publicly release the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Notwithstanding the foregoing, we are not entitled to rely on the safe harbor for forward looking statements under 27A of the Securities Act or 21E of the Exchange Act as long as our stock is classified as a penny stock within the meaning of Rule 3a51-1 of the Exchange Act. A penny stock is generally defined to be any equity security that has a market price (as defined in Rule 3a51-1) of less than $5.00 per share, subject to certain exceptions.

The following discussion should be read in conjunction with the Consolidated Financial Statements, including the notes thereto.

Overview

Business Overview

Since 2016, the focus of our business has been to build crude oil distillation units and refining facilities (CDUs) in the Permian Basin in West Texas. We revised our business plan in 2021 to move MMEX to clean energy production, leveraging our history, management and business relationships from the traditional energy sector.

Since 2021 MMEX has expanded its focus to the development, financing, construction and operation of clean fuels infrastructure projects powered by renewable energy. We have formed two operating sub-divisions of the Company - one sub-division to transition from legacy refining transportation fuels by producing them as ultra clean fuels with carbon capture or as stand-alone renewable or clean fuels projects, and the second sub-division which plans to produce green and/or blue hydrogen with the option for conversion of hydrogen to ammonia or methanol. These two sub-divisions will be operating respectively as Clean Energy Global, LLC and Hydrogen Global, LLC. The planned projects are designed to be powered by solar and wind renewable energy.

Through April 30, 2022, we have had no revenues and have reported continuing losses from operations.

Results of Operations

We recorded a net loss of $228,730 or $(0.02) per share, for fiscal year ended April 30, 2022, compared to a net loss of $24,526,886 or $(14.23) per share, for the fiscal year ended April 30, 2021. As discussed below, the net income or loss for any fiscal year fluctuates materially due to non-operating gains and losses.

Revenues

We have not yet begun to generate revenues.

General and Administrative Expenses

Our general and administrative expenses increased $426,201 to $1,293,672 for the year ended April 30, 2022 from $867,471 for the year ended April 30, 2021. The increase resulted from higher professional fee costs, which included increased costs for legal, public relations, and consulting services.

Project Costs

Our project costs increased $1,458,609 to $1,637,742 for the year ended April 30, 2022 from $179,133 for the year ended April 30, 2021. The levels of spending on our projects will vary from period to period based on availability of financing and will be expensed as project costs are incurred. During the year ended April 30, 2022, we obtained financing and were able to move forward on our projects, which included incurring costs for the acquisition of rights, planning, design and permitting.

Depreciation and Amortization Expense

Our depreciation and amortization expenses remained constant, totaling $35,877 and $34,875 for the years ended April 30, 2022 and 2021, respectively. The expense results from the depreciation of land improvements and amortization of land easements.

Other Income (Expense)

Our interest expense decreased $625,711 to $517,784 for the year ended April 30, 2022 from $1,143,495 for the year ended April 30, 2021. We entered into fewer convertible debt arrangements in the current fiscal year, resulting in less amortization of debt discount to interest expense, and our debt arrangements during the year ended April 30, 2022 had more favorable interest rates, thus explaining the decrease in interest expense over time.

For the years ended April 30, 2022 and 2021, we reported gains (losses) on derivative liabilities of $3,010,042 and $(22,906,922), respectively. In a series of subscription agreements, we issued warrants in prior years that contained certain anti-dilution provisions that we have identified as derivatives. We also identified the variable conversion feature of certain convertible notes payable as derivatives. We estimated the fair value of the derivatives using multinomial lattice models that value the warrants based on a probability weighted cash flow model using projections of the various potential outcomes. These estimates are based on multiple inputs, including the market price of our stock, interest rates, our stock price volatility and management’s estimates of various potential equity financing transactions. These inputs are subject to significant changes from period to period and to management's judgment; therefore, the estimated fair value of the derivative liabilities will fluctuate from period to period, and the fluctuation may be material. During the year ended April 30, 2022 all derivative liabilities were written off the books, resulting in a larger gain in the current period than in the prior period.

We reported a gain on extinguishment of debt of $243,303 for the year ended April 30, 2022 compared to a gain on extinguishment of debt of $605,010 for the year ended April 30, 2021. The gain on extinguishment of debt generally results from the settlement and extinguishment of convertible notes payable and certain accounts payable and accrued expenses and can fluctuate over time as we are able to settle or pay off debt.

Net Income (Loss)

As a result of the above, we reported net losses of $228,730 and $24,526,886 for the years ended April 30, 2022 and 2021, respectively.

Liquidity and Capital Resources

Working Capital

As of April 30, 2022, we had current assets of $184,200, comprised of cash of $136,867 and prepaid expenses and other current assets of $47,333, and current liabilities of $3,054,377, resulting in a working capital deficit of $2,870,177.

Sources and Uses of Cash

Our sources and uses of cash for the years ended April 30, 2022 and 2021 were as follows:

| | 2022 | | | 2021 | |

| | | | | | |

Cash, Beginning of Year | | $ | 330,449 | | | $ | 66,830 | |

Net Cash Used in Operating Activities | | | (3,402,572 | ) | | | (805,683 | ) |

Net Cash Used in Investing Activities | | | (677,905 | ) | | | - | |

Net Cash Provided by Financing Activities | | | 3,886,895 | | | | 1,069,302 | |

| | | | | | | | |

Cash, End of Year | | $ | 136,867 | | | $ | 330,449 | |

We used net cash of $3,402,572 in operating activities for the year ended April 30, 2022 as a result of our net loss of $228,730, our non-cash gains of $3,253,345, our increase in prepaid expenses and other current assets of $9,440, our increase in accounts payable of $116,276, and our increase in accounts payable and accrued expenses – related parties of $156,064, partially offset by non-cash expenses totaling $279,887, a decrease in our deposit of $900, and an increase in accrued expenses of $80,496.

In comparison, we used net cash of $805,683 in operating activities for the year ended April 30, 2021 as a result of our net loss of $24,526,886, our non-cash gain of $605,010 and our increase in prepaid expenses and other current assets of $14,748, partially offset by non-cash expenses totaling $23,402,206, and increases in accounts payable of $3,695, accrued expenses of $756,839 and accounts payable and accrued expenses – related parties of $178,221.

Net cash used in investing activities was $677,905, and $0 for the years ended April 30, 2022 and 2021, respectively, comprised on the purchase of property and equipment.

Net cash provided by financing activities was $3,886,895 for the year ended April 30, 2022, comprised of proceeds from notes payable of $352,500, proceeds from convertible notes payable of $233,500, proceeds from the sale of common and series B preferred stock and warrants of $4,500,000, and proceeds from warrant exercise of $73, partially offset by repayments of notes payable of $388,048, repayments of convertible notes payable of $255,331, and the payment of $555,799 in offering costs.

By comparison, net cash provided by financing activities was $1,069,302 for the year ended April 30, 2021, comprised of proceeds from notes payable of $775,000, proceeds from convertible notes payable of $10,000, proceeds from convertible notes payable – related parties of $163,500, proceeds from SBA bridge loan of $10,000, and proceeds from a PPP loan payable of $150,000, partially offset by repayments of convertible notes payable of $39,198.

Going Concern Uncertainty

Our financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplate the realization of assets and liquidation of liabilities in the normal course of business. We have incurred continuous losses from operations, have an accumulated deficit of $68,213,423 and a total stockholders’ deficit of $1,755,980 at April 30, 2022, and have reported negative cash flows from operations since inception. In addition, as of April 30, 2022 we did not have the cash resources to meet our operating commitments for the next twelve months. We require capital investments to implement our business plan, including the development of our planned hydrogen projects. Additionally, our ability to continue as a going concern must be considered in light of the problems, expenses and complications frequently encountered by entrance into established markets and the competitive environment in which we operate.

We expect to continue to seek additional funding through private or public equity and debt financing. Our ability to continue as a going concern is dependent on our ability to generate sufficient cash from operations to meet our cash needs and/or to raise funds to finance ongoing operations and repay debt. However, there can be no assurance that we will be successful in our efforts to raise additional debt or equity capital and/or that our cash generated by our operations will be adequate to meet our needs. These factors, among others, raise substantial doubt that we will be able to continue as a going concern for a reasonable period of time.

The financial statements do not include any adjustments that might result from the outcome of any uncertainty as to the Company's ability to continue as a going concern. The financial statements also do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classifications of liabilities that might be necessary should the Company be unable to continue as a going concern.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a material current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Critical Accounting Policies

Our results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to inventories, investments, intangible assets, income taxes, financing operations, and contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

For further information on our significant accounting policies see the notes to our consolidated financial statements included in this Annual Report. There were no material changes to our significant accounting policies during the year ended April 30, 2022 and there are no policies we deem to be critical accounting policies.

Item 7A: Quantitative and Qualitative Disclosures About Market Risk

As a smaller reporting company, we are not required to provide the information required by this item.

Item 8: Financial Statements and Supplementary Data

The following financial statements are being filed with this report and are located immediately following the signature page.

Index to Consolidated Financial Statements

Report of Independent Registered Public Accounting Firm

Consolidated Balance Sheets as of April 30, 2022 and 2021

Consolidated Statements of Operations for the years ended April 30, 2022 and 2021

Consolidated Statements of Stockholders’ Deficit for the years ended April 30, 2022 and 2021

Consolidated Statements of Cash Flows for the years ended April 30, 2022 and 2021

Notes to Consolidated Financial Statements

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

There have been no changes in or disagreements with our accountants on accounting and financial disclosures.

Item 9A(T): Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We carried out an evaluation, under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, of the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)). Based upon that evaluation, our principal executive officer and principal financial officer concluded that, as of April 30, 2022, our disclosure controls and procedures were effective to ensure that information required to be disclosed in reports filed under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the required time periods and is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

Management's Annual Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Securities Exchange Act, as amended. Our management assessed the effectiveness of our internal control over financial reporting as of April 30, 2022. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") in Internal Control-Integrated Framework. Based on our evaluation, management concluded that we maintained effective internal control over financial reporting as of April 30, 2022, based on the COSO framework criteria. Management believes our processes and controls are sufficient to ensure the consolidated financial statements included in this Form 10-K were fairly stated in accordance with U.S. GAAP.

Changes in Internal Control Over Financial Reporting