Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

May 15 2024 - 7:41AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number 001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE PROSPECTUS FORMING A PART

OF MIZUHO FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-266555) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS

REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

| Date: May 15, 2024 |

|

| Mizuho Financial Group, Inc. |

|

|

| By: |

|

/s/ Takefumi Yonezawa |

| Name: |

|

Takefumi Yonezawa |

| Title: |

|

Senior Executive Officer / Group CFO |

This document has been translated from the Japanese original for reference purposes only. In the event of any

discrepancy between this translated document and the Japanese original, the original shall prevail. Mizuho Financial Group, Inc. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the

translation.

May 15, 2024

|

|

|

|

|

|

|

|

|

Company: Mizuho Financial Group, Inc.

Representative: Masahiro Kihara, President & Group CEO

Head Office: 1-5-5 Otemachi, Chiyoda-ku, Tokyo

Stock code: 8411 (Tokyo Stock Exchange Prime Market) |

Opinion of Mizuho’s Board of Directors on Shareholder Proposals

Regarding the agenda of the 22nd Ordinary General Meeting of Shareholders scheduled to be held on

June 26, 2024, Mizuho Financial Group, Inc. (President & CEO: Masahiro Kihara) has received a document stating shareholders’ intentions to exercise their proposal rights. Mizuho hereby announces that at its Board of Directors

meeting held today, it has resolved to oppose the shareholder proposals.

| 1. |

Proposing Shareholders |

Joint proposals by three shareholders

* As some of the proposing shareholders are individuals, the names are withheld.

| 2. |

The Shareholder Proposals |

Please refer to the Appendix.

| 3. |

Opinion of the Board of Directors on the Shareholder Proposals and the Reasons therefor |

| |

(1) |

Proposal 1 Partial amendment to the Articles of Incorporation (Director competencies for the effective

management of climate-related business risks and opportunities) |

The Board of Directors opposes this proposal.

We selected experience in and knowledge of environmental and other sustainability-related operations, including climate change-related

operations, as one of the areas in which the Board of Directors as a whole should possess specific skills. In addition, regarding the nominations of the directors and the evaluations of the effectiveness of the Board of Directors, we set out

policies and other frameworks in the Corporate Governance Guidelines and also regularly disclose the results of the evaluations on the effectiveness of the Board of Directors. Furthermore, by utilizing the expertise possessed by external experts, we

established a system that enables us to perform appropriate supervisory functions. Specifically, major management issues, including climate change risk management, are discussed at the Board of Directors meetings and the Risk Committee meetings and

the contents thereof are regularly disclosed.

With that said, it is important to ensure the balance, diversity and other related matters

of the Board of Directors as a whole in order to perform supervisory functions.

Accordingly, the Board of Directors is of the opinion that

it would be inappropriate to insert, as called for by this proposal, stipulations pertaining to specific areas such as climate change in the Articles of Incorporation, which should contain stipulations on corporate organization and other basic

items.

Details of our group’s opposition regarding the shareholder proposal are as described below.

| |

1. |

Sustainability Promotion Structure |

We set forth our vision for the future, centering on personal well-being and the achievement of a sustainable society and economy to support

it. In particular, we are addressing climate change as one of the most important issues in regard to our business strategies, and are promoting activities to address climate change. We also established a system where climate-related initiatives are

discussed at the business execution line, which includes the Sustainability Promotion Committee, Risk Management Committee and Executive Management Committee, and reports based on discussions at the business execution line are made to the Board of

Directors and supervision is performed with respect to such initiatives by the Board of Directors and the Risk Committee in accordance with the structure for promoting and managing each initiative.

In addition, external experts are invited to the Risk Committee and Sustainability Promotion Committee to provide recommendations to and

exchange opinions with directors and executive officers as defined in the Companies Act based on their expertise in sustainability, including climate change.

We continue to enhance our approaches to climate change based on active discussions with outside directors and committee members at meetings

of the Board of Directors and Risk Committee. For the composition of the Board of Directors and approach to considering candidates for members of the Board of Directors, please see page 84 of the Integrated Report (Annual Review)

“Composition and skills of the Board of Directors”.

<Discussions at meetings of the Board of Directors and Risk Committee>

| |

• |

|

It is necessary to be committed, through suggestions to clients and policy recommendations, to more effective

engagement and to risk controls in carbon-related sectors as a result of such activities. |

|

| |

• |

|

It is also necessary to identify risks related to technologies and next-generation technologies for transitions.

|

|

| |

• |

|

Transition risks have been highlighted over the past few years; however, we should also pay attention anew to

physical risks in light of the extreme weather conditions in recent years. Further, it is necessary to confirm the macroeconomic impacts resulting from such risks. |

|

| |

• |

|

It should also be noted that events that do not form part of the basis for calculation of the amount of the

impact under the scenario analyses may occur. Such potential impact includes the impact of reputational damage to credit clients which could be triggered by ESG factors. |

|

| |

• |

|

Regarding credit policies for cases where our engagement is not effective and the initiatives toward

decarbonization are not progressing, it is necessary to thoroughly discuss these from the perspective of risk management control. |

|

| |

• |

|

Our sustainability initiatives are steadily progressing. Going forward, it will be essential whether or not our

efforts are actually having an impact on society towards decarbonization and structural transformation in industry for decarbonization. |

|

This proposal requires inserting into the Articles of Incorporation stipulations pertaining to

specific and individual matters, such as the formulation of policies and processes for nominating directors, and the evaluation of the Board’s effectiveness in relation to a specific area, i.e., climate change. We will continue to enhance our

approaches, taking into account rapidly changing circumstances and the discussions at business execution and supervisory lines, in response to climate change and various environmental and social issues. In this context, it is important to ensure the

balance, diversity and other related matters of the Board of Directors as a whole in order to perform effective supervisory functions. Accordingly, the Board of Directors is of the opinion that it would be inappropriate to insert, as called for by

this proposal, stipulations pertaining to specific areas such as climate change in the Articles of Incorporation, which should contain stipulations on corporate organization and other basic items.

| |

(2) |

Proposal 2 Partial amendment to the Articles of Incorporation (Assessment of customers’ climate

change transition plans) |

The Board of Directors opposes this proposal.

In light of the importance of climate-related risk management, we have established the risk control framework for carbon-related sectors and

disclose the criteria for evaluation of, and the developments in, clients’ status of responses to transition risks. We engage with our clients based on the understanding that our role as a financial institution is fulfilled by supporting our

clients through financing and other measures in order to promote the transition of the real economy. On that basis, we carefully consider whether to continue business with a client in the event that the client has not formulated a transition

strategy even after a certain period of time after the first engagement.

In addition, we are continuously enhancing this framework in

order to pursue efforts to limit the temperature increase within 1.5°C, such as by planning on adding “Target and performance are consistent with the 1.5 degree-aligned pathway” to the criteria for evaluation of clients’ status of

responses to transition risks.

With that said, in respect of the Articles of Incorporation, which should contain stipulations on corporate

organization and other basic items, inserting stipulations pertaining to individual business execution therein may hinder our ability to respond flexibly and promptly. Accordingly, the Board of Directors is of the opinion that it would be

inappropriate to add what this proposal requires to the Articles of Incorporation.

Details of our group’s opposition regarding the

shareholder proposal are as described below.

| |

1. |

Initiatives to Address Climate Change |

We have developed “Mizuho’s Approach to Achieving Net Zero by 2050,” which outlines our aims and actions to achieve a

decarbonized society by 2050 by pursuing efforts to limit the temperature increase within 1.5°C, and “Net Zero Transition Plan,” which clarifies medium to long term strategies and initiatives. We are promoting our climate change

responses in an integrated manner, from the perspectives of facilitating transitions in the real economy, capturing business opportunities and enhancing risk management.

<The Net Zero Transition Plan – Overview –>

| |

2. |

Climate-Related Risk Management |

| |

(1) |

Overview of the risk control framework for carbon-related sectors |

We control risks through engagement for the purposes described below in sectors found in qualitative evaluations to have high transition risks

(carbon-related sectors), and disclose the details of such measures to the public. We evaluate the degree of risk for each client along two axes: the client’s sector and the status of the client’s responses to transition risks. From these

evaluations, we provide appropriate support for the client’s transition.

We will continue to make gradual improvements to our risk

control frameworks for carbon-related sectors through quantitative identification of climate-related risks and revisions to evaluations of client responses to transition risks in light of the external business landscape.

|

|

|

|

|

| Purposes |

|

|

|

• Support client transitions and control Mizuho’s transition risk through engagement.

• Identify areas with high

transition risks to help construct an appropriate Mizuho portfolio that accounts for climate-related risks.

• Support client transitions to facilitate transition in the real economy, and gradually align

Mizuho’s portfolio with the Paris Agreement. |

| |

|

| Two-axis risk evaluations and support |

|

|

| Axis |

|

Client’s sector (vertical axis) |

|

Status of transition risk responses (horizontal axis) |

| Risk evaluation

criteria |

|

The company’s business segment with the highest sales or energy mix |

|

• Willingness to take measures against transition risk

• Transition strategy in place, setting of quantitative targets

• Target level, tangibility of means to an end and progress, track record and

objectivity |

| Transition

support |

|

Support for business structural transformations leading to lower risk areas and sectors |

|

Encourage and support clients’ responses to transition risks |

In the fiscal year 2024, we plan to add “Certain GHG emission reductions have been

achieved relative to targets” and “Target and performance are consistent with the 1.5 degree-aligned pathway” to the criteria for evaluating status of responses to transition risks.

<Risk Control Framework for Carbon-Related Sectors>

The progress of clients’ responses to the transition risks, confirmed based on the above framework,

have been advanced in each sector compared to the previous fiscal years.

| |

(2) |

Exposure control in high-risk areas |

For high-risk areas identified with our two-axis risk evaluations, we control risks on the basis of

the following exposure control policy.

| |

• |

|

We pursue greater engagement with clients to support them in formulating effective strategies for transition

risks, in disclosing their progress and in embarking at an early stage on business structural transformations in order to move into a lower risk sector. |

|

| |

• |

|

In order to facilitate a client’s business structural transformations, we provide necessary transition

support after verifying that the client has fulfilled the conditions in line with international standards under the “transition support framework.” |

|

| |

• |

|

We carefully consider whether to continue business with a client in the event that the client is not willing to

address transition risks and has not formulated a transition strategy even one year after our initial engagement. |

|

| |

• |

|

In the ways described above, we reduce our exposure over the medium to long term. |

|

We will continue to clarify and enhance the scope of and our approaches to the high-risk areas

as well as the conditions on providing support for business structural transformations.

This proposal requires inserting into the Articles of Incorporation stipulations pertaining

to specific and individual business execution, such as the disclosure of the assessment method for clients’ transition plans and measures to be taken after the assessment.

We will continue to enhance our approaches, taking into account rapidly changing circumstances and the discussions between our business

execution and supervisory lines, in response to climate change and various environmental and social issues. However, as amendment to the Articles of Incorporation requires a special resolution at a general meeting of shareholders, should this

proposal be adopted, it may hinder our ability to respond flexibly and promptly.

(Appendix)

The Shareholder Proposal

(The

following “Details of the proposal” and “Reasons for the proposal” are an English translation of the original text described in a form submitted by the shareholders.)

Proposal 1

Partial amendment to the Articles of Incorporation

(Director competencies for the effective management of climate-related business risks and opportunities)

| 1. |

Details of the proposal |

The following clause shall be added to the Articles of Incorporation:

| |

Chapter V |

: “Directors and Board of Directors” |

| |

Clause |

: Director Nomination (Director competencies for the effective management of climate-related business risks and

opportunities) |

To promote the long-term success of the Company, given the risks and opportunities associated with

climate change, the Company shall establish and disclose policies and processes for nominating directors and evaluating the board’s effectiveness that ensure the management of climate-related business risks and opportunities is embedded in the

Company’s core management strategy, noting the appropriate balance and diversity of knowledge, experience and skills of the board as a whole.

| 2. |

Reasons for the proposal |

This proposal requests that the Company disclose necessary information in order for shareholders to ensure the Company’s board has the

competence required to properly oversee climate-related risks and opportunities.

The Company is exposed to substantial climate-related

financial risk, given its significant involvement in carbon-intensive sectors such as fossil fuels. However, shareholders are currently unable to assess if the board is capable of fulfilling its duty to mitigate the aforesaid risks. To adequately

manage climate-related risks and opportunities, the board of directors requires expertise in areas including climate science, low carbon transition, and public policy

This proposal is aligned with what is expected by the Japanese Corporate Governance Code, and by investors through investor initiatives (e.g.

Transition Pathway Initiative) and the International Sustainability Standard Board (ISSB).

Approval of this proposal will provide

investors with critical information required to understand the security of their capital. It will also place the Company in a better position to manage transition risks and opportunities, and to maintain long-term corporate value as the Company

navigates the shift toward a decarbonized economy.

(Appendix)

The Shareholder Proposal

(The

following “Details of the proposal” and “Reasons for the proposal” are an English translation of the original text described in a form submitted by the shareholders.)

Proposal 2

Partial amendment to the Articles of Incorporation

(Assessment of customers’ climate change transition plans)

| 1. |

Details of the proposal |

The following clause shall be added to the Articles of Incorporation:

| |

Chapter |

: “Climate-related risk management” |

| |

Clause |

: Transition Plan (Assessment of clients’ climate change transition plans) |

Noting the Company’s climate change commitments and climate risk management strategies, the Company shall disclose:

| |

i. |

How the Company will assess fossil fuel sector clients’ climate change transition plans for credible

alignment with the 1.5°C goal of the Paris Agreement and |

| |

ii. |

The consequences of clients not producing credible Paris-aligned transition plans, including the restriction of

new finance. |

| 2. |

Reasons for the proposal |

The proposal requests disclosure of information necessary for shareholders to ensure that the Company appropriately manages climate-related

risks by supporting clients’ genuine decarbonisation transitions.

The Company has committed to the “unwavering goal of pursuing

the 1.5°C target of the Paris Agreement and achieving net zero by 2050” and recognises climate change as a “top risk”. The Company claims to verify clients in carbon-related sectors have valid targets and appropriate transition

strategies “in line with international standards”.

However, the Company continues to provide significant financial support to

fossil fuel clients that do not have transition plans credibly aligned with the Paris Agreement’s 1.5°C target.

The disclosures

requested in this proposal are required to ensure the Company adequately enacts its stated risk control measures, and aligns with its commitment to reduce finance portfolio emissions to net zero by 2050.

These disclosures are in line with investor expectations (e.g.Transition Pathway Initiative), and will help maintain and enhance the

Company’s long-term corporate value.

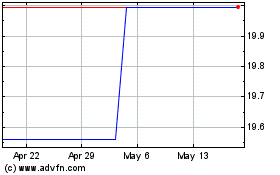

Mizuho Finl (PK) (USOTC:MZHOF)

Historical Stock Chart

From Apr 2024 to May 2024

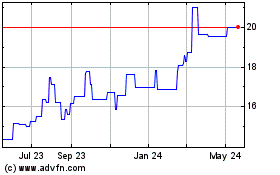

Mizuho Finl (PK) (USOTC:MZHOF)

Historical Stock Chart

From May 2023 to May 2024