UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 3

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2009

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 0-29486

MERGE HEALTHCARE INCORPORATED

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

39-1600938

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I. R. S. Employer Identification No.)

|

900 Walnut Ridge Drive, Hartland, Wisconsin 53029

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code)

(262) 367-0700

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value per share

|

|

NASDAQ Global Market

|

Securities registered under Section 12(g) of the Exchange Act:

NONE

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

o

No

x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

o

No

x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “accelerated filers”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

o

|

|

Accelerated filer

x

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

o

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

o

No

x

The aggregate market value for the Registrant’s voting and non-voting common equity held by non-affiliates of the Registrant as of June 30, 2009, based upon the closing sale price of the Common Stock on June 30, 2009, as reported on the NASDAQ Global Market, was approximately

$116,910,210. Shares of Common Stock held by each officer and director and by each person who owns ten percent or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the Registrant’s common stock, par value $0.01 per share, as of August 5, 2010: 83,268,608

EXPLANATORY NOTE

This Amendment No. 3 on Form 10-K/A (“Amendment No. 3”) to our Annual Report on Form 10-K for the year ended December 31, 2009, filed with the United States Securities and Exchange Commission (“SEC”) on March 12, 2010 (the “Form 10-K”), as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on March 17, 2010 (“Amendment No. 1”) and Amendment No. 2 on Form 10-K/A filed with the SEC on April 30, 2010 (“Amendment No. 2”), is being filed by Merge Healthcare Incorporated (“Merge Healthcare,” “we,” “us,” or “our”) for the sole purposes of (i) amending the Item 11 information in Amendment No. 2 to include the table on quantified termination and change in control benefits under the section captioned “Potential Payments upon Termination or Change in Control” that was also included in our subsequently filed definitive proxy statement filed with the SEC on August 12, 2010 and (ii) amending Item 15(a) of the Form 10-K to include or incorporate by reference, as the case may be, new Exhibits 10.15, 10.16 and 10.17.

Exhibit 10.15 is a Value Added Reseller Agreement dated March 31, 2009 pursuant to which Merrick Healthcare Solutions, LLC d/b/a Olivia Greets (“Merrick Healthcare”) purchased software licenses from a subsidiary of Merge Healthcare for $400,000. Exhibit 10.16 is the Olivia Greets Standard Reseller Agreement dated March 12, 2010, pursuant to which Merge Healthcare received the right to market, resell and supply certain of Merrick Healthcare’s products and services. Both Exhibit 10.15 and Exhibit 10.16 were terminated on July 30, 2010, in connection with Merge Healthcare’s acquisition from Merrick Healthcare on July 30, 2010, of substantially all of the assets related to the development and distribution of the Olivia Greets system. Exhibit 10.17 is a Senior Secured Term Note between Merge Healthcare and Merrick RIC, LLC, pursuant to which Merge Healthcare borrowed $15,000,000 on June 4, 2008. This Senior Secured Term Note was repaid in full by Merge Healthcare on November 18, 2009.

No other changes have been made to the Form 10−K, Amendment No. 1 or Amendment No. 2. This Amendment No. 3 does not reflect events occurring after the filing of the Form 10-K, nor does it modify or update the disclosures and information contained in the Form 10−K, Amendment No. 1 or Amendment No. 2 in any way other than as described in this Explanatory Note.

Updated certifications of our principal executive and financial officer are included as exhibits to this Amendment No. 3.

PART III

Item 11. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

COMPENSATION DISCUSSION AND ANALYSIS

INTRODUCTION

This Compensation Discussion describes our executive compensation program for 2009 and certain elements of the 2010 program. We use this program to attract, motivate, and retain colleagues whom the Board has selected to lead our business.

This section of the Proxy Statement explains how the Compensation Committee made its compensation decisions for our officers who also comprise our named executive officers. Those Named Executive Officers are our Chief Executive Officer, Justin C. Dearborn; our Executive Vice President — North American Direct Sales, Nancy J. Koenig; our Vice President, General Counsel and Corporate Secretary, Ann Mayberry—French; our Chief Financial Officer, Steven M. Oreskovich; and our Executive Vice President — Research and Development, Antonia A. Wells.

MARKET AND BUSINESS CONDITIONS

Although the global economy rebounded somewhat toward the end of 2009, our business remained affected by the downturn that started in 2008. Healthcare in particular showed country-by-country challenges and opportunities as a direct result of the local government investment. In 2009 our major market, the U.S., passed dramatic healthcare legislation intended to spark new investment in health IT. While it originally served to freeze the market as elements of the legislation were further defined, market conditions improved toward the end of 2009 and major market segments are forecasted for growth in 2010 and onward. At the same time, legislation aimed at reducing reimbursement to our customers hindered their ability to invest in our solutions. Merge Healthcare improved its financial position during the second half of 2008 and continued to grow top line revenue throughout 2009. Management successfully limited overhead while growing revenue in order to improve our financial strength and sustain future performance.

PHILOSOPHY AND GOALS OF OUR EXECUTIVE COMPENSATION PROGRAM

Compensation Philosophy

The primary objectives of our executive compensation policies are as follows:

|

|

•

|

to attract and retain talented executives by providing compensation that is in alignment with the compensation provided to executives at companies of comparable size and growth trajectory in the health care information technology industry, while maintaining compensation within levels that are consistent with our annual budget, financial objectives and operating performance; and

|

|

|

•

|

to provide appropriate incentives for executives to work toward the achievement of our annual financial performance and business goals, based primarily on diluted earnings per share.

|

Our incentive compensation programs are designed to reward executive and other employee contributions based on the success of our organization. Specifically, they are designed to reward achievement of our annual financial performance and business goals and creation of stockholder value.

Compensation Mix

Historically, we have used a mix of short—term compensation (base salaries and annual cash incentive bonuses) and long—term compensation (stock option grants and restricted stock awards) to meet the objectives of our compensation programs. We do not have a fixed policy for allocating between long—term and short—term compensation or between cash and non—cash compensation. Because we believe that it is important to align the interests of our executives with those of our stockholders, equity incentive compensation has made up a portion of each current executive’s overall compensation package. In the near term, we plan to continue to use primarily short—term compensation (base salaries and annual cash incentive bonuses) as well as long—term compensation, as appropriate.

The compensation that we pay our Named Executive Officers consists of base salary, cash incentive compensation and stock option awards. The following discussion explains the reason we pay each element of compensation, how the amount of each element is determined, and how each element fits into our overall compensation philosophy and affects decisions regarding other elements.

We seek to pay executives a base salary in alignment with salaries of executives at companies of comparable position in the healthcare information technology industry and at a rate that fits within our annual budget, financial objectives and operating performance. However, we do not make use of any formal survey information or benchmark against any specific compensation percentiles. We have not historically attempted to make base salary a certain percentage of total compensation.

In light of the Company’s 2009 annual performance and the public sentiment regarding corporate bonus payouts for substandard, annual corporate performance, the Compensation Committee determined that Merge Healthcare’s performance did not warrant cash incentive payments for 2009.

In early 2010, the Compensation Committee established targets for bonuses for Merge Healthcare’s Named Executive Officers, as well as the rest of the employees. However, due to the Company’s acquisition of AMICAS, Inc., such targets are no longer in effect.

Role of the Compensation Committee

The Compensation Committee of our Board is responsible for administering our compensation practices and ensuring they are designed to drive corporate performance. Our Compensation Committee reviews compensation policies affecting our executive officers annually, taking into consideration our financial performance, our position within the health care information technology industry, the executive compensation policies of similar companies in similar industries and, when reviewing individual compensation levels, certain individual factors, including the executive’s level of experience and responsibility and the personal contribution that the individual has made to our success. Further, our Compensation Committee also considers the global economic trends and the macroeconomic environment.

Annually, our Compensation Committee reviews the base salaries of all executive officers and based on these reviews, may adjust these salaries to ensure external competitiveness and to reflect the executive’s individual position and performance, as well as the performance of our Company. In addition to these factors, our Compensation Committee considers the recommendations of our Chief Executive Officer when adjusting base salaries of our Named Executive Officers other than himself. Our Chief Executive Officer can and does call and attend Compensation Committee meetings. We may also make base salary adjustments during the year if the scope of an executive officer’s responsibility changes relative to the other executives.

Modifications To Our Executive Compensation Program

The Committee continues to focus its efforts to refine the executive compensation structure and process consistent with evolving good governance practices.

Beginning in June 2008, in connection with the investment by Merrick RIS, LLC (“Merrick”) in our Company, several changes occurred in the makeup of our senior management team. Specifically, effective on the closing of the Merrick investment, Mr. Dearborn became our Chief Executive Officer, Mr. Oreskovich became our Chief Financial Officer, Ms. Koenig became our President of Merge Fusion and Ms. Wells became our President of Merge OEM. In connection with these changes, the Compensation Committee proposed and the Board accepted several modifications to our executive officer and director compensation programs to ensure that we offer competitive compensation that will help us to retain our executive officers and to reflect the views of the current members of our Board and the Compensation Committee on appropriate compensation structures. In April 2010, several additional changes occurred in the makeup of our senior management team, namely Nancy J. Koenig was appointed Executive Vice President — North American Direct Sales and Antonia A. Wells was appointed Executive Vice President — Research and Development.

We have entered into letter agreements with four (4) Named Executive Officers: Mr. Dearborn, Ms. Koenig, Mr. Oreskovich and Ms. Wells. The agreements formalize and confirm the base compensation, target annual bonus amounts and the stock option grants that we agreed to in connection with the hiring of Mr. Dearborn and Ms. Koenig, and Mr. Oreskovich’s and Ms. Wells’ promotions. The agreements provide for twelve (12) months’ base salary as severance upon a termination other than for cause or other than due to the executive officer’s death or disability, conditioned on the executive officer’s execution of a release agreement. The agreements do not include a definition of “cause.” In addition, upon a change in control of Merge Healthcare, all of the executive officers’ stock options will vest. We proposed the amounts of these severance benefits and the triggering events based on the subjective judgments and experiences of the members of the Compensation Committee indicating that these amounts are consistent with market practice and that the triggering events are likely to involve circumstances in which it is customary and appropriate to offer the protections embodied in the letter agreements.

We established the terms of the compensation arrangements with four (4) of our Named Executive Officers at the time of the closing of the Merrick investment, as noted above. The compensation arrangements for our Named Executive Officers as of December 31, 2009 were as follows: Mr. Dearborn received an annual base salary of $250,000 and has a target annual bonus equal to his base salary. Ms. Koenig received an annual base salary of $200,000 and has a target annual bonus equal to her base salary. Ms. Wells received an annual base salary of CAD$200,000 and has a target annual bonus equal to her annual base salary. Mr. Oreskovich received an annual base salary of $200,000 and has a target annual bonus equal to 50% of his annual base salary. The compensation arrangement for Ms.

Mayberry—French was determined upon her date of hire. As of December 31, 2009, those arrangements were as follows: Ms. Mayberry—French was hired at an annual salary of $150,000 and received a salary increase effective on January 1, 2009, due to additional responsibility for the Human Resources function of Merge Healthcare. Because of the salary increase Ms. Mayberry—French received an annual salary of $160,000 and had a target annual bonus of thirty five percent (35%) of her base salary. No bonuses were paid to the named executive officers under the 2009 annual bonus program because the factors defined by the Compensation Committee were not achieved.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S—K set forth above with management and, based on such review and discussions, the Compensation Committee recommended to our Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

The Compensation Committee

Dennis Brown, Chairperson

Gregg G. Hartemayer

Richard A. Reck

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Summary Compensation Tables

The following table relates to the compensation earned by our current Named Executive Officers for the fiscal years ended December 31, 2007, 2008 and 2009.

|

Name and

Principal

Position

|

Year

|

|

Salary ($)

|

|

|

Bonus(1)

($)

|

|

|

Stock

Awards(2)

($)

|

|

|

Option

Awards(2)

($)

|

|

|

Non Equity

Incentive Plan

Compensation(3)

($)

|

|

|

All Other Compensation

($)

|

|

|

Total

($)

|

|

|

Justin C.

|

2009

|

|

|

250,000

|

|

|

|

50,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

17,453

|

(5)

|

|

|

317,453

|

|

|

Dearborn(4)

|

2008

|

|

|

143,109

|

|

|

|

—

|

|

|

|

—

|

|

|

|

340,000

|

|

|

|

—

|

|

|

|

7,018

|

(5)

|

|

|

490,127

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven M.

|

2009

|

|

|

200,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

14,475

|

(5)

|

|

|

214,475

|

|

|

Oreskovich(6)

|

2008

|

|

|

189,583

|

|

|

|

—

|

|

|

|

—

|

|

|

|

82,000

|

|

|

|

—

|

|

|

|

10,222

|

(5)

|

|

|

281,805

|

|

|

Chief Financial Officer

|

2007

|

|

|

175,000

|

|

|

|

130,000

|

|

|

|

80,000

|

|

|

|

150,000

|

|

|

|

5,469

|

|

|

|

9,514

|

(5)

|

|

|

549,983

|

|

|

and Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nancy J. Koenig(4)

|

2009

|

|

|

200,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

4,687

|

(5)

|

|

|

204,687

|

|

|

Executive Vice

|

2008

|

|

|

114,487

|

|

|

|

—

|

|

|

|

—

|

|

|

|

82,000

|

|

|

|

—

|

|

|

|

2,236

|

(5)

|

|

|

198,723

|

|

|

President — North

American Direct Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Antonia A. Wells(7)

|

2009

|

|

|

199,123

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

11,223

|

(8)

|

|

|

210,346

|

|

|

Executive Vice

|

2008

|

|

|

160,474

|

|

|

|

—

|

|

|

|

—

|

|

|

|

82,000

|

|

|

|

—

|

|

|

|

5,975

|

(8)

|

|

|

248,449

|

|

|

President — Research and Development

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ann G.

|

2009

|

|

|

160,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

15,535

|

(5)

|

|

|

175,535

|

|

|

Mayberry—French(9)

|

2008

|

|

|

60,288

|

|

|

|

—

|

|

|

|

—

|

|

|

|

88,000

|

|

|

|

—

|

|

|

|

4,882

|

(5)

|

|

|

153.170

|

|

|

Vice President, General Counsel & Corporate Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________

|

(1)

|

For 2007, reflects a retention bonus of $105,000 for Mr. Oreskovich, and a discretionary bonus of $25,000 for Mr. Oreskovich. For 2009, reflects a discretionary bonus of $50,000 for Mr. Dearborn.

|

|

(2)

|

Our Named Executive Officers were not granted any stock or option awards in the fiscal year ended December 31, 2009. The dollar amounts for the awards represent the grant-date fair value calculated in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718 (“FASB ASC 718”) for each Named Executive Officer. Assumptions used in the calculation of these amounts are described in Note 9 to our audited financial statements for the fiscal year ended December 31, 2009 included in our Annual Report on Form 10–K filed with the Commission on March 12, 2010, as amended March 17, 2010 and April 30, 2010.

|

|

(3)

|

Represents the cash incentive award earned under our 2007 performance—based cash bonus plan.

|

|

(4)

|

Mr. Dearborn and Ms. Koenig each began employment with us at the consummation of the Merrick transaction, effective June 4, 2008.

|

|

(5)

|

For 2009, represents our matching contribution under our 401(k) employee retirement savings plan ($6,510 for Mr. Dearborn, $6,000 for Mr. Oreskovich, and $4,800 for Ms. Mayberry—French) and medical, dental, optical, long term disability and life insurance benefits ($10,943 for Mr. Dearborn, $8,475 for Mr. Oreskovich, $4,687 for Ms. Koenig, and $10,735 for Ms. Mayberry—French). For 2008, represents our matching contribution under our 401(k) employee retirement savings plan ($1,875 for Mr. Dearborn, $5,688 for Mr. Oreskovich, and $1,125 for Ms. Mayberry—French) and medical, dental, optical and life insurance benefits ($5,143 for Mr. Dearborn, $4,534 for Mr. Oreskovich, $2,236 for Ms. Koenig, and $3,757 for Ms. Mayberry—French). For 2007, represents our matching contribution under our 401(k) employee retirement savings plan ($5,250 for Mr. Oreskovich) and medical, dental, optical and life insurance benefits ($4,264 for Mr. Oreskovich).

|

|

(6)

|

At the consummation of the Merrick transaction effective June 4, 2008, Mr. Oreskovich was promoted to the position of Chief Financial Officer and Treasurer. Prior to that time, Mr. Oreskovich held the position of Vice President of Internal Audit.

|

|

(7)

|

At the consummation of the Merrick transaction effective June 4, 2008, Ms. Wells was promoted to the position of President, Merge OEM. Prior to that time, Ms. Wells held the position of Vice President, Customer Operations of our Cedara business division.

|

|

(8)

|

For 2009, represents our contribution of $5,931 under our Deferred Profit Sharing Plan (“DPSP”) for Canadian employees and the payment of $5,292 in medical, dental, optical and life insurance and related costs for the benefit of Ms. Wells. For 2008, represents our contribution of $2,207 under our Deferred Profit Sharing Plan (“DPSP”) for Canadian employees and the payment of $3,768 in medical, dental, optical and life insurance and related costs for the benefit of Ms. Wells.

|

|

(9)

|

Ms. Mayberry—French began her employment with us effective August 4, 2008.

|

Grants Of Plan—Based Awards For Fiscal Year 2009

Merge Healthcare did not grant any plan-based equity or non-equity awards to its Named Executed Officers in fiscal 2009.

Outstanding Equity Awards At 2009 Fiscal Year—End

The following table contains information concerning equity awards held by our current Named Executive Officers that were outstanding as of December 31, 2009.

|

|

|

|

|

|

OPTION AWARDS

|

|

|

|

STOCK AWARDS

|

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised Options (#) Exercisable

|

|

|

Number of

Securities

Underlying

Unexercised Options (#) Unexercisable

|

|

|

Option

Exercise

Price

($)

|

|

Option

Expiration

Date

|

|

Number of Shares or

Units of Stock That

Have Not Vested

(#)(1)

|

|

|

Market Value of

Shares or Units of

Stock That Have Not

Vested

($)(2)

|

|

|

Justin C. Dearborn

|

|

|

100,000

|

|

|

|

300,000

|

|

|

|

0.68

|

|

06/03/2014

|

|

|

|

|

|

|

|

|

|

|

50,000

|

|

|

|

150,000

|

|

|

|

1.47

|

|

08/18/2014

|

|

|

|

|

|

|

|

Steven M. Oreskovich

|

|

|

20,000

|

|

|

|

—

|

|

|

|

15.00

|

|

04/01/2010

|

|

|

53,333

|

|

|

|

179,199

|

|

|

|

|

|

5,000

|

|

|

|

—

|

|

|

|

12.96

|

|

07/16/2010

|

|

|

|

|

|

|

|

|

|

|

|

|

35,000

|

|

|

|

—

|

|

|

|

17.50

|

|

05/31/2011

|

|

|

|

|

|

|

|

|

|

|

|

|

100,000

|

|

|

|

—

|

|

|

|

8.05

|

|

09/05/2012

|

|

|

|

|

|

|

|

|

|

|

|

|

30,000

|

|

|

|

30,000

|

|

|

|

4.99

|

|

04/02/2013

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000

|

|

|

|

150,000

|

|

|

|

0.68

|

|

06/03/2014

|

|

|

|

|

|

|

|

|

|

Nancy J. Koenig

|

|

|

50,000

|

|

|

|

150,000

|

|

|

|

0.68

|

|

06/03/2014

|

|

|

|

|

|

|

|

|

|

Antonia A. Wells

|

|

|

25,000

|

|

|

|

—

|

|

|

|

17.50

|

|

05/31/2011

|

|

|

53,333

|

|

|

|

179,199

|

|

|

|

|

|

10,000

|

|

|

|

—

|

|

|

|

17.82

|

|

10/19/2011

|

|

|

|

|

|

|

|

|

|

|

|

|

18,750

|

|

|

|

6,250

|

|

|

|

6.34

|

|

11/16/2012

|

|

|

|

|

|

|

|

|

|

|

|

|

17,500

|

|

|

|

17,500

|

|

|

|

4.99

|

|

04/02/2013

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000

|

|

|

|

150,000

|

|

|

|

0.68

|

|

06/03/2014

|

|

|

|

|

|

|

|

|

|

Ann G. Mayberry—French

|

|

|

25,000

|

|

|

|

75,000

|

|

|

|

1.47

|

|

08/18/2014

|

|

|

|

|

|

|

|

|

____________

|

(1)

|

One hundred percent (100%) of the restricted stock will vest on November 24, 2010.

|

|

(2)

|

Reflects the value as calculated using the closing market price of our Common Stock as of the last trading day in fiscal year 2009, December 31, 2009 ($3.36).

|

In 2009, none of our Named Executive Officers exercised any of their vested options or had any shares of restricted stock that vested.

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

Description of Agreements Providing for Potential Payments

The table below reflects the amount of compensation to each of the Named Executive Officers without a change in control and upon a change of control, in each case, in the event of termination of the Named Executive Officer’s employment arrangement with the Company (i) upon termination by the Company without cause or upon resignation by the Named Executive Officers for good reason, (ii) for cause and (iii) upon the Named Executive Officer’s death or disability. The amounts shown assume that such termination was effective as of December 31, 2009, and thus includes amounts earned through such time and are estimates of the amounts which would be paid upon termination. The actual amounts to be paid out can only be determined at the time of termination.

|

|

|

NO CHANGE IN CONTROL

|

|

|

UPON CHANGE IN CONTROL

|

|

|

|

|

Payments upon

|

|

|

|

|

|

|

|

|

Payments upon

|

|

|

|

|

|

|

|

|

|

|

Termination without

|

|

|

Payments upon

|

|

|

Payments upon

|

|

|

Termination without

|

|

|

Payments upon

|

|

|

Payments upon

|

|

|

|

|

Cause / Resignation

|

|

|

Termination for

|

|

|

Death

|

|

|

Cause / Resignation

|

|

|

Termination for

|

|

|

Death

|

|

|

Name

|

|

for Good Reason ($)

|

|

|

Cause ($)

|

|

|

or Disability ($)

|

|

|

for Good Reason ($)

|

|

|

Cause ($)

|

|

|

or Disability ($)

|

|

|

Justin C. Dearborn

|

|

$

|

250,000

|

(1)

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

250,000

|

(1)

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Steven M. Oreskovich

|

|

$

|

379,199

|

(1)(2)

|

|

$

|

0

|

|

|

$

|

179,199

|

(2)

|

|

$

|

379,199

|

(1)(2)

|

|

$

|

0

|

|

|

$

|

179,199

|

(2)

|

|

Nancy J. Koenig

|

|

$

|

200,000

|

(1)

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

200,000

|

(1)

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Antonia A. Wells

|

|

$

|

378,322

|

(1)(2)

|

|

$

|

0

|

|

|

$

|

179,199

|

(2)

|

|

$

|

378,322

|

(1)(2)

|

|

$

|

0

|

|

|

$

|

179,199

|

(2)

|

|

Ann G. Mayberry– French (3)

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

____________

|

(1)

|

On July 3, 2008, we entered into letter agreements with Mr. Dearborn, Ms. Koenig, Mr. Oreskovich and Ms. Wells that provide for twelve (12) months’ base salary as severance upon a termination other than for cause and other than due to the executive officer’s death or disability, conditioned on the executive officer’s execution of a release agreement.

|

|

(2)

|

Mr. Oreskovich’s and Ms. Wells’ restricted stock awards provide for the lapse of the restrictions and full vesting upon: (a) the termination of the executive officer’s employment by us without cause or by the employee for good reason (as defined in the agreement), (b) the termination of the executive officer’s employment due to disability, (c) the involuntary termination of the executive officer’s employment or resignation for good reason within 365 days after a change in control, or (d) the sale by us of the business unit with respect to which the Named Executive Officer primarily performs services. Amounts included with respect to restricted stock represent the market value of unvested restricted stock based on the closing trading price ($3.36) of Merge Healthcare’s common stock at December 31, 2009 (the last trading day of fiscal 2009).

|

|

(3)

|

Ms. Mayberry-French does not have a letter agreement with the Company.

|

OUTSTANDING EQUITY AWARDS OF DIRECTORS AT FISCAL YEAR END

The following table contains information concerning equity awards held by our Directors that were outstanding as of December 31, 2009.

|

|

|

Option Awards(1)

|

|

|

|

|

Name

|

|

Number of Securities

Underlying Options

(#)

|

|

|

Exercise Price of

Option Awards

($ / Share)

|

|

Expiration Date

|

|

Aggregate Number of

Securities

Underlying Options

(#)

|

|

|

Dennis Brown

|

|

|

5,000

|

|

|

|

9.78

|

|

05/21/2013

|

|

|

295,000

|

|

|

|

|

|

10,000

|

|

|

|

16.19

|

|

05/20/2014

|

|

|

|

|

|

|

|

|

15,000

|

|

|

|

17.50

|

|

06/01/2015

|

|

|

|

|

|

|

|

|

15,000

|

|

|

|

6.59

|

|

12/27/2016

|

|

|

|

|

|

|

|

|

10,000

|

|

|

|

5.52

|

|

01/30/2017

|

|

|

|

|

|

|

|

|

15,000

|

|

|

|

6.01

|

|

05/10/2017

|

|

|

|

|

|

|

|

|

225,000

|

(2)

|

|

|

1.47

|

|

08/18/2018

|

|

|

|

|

|

Michael W. Ferro, Jr.

|

|

|

400,000

|

(3)

|

|

|

0.57

|

|

11/19/2018

|

|

|

400,000

|

|

|

Gregg G. Hartemayer

|

|

|

225,000

|

(2)

|

|

|

1.47

|

|

08/18/2018

|

|

|

225,000

|

|

|

Richard A. Reck

|

|

|

411

|

|

|

|

7.46

|

|

04/23/2013

|

|

|

285,411

|

|

|

|

|

|

5,000

|

|

|

|

9.78

|

|

05/21/2013

|

|

|

|

|

|

|

|

|

10,000

|

|

|

|

16.19

|

|

05/20/2014

|

|

|

|

|

|

|

|

|

15,000

|

|

|

|

17.50

|

|

06/01/2015

|

|

|

|

|

|

|

|

|

15,000

|

|

|

|

6.59

|

|

12/27/2016

|

|

|

|

|

|

|

|

|

15,000

|

|

|

|

6.01

|

|

05/10/2017

|

|

|

|

|

|

|

|

|

225,000

|

(2)

|

|

|

1.47

|

|

08/18/2018

|

|

|

|

|

|

Neele E. Stearns, Jr.

|

|

|

300,000

|

(4)

|

|

|

1.47

|

|

08/18/2018

|

|

|

300,000

|

|

____________

|

(1)

|

All options are fully vested and exercisable, with the exception of the options granted on August 19, 2008 with an August 18, 2018 expiration date, and the options granted on November 20, 2008 with a November 19, 2018 expiration date, which options vest and are exercisable as noted below.

|

|

(2)

|

Options vest in sixteen (16) equal quarterly increments of 14,062.5 shares, with the first increment vesting on the date of grant, August 19, 2008, with subsequent increments vesting on November 30, February 28, May 31 and August 31 thereafter.

|

|

(3)

|

Options vest in sixteen (16) equal quarterly increments of 25,000 shares, with the first increment vesting on the date of grant, November 20, 2008, with subsequent increments vesting on February 28, May 31, August 31 and November 30 thereafter.

|

|

(4)

|

Options vest in sixteen (16) equal quarterly increments of 18,750 shares, with the first increment vesting on the date of grant, August 19, 2008, with subsequent increments vesting on November 30, February 28, May 31 and August 31 thereafter.

|

PART IV

Item 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

(b) See Exhibit Index that follows.

Exhibit Index

|

2.1

|

|

Agreement and Plan of Merger, dated as of May 30, 2009, by and among Registrant, Merge Acquisition Corp., a wholly owned subsidiary of Registrant, and etrials Worldwide, Inc.

(A)

|

|

2.2

|

|

Agreement and Plan of Merger, dated as of August 7, 2009, by and among Registrant, Merge Acquisition Corporation, a wholly owned subsidiary of Registrant, Confirma, Inc. and John L. Brooks

(B)

|

|

3.1

|

|

Certificate of Incorporation as filed on October 14, 2008, and Certificate of Merger as filed on December 3, 2008 and effective on December 5, 2008

(C)

|

|

3.2

|

|

Bylaws of Registrant

(C)

|

|

10.1

|

|

Registration Rights Agreement, dated June 4, 2008, by and between Registrant and Merrick RIS, LLC

(D)

|

|

10.2

|

|

Securities Purchase Agreement, dated May 21, 2008, by and among Registrant, the subsidiaries listed on the Schedule of Subsidiaries attached thereto, and Merrick RIS, LLC

(E)

|

|

10.3

|

|

Employment Letter Agreement between the Registrant and Justin C. Dearborn entered into as of June 4, 2008

(F)

*

|

|

10.4

|

|

Employment Letter Agreement between the Registrant and Steven M. Oreskovich entered into as of June 4, 2008

(F)

*

|

|

10.5

|

|

Employment Letter Agreement between the Registrant and Nancy J. Koenig entered into as of June 4, 2008

(F)

*

|

|

10.6

|

|

Employment Letter Agreement between the Registrant and Antonia Wells entered into as of June 4, 2008

(F)

*

|

|

10.7

|

|

Amendment dated July 1, 2008 to that certain Securities Purchase Agreement, dated May 21, 2008, by and among the Registrant, certain of its subsidiaries and Merrick RIS, LLC

(G)

|

|

10.8

|

|

Consulting Agreement, effective as of January 1, 2009, by and between Registrant and Merrick RIS, LLC

(C)

|

|

10.9

|

|

1996 Stock Option Plan for Employees of Registrant dated May 13, 1996

(H)

, as amended and restated in its entirety as of September 1, 2003

(I)

*

|

|

10.10

|

|

1998 Stock Option Plan for Directors

(J)

*

|

|

10.11

|

|

2000 Employee Stock Purchase Plan of Registrant effective July 1, 2000

(K)

*

|

|

10.12

|

|

2003 Stock Option Plan of Registrant dated June 24, 2003, and effective July 17, 2003

(I)

*

|

|

10.13

|

|

2005 Equity Incentive Plan adopted March 4, 2005, and effective May 24, 2005

(L)

*

|

|

10.14

|

|

Amendment effective as of January 1, 2010 to that certain Consulting Agreement, effective as of January 1, 2009, by and among the Registrant and Merrick RIS, LLC

|

|

10.15

|

|

Value Added Reseller Agreement dated March 31, 2009 between a subsidiary of the Registrant and Merrick Healthcare Solutions, LLC d/b/a Olivia Greets

|

|

10.16

|

|

Olivia Greets Standard Reseller Agreement dated March 12, 2010 between the Registrant and Merrick Healthcare Solutions, LLC d/b/a Olivia Greets

|

|

10.17

|

|

Senior Secured Term Note, dated June 4, 2008, between Registrant and Merrick RIC, LLC

(D)

|

|

14.1

|

|

Code of Ethics

(C)

|

|

14.2

|

|

Whistleblower Policy

(C)

|

|

21

|

|

Subsidiaries of Registrant †

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm – BDO Seidman, LLP †

|

|

23.2

|

|

Consent of Independent Registered Public Accounting Firm – KPMG LLP †

|

|

31.1

|

|

Certificate of Chief Executive Officer (principal executive officer) Pursuant to Rule 13a-14(a) under the Securities Exchange Act of 1934

|

|

31.2

|

|

Certificate of Chief Financial Officer (principal accounting officer) Pursuant to Rule 13a-14(a) under the Securities Exchange Act of 1934

|

|

32

|

|

Certificate of Chief Executive Officer (principal executive officer) and Chief Financial Officer (principal accounting officer) Pursuant to Section 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

__________________

|

(A)

|

|

Incorporated by reference from the Registrant’s Current Report on Form 8-K dated May 30, 2009.

|

|

(B)

|

|

Incorporated by reference from the Registrant’s Current Report on Form 8-K dated August 7, 2009.

|

|

(C)

|

|

Incorporated by reference from the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008.

|

|

(D)

|

|

Incorporated by reference from the Registrant’s Current Report on Form 8-K dated June 6, 2008.

|

|

(E)

|

|

Incorporated by reference from the Registrant’s Current Report on Form 8-K dated May 22, 2008.

|

|

(F)

|

|

Incorporated by reference from the Registrant’s Current Report on Form 8-K dated July 15, 2008.

|

|

(G)

|

|

Incorporated by reference from the Registrant’s Current Report on Form 8-K dated July 7, 2008.

|

|

(H)

|

|

Incorporated by reference from Registration Statement on Form SB-2 (No. 333-39111) effective January 29, 1998.

|

|

(I)

|

|

Incorporated by reference from the Registrant’s Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2003.

|

|

(J)

|

|

Incorporated by reference from the Registrant’s Annual Report on Form 10-KSB for the fiscal year ended December 31, 1997.

|

|

(K)

|

|

Incorporated by reference from the Registrant’s Proxy Statement for Annual Meeting of Shareholders dated May 8, 2000.

|

|

(L)

|

|

Incorporated by reference from the Registrant’s Registration Statement on Form S-8 (No. 333-125386) effective June 1, 2005.

|

|

*

|

|

Management contract or compensatory plan or arrangement required to be filed as an exhibit to this Annual Report on Form 10-K.

|

|

†

|

|

These Exhibits were previously filed with the Registrant’s Form 10−K (File No. 001-33006) for the year ended December 31, 2009, filed on March 12, 2010, as previously amended by Amendment No. 1 and Amendment No. 2.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

MERGE HEALTHCARE INCORPORATED

|

|

|

|

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Justin C. Dearborn

|

|

|

|

By: Justin C. Dearborn

|

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Steven M. Oreskovich

|

|

|

|

By: Steven M. Oreskovich

|

|

|

|

Title: Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

|

August 26, 2010

|

|

/s/ Michael W. Ferro, Jr.

|

|

|

|

By: Michael W. Ferro, Jr.

|

|

|

|

Chairman of the Board

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Dennis Brown

|

|

|

|

By: Dennis Brown

|

|

|

|

Director

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Justin C. Dearborn

|

|

|

|

By: Justin C. Dearborn

|

|

|

|

Chief Executive Officer and Director

|

|

|

|

(principal executive officer)

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Steven M. Oreskovich

|

|

|

|

By: Steven M. Oreskovich

|

|

|

|

Title: Chief Financial Officer

|

|

|

|

(principal financial officer

and principal accounting officer)

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Gregg G. Hartemayer

|

|

|

|

By: Gregg G. Hartemayer

|

|

|

|

Director

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Richard A. Reck

|

|

|

|

By: Richard A. Reck

|

|

|

|

Director

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Neele E. Stearns, Jr.

|

|

|

|

By: Neele E. Stearns, Jr.

|

|

|

|

Director

|

|

|

|

|

|

August 26, 2010

|

|

/s/ Jeff Surges

|

|

|

|

By: Jeff Surges

|

|

|

|

Director

|

|

|

|

|

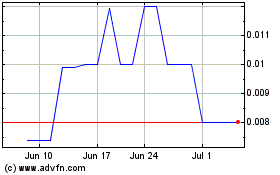

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Nov 2023 to Nov 2024