UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April

1, 2010

Merge Healthcare Incorporated

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

39-1600938

|

|

(State or Other Jurisdiction of

|

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

|

Identification No.)

|

|

|

|

|

|

6737 West Washington Street, Suite 2250

|

|

|

|

Milwaukee, Wisconsin

|

|

53214

|

|

(Address of Principal Executive Offices)

|

|

(ZIP Code)

|

(414) 977-4000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

This Form 8-K is intended to supplement the Form 8-K filed on March 4, 2010.

Item 1.01 Entry into a Material Definitive Agreement.

On April 1, 2010, Merge Healthcare Incorporated (the “Company”) entered into a Securities Purchase Agreement with a limited number of institutional and accredited investors (each, individually, an “Investor,” and collectively, the “Investors”). Pursuant to the Securities Purchase Agreement,

the Company agreed to issue an aggregate of 41,750 shares of Series A Non-Voting Preferred Stock, par value $0.01 per share (“Series A Preferred Stock”), at a price of $627.40 per share, and 7,515,000 shares of its common stock, par value $0.01 per share (the “Common Stock”), at a price of $2.07 per share, for a total purchase price of approximately $41,750,000. The Company intends to use the net proceeds from the offering to finance the acquisition of AMICAS, Inc.

The shares of Series A Preferred Stock will rank in priority, with respect to payment of dividends and return of capital upon liquidation, dissolution or winding-up, ahead of the shares of all other classes of Merge’s capital stock. The holders of Series A Preferred Stock will be entitled to receive cumulative

compounding dividends at a rate of 15% per annum of the “Designated Price” of $1,000 per share of Series A Preferred Stock (as adjusted for stock splits, combinations, reclassifications and the like). Subject to certain written notice requirements, Merge may, at any time and on a pro rata basis, redeem the outstanding Series A Preferred Stock by paying the Designated Price per share plus any accrued but unpaid dividends. Upon a Change of Control, as that term is defined in the

Securities Purchase Agreement, the holders of the Series A Preferred Stock may, subject to certain restrictions specifically outlined in the Securities Purchase Agreement, require Merge to redeem all of such holder’s then-outstanding shares of Series A Preferred Stock by paying in cash the Designated Price per share plus any accrued but unpaid dividends. In addition, in the event that prior to the second anniversary of the date such shares are issued, Merge seeks to redeem a holder’s shares

of Series A Preferred Stock or such holder elects to require Merge to redeem their shares of Series A Preferred Stock upon a Change of Control, such holder will also be entitled to receive a minimum of two years of dividend payments (giving effect to the payment of any dividends actually paid prior to such date).

The holders of the Series A Preferred Stock are not entitled to receive notice of or to vote at any meeting of Merge’s stockholders, except for meetings of the holders of the Series A Preferred Stock as a class, called to amend the terms of the Series A Preferred Stock, approve the issuance of any senior or

pari

passu

preferred equity or the incurrence of indebtedness other than $200 million in high yield debt to be issued in connection with the acquisition of AMICAS, Inc. and other debt instruments such as revolving lines of credit, sale/leaseback, forgivable loans from government entities for retention/relocation incentives, and capital leases, incurred by Merge in its ordinary course of business, or otherwise as required by law.

The shares of Series A Preferred Stock and Common Stock are being issued by the Company in a private placement in reliance upon the exemption from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 thereunder. The Securities Purchase Agreement restricts

transfers of the Series A Preferred Stock and Common Stock associated with the offering. Pursuant to that restriction, from and after the date such shares are issued and until the earlier of (a) the first anniversary of their issuance or (b) the occurrence of a Change of Control, no Investor will transfer any such shares to any person, other than to its affiliates, without the prior written consent of the Company. The securities may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements of the Securities Act. The Company has agreed to use commercially reasonable efforts to prepare and file with the SEC as promptly as reasonably practicable a registration statement with the Securities and Exchange Commission (“SEC”) to register for resale the shares of Common Stock sold pursuant to the Securities Purchase Agreement. The Company is also required to apply to cause the shares of Common Stock to be approved

for listing on such national securities exchange, subject to official notice of issuance, and file or cause to be filed a Form D Notice of Exempt Offering of Securities with respect to the shares issued to the Investors pursuant to the terms of the Securities Purchase Agreement.

Pursuant to the terms of the Securities Purchase Agreement, the Company and the Investors have made representations and warranties regarding matters that are customarily included in financings of this nature, including, without limitation, each Investor has represented to the Company that it is an “accredited investor” as defined

in Rule 501(a) and that such Investor is acquiring the securities for investment purposes for such Investor’s own account and not with a view toward distribution of the securities. The Securities Purchase Agreement also contains indemnification agreements among the parties in the event of certain liabilities related to the issuance of the securities.

Merrick RIS, LLC (“Merrick”), which beneficially owned 37.37% of the Company’s outstanding Common Stock as of February 28, 2010, has subscribed to purchase 1.8 million shares of Common Stock for an aggregate investment of $10 million and 10,000 shares of Series A Preferred Stock on the same terms and conditions

of the other Investors. Following completion of the securities

issuance, Merrick will beneficially own approximately 36.14% of the Company’s outstanding Common Stock. Michael W. Ferro, Jr., the Company’s Chairman of the Board, and trusts for the benefit of Mr. Ferro’s family members, beneficially own a majority of the equity interest in Merrick. Mr. Ferro also serves as the chairman

and chief executive officer of Merrick. In addition, Justin C. Dearborn, our Chief Executive Officer and a Director, served as Managing Director and General Counsel of Merrick Ventures, LLC from January 2007 until his appointment as Chief Executive Officer of Merge on June 4, 2008.

The foregoing description of the Securities Purchase Agreement or of the Series A Preferred Stock does not purport to be complete and is qualified in its entirety by the form of Securities Purchase Agreement, attached hereto as Exhibit 10.1, and the Certificate of Designations, attached hereto as Exhibit 10.2, both of which are incorporated

herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 is hereby incorporated by reference into this Item 3.02. The shares of Series A Preferred Stock and Common Stock are being issued by the Company in a private placement in reliance upon the exemption from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended (the “Securities

Act”), and Rule 506 thereunder. Each Investor is an “accredited investor” as defined in Rule 501(a) and each Investor has represented to the Company that such Investor is acquiring the securities for investment purposes for such Investor’s own account and not with a view toward distribution of the securities. The Company advised each Investor that the securities that will be issued to them in connection with the Securities Purchase Agreement have not been registered

under the Securities Act and may not be sold unless they are registered under the Securities Act or sold pursuant to a valid exemption from registration under the Securities Act. The certificates representing the shares of Common Stock issued to the Investors will contain a legend that such shares of Common Stock have not been registered under the Securities Act and will state the restrictions on transfer and resale as described above. Additionally, the Company did not engage in any general solicitation

or advertisement in connection with the Security Purchase Agreement.

Item 8.01. Other Events.

The press release issued by the Company on April 2, 2010 announcing the Financing is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

The information contained in Item 8.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished to the Securities and Exchange Commission and shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to liabilities of that Section, nor shall it be deemed to

be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act.

Item 9.01. Financial Statements and Exhibits.

Exhibit 10.1 Form of Securities Purchase Agreement, dated April 1, 2010, by and among Merge Healthcare Incorporated and the Investors

Exhibit 10.2 Form of Certificate of Designations

Exhibit 10.14 First Amendment to the Consulting Agreement. Exhibit 10.14 was inadvertently omitted from the Form 10-K filed on March 12, 2010.

Exhibit 99.1 Press Release dated April 2, 2010

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MERGE HEALTHCARE INCORPORATED

|

|

|

|

|

|

|

|

Date: April 2, 2010

|

|

|

|

/s/ Ann Mayberry-French

|

|

|

By: Ann Mayberry-French

|

|

|

Title: General Counsel

|

|

|

|

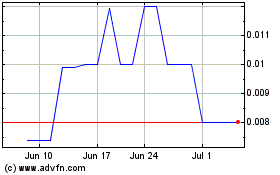

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Nov 2023 to Nov 2024