Merge Healthcare Inc - Current report filing (8-K)

July 23 2008 - 5:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

July 17, 2008

|

MERGE HEALTHCARE INCORPORATED

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Wisconsin

|

0-29486

|

39-1600938

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

6737 West Washington Street, Suite 2250, Milwaukee, Wisconsin

|

|

53214-5650

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

(414) 977-4000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 4, 2008, the Board of Directors of Merge Healthcare Incorporated (the "Registrant") accepted the resignations of Kenneth D. Rardin, Chief Executive Officer, Steven R. Norton, Chief Financial Officer, and Gary D. Bowers, President Merge Healthcare North America. On July 17, 2008, the Registrant and Mr. Rardin entered into an agreement (the "Rardin Separation Agreement") whereby Mr. Rardin will receive separation payments in the aggregaate amount of $1,394,000. One payment will be made on or about July 31, 2008 and the other payment will be made on or about January 2, 2009. Each of the payments will be less applicable withholding and other standard deductions. In addition, the Registrant has agreed for 18 months to pay 80% of the Registrant’s premium for continuing insurance coverage under COBRA with Mr. Rardin paying the balance.

On July 17, 2008, the Registrant and Mr. Norton entered into an agreement (the "Norton Separation Agreement") whereby Mr. Norton will receive on or about July 31, 2008 a lump sum separation payment of $548,400, less applicable withholding and other standard deductions. In addition, the Registrant has agreed for 12 months to pay 80% of the Registrant’s premium for continuing insurance coverage under COBRA with Mr. Norton paying the balance.

On July 20, 2008, the Registrant and Mr. Bowers entered into an agreement (the "Bowers Separation Agreement") whereby Mr. Bowers will receive on or about July 31, 2008 a lump sum separation payment of $349,053, less applicable withholding and other standard deductions. In addition, the Registrant has agreed for 12 months to pay 80% of the Registrant’s premium for continuing insurance coverage under COBRA with Mr. Bowers paying the balance.

Generally, the amounts being paid under the Rardin Separation Agreement, the Norton Separation Agreement and the Bowers Separation Agreement are 80% of the applicable severance amounts set forth in each such individual’s employment agreement with the Registrant, as amended.

Each of Mr. Rardin, Mr. Norton and Mr. Bowers have agreed with the Registrant that each of such individual’s non-compete and confidentiality obligations under his employment agreement shall continue in accordance with its terms, and each such individual has entered into a release for the benefit of the Registrant and others that would cover certain claims.

The foregoing summaries of the terms of the Rardin Separation Agreement, the Norton Separation Agreement and the Bowers Separation Agreement are not complete and are qualified in their entirety by reference to the Separation Agreements, which are attached to this Current Report as Exhibits 10.23, 10.24, and 10.25, respectively.

Item 9.01 Financial Statements and Exhibits.

Exhibit 10.23 Separation Agreement between the Registrant and Kenneth D. Rardin entered into as of July 17, 2008.

Exhibit 10.24 Separation Agreement between the Registrant and Steven R. Norton entered into as of July 17, 2008.

Exhibit 10.25 Separation Agreement between the Registrant and Gary D. Bowers entered into as of July 20, 2008.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

MERGE HEALTHCARE INCORPORATED

|

|

|

|

|

|

|

|

July 23, 2008

|

|

By:

|

|

Craig D. Apolinsky

|

|

|

|

|

|

|

|

|

|

|

|

Name: Craig D. Apolinsky

|

|

|

|

|

|

Title: General Counsel

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.23

|

|

Exhibit 10.23 Separation Agreement between the Registrant and Kenneth D. Rardin entered into as of July 17, 2008.

|

|

10.24

|

|

Exhibit 10.24 Separation Agreement between the Registrant and Steven R. Norton entered into as of July 17, 2008.

|

|

10.25

|

|

Exhibit 10.25 Separation Agreement between the Registrant and Gary D. Bowers entered into as of July 20, 2008.

|

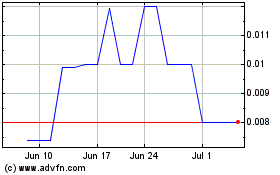

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2024 to Aug 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Aug 2023 to Aug 2024